Key Insights

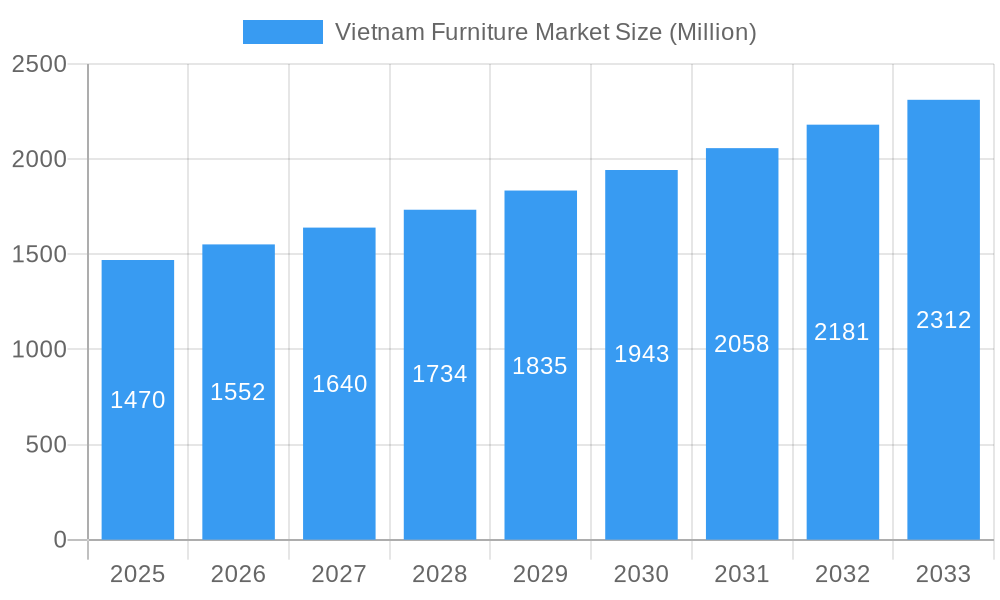

The Vietnam furniture market, valued at $1.47 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.33% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes among Vietnam's burgeoning middle class are stimulating demand for higher-quality and stylish furniture across residential, commercial, and hospitality sectors. Furthermore, the increasing popularity of modern interior design trends and a growing preference for ergonomic and sustainable furniture are significantly shaping consumer choices. Government initiatives promoting the domestic furniture industry, including investments in infrastructure and skill development, are also contributing to market growth. The market is segmented by application (home, office, hospitality, other), material (wood, metal, plastic, other), and distribution channel (home centers, flagship stores, specialty stores, online, other). While the dominance of traditional wood furniture persists, a gradual shift towards metal and plastic furniture is observable, reflecting both cost considerations and design preferences. The online distribution channel is experiencing accelerated growth, driven by increased internet penetration and the convenience offered by e-commerce platforms. Leading players like IKEA, alongside established domestic companies like Duc Thanh Wood Processing JSC and Kaiser 1 Furniture, are strategically leveraging these trends to maintain market share and expand their reach. However, challenges remain, including fluctuations in raw material prices, intense competition, and the need to consistently adapt to evolving consumer demands and global design trends. Successfully navigating these factors will be crucial for sustained growth within the Vietnamese furniture sector.

Vietnam Furniture Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, driven by ongoing economic development and urbanization. The robust growth in the hospitality sector, particularly in tourism-focused areas, is creating significant opportunities. Simultaneously, the increasing focus on sustainable and eco-friendly furniture production methods will reshape market dynamics, incentivizing companies to adopt environmentally responsible practices and sourcing strategies. Competitive pressures will likely intensify, with both domestic and international companies vying for market share. This will necessitate strategic investments in innovation, brand building, and supply chain optimization for companies to achieve sustained success in the increasingly competitive Vietnamese furniture landscape. Diversification into new product lines and exploring niche market segments will be critical for companies seeking to differentiate themselves and capture a greater share of the expanding market.

Vietnam Furniture Market Company Market Share

Vietnam Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam furniture market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking a deep understanding of this dynamic market. The report segments the market by application (home, office, hospitality, other), material (wood, metal, plastic, other), and distribution channel (home centers, flagship stores, specialty stores, online, other). Market size is presented in million units.

Vietnam Furniture Market Dynamics & Structure

The Vietnam furniture market is characterized by a mix of domestic and international players, with increasing competition from global brands. Market concentration is moderate, with a few dominant players and numerous smaller firms. Technological innovation is driven by the adoption of advanced manufacturing techniques and automation, although barriers remain due to cost and skills gaps. The regulatory framework is generally supportive of the industry, although navigating permits and compliance requirements can be challenging. Substitute products include imported furniture and locally produced alternatives utilizing different materials. End-user demographics are evolving, with a growing middle class driving demand for higher-quality and stylish furniture. M&A activity is relatively low but is expected to increase as international players seek expansion opportunities.

- Market Concentration: Moderate (xx% market share held by top 5 players in 2024)

- Technological Innovation Drivers: Automation, advanced manufacturing techniques, design software

- Regulatory Framework: Supportive, with some bureaucratic hurdles

- Competitive Product Substitutes: Imported furniture, locally-made alternatives

- End-User Demographics: Growing middle class, increasing demand for higher-end furniture

- M&A Trends: Low activity currently, potential for increased activity with foreign investment

Vietnam Furniture Market Growth Trends & Insights

The Vietnam furniture market has experienced significant growth over the past few years, driven by rising disposable incomes, urbanization, and increasing construction activity. The market size (in million units) is expected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million units by 2033 from xx million units in 2024. Adoption rates of new furniture designs and materials are influenced by evolving consumer preferences and trends. Technological disruptions, such as e-commerce platforms and 3D printing, are altering the market landscape. Shifts in consumer behavior include a preference for sustainable and ethically sourced products. Market penetration of online furniture sales is steadily growing, posing both opportunities and challenges for traditional retailers.

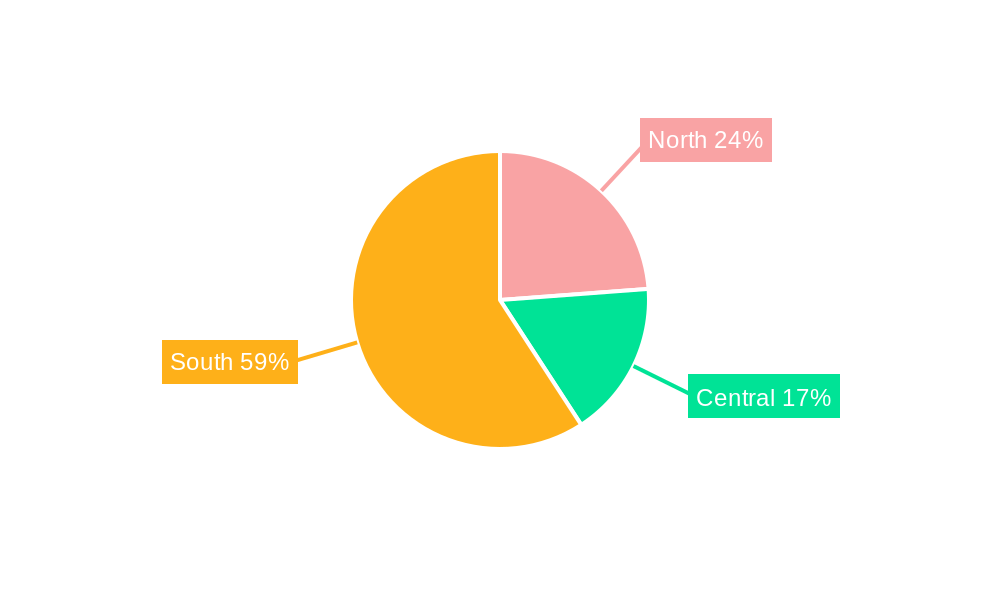

Dominant Regions, Countries, or Segments in Vietnam Furniture Market

The home furniture segment is the dominant application, driven by a large and growing population and increasing urbanization. Wood remains the preferred material due to cultural preferences and its availability. Home centers and specialty stores are the primary distribution channels, although online sales are rapidly expanding. The Ho Chi Minh City and Hanoi regions demonstrate the highest growth rates due to their robust economies and infrastructure development.

- Dominant Application: Home Furniture (xx million units in 2024)

- Dominant Material: Wood (xx million units in 2024)

- Dominant Distribution Channel: Home Centers and Specialty Stores (xx million units in 2024)

- Key Growth Drivers: Rising disposable incomes, urbanization, infrastructure development, government support for the industry.

Vietnam Furniture Market Product Landscape

The Vietnam furniture market offers a diverse range of products, from traditional handcrafted pieces to modern, mass-produced items. Product innovation is focused on incorporating sustainable materials, ergonomic designs, and smart features. Key performance metrics include durability, aesthetics, functionality, and affordability. Unique selling propositions often emphasize craftsmanship, local materials, and personalized designs. Technological advancements like 3D printing and CNC machining are gradually enhancing efficiency and customization.

Key Drivers, Barriers & Challenges in Vietnam Furniture Market

Key Drivers: Rising disposable incomes, increasing urbanization, supportive government policies, and the expansion of foreign brands. The growth of the construction and hospitality sectors strongly fuels demand.

Key Challenges: Intense competition, fluctuations in raw material prices, skills shortages, and infrastructure limitations in certain regions. Supply chain disruptions and high transportation costs can also affect market dynamics.

Emerging Opportunities in Vietnam Furniture Market

Emerging opportunities include the growth of the e-commerce sector, demand for sustainable furniture, increasing interest in bespoke furniture, and the expansion into new market segments (such as co-working spaces and serviced apartments). The potential for exporting Vietnamese furniture to international markets is also significant.

Growth Accelerators in the Vietnam Furniture Market Industry

Strategic partnerships between local and international companies, technological innovation, investment in skills development, and government initiatives to support the industry are key growth accelerators. Sustainable practices and the adoption of circular economy principles are gaining traction and will drive market expansion further.

Key Players Shaping the Vietnam Furniture Market Market

- Duc Thanh Wood Processing JSC

- Kaiser 1 Furniture

- AA Corporation

- Hoang Moc Furniture

- Johnson Wood Products

- IKEA

- An Viet Furniture

- Noi That Kenli

- Tran Duc Furnishings

- Cassina

Notable Milestones in Vietnam Furniture Market Sector

- September 2023: International firms like JYSK and BoConcept expand aggressively into Vietnam, establishing manufacturing plants and retail chains.

- July 2023: AA Corporation completes a significant interior fit-out project at the Regent Phu Quoc resort, showcasing high-end furniture capabilities.

- January 2022: IKEA enhances its e-commerce capabilities, improving global and Vietnamese market reach.

In-Depth Vietnam Furniture Market Outlook

The Vietnam furniture market is poised for sustained growth in the coming years, driven by several positive factors. The increasing middle class, urbanization, and foreign direct investment will continue to fuel demand. Opportunities exist in higher-value segments, sustainable products, and online sales. Strategic partnerships, technological innovation, and a focus on quality will be crucial for success in this competitive market. The market is expected to reach xx million units by 2033, presenting substantial opportunities for both domestic and international players.

Vietnam Furniture Market Segmentation

-

1. Application

- 1.1. Home Furniture

- 1.2. Office Furniture

- 1.3. Hospitality Furniture

- 1.4. Other Furniture

-

2. Material

- 2.1. Wood

- 2.2. Metal

- 2.3. Plastic

- 2.4. Other Materials

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

Vietnam Furniture Market Segmentation By Geography

- 1. Vietnam

Vietnam Furniture Market Regional Market Share

Geographic Coverage of Vietnam Furniture Market

Vietnam Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The higher demand for space-saving and modular furniture solutions; Increasing demand for luxurious home furniture

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Second-hand furniture; High labor costs

- 3.4. Market Trends

- 3.4.1. Bedroom Furniture is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Furniture

- 5.1.2. Office Furniture

- 5.1.3. Hospitality Furniture

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Wood

- 5.2.2. Metal

- 5.2.3. Plastic

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Duc Thanh Wood Processing JSC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kaiser 1 Furniture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AA Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hoang Moc Furniture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Wood Products

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IKEA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 An Viet Furniture

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Noi That Kenli

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tran Duc Furnishings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cassina

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Duc Thanh Wood Processing JSC

List of Figures

- Figure 1: Vietnam Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Vietnam Furniture Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Vietnam Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Vietnam Furniture Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 5: Vietnam Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Vietnam Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Vietnam Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Vietnam Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Vietnam Furniture Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Vietnam Furniture Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Vietnam Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Vietnam Furniture Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 13: Vietnam Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Vietnam Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Vietnam Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Vietnam Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Furniture Market?

The projected CAGR is approximately 5.33%.

2. Which companies are prominent players in the Vietnam Furniture Market?

Key companies in the market include Duc Thanh Wood Processing JSC, Kaiser 1 Furniture, AA Corporation, Hoang Moc Furniture, Johnson Wood Products, IKEA, An Viet Furniture, Noi That Kenli, Tran Duc Furnishings, Cassina.

3. What are the main segments of the Vietnam Furniture Market?

The market segments include Application, Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.47 Million as of 2022.

5. What are some drivers contributing to market growth?

The higher demand for space-saving and modular furniture solutions; Increasing demand for luxurious home furniture.

6. What are the notable trends driving market growth?

Bedroom Furniture is Driving the Market.

7. Are there any restraints impacting market growth?

Growing Demand for Second-hand furniture; High labor costs.

8. Can you provide examples of recent developments in the market?

September 2023: International firms are rapidly expanding into the Vietnam furniture industry as a result of lower tariffs, an easy trading environment, convenient logistic services, and a wide range of materials for manufacturing furniture in the country. Denmark’s JYSK and BoConcept are the leading international players in this expansion. The international players are aiming to establish their manufacturing plants as well as to capture the Vietnamese furniture retail chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Furniture Market?

To stay informed about further developments, trends, and reports in the Vietnam Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence