Key Insights

Spain's Third-Party Logistics (3PL) market, estimated at 14.46 billion in 2025, is poised for robust growth with a projected Compound Annual Growth Rate (CAGR) of 4.03% from 2025 to 2033. This expansion is fueled by the burgeoning e-commerce sector, driving demand for sophisticated warehousing, order fulfillment, and last-mile delivery services. Key industries, including manufacturing and automotive, are increasingly leveraging 3PL providers to optimize supply chains and concentrate on core operations. Globalization and the need for efficient international logistics also significantly contribute to market dynamics. While potential challenges like labor availability and fuel costs exist, the market outlook remains highly positive. Diversification of services, including specialized solutions for pharmaceuticals and healthcare, alongside the growth of the construction sector, further enriches market potential. Leading global players and specialized regional providers are strategically positioned to capture these opportunities.

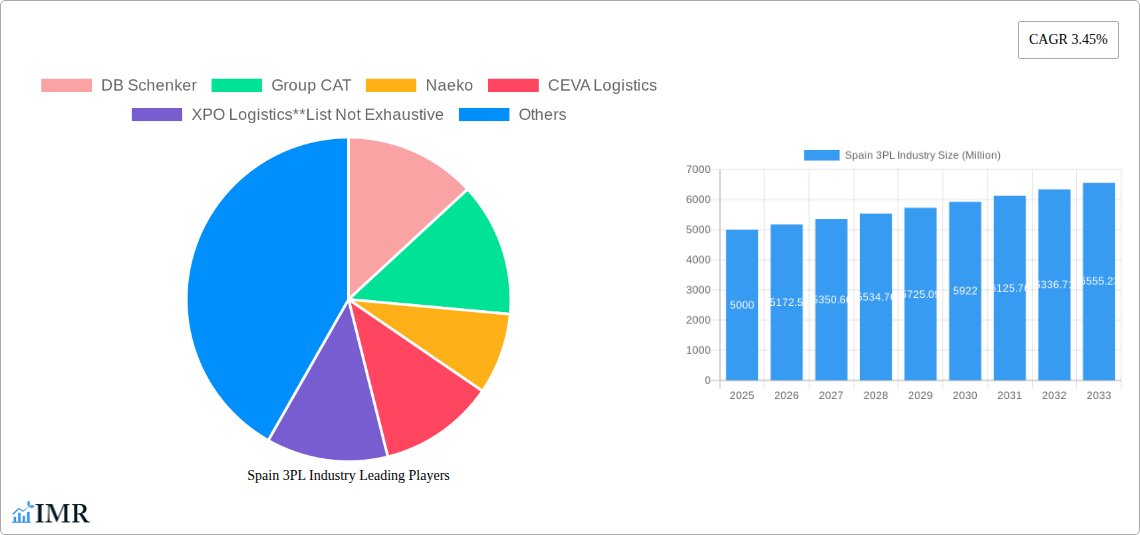

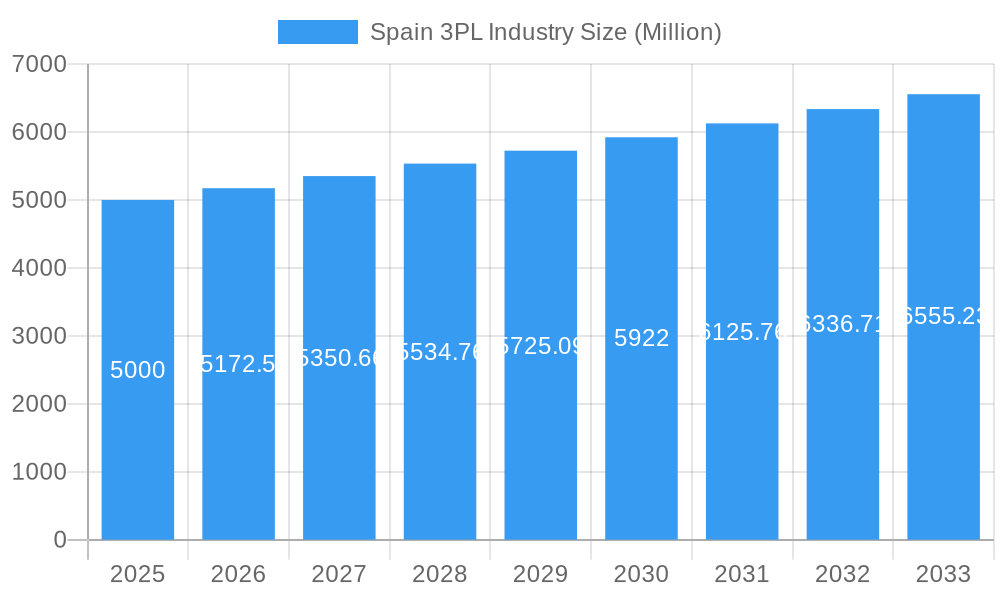

Spain 3PL Industry Market Size (In Billion)

The competitive arena features a dynamic blend of established multinational corporations and agile niche providers, offering tailored solutions to diverse client needs. Intensified competition is anticipated through market entry and service expansion. Mergers, acquisitions, and strategic alliances will be crucial in expanding service portfolios and geographical footprints. Technological innovation, particularly in real-time tracking and data analytics, remains a critical differentiator. Furthermore, the increasing emphasis on sustainable and environmentally conscious logistics solutions reflects evolving market demands and societal expectations. Consequently, the Spanish 3PL market offers significant opportunities for adaptable and innovative businesses.

Spain 3PL Industry Company Market Share

Spain 3PL Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Spain 3PL industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, growth trends, key players, and future opportunities within the Spanish 3PL landscape. The report segments the market by service (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution) and end-user (Manufacturing & Automotive, Oil & Gas and Chemicals, Distributive Trade, Pharma & Healthcare, Construction, Other End Users).

Spain 3PL Industry Market Dynamics & Structure

The Spanish 3PL market is characterized by a moderate level of concentration, with several large multinational players alongside smaller, regional operators. Technological innovation, driven by e-commerce growth and supply chain optimization demands, is a key driver. Regulatory frameworks, particularly concerning data privacy and transportation regulations, significantly impact market operations. Competitive substitutes include in-house logistics solutions, but the increasing complexity of supply chains favors 3PL adoption. The end-user demographics are diverse, reflecting Spain's varied industrial sectors. M&A activity has been moderate, with larger players consolidating their market share.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025 (estimated).

- Technological Innovation: High adoption of warehouse management systems (WMS), transportation management systems (TMS), and automation technologies.

- Regulatory Framework: Compliance with EU and national regulations concerning data protection and transportation is crucial.

- M&A Activity: Approximately xx deals (in millions of euros) occurred between 2019-2024.

Spain 3PL Industry Growth Trends & Insights

The Spanish 3PL market experienced robust growth between 2019 and 2024, driven by the expansion of e-commerce, the increasing complexity of global supply chains, and the rising demand for value-added logistics services. The market is expected to maintain a steady growth trajectory throughout the forecast period (2025-2033). Technological disruptions, such as the adoption of automation and AI, are accelerating efficiency gains and driving market evolution. Shifts in consumer behavior, particularly towards faster delivery times and greater transparency, are influencing 3PL service offerings. Market size is projected to reach xx million euros in 2025, with a CAGR of xx% between 2025 and 2033. Increased market penetration of advanced technologies is expected to further fuel growth.

Dominant Regions, Countries, or Segments in Spain 3PL Industry

The Madrid and Barcelona regions are the dominant centers for 3PL activity in Spain, driven by their strong industrial bases and proximity to major ports. The Distributive Trade (wholesale and retail, including e-commerce) segment represents the largest share of the market, followed by the Manufacturing & Automotive sector. International Transportation Management is experiencing significant growth due to Spain's strategic geographic location and expanding global trade relationships.

- Key Drivers: Strong economic growth in key sectors, robust e-commerce expansion, improved infrastructure, and government initiatives supporting logistics development.

- Distributive Trade (e-commerce): This segment's growth is propelled by increasing online shopping and the need for efficient last-mile delivery solutions.

- Manufacturing & Automotive: This sector's growth is driven by the increasing need for supply chain optimization and just-in-time inventory management.

Spain 3PL Industry Product Landscape

The Spanish 3PL market offers a diverse range of services, encompassing domestic and international transportation management, warehousing, and value-added services such as packaging, labeling, and kitting. Technological advancements are significantly impacting service offerings. The integration of WMS, TMS, and other software solutions enhances efficiency, visibility, and customer service. Unique selling propositions increasingly involve specialized services catering to specific industry needs, such as temperature-controlled transportation for pharmaceuticals or specialized handling for hazardous materials. Automated solutions such as AutoStore™ systems are becoming increasingly prevalent.

Key Drivers, Barriers & Challenges in Spain 3PL Industry

Key Drivers: E-commerce growth, increasing global trade, the need for supply chain optimization, and technological advancements such as automation and AI.

Challenges: Intense competition, labor shortages, rising fuel costs, and regulatory complexity impacting transportation and data privacy. The impact of these factors could lead to a xx% increase in operating costs by 2030 (estimated).

Emerging Opportunities in Spain 3PL Industry

Emerging opportunities lie in the expansion of e-commerce logistics, particularly last-mile delivery solutions in smaller cities and rural areas. The growing demand for sustainable and environmentally friendly logistics solutions presents further opportunities for innovative 3PL providers. The increasing adoption of AI and automation in warehouse operations and transportation management offers significant efficiency gains and cost savings. The specialization in niche sectors, such as cold chain logistics for pharmaceuticals and personalized logistics solutions, offers significant growth potential.

Growth Accelerators in the Spain 3PL Industry

Technological advancements, strategic partnerships between 3PL providers and technology companies, and market expansion into new regions and sectors will be key growth catalysts. The adoption of innovative technologies, such as blockchain for enhanced supply chain traceability, will play a crucial role in driving long-term growth and efficiency. Investment in infrastructure and skilled workforce development is essential to support the industry's expansion.

Key Players Shaping the Spain 3PL Industry Market

- DB Schenker

- Group CAT

- Naeko

- CEVA Logistics

- XPO Logistics

- OIA Global

- Carcaba

- TIBA

- Rhenus Logistics

- DSV

- Decal FM Logistics

Notable Milestones in Spain 3PL Industry Sector

- June 2023: Factor 5 implements an AutoStore™ automated system, boosting efficiency in its cosmetics operations.

- April 2023: CEVA Logistics gains full control of BERGÉ GEFCO, expanding its finished vehicle logistics capabilities.

In-Depth Spain 3PL Industry Market Outlook

The Spanish 3PL market is poised for sustained growth, driven by technological innovation, e-commerce expansion, and the increasing demand for efficient and reliable supply chain solutions. Strategic partnerships, investments in automation, and a focus on sustainability will be key to realizing the market's full potential. The focus on niche markets and value-added services will drive future growth and market differentiation. Expansion into emerging technologies such as drone delivery and autonomous vehicles will also contribute to market transformation.

Spain 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Spain 3PL Industry Segmentation By Geography

- 1. Spain

Spain 3PL Industry Regional Market Share

Geographic Coverage of Spain 3PL Industry

Spain 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. Growth in Refrigerated Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Group CAT

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Naeko

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEVA Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XPO Logistics**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OIA Global

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carcaba

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TIBA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DSV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Decal FM Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Spain 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Spain 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Spain 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Spain 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain 3PL Industry?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the Spain 3PL Industry?

Key companies in the market include DB Schenker, Group CAT, Naeko, CEVA Logistics, XPO Logistics**List Not Exhaustive, OIA Global, Carcaba, TIBA, Rhenus Logistics, DSV, Decal FM Logistics.

3. What are the main segments of the Spain 3PL Industry?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.46 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Growth in Refrigerated Logistics.

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

June 2023: Third-party logistics operator Factor 5 recently commissioned a goods-to-person solution featuring an AutoStore™ automated storage and picking system provided by intelligent automation solution provider Dematic. The solution enhances its order process for perfumes and cosmetics products with the aim of boosting sales and strengthening its ability to compete in the long term. The solution went live in March at Factor 5’s Alovera site northeast of Madrid.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain 3PL Industry?

To stay informed about further developments, trends, and reports in the Spain 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence