Key Insights

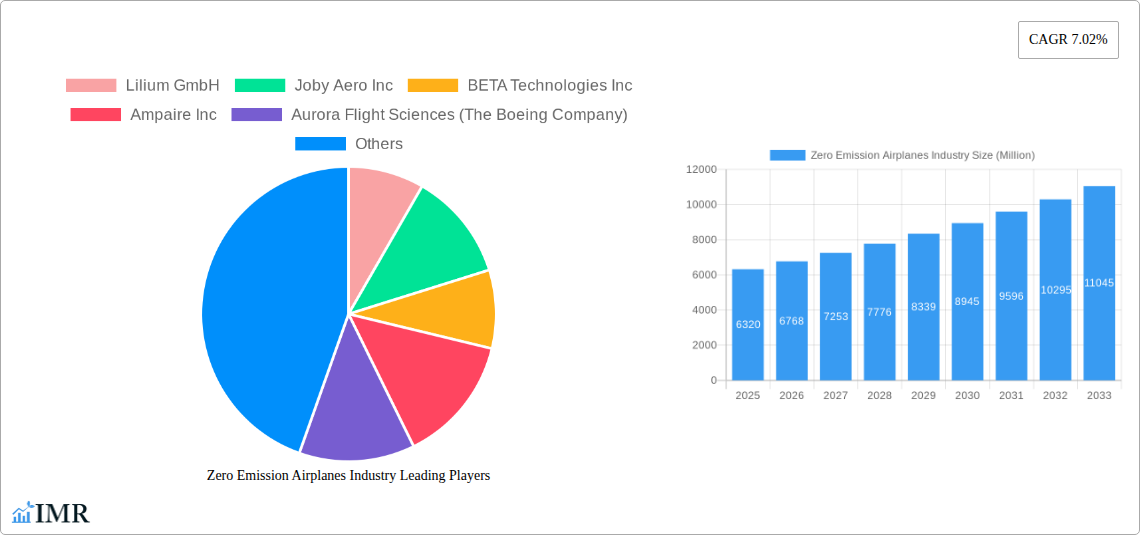

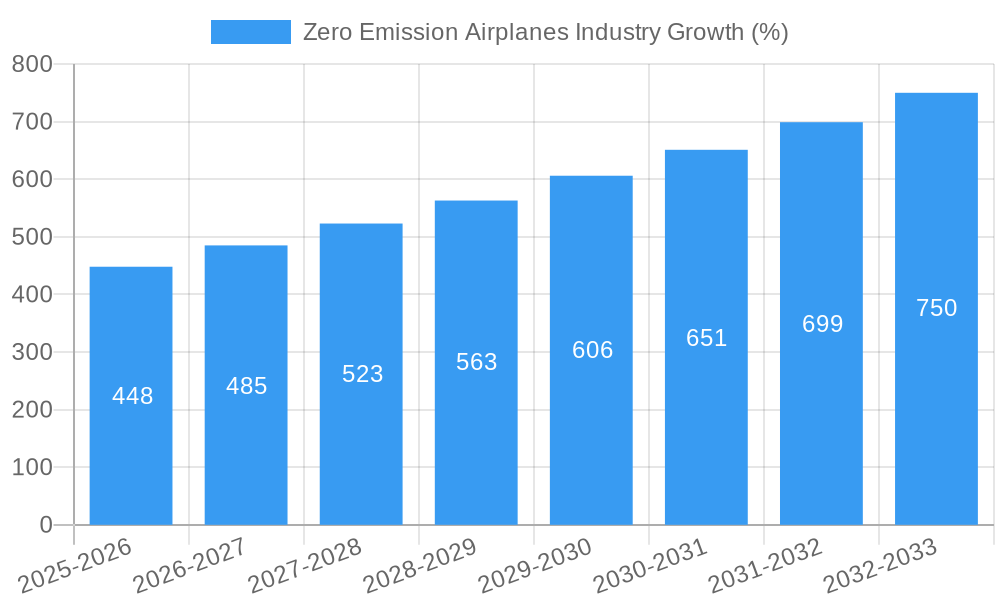

The zero-emission airplane industry is poised for significant growth, driven by increasing environmental concerns and stringent emission regulations globally. The market, currently valued at $6.32 billion in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 7.02% from 2025 to 2033. This expansion is fueled by substantial investments in research and development from both established aerospace giants like Airbus and Boeing, and innovative startups such as Lilium and Joby Aero. Technological advancements in battery technology, hydrogen fuel cells, and electric propulsion systems are crucial enablers of this growth. The commercial and general aviation segments are expected to be primary drivers, with early adoption anticipated in short-haul flights and regional air travel. Government incentives and supportive policies further accelerate market penetration. While challenges remain, including infrastructure development for charging and refueling, and the high initial cost of zero-emission aircraft, the long-term prospects are extremely positive. The industry's success hinges on overcoming technological hurdles to increase range and payload capacity, making zero-emission aircraft economically viable for wider adoption across various applications.

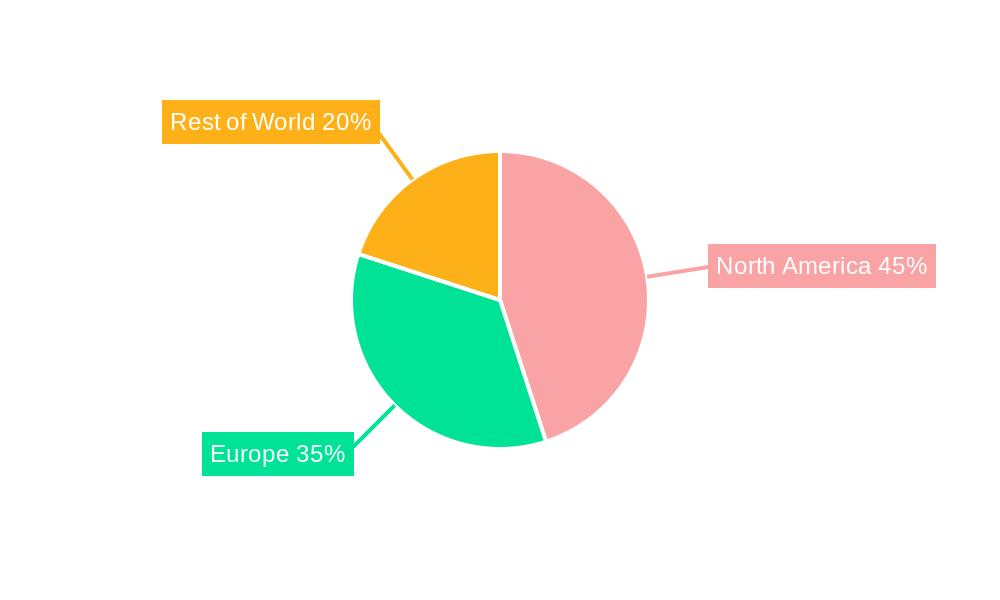

The regional distribution of the market is likely to reflect existing aviation infrastructure and economic activity. North America and Europe are anticipated to dominate the initial phases of market adoption, due to their advanced technological infrastructure and stringent environmental regulations. However, the Rest of the World segment is expected to witness significant growth as technological advancements reduce the cost barrier and increase the accessibility of zero-emission airplanes. The competitive landscape is dynamic, characterized by a mix of established players leveraging existing expertise and agile startups developing disruptive technologies. Strategic partnerships and collaborations are expected to be crucial in accelerating the market's growth and technological advancement. The increasing demand for sustainable aviation solutions will propel the zero-emission airplane market to significant heights over the coming decade. The focus on reducing carbon footprint will likely lead to further government regulations and investment that will support the industry's expansion.

Zero Emission Airplanes: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Zero Emission Airplanes industry, encompassing market dynamics, growth trends, key players, and future outlook. From the parent market of aviation to the child market segments of commercial/general aviation and military applications, this study offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Market values are presented in million units.

Zero Emission Airplanes Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the zero-emission airplane industry. We delve into market concentration, exploring the market share held by key players and assessing the level of competition. The analysis considers technological innovation drivers, including battery technology, electric motor advancements, and lightweight materials, alongside the impact of regulatory frameworks on market growth. Furthermore, the report examines the influence of competitive product substitutes (e.g., high-speed rail) and end-user demographics (e.g., shifting travel preferences). Finally, it explores M&A activity within the sector, providing quantitative data on deal volumes and qualitative insights into strategic rationale.

- Market Concentration: The market is currently fragmented, with xx% market share held by the top 5 players.

- Technological Innovation: Key drivers include improvements in battery energy density and electric motor efficiency. Barriers include high development costs and certification challenges.

- Regulatory Framework: Government incentives and stringent emission regulations are accelerating market adoption.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024, indicating significant consolidation efforts.

Zero Emission Airplanes Industry Growth Trends & Insights

This section presents a detailed analysis of the Zero Emission Airplanes market's evolution, utilizing XXX to provide comprehensive insights. We examine the historical market size (2019-2024) and forecast market size (2025-2033), quantifying market growth with specific metrics like the Compound Annual Growth Rate (CAGR). The analysis includes an assessment of adoption rates across different segments and geographical regions, considering technological disruptions and shifts in consumer behavior, such as increasing environmental awareness and demand for sustainable travel options. The impact of government policies and technological advancements on market penetration will be explored. The projected market size in 2033 is estimated to be xx Million units. CAGR for 2025-2033 is projected at xx%.

Dominant Regions, Countries, or Segments in Zero Emission Airplanes Industry

This section identifies the leading geographical regions, countries, and application segments driving market growth. The analysis focuses on the relative dominance of Commercial and General Aviation versus Military Aviation, examining their respective market shares and growth potentials. Key drivers such as economic policies, infrastructure development, and government support are highlighted for each segment. The report will also analyze the factors contributing to the leading region's or country's dominance.

- Commercial and General Aviation: North America and Europe are leading segments due to supportive regulatory environments and strong consumer demand.

- Military Aviation: Government investments in research and development and operational requirements are key drivers in this segment. The US is expected to be a dominant player.

Zero Emission Airplanes Industry Product Landscape

This section provides an overview of the various types of zero-emission airplanes currently available or under development. The analysis highlights key product innovations, focusing on design features, performance metrics (range, payload, speed), and unique selling propositions. Technological advancements in battery technology, electric propulsion systems, and aircraft design are discussed, emphasizing their impact on market competitiveness.

Key Drivers, Barriers & Challenges in Zero Emission Airplanes Industry

This section outlines the key factors driving and hindering the growth of the zero-emission airplane market. Driving forces include:

- Government regulations and incentives aimed at reducing carbon emissions in aviation.

- Technological advancements leading to increased battery capacity and efficiency.

- Growing consumer demand for sustainable travel options.

Challenges include:

- High development and production costs.

- Limited range and payload capacity compared to traditional aircraft.

- The need for extensive infrastructure development for charging and maintenance. This translates to approximately xx Million units of lost sales potential annually.

Emerging Opportunities in Zero Emission Airplanes Industry

This section identifies emerging opportunities for growth in the zero-emission airplane market. These may include the expansion into new geographical markets, the development of innovative applications (e.g., air taxis), or catering to evolving consumer preferences towards sustainable and convenient air travel.

Growth Accelerators in the Zero Emission Airplanes Industry Industry

Long-term growth will be propelled by technological breakthroughs in battery technology and electric propulsion systems, enabling increased range, payload capacity, and efficiency. Strategic partnerships between aircraft manufacturers, battery suppliers, and infrastructure providers are crucial for market expansion. Government policies and investments in research and development further contribute to growth acceleration.

Key Players Shaping the Zero Emission Airplanes Industry Market

- Lilium GmbH

- Joby Aero Inc

- BETA Technologies Inc

- Ampaire Inc

- Aurora Flight Sciences (The Boeing Company)

- Avinor AS

- Wright Electric

- Airbus SE

- Evektor spol s r o

- PIPISTREL d o o

- Equator Aircraft AS

- Rolls-Royce plc

- Heart Aerospace

- ZeroAvia Inc

- Eviation

- NASA

- Bye Aerospace

Notable Milestones in Zero Emission Airplanes Industry Sector

- July 2021: Airbus Helicopters conducts the full-scale demonstrator flight of its electric helicopter, CityAirbus.

- July 2021: Beta Technologies completes the longest crewed test flight of its Alia aircraft (205 miles).

In-Depth Zero Emission Airplanes Industry Market Outlook

The zero-emission airplane market is poised for significant growth driven by technological advancements, supportive government policies, and increasing environmental awareness. Strategic partnerships and investments in infrastructure will further accelerate market expansion, creating substantial opportunities for industry players. The market's future potential lies in the development of efficient, cost-effective, and commercially viable electric aircraft that can cater to a broader range of applications.

Zero Emission Airplanes Industry Segmentation

-

1. Application

- 1.1. Commercial and General Aviation

- 1.2. Military Aviation

Zero Emission Airplanes Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Rest of World

Zero Emission Airplanes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Evolving Emissions Regulations Driving the Pace of Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial and General Aviation

- 5.1.2. Military Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial and General Aviation

- 6.1.2. Military Aviation

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial and General Aviation

- 7.1.2. Military Aviation

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of World Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial and General Aviation

- 8.1.2. Military Aviation

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. North America Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Europe Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Rest of World Zero Emission Airplanes Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Lilium GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Joby Aero Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BETA Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ampaire Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aurora Flight Sciences (The Boeing Company)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Avinor AS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Wright Electric

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Airbus SE

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Evektor spol s r o

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 PIPISTREL d o o

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Equator Aircraft AS

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Rolls-Royce plc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Heart Aerospace

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 ZeroAvia Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Eviation

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 NASA

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Bye Aerospace

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.1 Lilium GmbH

List of Figures

- Figure 1: Global Zero Emission Airplanes Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Zero Emission Airplanes Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Zero Emission Airplanes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Zero Emission Airplanes Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Zero Emission Airplanes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Rest of World Zero Emission Airplanes Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Rest of World Zero Emission Airplanes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: North America Zero Emission Airplanes Industry Revenue (Million), by Application 2024 & 2032

- Figure 9: North America Zero Emission Airplanes Industry Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Zero Emission Airplanes Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Zero Emission Airplanes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Zero Emission Airplanes Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: Europe Zero Emission Airplanes Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: Europe Zero Emission Airplanes Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Zero Emission Airplanes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Rest of World Zero Emission Airplanes Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: Rest of World Zero Emission Airplanes Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: Rest of World Zero Emission Airplanes Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Rest of World Zero Emission Airplanes Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Zero Emission Airplanes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Zero Emission Airplanes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Zero Emission Airplanes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Zero Emission Airplanes Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Zero Emission Airplanes Industry?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the Zero Emission Airplanes Industry?

Key companies in the market include Lilium GmbH, Joby Aero Inc, BETA Technologies Inc, Ampaire Inc, Aurora Flight Sciences (The Boeing Company), Avinor AS, Wright Electric, Airbus SE, Evektor spol s r o, PIPISTREL d o o, Equator Aircraft AS, Rolls-Royce plc, Heart Aerospace, ZeroAvia Inc, Eviation, NASA, Bye Aerospace.

3. What are the main segments of the Zero Emission Airplanes Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.32 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Evolving Emissions Regulations Driving the Pace of Development.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2021, Airbus Helicopters conducted the full-scale demonstrator flight of its electric helicopter. CityAirbus has a multi-copter configuration that features four ducted high-lift propulsion units. Its eight propellers are driven by electric motors at around 950 rpm to ensure a low acoustic footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Zero Emission Airplanes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Zero Emission Airplanes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Zero Emission Airplanes Industry?

To stay informed about further developments, trends, and reports in the Zero Emission Airplanes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence