Key Insights

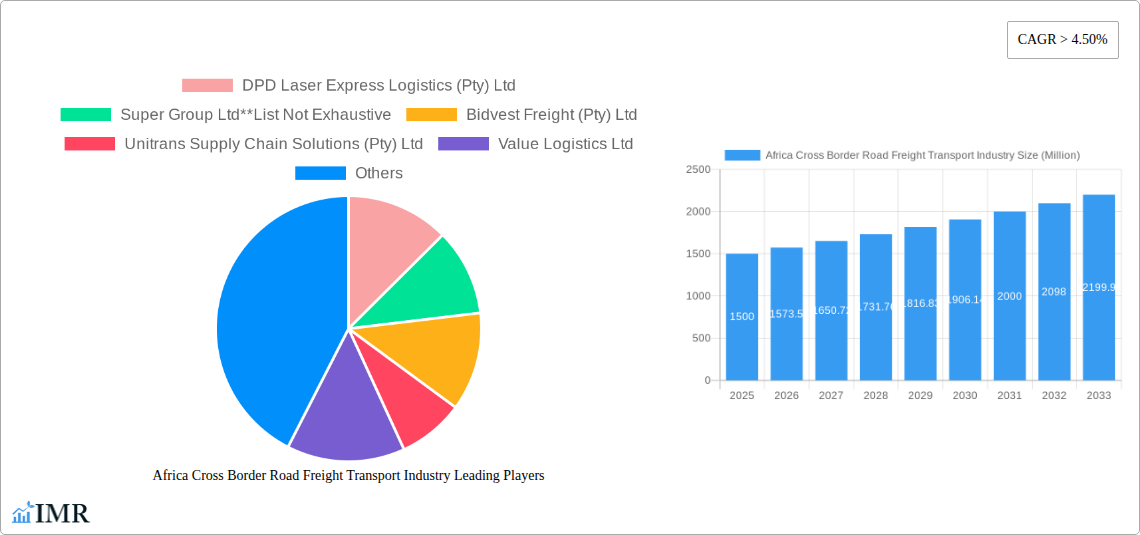

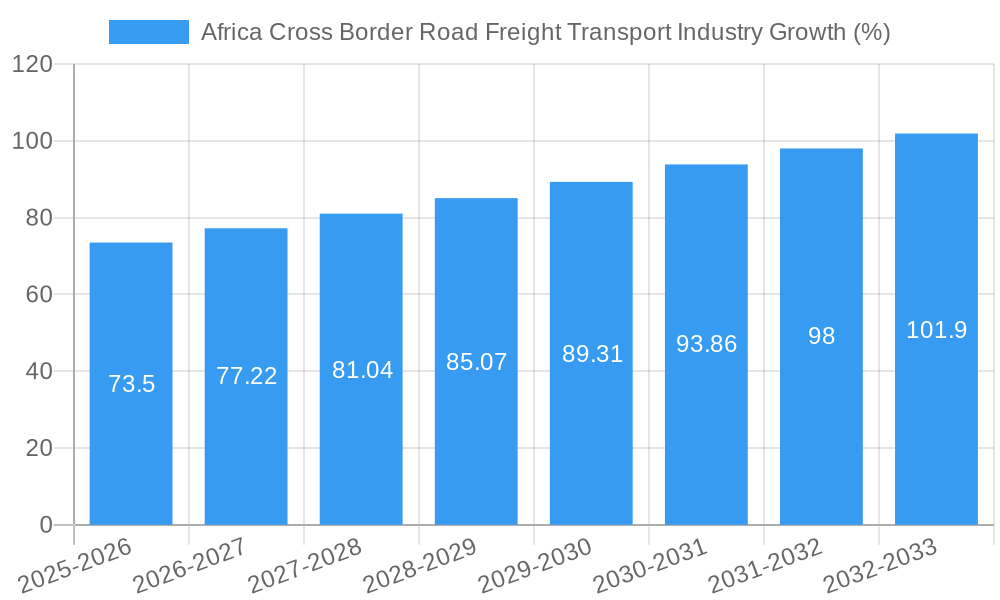

The African cross-border road freight transport industry is experiencing robust growth, driven by increasing intra-African trade facilitated by the African Continental Free Trade Area (AfCFTA) and expanding regional economic activities. The market, currently valued at an estimated $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.5% from 2025 to 2033. This expansion is fueled by several key factors: rising demand for goods across borders, the development of improved infrastructure in certain regions, and the growth of e-commerce, which necessitates efficient and reliable transportation networks. However, challenges remain, including insufficient infrastructure in many parts of Africa, bureaucratic hurdles at border crossings causing delays and increasing costs, and security concerns that impact logistics operations. The industry is segmented by end-user, with manufacturing and automotive, oil, gas, and chemicals, and agriculture being major contributors to the overall market volume. Key players in this dynamic sector include established logistics providers like DHL Freight Forwarding, DSV South Africa, and local companies such as DPD Laser Express Logistics and Bidvest Freight. Understanding the interplay between growth drivers and existing constraints is crucial for businesses to effectively strategize and capitalize on opportunities within this expanding market.

The competitive landscape is marked by a mix of multinational corporations and local players, each with unique strengths and challenges. Multinationals benefit from established networks and advanced technologies, while local companies possess intimate knowledge of regional specifics. This leads to a diverse range of service offerings catering to varied needs. Future growth will be influenced by policy reforms aimed at streamlining cross-border trade procedures, investments in infrastructure development such as improved roads and border control systems, and the continued integration of technology to enhance efficiency and transparency. The industry's focus on sustainable practices and technological advancement such as route optimization software and real-time tracking systems will also play a significant role in shaping its future trajectory. The uneven distribution of infrastructure and the varying levels of economic development across the African continent will continue to affect regional market penetration and overall growth.

Africa Cross Border Road Freight Transport Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa Cross Border Road Freight Transport industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a detailed examination of market dynamics, growth trends, key players, and future outlook, this report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report analyzes the parent market of Logistics and Transportation in Africa and the child market of Cross Border Road Freight Transport, offering a granular view of this dynamic sector. The market size across the entire study period is projected to reach xx Million.

Africa Cross Border Road Freight Transport Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends shaping the African cross-border road freight transport industry. The market is characterized by a moderate level of concentration, with several large players and a significant number of smaller, regional operators. The report assesses market share dynamics for leading players, including but not limited to DPD Laser Express Logistics (Pty) Ltd, Super Group Ltd, Bidvest Freight (Pty) Ltd, and Unitrans Supply Chain Solutions (Pty) Ltd.

- Market Concentration: The industry exhibits a moderately consolidated structure with a Herfindahl-Hirschman Index (HHI) estimated at xx, indicating the presence of both large multinational corporations and smaller regional players.

- Technological Innovation: Adoption of telematics, GPS tracking, and route optimization software is growing, though faced with challenges in infrastructure and digital literacy.

- Regulatory Framework: Varying regulations across African countries create complexity and logistical hurdles for cross-border operations. Harmonization efforts and streamlining customs procedures are crucial for future growth.

- Competitive Substitutes: Rail and air freight are key substitutes, with their competitiveness influenced by factors like cost, transit time, and infrastructure availability.

- M&A Activity: The number of mergers and acquisitions (M&A) within the sector from 2019-2024 was recorded at xx deals, with a total value of xx Million. Consolidation is anticipated to continue.

- End-User Demographics: The report analyzes the varying needs and demands of end-users across diverse sectors like manufacturing, agriculture, and oil & gas.

Africa Cross Border Road Freight Transport Industry Growth Trends & Insights

Leveraging comprehensive data analysis, this section provides a detailed overview of market size evolution, adoption rates of new technologies, and shifts in consumer behavior within the African cross-border road freight transport market. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), driven by factors including increasing cross-border trade, infrastructure development, and expanding e-commerce activities. Market penetration is expected to reach xx% by 2033. Technological disruptions, such as the adoption of blockchain for enhanced supply chain transparency and the use of AI-powered route optimization systems, are shaping the industry.

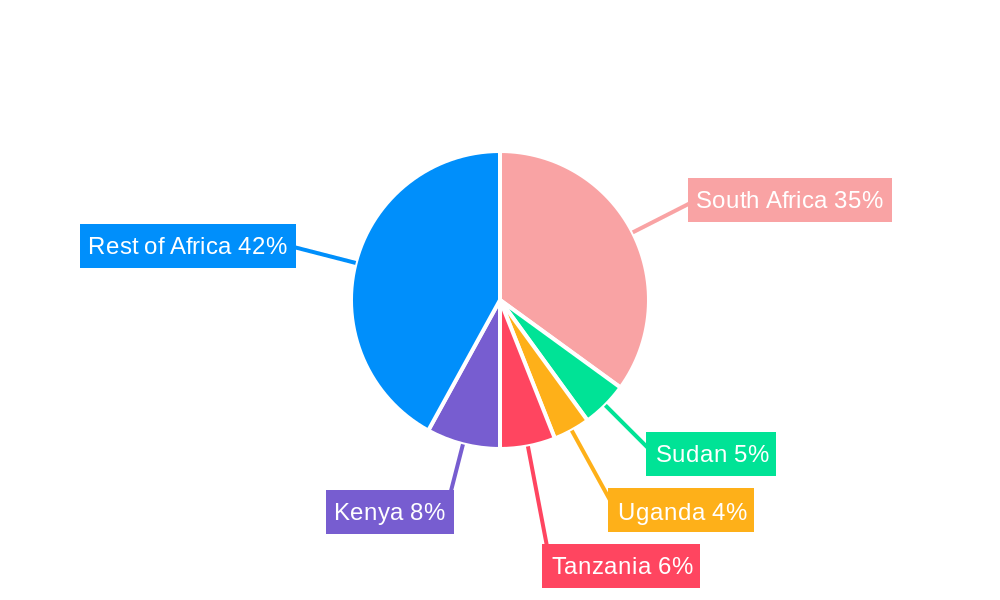

Dominant Regions, Countries, or Segments in Africa Cross Border Road Freight Transport Industry

This section pinpoints the leading regions, countries, and end-user segments within the African cross-border road freight transport industry. South Africa, Kenya, and Nigeria are currently the dominant markets, driven by their strong economies, well-developed infrastructure (relative to other regions), and strategic locations. The Manufacturing and Automotive segment demonstrates the highest demand, followed by Oil, Gas, and Chemicals.

- Key Drivers:

- Economic Growth: Rapid economic expansion in several African nations fuels demand for efficient cross-border logistics.

- Infrastructure Development: Investments in road networks and border crossing facilities are improving connectivity.

- Government Policies: Initiatives promoting regional trade and trade facilitation are boosting market growth.

- Dominance Factors:

- Market Size: South Africa holds the largest market share due to its advanced infrastructure and high volume of cross-border trade.

- Growth Potential: The fastest growth rates are anticipated in East and West Africa as infrastructure improves and economic activity expands.

Africa Cross Border Road Freight Transport Industry Product Landscape

The industry offers a range of services, including full truckload (FTL), less-than-truckload (LTL), specialized transportation (hazardous materials, oversized cargo), and value-added services such as warehousing and customs brokerage. Technological advancements are leading to the emergence of intelligent transportation systems, enhanced tracking and monitoring capabilities, and improved route optimization, enhancing efficiency and minimizing transit times. The increasing use of GPS tracking systems and telematics provides increased security and real-time tracking capabilities, offering significant improvements over traditional methods.

Key Drivers, Barriers & Challenges in Africa Cross Border Road Freight Transport Industry

Key Drivers: Increased cross-border trade within the African Continental Free Trade Area (AfCFTA), rising e-commerce activities, and investments in regional infrastructure development are primary growth drivers. The increasing adoption of technology for improved efficiency and transparency is another significant contributing factor.

Key Challenges: Inadequate infrastructure (poor road conditions, limited border crossing facilities), bureaucratic hurdles (complex customs procedures, lengthy border crossing times), insecurity (theft, hijacking), and a lack of skilled labor remain significant barriers. These challenges lead to increased transit times, higher transportation costs, and supply chain disruptions. The quantifiable impact is estimated to result in xx Million in lost revenue annually.

Emerging Opportunities in Africa Cross Border Road Freight Transport Industry

Emerging opportunities include the expansion of e-commerce logistics, the growth of specialized transport solutions (e.g., cold chain logistics for pharmaceuticals), and the development of integrated logistics platforms that streamline cross-border operations. The increased adoption of technology within the industry, such as the utilization of digital freight marketplaces and the implementation of advanced tracking and monitoring systems, creates new avenues for growth and efficiency.

Growth Accelerators in the Africa Cross Border Road Freight Transport Industry Industry

Long-term growth is expected to be accelerated by the continued implementation of the AfCFTA, the improvement of regional infrastructure, and the adoption of innovative technologies such as blockchain and AI. Strategic partnerships between logistics providers and technology companies will also play a key role in driving market expansion and enhancing operational efficiency.

Key Players Shaping the Africa Cross Border Road Freight Transport Industry Market

- DPD Laser Express Logistics (Pty) Ltd

- Super Group Ltd

- Bidvest Freight (Pty) Ltd

- Unitrans Supply Chain Solutions (Pty) Ltd

- Value Logistics Ltd

- Biddulphs Removals and Storage SA (Pty) Ltd

- CEVA Logistics

- Cargo Carriers (Pty) Ltd

- APM Terminals Trucking South Africa (Pty) Ltd

- Barloworld Logistics Africa (Pty) Ltd

- DHL Freight Forwarding

- DSV South Africa (Pty) Ltd

Notable Milestones in Africa Cross Border Road Freight Transport Industry Sector

- 2020: Launch of the African Continental Free Trade Area (AfCFTA), significantly impacting cross-border trade volumes.

- 2021: Several major logistics companies invested in technology upgrades, improving tracking and efficiency.

- 2022: Increased focus on sustainable transportation solutions, with several companies adopting eco-friendly vehicles.

- 2023: Several mergers and acquisitions occurred, resulting in industry consolidation.

In-Depth Africa Cross Border Road Freight Transport Industry Market Outlook

The future of the African cross-border road freight transport industry is bright, driven by continued economic growth, infrastructure development, and technological advancements. Strategic partnerships, investments in technology, and a focus on sustainability will be crucial for success. The market is expected to experience robust growth, with opportunities for both established players and new entrants to capitalize on the expanding market potential. The projected market size in 2033 is estimated to be xx Million.

Africa Cross Border Road Freight Transport Industry Segmentation

-

1. End User

- 1.1. Manufacturing and Automotive

- 1.2. Oil, Gas and Chemicals

- 1.3. Agriculture

- 1.4. Fishing, and Forestry

- 1.5. Construction

- 1.6. Distributive Trade

- 1.7. Pharmaceutical and Healthcare

- 1.8. Other En

Africa Cross Border Road Freight Transport Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Cross Border Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs

- 3.4. Market Trends

- 3.4.1. Growing Intra-regional Trade in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Manufacturing and Automotive

- 5.1.2. Oil, Gas and Chemicals

- 5.1.3. Agriculture

- 5.1.4. Fishing, and Forestry

- 5.1.5. Construction

- 5.1.6. Distributive Trade

- 5.1.7. Pharmaceutical and Healthcare

- 5.1.8. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. South Africa Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 DPD Laser Express Logistics (Pty) Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Super Group Ltd**List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bidvest Freight (Pty) Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Unitrans Supply Chain Solutions (Pty) Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Value Logistics Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Biddulphs Removals and Storage SA (Pty) Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CEVA Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cargo Carriers (Pty) Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 APM Terminals Trucking South Africa (Pty) Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Barloworld Logistics Africa (Pty) Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 DHL Freight Forwarding

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 DSV South Africa (Pty) Ltd

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 DPD Laser Express Logistics (Pty) Ltd

List of Figures

- Figure 1: Africa Cross Border Road Freight Transport Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Cross Border Road Freight Transport Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Cross Border Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 3: Africa Cross Border Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Cross Border Road Freight Transport Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Africa Cross Border Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Cross Border Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Cross Border Road Freight Transport Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Africa Cross Border Road Freight Transport Industry?

Key companies in the market include DPD Laser Express Logistics (Pty) Ltd, Super Group Ltd**List Not Exhaustive, Bidvest Freight (Pty) Ltd, Unitrans Supply Chain Solutions (Pty) Ltd, Value Logistics Ltd, Biddulphs Removals and Storage SA (Pty) Ltd, CEVA Logistics, Cargo Carriers (Pty) Ltd, APM Terminals Trucking South Africa (Pty) Ltd, Barloworld Logistics Africa (Pty) Ltd, DHL Freight Forwarding, DSV South Africa (Pty) Ltd.

3. What are the main segments of the Africa Cross Border Road Freight Transport Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The rise in online shopping and consumer demand for fast delivery; Rise in cross-border trade activities.

6. What are the notable trends driving market growth?

Growing Intra-regional Trade in the Region.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Cross Border Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Cross Border Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Cross Border Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Africa Cross Border Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence