Key Insights

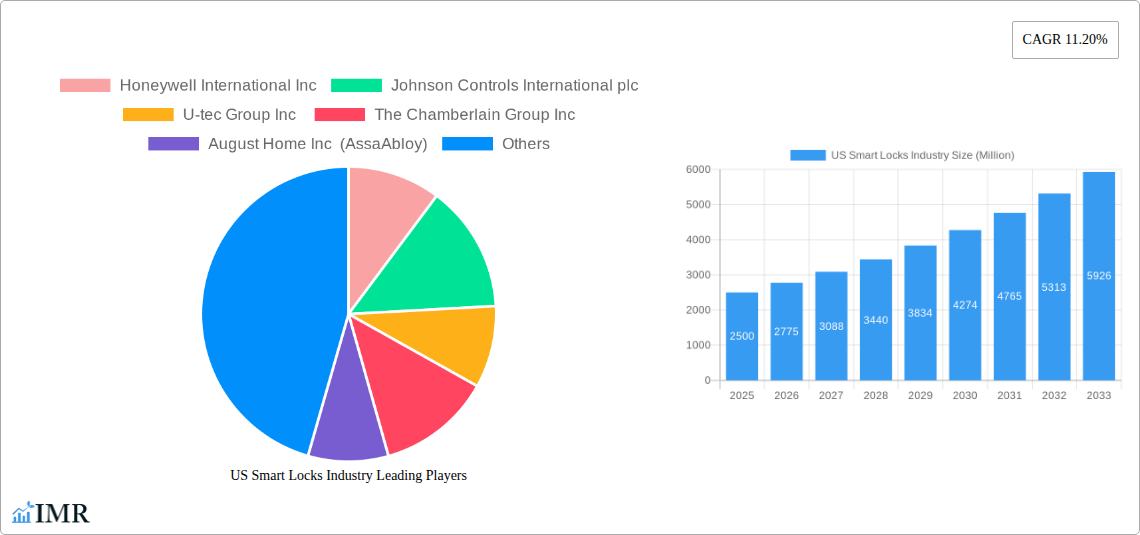

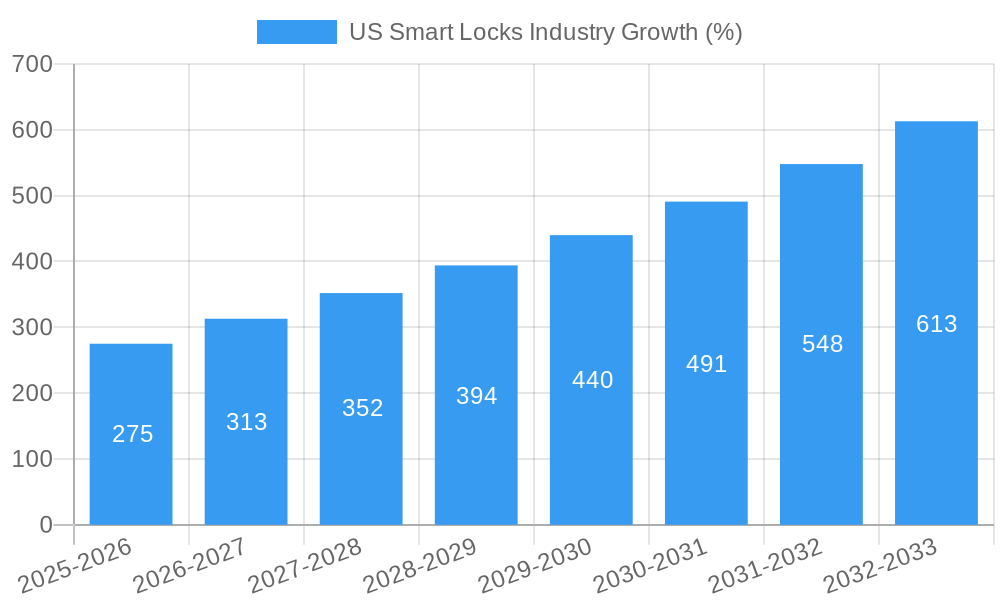

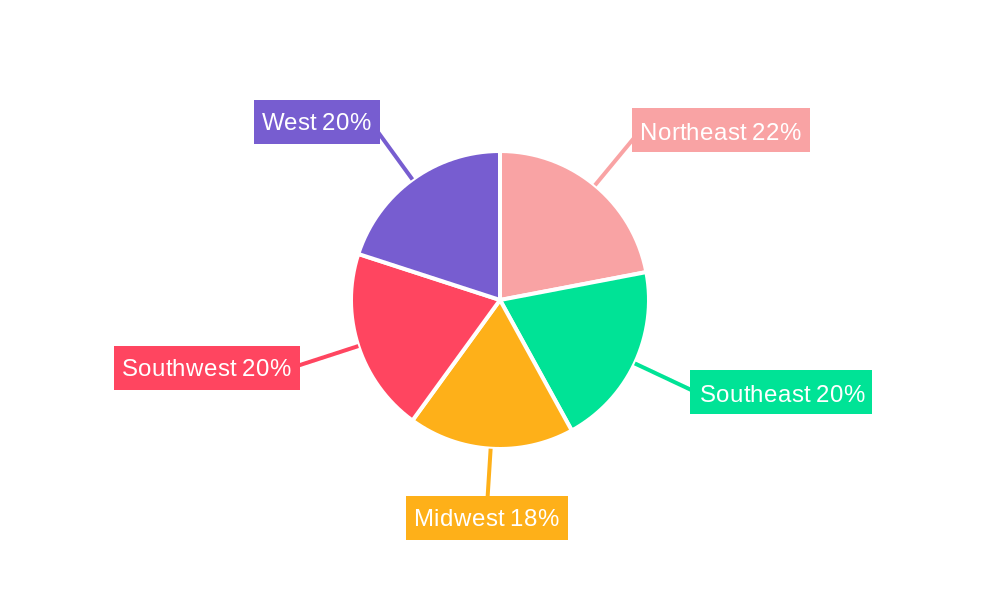

The US smart lock market, currently experiencing robust growth, is projected to reach a substantial size driven by increasing consumer demand for enhanced home security and convenience. The market's Compound Annual Growth Rate (CAGR) of 11.20% from 2019-2033 indicates a significant upward trajectory. This growth is fueled by several key factors. Rising adoption of smart home technology, coupled with increasing urbanization and concerns about home security, are major drivers. The integration of smart locks with other smart home devices and platforms, such as voice assistants and home automation systems, is further boosting market expansion. Consumer preference for keyless entry, remote access capabilities, and increased security features are contributing significantly to the market's expansion. The market is segmented by end-user (residential and commercial) and type (deadbolt, padlock, and other types including lever handles and mortise locks). The residential segment currently dominates, but the commercial sector is witnessing accelerated growth due to the integration of smart locks in multi-unit dwellings, offices, and hotels. Competition in the market is fierce, with major players like Honeywell, Johnson Controls, Assa Abloy (August Home), Allegion, and Spectrum Brands (Kwikset) vying for market share through innovation and strategic partnerships. Regional variations exist within the US market; however, given the widespread adoption of smart technology, growth is projected across all regions—Northeast, Southeast, Midwest, Southwest, and West—although certain regions might show slightly faster adoption rates than others depending on factors like technology infrastructure and consumer affluence.

The forecast period of 2025-2033 is expected to witness continued market expansion, propelled by technological advancements such as improved biometric authentication, enhanced cybersecurity measures, and the development of more sophisticated smart lock systems. The increasing integration of smart locks with other Internet of Things (IoT) devices will create a synergistic effect, furthering market penetration. While challenges such as concerns about data privacy and potential vulnerabilities remain, the overall market outlook remains positive, fueled by ongoing technological innovation and a strong consumer demand for seamless, secure, and convenient access solutions. The introduction of innovative features like smart keypads, fingerprint scanners, and smartphone app integration will continue to propel growth throughout the forecast period. However, pricing and potential compatibility issues could serve as moderate restraints to broader adoption.

US Smart Locks Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US smart locks market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report focuses on key market segments including Residential and Commercial end-users and Deadbolt, Padlock, and Other Types (Lever Handles, Mortise) of smart locks. The market is expected to reach xx million units by 2033, exhibiting significant growth potential.

US Smart Locks Industry Market Dynamics & Structure

The US smart locks market is characterized by a moderately consolidated structure with key players like Honeywell International Inc, Johnson Controls International plc, and Assa Abloy (August Home Inc) holding significant market share. Technological innovation, driven by advancements in connectivity (Wi-Fi, Bluetooth, Z-Wave), biometric authentication, and improved security features, are major drivers. Regulatory frameworks concerning data privacy and security are increasingly influencing market dynamics. The market experiences competition from traditional mechanical locks, but the increasing demand for convenience and enhanced security is fostering smart lock adoption. Mergers and acquisitions (M&A) activity, though moderate, is consolidating the market.

- Market Concentration: Moderately Consolidated (Top 5 players hold approximately xx% market share in 2025).

- Technological Drivers: Advancements in connectivity, biometrics, and security algorithms.

- Regulatory Landscape: Growing focus on data privacy and security standards.

- Competitive Substitutes: Traditional mechanical locks.

- M&A Activity: Moderate consolidation through strategic acquisitions. xx deals recorded between 2019-2024.

- Innovation Barriers: High R&D costs, integration complexities with existing smart home ecosystems.

US Smart Locks Industry Growth Trends & Insights

The US smart locks market has experienced substantial growth between 2019 and 2024, driven by increasing consumer awareness of smart home technology, rising disposable incomes, and enhanced security concerns. The market size, valued at xx million units in 2024, is projected to reach xx million units by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by factors such as rising adoption rates in both residential and commercial sectors, technological advancements leading to improved user experience and security, and a shift in consumer preferences towards convenient and connected home solutions. Market penetration is expected to increase significantly, particularly in the residential sector.

Dominant Regions, Countries, or Segments in US Smart Locks Industry

The Residential segment is the dominant end-user segment in the US smart locks market, accounting for a significant share of total sales in 2025. This is attributed to factors such as increasing homeowner preference for enhanced security, convenience, and remote access capabilities. Among product types, deadbolt smart locks currently hold the largest market share, followed by other types like lever handles and mortise locks. Specific regions with high adoption rates include urban and suburban areas in the Western and Northeastern states, driven by higher household incomes and tech-savviness.

- Key Drivers (Residential Segment): Increased consumer awareness of home security, rising disposable incomes, preference for convenience.

- Key Drivers (Deadbolt Segment): High compatibility with existing door hardware, strong security features.

- Dominance Factors: High adoption rates in residential settings, growing preference for convenience and enhanced security features.

- Growth Potential: Expansion into untapped market segments like multi-family dwellings and commercial properties.

US Smart Locks Industry Product Landscape

The US smart locks market offers a diverse range of products with varying functionalities and technological integrations. Products include keypads, fingerprint scanners, mobile app-based controls, and voice assistant compatibility. Key features focus on enhanced security through encryption and tamper detection. Innovation is evident in the integration of smart home platforms, offering seamless connectivity and centralized control. Products are differentiated through features like remote access, guest codes, and advanced security protocols.

Key Drivers, Barriers & Challenges in US Smart Locks Industry

Key Drivers:

- Increasing demand for home security solutions.

- Rising adoption of smart home technologies.

- Growing preference for convenient access control.

- Technological advancements (e.g., improved battery life, enhanced security features).

Key Challenges & Restraints:

- High initial investment costs compared to traditional locks.

- Concerns about data security and privacy breaches.

- Potential for technical glitches and compatibility issues.

- Supply chain disruptions impacting production and availability. This has led to approximately a xx% increase in prices in 2022.

Emerging Opportunities in US Smart Locks Industry

- Integration with other smart home devices: Seamless connectivity with existing ecosystems like Google Home and Amazon Alexa.

- Expansion into commercial applications: Growth opportunities in office buildings, hospitality, and retail.

- Development of advanced security features: Biometric authentication, AI-powered threat detection.

- Focus on sustainable and energy-efficient designs: Meeting increasing consumer demand for eco-friendly products.

Growth Accelerators in the US Smart Locks Industry

Continued technological advancements, strategic partnerships among smart lock manufacturers and smart home platforms, and expansion into new market segments such as commercial applications and multi-family residences will be pivotal in accelerating market growth. Government initiatives promoting smart city development and increased focus on cybersecurity will also play a significant role.

Key Players Shaping the US Smart Locks Industry Market

- Honeywell International Inc

- Johnson Controls International plc

- U-tec Group Inc

- The Chamberlain Group Inc

- August Home Inc (AssaAbloy)

- Allegion plc

- Kwikset (Spectrum Brands)

- Crestron Electronics Inc

- Master Lock (Fortune Brands Home & Security)

Notable Milestones in US Smart Locks Industry Sector

- April 2021: Yale launched Linus Smart Lock, integrating with leading smart home systems, voice assistants, and home share platforms. This launch significantly boosted market competition and consumer interest in enhanced connectivity options.

In-Depth US Smart Locks Industry Market Outlook

The US smart locks market is poised for continued robust growth over the forecast period (2025-2033). Technological advancements, increasing consumer demand for secure and convenient access control solutions, and strategic partnerships will be key drivers. Expansion into new market segments and innovative product development will unlock significant opportunities for market players. The market is expected to witness a sustained increase in adoption rates and higher market penetration across various residential and commercial segments.

US Smart Locks Industry Segmentation

-

1. End-user

- 1.1. Residential

- 1.2. Commercial

-

2. Type

- 2.1. Deadbolt

- 2.2. Padlock

- 2.3. Other Types (Lever Handles, Mortise)

US Smart Locks Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

US Smart Locks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Smart Home Adoption

- 3.2.2 Increase of Home break-ins

- 3.2.3 Thereby Aiding in the Market Growth for Residential Segment

- 3.3. Market Restrains

- 3.3.1. Diminishing Profit Margins and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Commercial Segment is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Deadbolt

- 5.2.2. Padlock

- 5.2.3. Other Types (Lever Handles, Mortise)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Northeast US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 7. Southeast US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 8. Midwest US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southwest US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 10. West US Smart Locks Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Johnson Controls International plc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 U-tec Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Chamberlain Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 August Home Inc (AssaAbloy)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allegion plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kwikset (Spectrum Brands)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crestron Electronics Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Master Lock (Fortune Brands Home & Security)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: US Smart Locks Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: US Smart Locks Industry Share (%) by Company 2024

List of Tables

- Table 1: US Smart Locks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: US Smart Locks Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: US Smart Locks Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: US Smart Locks Industry Volume K Unit Forecast, by End-user 2019 & 2032

- Table 5: US Smart Locks Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: US Smart Locks Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: US Smart Locks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: US Smart Locks Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: US Smart Locks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: US Smart Locks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Northeast US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northeast US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Southeast US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Southeast US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Midwest US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Midwest US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Southwest US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Southwest US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: West US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: US Smart Locks Industry Revenue Million Forecast, by End-user 2019 & 2032

- Table 22: US Smart Locks Industry Volume K Unit Forecast, by End-user 2019 & 2032

- Table 23: US Smart Locks Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: US Smart Locks Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 25: US Smart Locks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: US Smart Locks Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Canada US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Mexico US Smart Locks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Mexico US Smart Locks Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Smart Locks Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the US Smart Locks Industry?

Key companies in the market include Honeywell International Inc, Johnson Controls International plc, U-tec Group Inc , The Chamberlain Group Inc, August Home Inc (AssaAbloy), Allegion plc, Kwikset (Spectrum Brands), Crestron Electronics Inc, Master Lock (Fortune Brands Home & Security).

3. What are the main segments of the US Smart Locks Industry?

The market segments include End-user, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Smart Home Adoption. Increase of Home break-ins. Thereby Aiding in the Market Growth for Residential Segment.

6. What are the notable trends driving market growth?

Commercial Segment is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Diminishing Profit Margins and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

April 2021: Yale launched Linus Smart Lock with the abiity to connect with leading smart home systems, voice assistants, and home share platforms for effortless door control and access management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Smart Locks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Smart Locks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Smart Locks Industry?

To stay informed about further developments, trends, and reports in the US Smart Locks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence