Key Insights

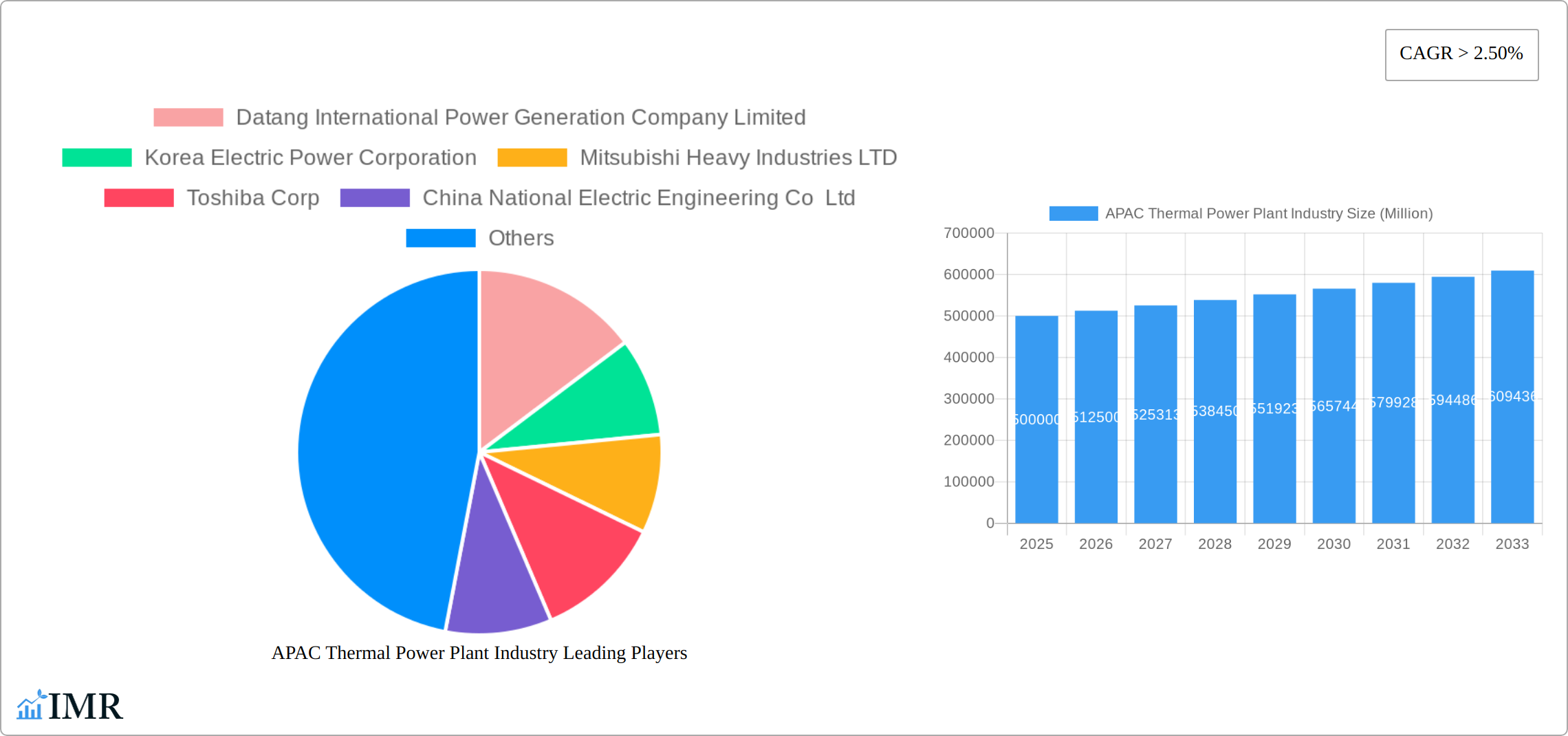

The Asia-Pacific (APAC) thermal power plant industry is experiencing robust growth, driven by increasing energy demand from rapidly developing economies like China, India, and Southeast Asia. The market, valued at approximately $X billion in 2025 (assuming a logical market size based on the provided CAGR and market trends—a precise figure would require additional data), is projected to expand at a compound annual growth rate (CAGR) exceeding 2.50% from 2025 to 2033. This growth is fueled by factors such as rising industrialization, urbanization, and population growth, all of which necessitate increased electricity generation. Coal continues to dominate the fuel type segment, although a gradual shift towards natural gas and other cleaner fuel sources is anticipated due to growing environmental concerns and government regulations promoting renewable energy. However, this transition is likely to be gradual, given the significant existing coal-fired infrastructure and the relatively lower cost of coal compared to other options in many APAC countries.

Major players like Datang International Power Generation, Korea Electric Power Corporation, and others are strategically investing in capacity expansion and technological upgrades to meet the rising demand and enhance efficiency. However, the industry also faces significant restraints, including environmental regulations aimed at reducing carbon emissions and the increasing competitiveness of renewable energy sources like solar and wind power. The regional distribution of the market is heavily skewed towards China, India, and other rapidly developing Southeast Asian nations, reflecting their high energy consumption rates and ongoing infrastructural development. The forecast period of 2025-2033 will see a complex interplay of growth drivers, environmental concerns, and technological advancements shaping the future landscape of the APAC thermal power plant industry. Further diversification of fuel sources, alongside strategic investments in cleaner technologies, will be crucial for sustainable growth within the industry.

APAC Thermal Power Plant Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) thermal power plant industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Thermal Power Plants) and child markets (Coal, Gas, Nuclear, and Other Fuel Types), this report is essential for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year.

APAC Thermal Power Plant Industry Market Dynamics & Structure

The APAC thermal power plant market is characterized by a moderately concentrated structure, with key players like Datang International Power Generation Company Limited, Korea Electric Power Corporation, Mitsubishi Heavy Industries LTD, and Toshiba Corp holding significant market share. Market concentration is approximately xx%, with the top 5 players accounting for xx% of the total revenue in 2024. Technological innovation, driven by increasing efficiency demands and environmental regulations, is a key driver. Stringent emission standards and government policies promoting renewable energy sources present both challenges and opportunities. The market is also influenced by mergers and acquisitions (M&A) activity, with xx deals recorded in the historical period (2019-2024) valued at approximately $xx million. Competitive substitutes, such as renewable energy sources (solar, wind), are gaining traction, impacting market growth. End-user demographics, primarily dominated by industrial and commercial sectors, play a crucial role in shaping demand.

- Market Concentration: xx% in 2024 (top 5 players)

- M&A Deal Volume (2019-2024): xx deals, valued at $xx million

- Key Innovation Drivers: Efficiency improvements, environmental regulations

- Competitive Substitutes: Renewable energy sources

APAC Thermal Power Plant Industry Growth Trends & Insights

The APAC thermal power plant market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of $xx million in 2024. This growth is attributed to increasing energy demand driven by rapid economic development and industrialization across the region. However, adoption rates are expected to moderate in the forecast period (2025-2033) due to the increasing penetration of renewable energy sources and stricter environmental regulations. Technological disruptions, such as advanced gas turbines and high-efficiency coal plants, are influencing market dynamics. Shifts in consumer behavior towards cleaner energy sources are putting pressure on the traditional thermal power sector. The market is projected to reach $xx million by 2033, exhibiting a CAGR of xx% during the forecast period. Market penetration of advanced technologies is expected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in APAC Thermal Power Plant Industry

China and India remain the dominant forces in the APAC thermal power plant market, collectively accounting for a significant majority of the total market share in 2024. China's dominance stems from its robust economic growth, substantial industrial activity, and a large energy-intensive manufacturing sector. India's substantial market share is fueled by its burgeoning population and rapidly expanding industrial base, driving ever-increasing energy demands. While coal continues to hold the largest share in the fuel type market, the proportion is gradually shifting with a growing contribution from gas and nuclear power, reflecting a complex interplay of economic, environmental, and geopolitical factors. Other significant players in the region include countries like Indonesia, Vietnam, and Australia, each with its unique energy mix and developmental trajectory.

- Key Drivers in China: Strong economic growth, industrial expansion, large energy demand, government support for infrastructure development, and ongoing investments in modernization.

- Key Drivers in India: Increasing energy demand from a rapidly rising population and industrial growth, government initiatives promoting energy security, and investments in new power generation capacity.

- Dominant Fuel Type: Coal (Market share details require further specification, considering the evolving energy landscape and the introduction of newer technologies and fuel sources). A diversification towards natural gas and renewables is observable.

APAP Thermal Power Plant Industry Product Landscape

The APAP thermal power plant market features a range of products, including advanced gas turbines, supercritical and ultra-supercritical coal-fired plants, and nuclear reactors. These products are characterized by increasing efficiency, reduced emissions, and improved reliability. Technological advancements focus on incorporating advanced emission control technologies, improving fuel efficiency, and enhancing operational flexibility to meet fluctuating energy demands. Unique selling propositions include higher capacity factors, lower operating costs, and reduced environmental impact.

Key Drivers, Barriers & Challenges in APAC Thermal Power Plant Industry

Key Drivers: Increasing energy demand driven by robust economic growth and rapid industrialization across the region; government support for infrastructure development and energy security initiatives; technological advancements leading to increased efficiency and, in some cases, reduced emissions; and strategic investments in advanced thermal power generation.

Challenges & Restraints: Stringent environmental regulations and emission reduction targets are leading to increased compliance costs and driving a transition toward cleaner energy sources; fluctuating and often rising fuel prices significantly impact operational costs; intensifying competition from renewable energy sources (solar, wind, hydro) is reshaping the energy landscape; supply chain disruptions and geopolitical uncertainties continue to affect equipment procurement, project timelines, and overall costs; regulatory hurdles, permitting delays, and land acquisition challenges impact project development and deployment; and a skilled workforce shortage presents a significant operational challenge.

Emerging Opportunities in APAP Thermal Power Plant Industry

Emerging opportunities include the development of combined cycle power plants integrating gas and renewable energy sources; advancements in carbon capture, utilization, and storage (CCUS) technologies; exploring opportunities in less developed countries with high growth potential. Furthermore, there is a growing focus on developing smart grids and integrating thermal power plants for efficient operation.

Growth Accelerators in the APAC Thermal Power Plant Industry

Sustained growth in the APAC thermal power plant industry will hinge on several key factors. Technological innovations focused on enhancing efficiency, reducing emissions, and improving grid flexibility are crucial. Strategic partnerships between power producers, technology providers, and investors are essential to accelerate the adoption of advanced technologies and optimize project financing. Expansion into new and underserved markets within the APAC region, coupled with governmental policies supporting energy security and modernization, will play a decisive role. Furthermore, a focus on integrating thermal power with renewable sources to create hybrid systems will be a crucial growth driver.

Key Players Shaping the APAC Thermal Power Plant Industry Market

- Datang International Power Generation Company Limited

- Korea Electric Power Corporation

- Mitsubishi Heavy Industries LTD

- Toshiba Corp

- China National Electric Engineering Co Ltd

- China Energy Engineering Corporation (CEEC)

- Adani Group

- NTPC Limited

- Tata Group

- Tokyo Electric Power Company Holdings Inc

Notable Milestones in APAC Thermal Power Plant Industry Sector

- March 2022: Harbin Electric and GE Gas Power secured an order for three GE 9HA.01 gas turbines (2 GW capacity) for Shenzhen Energy Group's Guangming combined-cycle power plant. This project highlights a notable shift toward advanced, high-efficiency gas turbine technology in China, demonstrating a commitment to cleaner and more efficient power generation.

- January 2022: China National Nuclear Corporation (CNNC) connected the 1161MWe Hualong One reactor (Unit 6) at the Fuqing nuclear power plant to the grid. This milestone showcased advancements in domestically developed nuclear power technology in China, highlighting the country's ambition to expand its nuclear energy capacity.

- [Add other recent significant milestones here with dates and brief descriptions] Include examples of significant project completions, technological breakthroughs, policy changes, or mergers and acquisitions that have shaped the industry.

In-Depth APAC Thermal Power Plant Industry Market Outlook

The APAC thermal power plant market is expected to experience continued growth, albeit at a potentially moderated pace compared to previous years. This moderated growth reflects a transition towards a more diversified energy mix, with increasing contributions from renewable energy sources and a focus on improving the efficiency and environmental performance of thermal power plants. Increasing energy demand, driven by economic growth and population increases, will remain a significant driver. However, the industry's trajectory will be significantly influenced by the pace of technological innovation, the implementation of stricter environmental regulations, and the evolving geopolitical landscape. The market presents compelling opportunities for technology providers, power producers, and investors, but success will depend on adapting to this dynamic and evolving environment, embracing technological advancements, and focusing on sustainability.

APAC Thermal Power Plant Industry Segmentation

-

1. Fuel Type

- 1.1. Coal

- 1.2. Gas

- 1.3. Nuclear

- 1.4. Other Fuel Types

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Rest of Asia-Pacific

APAC Thermal Power Plant Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

APAC Thermal Power Plant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Coal Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. Coal

- 5.1.2. Gas

- 5.1.3. Nuclear

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. China APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. Coal

- 6.1.2. Gas

- 6.1.3. Nuclear

- 6.1.4. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. India APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. Coal

- 7.1.2. Gas

- 7.1.3. Nuclear

- 7.1.4. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Japan APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. Coal

- 8.1.2. Gas

- 8.1.3. Nuclear

- 8.1.4. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of Asia Pacific APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. Coal

- 9.1.2. Gas

- 9.1.3. Nuclear

- 9.1.4. Other Fuel Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. China APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 11. Japan APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 12. India APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 13. South Korea APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southeast Asia APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 15. Australia APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 16. Indonesia APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 17. Phillipes APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 18. Singapore APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 19. Thailandc APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 20. Rest of Asia Pacific APAC Thermal Power Plant Industry Analysis, Insights and Forecast, 2019-2031

- 21. Competitive Analysis

- 21.1. Global Market Share Analysis 2024

- 21.2. Company Profiles

- 21.2.1 Datang International Power Generation Company Limited

- 21.2.1.1. Overview

- 21.2.1.2. Products

- 21.2.1.3. SWOT Analysis

- 21.2.1.4. Recent Developments

- 21.2.1.5. Financials (Based on Availability)

- 21.2.2 Korea Electric Power Corporation

- 21.2.2.1. Overview

- 21.2.2.2. Products

- 21.2.2.3. SWOT Analysis

- 21.2.2.4. Recent Developments

- 21.2.2.5. Financials (Based on Availability)

- 21.2.3 Mitsubishi Heavy Industries LTD

- 21.2.3.1. Overview

- 21.2.3.2. Products

- 21.2.3.3. SWOT Analysis

- 21.2.3.4. Recent Developments

- 21.2.3.5. Financials (Based on Availability)

- 21.2.4 Toshiba Corp

- 21.2.4.1. Overview

- 21.2.4.2. Products

- 21.2.4.3. SWOT Analysis

- 21.2.4.4. Recent Developments

- 21.2.4.5. Financials (Based on Availability)

- 21.2.5 China National Electric Engineering Co Ltd

- 21.2.5.1. Overview

- 21.2.5.2. Products

- 21.2.5.3. SWOT Analysis

- 21.2.5.4. Recent Developments

- 21.2.5.5. Financials (Based on Availability)

- 21.2.6 China Energy Engineering Corporation (CEEC)

- 21.2.6.1. Overview

- 21.2.6.2. Products

- 21.2.6.3. SWOT Analysis

- 21.2.6.4. Recent Developments

- 21.2.6.5. Financials (Based on Availability)

- 21.2.7 Adani Group

- 21.2.7.1. Overview

- 21.2.7.2. Products

- 21.2.7.3. SWOT Analysis

- 21.2.7.4. Recent Developments

- 21.2.7.5. Financials (Based on Availability)

- 21.2.8 NTPC Limited

- 21.2.8.1. Overview

- 21.2.8.2. Products

- 21.2.8.3. SWOT Analysis

- 21.2.8.4. Recent Developments

- 21.2.8.5. Financials (Based on Availability)

- 21.2.9 Tata Group

- 21.2.9.1. Overview

- 21.2.9.2. Products

- 21.2.9.3. SWOT Analysis

- 21.2.9.4. Recent Developments

- 21.2.9.5. Financials (Based on Availability)

- 21.2.10 Tokyo Electric Power Company Holdings Inc

- 21.2.10.1. Overview

- 21.2.10.2. Products

- 21.2.10.3. SWOT Analysis

- 21.2.10.4. Recent Developments

- 21.2.10.5. Financials (Based on Availability)

- 21.2.1 Datang International Power Generation Company Limited

List of Figures

- Figure 1: Global APAC Thermal Power Plant Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global APAC Thermal Power Plant Industry Volume Breakdown (Gigawatt, %) by Region 2024 & 2032

- Figure 3: Asia Pacific APAC Thermal Power Plant Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: Asia Pacific APAC Thermal Power Plant Industry Volume (Gigawatt), by Country 2024 & 2032

- Figure 5: Asia Pacific APAC Thermal Power Plant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Thermal Power Plant Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: China APAC Thermal Power Plant Industry Revenue (Million), by Fuel Type 2024 & 2032

- Figure 8: China APAC Thermal Power Plant Industry Volume (Gigawatt), by Fuel Type 2024 & 2032

- Figure 9: China APAC Thermal Power Plant Industry Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 10: China APAC Thermal Power Plant Industry Volume Share (%), by Fuel Type 2024 & 2032

- Figure 11: China APAC Thermal Power Plant Industry Revenue (Million), by Geography 2024 & 2032

- Figure 12: China APAC Thermal Power Plant Industry Volume (Gigawatt), by Geography 2024 & 2032

- Figure 13: China APAC Thermal Power Plant Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 14: China APAC Thermal Power Plant Industry Volume Share (%), by Geography 2024 & 2032

- Figure 15: China APAC Thermal Power Plant Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: China APAC Thermal Power Plant Industry Volume (Gigawatt), by Country 2024 & 2032

- Figure 17: China APAC Thermal Power Plant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: China APAC Thermal Power Plant Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: India APAC Thermal Power Plant Industry Revenue (Million), by Fuel Type 2024 & 2032

- Figure 20: India APAC Thermal Power Plant Industry Volume (Gigawatt), by Fuel Type 2024 & 2032

- Figure 21: India APAC Thermal Power Plant Industry Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 22: India APAC Thermal Power Plant Industry Volume Share (%), by Fuel Type 2024 & 2032

- Figure 23: India APAC Thermal Power Plant Industry Revenue (Million), by Geography 2024 & 2032

- Figure 24: India APAC Thermal Power Plant Industry Volume (Gigawatt), by Geography 2024 & 2032

- Figure 25: India APAC Thermal Power Plant Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 26: India APAC Thermal Power Plant Industry Volume Share (%), by Geography 2024 & 2032

- Figure 27: India APAC Thermal Power Plant Industry Revenue (Million), by Country 2024 & 2032

- Figure 28: India APAC Thermal Power Plant Industry Volume (Gigawatt), by Country 2024 & 2032

- Figure 29: India APAC Thermal Power Plant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: India APAC Thermal Power Plant Industry Volume Share (%), by Country 2024 & 2032

- Figure 31: Japan APAC Thermal Power Plant Industry Revenue (Million), by Fuel Type 2024 & 2032

- Figure 32: Japan APAC Thermal Power Plant Industry Volume (Gigawatt), by Fuel Type 2024 & 2032

- Figure 33: Japan APAC Thermal Power Plant Industry Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 34: Japan APAC Thermal Power Plant Industry Volume Share (%), by Fuel Type 2024 & 2032

- Figure 35: Japan APAC Thermal Power Plant Industry Revenue (Million), by Geography 2024 & 2032

- Figure 36: Japan APAC Thermal Power Plant Industry Volume (Gigawatt), by Geography 2024 & 2032

- Figure 37: Japan APAC Thermal Power Plant Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 38: Japan APAC Thermal Power Plant Industry Volume Share (%), by Geography 2024 & 2032

- Figure 39: Japan APAC Thermal Power Plant Industry Revenue (Million), by Country 2024 & 2032

- Figure 40: Japan APAC Thermal Power Plant Industry Volume (Gigawatt), by Country 2024 & 2032

- Figure 41: Japan APAC Thermal Power Plant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Japan APAC Thermal Power Plant Industry Volume Share (%), by Country 2024 & 2032

- Figure 43: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue (Million), by Fuel Type 2024 & 2032

- Figure 44: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume (Gigawatt), by Fuel Type 2024 & 2032

- Figure 45: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 46: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume Share (%), by Fuel Type 2024 & 2032

- Figure 47: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue (Million), by Geography 2024 & 2032

- Figure 48: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume (Gigawatt), by Geography 2024 & 2032

- Figure 49: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 50: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume Share (%), by Geography 2024 & 2032

- Figure 51: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume (Gigawatt), by Country 2024 & 2032

- Figure 53: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 5: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: China APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Japan APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: India APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: South Korea APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: Southeast Asia APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southeast Asia APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Australia APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: Indonesia APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Indonesia APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Phillipes APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Phillipes APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 27: Singapore APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 29: Thailandc APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific APAC Thermal Power Plant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific APAC Thermal Power Plant Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 33: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 34: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 35: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 37: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 39: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 40: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 41: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 43: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 45: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 46: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 47: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 49: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 51: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 52: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Fuel Type 2019 & 2032

- Table 53: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 55: Global APAC Thermal Power Plant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global APAC Thermal Power Plant Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Thermal Power Plant Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the APAC Thermal Power Plant Industry?

Key companies in the market include Datang International Power Generation Company Limited, Korea Electric Power Corporation, Mitsubishi Heavy Industries LTD, Toshiba Corp, China National Electric Engineering Co Ltd, China Energy Engineering Corporation (CEEC), Adani Group, NTPC Limited, Tata Group, Tokyo Electric Power Company Holdings Inc.

3. What are the main segments of the APAC Thermal Power Plant Industry?

The market segments include Fuel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Coal Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

March 2022: Harbin Electric and GE Gas Power announced that Shenzhen Energy Group Corporation Co., Ltd., a government-owned power utility, has ordered power generation equipment for its Guangming combined-cycle power plant, located in the Shenzhen Guangming district of Guangdong province in China. The facility will be powered by three GE 9HA.01 gas turbines with a capacity of up to 2 gigawatts (GW).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Thermal Power Plant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Thermal Power Plant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Thermal Power Plant Industry?

To stay informed about further developments, trends, and reports in the APAC Thermal Power Plant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence