Key Insights

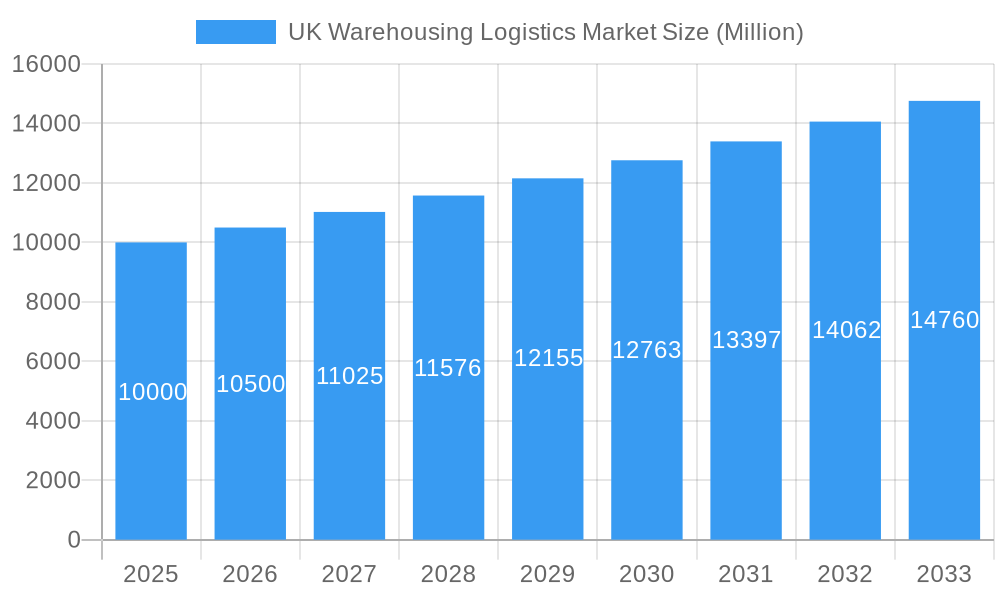

The UK warehousing and logistics market is experiencing robust expansion, offering significant investment and business prospects. With an estimated market size of 38.2 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.7%, the sector is poised for sustained growth throughout the next decade. Key growth drivers include the booming e-commerce sector, necessitating advanced storage, fulfillment, and last-mile delivery solutions. Enhanced supply chain resilience, diversification strategies in response to global disruptions, and growth in vital UK sectors such as food and beverage, healthcare, and manufacturing further underpin this positive trajectory. The market is segmented by end-users, with manufacturing, consumer goods, food and beverage, and retail segments representing the largest contributions.

UK Warehousing Logistics Market Market Size (In Billion)

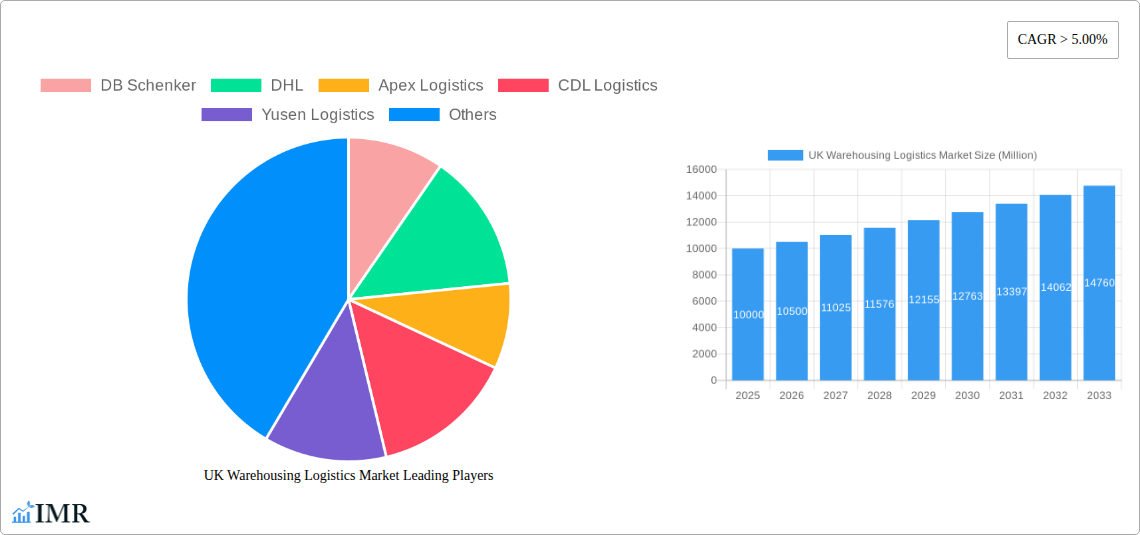

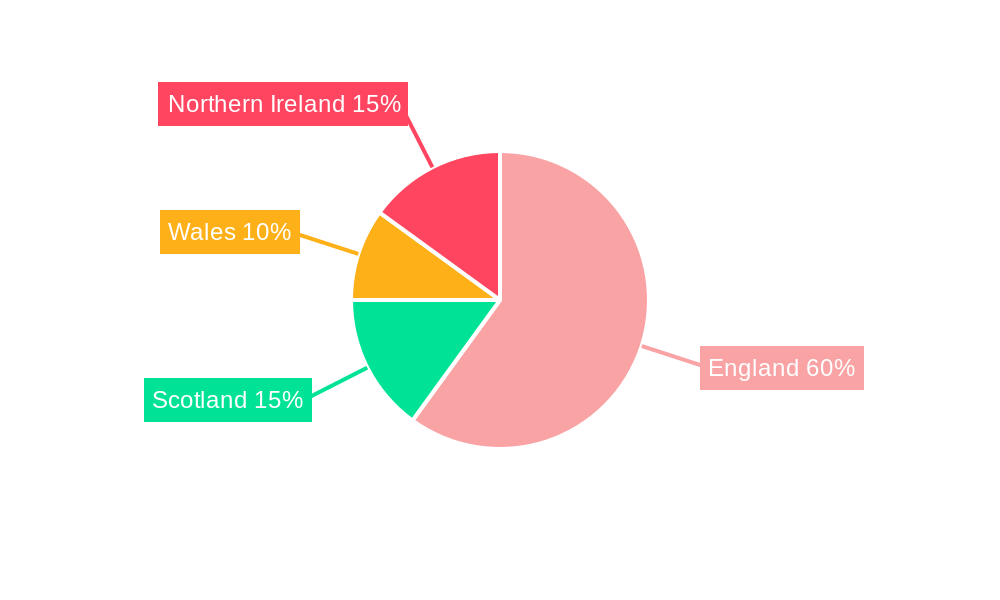

However, the market faces potential constraints. Escalating labor and fuel costs, alongside a persistent shortage of skilled logistics professionals, could impede expansion. Furthermore, evolving environmental sustainability and transportation regulations within the UK may require substantial investment in technology and infrastructure upgrades. Despite these challenges, the long-term outlook remains favorable, driven by the sustained growth of online retail, increasing consumer demand, and government efforts to bolster UK logistics infrastructure. Leading market participants, including DB Schenker, DHL, and Kuehne + Nagel, are strategically positioned to capitalize on this growth, while smaller enterprises must prioritize innovation and specialization to succeed in a competitive landscape. Market performance will be closely tied to the broader UK economic climate and technological advancements in automation and efficiency within the warehousing and logistics domain. Regional disparities in infrastructure and demand across England, Wales, Scotland, and Northern Ireland present opportunities for tailored investment and strategic market approaches.

UK Warehousing Logistics Market Company Market Share

UK Warehousing Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK warehousing logistics market, encompassing market size, growth trends, key players, and future outlook. With a focus on the parent market of logistics and the child market of warehousing, this report is an essential resource for industry professionals, investors, and strategic planners. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

UK Warehousing Logistics Market Dynamics & Structure

The UK warehousing logistics market is characterized by a moderately concentrated structure, with several major players commanding significant market share. Technological innovation, particularly in automation and digitalization, is a key driver of market growth. Stringent regulatory frameworks, including environmental regulations and safety standards, significantly influence operational costs and strategies. The market faces competition from alternative solutions such as decentralized warehousing and improved transportation networks. End-user demographics, particularly the growth of e-commerce and the increasing demand for efficient supply chains across various sectors, are shaping market demand. Mergers and acquisitions (M&A) activity is moderate, reflecting consolidation efforts among players seeking to expand their scale and service offerings.

- Market Concentration: xx% held by top 5 players (2024).

- M&A Deal Volume (2019-2024): xx deals.

- Key Technological Drivers: Automation (Robotics, AI), Blockchain, IoT.

- Innovation Barriers: High initial investment costs for advanced technologies, integration complexities, skills gaps.

- Regulatory Landscape: Stringent environmental regulations (emissions, waste management), health and safety standards, data privacy regulations.

UK Warehousing Logistics Market Growth Trends & Insights

The UK warehousing logistics market has experienced significant growth over the historical period (2019-2024), driven by the expansion of e-commerce, the increasing demand for efficient supply chain management, and technological advancements. This growth is expected to continue during the forecast period (2025-2033), albeit at a potentially moderated pace compared to the earlier years. The adoption rate of automation technologies is rising, significantly impacting operational efficiency and cost optimization. Changing consumer behavior, favoring faster delivery times and increased transparency, continues to push the demand for advanced logistics solutions.

- Market Size (2024): xx Million

- Market Size (2033): xx Million

- CAGR (2025-2033): xx%

- Market Penetration of Automation (2024): xx%

- Market Penetration of Automation (2033): xx%

Dominant Regions, Countries, or Segments in UK Warehousing Logistics Market

The South East region of the UK is currently the dominant region in the warehousing logistics market, driven by factors such as high population density, robust infrastructure (including major ports and airports), and a large concentration of businesses, particularly in the manufacturing, retail, and consumer goods sectors. However, other regions are witnessing significant growth, with investment in infrastructure and logistics hubs leading to increased capacity and attracting new businesses. Among end-users, the manufacturing and retail segments are the largest contributors to market demand, followed by the food and beverage and consumer goods sectors.

- Key Drivers (South East): High population density, established infrastructure, proximity to major transportation hubs, large business concentration.

- Key Drivers (Other Regions): Government initiatives promoting regional development, infrastructure investments, emergence of new logistics hubs, targeted incentives for businesses.

- Market Share (Manufacturing, 2024): xx%

- Market Share (Retail, 2024): xx%

UK Warehousing Logistics Market Product Landscape

The UK warehousing logistics market offers a range of services, from basic warehousing and storage to sophisticated value-added services like inventory management, order fulfillment, and reverse logistics. Product innovations are centered on improving efficiency, enhancing security, and leveraging technology. Automated guided vehicles (AGVs), warehouse management systems (WMS), and robotic process automation (RPA) are transforming warehouse operations. These advancements allow for increased throughput, reduced operational costs, and improved inventory accuracy.

Key Drivers, Barriers & Challenges in UK Warehousing Logistics Market

Key Drivers: E-commerce boom, increasing demand for efficient supply chains, technological advancements, government support for infrastructure development.

Challenges: Skills shortages in the logistics sector, rising labor costs, increasing transportation costs, Brexit-related complexities, and competition from overseas players. These factors could limit market expansion, although ongoing technological advancements are largely mitigating these issues.

Emerging Opportunities in UK Warehousing Logistics Market

Emerging trends include the rise of omnichannel fulfillment, the adoption of sustainable logistics practices, and the growing interest in automated warehousing solutions. Untapped markets include the provision of specialized warehousing services for niche sectors, and the expansion into rural and underserved areas.

Growth Accelerators in the UK Warehousing Logistics Market Industry

Technological breakthroughs in automation, AI, and data analytics are major growth drivers, along with strategic partnerships between logistics providers and technology firms. Expanding into new geographical areas and developing specialized services will further propel market growth.

Key Players Shaping the UK Warehousing Logistics Market

- DB Schenker

- DHL

- Apex Logistics

- CDL Logistics

- Yusen Logistics

- CEVA Logistics

- Whistl

- Fullers Logistics

- Kuehne + Nagel

- Expeditors

- Wincanton PLC

- Rhenus Logistics

Notable Milestones in UK Warehousing Logistics Market Sector

- August 2022: DHL expands its partnership with Nespresso, handling six million orders annually from a new Coventry facility.

- November 2022: PGS Global Logistics invests GBP 10 million in a new solar-powered warehouse in West Bromwich.

In-Depth UK Warehousing Logistics Market Outlook

The UK warehousing logistics market is poised for continued growth, driven by ongoing e-commerce expansion, technological advancements, and increasing demand for efficient supply chain solutions. Strategic partnerships, investments in sustainable practices, and the expansion into niche markets present significant opportunities for growth and profitability.

UK Warehousing Logistics Market Segmentation

-

1. End-User

- 1.1. Manufacturing

- 1.2. Consumer Goods

- 1.3. Food and Beverage

- 1.4. Retail

- 1.5. Healthcare

- 1.6. Other End-Users

UK Warehousing Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Warehousing Logistics Market Regional Market Share

Geographic Coverage of UK Warehousing Logistics Market

UK Warehousing Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. E-commerce Growth Driving the Warehouse Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Manufacturing

- 5.1.2. Consumer Goods

- 5.1.3. Food and Beverage

- 5.1.4. Retail

- 5.1.5. Healthcare

- 5.1.6. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Manufacturing

- 6.1.2. Consumer Goods

- 6.1.3. Food and Beverage

- 6.1.4. Retail

- 6.1.5. Healthcare

- 6.1.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Manufacturing

- 7.1.2. Consumer Goods

- 7.1.3. Food and Beverage

- 7.1.4. Retail

- 7.1.5. Healthcare

- 7.1.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Manufacturing

- 8.1.2. Consumer Goods

- 8.1.3. Food and Beverage

- 8.1.4. Retail

- 8.1.5. Healthcare

- 8.1.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Middle East & Africa UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Manufacturing

- 9.1.2. Consumer Goods

- 9.1.3. Food and Beverage

- 9.1.4. Retail

- 9.1.5. Healthcare

- 9.1.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Asia Pacific UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Manufacturing

- 10.1.2. Consumer Goods

- 10.1.3. Food and Beverage

- 10.1.4. Retail

- 10.1.5. Healthcare

- 10.1.6. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Apex Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CDL Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yusen Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CEVA Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Whistl**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fullers Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kuehne + Nagel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expeditors

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wincanton PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rhenus Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global UK Warehousing Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 3: North America UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 7: South America UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: South America UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 15: Middle East & Africa UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Middle East & Africa UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: Asia Pacific UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Asia Pacific UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: Global UK Warehousing Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 25: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 33: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Warehousing Logistics Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the UK Warehousing Logistics Market?

Key companies in the market include DB Schenker, DHL, Apex Logistics, CDL Logistics, Yusen Logistics, CEVA Logistics, Whistl**List Not Exhaustive, Fullers Logistics, Kuehne + Nagel, Expeditors, Wincanton PLC, Rhenus Logistics.

3. What are the main segments of the UK Warehousing Logistics Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.2 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

E-commerce Growth Driving the Warehouse Development.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

August 2022: DHL Supply Chain, the world's leading contract logistics provider, is extending its strategic partnership with Nestlé Nespresso S.A., the company announced today. Building on a relationship dating back to 2014, DHL will now also provide logistics and fulfillment services in the UK and the Republic of Ireland (ROI). The existing partnerships between DHL and Nespresso in Italy, Brazil, Malaysia, and Taiwan will continue. From Q1 2023, DHL will handle all warehousing across Nespresso's e-commerce and network of retail boutiques in the UK and ROI. Projected to handle six million orders in year one alone, the UK operation will be based in a dedicated omnichannel facility in Coventry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Warehousing Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Warehousing Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Warehousing Logistics Market?

To stay informed about further developments, trends, and reports in the UK Warehousing Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence