Key Insights

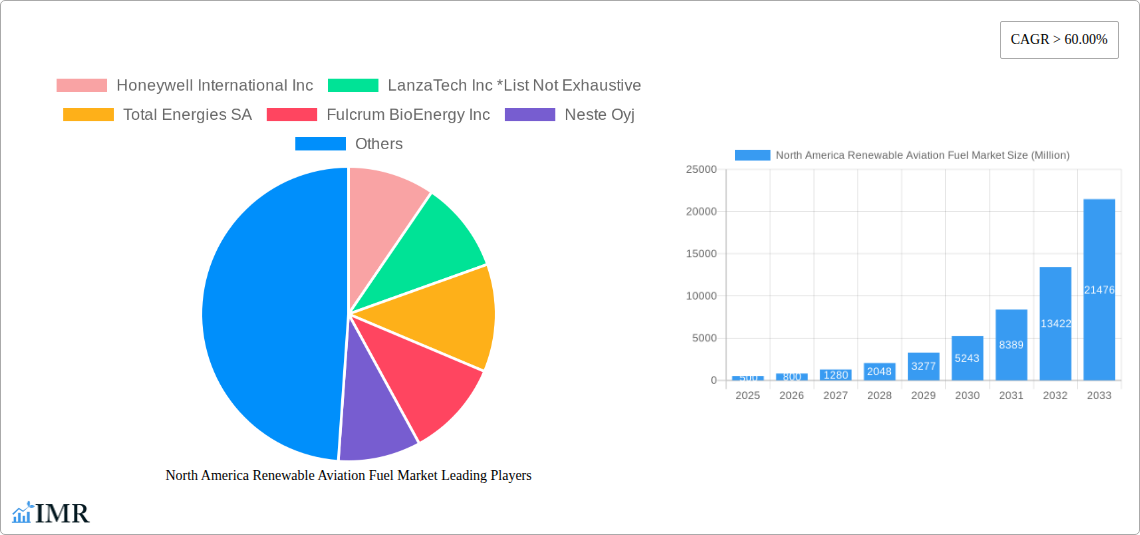

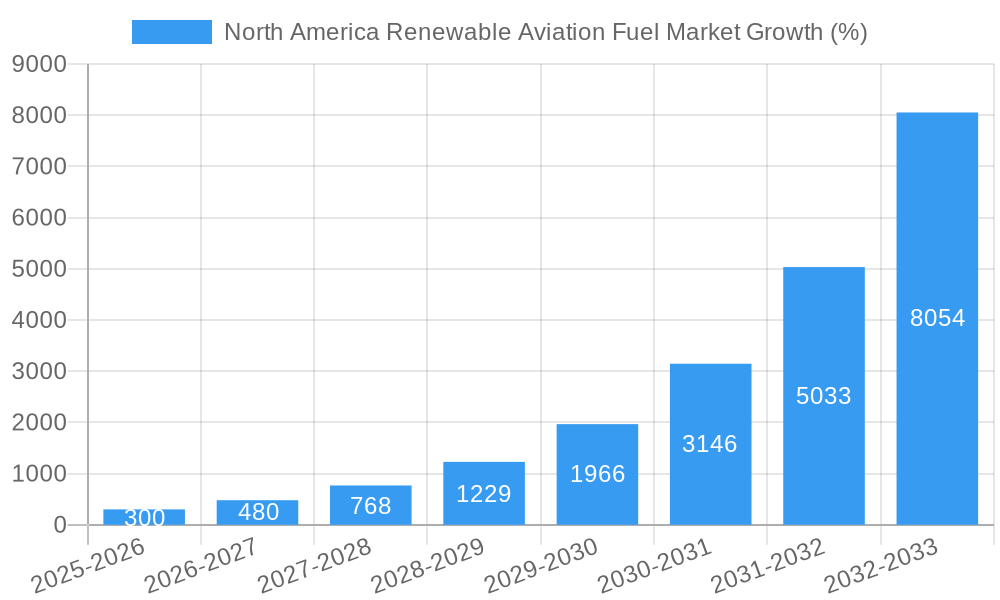

The North American renewable aviation fuel (RAF) market is experiencing explosive growth, driven by stringent environmental regulations aimed at reducing carbon emissions from the aviation sector and a rising consumer demand for sustainable travel options. With a Compound Annual Growth Rate (CAGR) exceeding 60% and a market size projected to reach several billion dollars by 2033 (precise figures require more data but this growth rate suggests a significant expansion from current market valuations), the industry presents a lucrative opportunity for investors and businesses. Key technologies fueling this growth include Fischer-Tropsch (FT) synthesis, Hydroprocessed Esters and Fatty Acids (HEFA), Synthesized Iso-Paraffinic (SIP), and Alcohol-to-Jet (AJT) pathways, each offering unique advantages in terms of feedstock availability and cost-effectiveness. The market is segmented by application into commercial and defense sectors, with the commercial sector currently dominating due to the larger volume of flights. Major players like Honeywell, LanzaTech, Total Energies, Neste, and others are actively investing in research, development, and commercialization of RAF technologies, further accelerating market expansion.

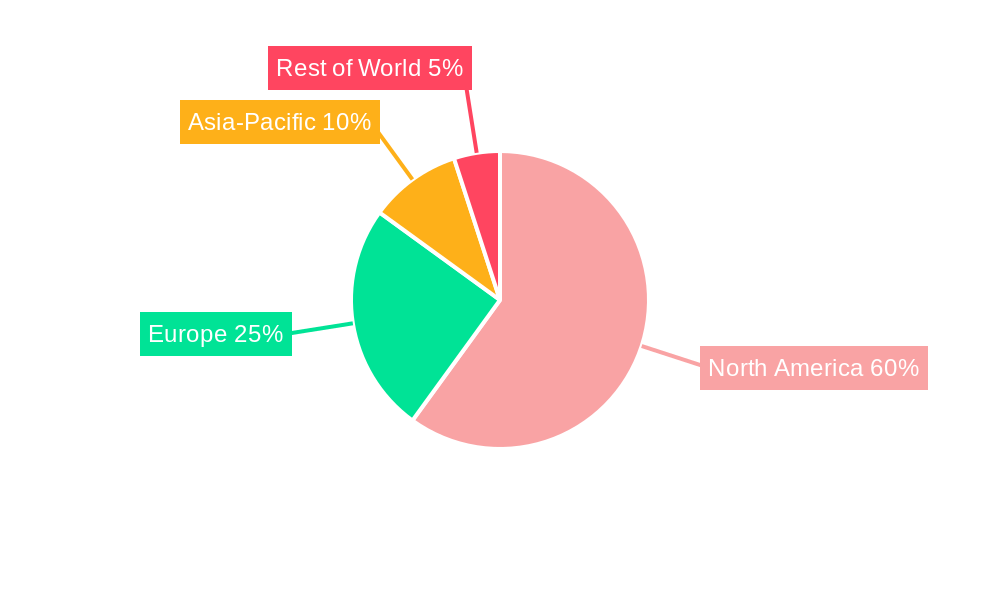

Growth is primarily fueled by government incentives, including tax credits and mandates for blending RAF into conventional jet fuel, coupled with airline commitments to reduce their carbon footprint. While challenges remain, such as the need for scalable and cost-competitive production processes and securing sufficient sustainable feedstocks, the long-term outlook for the North American RAF market remains exceptionally positive. The regional focus on North America reflects its established aviation infrastructure and proactive policy environment conducive to RAF adoption. However, competition is expected to intensify as other regions also embrace sustainable aviation solutions. The market is expected to see further consolidation as larger companies acquire smaller players to gain a foothold in this quickly evolving landscape.

North America Renewable Aviation Fuel Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America renewable aviation fuel market, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by technology (Fischer-Tropsch (FT), Hydroprocessed Esters and Fatty Acids (HEFA), Synthesisized Iso-Paraffinic (SIP), and Alcohol-to-Jet (AJT)) and application (Commercial, Defense). Key players analyzed include Honeywell International Inc, LanzaTech Inc, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Red Rock Biofuels LLC, SG Preston Company, and Gevo Inc. (List not exhaustive). The report projects a market value of xx Million by 2033.

North America Renewable Aviation Fuel Market Dynamics & Structure

The North America renewable aviation fuel market is characterized by moderate concentration, with several large players and numerous smaller entrants. Technological innovation, driven by the need to reduce carbon emissions, is a key driver. Stringent environmental regulations and government incentives are shaping the market landscape, fostering competition and stimulating investment in sustainable aviation fuel (SAF) production. The market faces competition from conventional jet fuel, though the increasing awareness of environmental concerns is gradually shifting the balance. Mergers and acquisitions are playing a significant role in market consolidation and expansion.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share (xx%).

- Technological Innovation: Significant investments in HEFA, FT, SIP, and AJT technologies are driving efficiency and cost reductions. Innovation barriers include high upfront capital costs and technological complexities.

- Regulatory Framework: Government policies, carbon emission reduction targets, and incentives are pushing adoption of SAF. Regulatory hurdles related to certification and standardization remain.

- Competitive Substitutes: Conventional jet fuel remains the primary substitute, but its environmental impact is increasingly a concern.

- End-User Demographics: Primarily commercial airlines and defense sectors, with growth potential in general aviation and other industries.

- M&A Trends: Consolidation through acquisitions and joint ventures is prevalent, driving scale and technological integration. The number of M&A deals within the last 5 years is approximately xx.

North America Renewable Aviation Fuel Market Growth Trends & Insights

The North America renewable aviation fuel market has experienced substantial growth in recent years, driven by the increasing urgency to decarbonize the aviation sector. The market size is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth reflects the growing adoption of SAF by major airlines and the ongoing development of advanced biofuel production technologies. The market penetration of SAF is currently low (xx%), but it is expected to increase significantly as production capacity expands and costs decline. Technological disruptions, such as improvements in conversion efficiency and feedstock utilization, are further accelerating market growth. Shifting consumer preferences towards sustainable travel are also adding impetus to the growth.

Dominant Regions, Countries, or Segments in North America Renewable Aviation Fuel Market

The Western region of North America, particularly California, is currently leading the market due to its strong environmental regulations, supportive government policies, and presence of key industry players. Within the technology segments, HEFA currently holds the largest market share (xx%) due to its relatively mature technology and established supply chains. The commercial aviation sector dominates the application segment (xx%), driven by large-scale adoption by major airlines.

- Key Drivers:

- Stringent environmental regulations and carbon emission reduction targets.

- Government incentives and subsidies for SAF production and adoption.

- Growing corporate sustainability initiatives among airlines and other end-users.

- Development of advanced biofuel production technologies.

- Dominance Factors:

- Presence of major renewable fuel producers and established supply chains.

- Supportive policy environment and infrastructure for biofuel production.

- High demand from major airlines operating in the region.

- California's proactive approach to environmental protection and carbon neutrality.

North America Renewable Aviation Fuel Market Product Landscape

The market offers a range of renewable aviation fuels, each with unique characteristics and applications. HEFA fuels are currently the most prevalent, while other technologies like FT and AJT are gaining traction. Continuous innovation is focused on enhancing fuel properties (e.g., energy density, cold-flow performance), improving production efficiency, and reducing costs. The unique selling proposition of these fuels lies in their significantly lower carbon footprint compared to conventional jet fuel, making them crucial for meeting sustainability targets.

Key Drivers, Barriers & Challenges in North America Renewable Aviation Fuel Market

Key Drivers: Increased environmental awareness, stringent emission regulations, government incentives (e.g., tax credits, grants), and rising demand from airlines committed to sustainability targets. Technological advancements are also reducing production costs and improving fuel efficiency.

Key Challenges: High production costs compared to conventional jet fuel, limited feedstock availability, complex supply chains, and technological challenges associated with scaling up production to meet increasing demand. Regulatory uncertainties and certification processes also pose obstacles to widespread adoption. The estimated impact of these challenges is a xx% reduction in projected market growth by 2030.

Emerging Opportunities in North America Renewable Aviation Fuel Market

Untapped markets such as general aviation and regional airlines present substantial growth opportunities. The development of new feedstocks (e.g., waste-based feedstocks) can significantly reduce production costs and enhance sustainability. Innovative applications, such as blending SAF with conventional jet fuel, and advancements in fuel distribution infrastructure can facilitate market expansion.

Growth Accelerators in the North America Renewable Aviation Fuel Market Industry

Technological breakthroughs in feedstock conversion and production efficiency are key drivers of long-term growth. Strategic partnerships between fuel producers, airlines, and technology providers are essential for scaling up production and accelerating market adoption. Expansion of SAF production facilities across North America will further propel market growth, especially in regions with supportive regulatory environments.

Key Players Shaping the North America Renewable Aviation Fuel Market Market

- Honeywell International Inc

- LanzaTech Inc

- Total Energies SA

- Fulcrum BioEnergy Inc

- Neste Oyj

- Red Rock Biofuels LLC

- SG Preston Company

- Gevo Inc

Notable Milestones in North America Renewable Aviation Fuel Market Sector

- March 2022: Aemetis Inc. announced an agreement with Qantas Airways Limited to supply 20 million liters of blended renewable aviation fuel from 2025, signaling increasing airline commitment to SAF.

- January 2022: Airbus SE commenced manufacturing aircraft at its US facility, designed to operate on blended renewable aviation fuel, indicating the industry's proactive approach to SAF integration.

In-Depth North America Renewable Aviation Fuel Market Market Outlook

The North America renewable aviation fuel market exhibits significant long-term growth potential, driven by increasing environmental concerns, supportive government policies, and technological advancements. Strategic partnerships and investments in production capacity expansion will be crucial for capitalizing on future market opportunities. The market's trajectory hinges on continued innovation, cost reductions, and overcoming supply chain challenges to achieve wider adoption and sustainability goals.

North America Renewable Aviation Fuel Market Segmentation

-

1. Technology

- 1.1. Fischer-Tropsch (FT)

- 1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 1.3. Synthesi

-

2. Application

- 2.1. Commercial

- 2.2. Defense

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Renewable Aviation Fuel Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Renewable Aviation Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 60.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Defense Sector to be the Fastest-Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Fischer-Tropsch (FT)

- 5.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 5.1.3. Synthesi

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Defense

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Fischer-Tropsch (FT)

- 6.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 6.1.3. Synthesi

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial

- 6.2.2. Defense

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Fischer-Tropsch (FT)

- 7.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 7.1.3. Synthesi

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial

- 7.2.2. Defense

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Fischer-Tropsch (FT)

- 8.1.2. Hydroprocessed Esters and Fatty Acids (HEFA)

- 8.1.3. Synthesi

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial

- 8.2.2. Defense

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Renewable Aviation Fuel Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Honeywell International Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 LanzaTech Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Total Energies SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fulcrum BioEnergy Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Neste Oyj

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Red Rock Biofuels LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 SG Preston Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gevo Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Renewable Aviation Fuel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Renewable Aviation Fuel Market Share (%) by Company 2024

List of Tables

- Table 1: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 5: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: United States North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Renewable Aviation Fuel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Renewable Aviation Fuel Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 23: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 31: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 35: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 37: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 39: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 43: North America Renewable Aviation Fuel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Renewable Aviation Fuel Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Renewable Aviation Fuel Market?

The projected CAGR is approximately > 60.00%.

2. Which companies are prominent players in the North America Renewable Aviation Fuel Market?

Key companies in the market include Honeywell International Inc, LanzaTech Inc *List Not Exhaustive, Total Energies SA, Fulcrum BioEnergy Inc, Neste Oyj, Red Rock Biofuels LLC, SG Preston Company, Gevo Inc.

3. What are the main segments of the North America Renewable Aviation Fuel Market?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Defense Sector to be the Fastest-Growing Segment.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

March 2022: Aemetis Inc announced that it agreed with Qantas Airways Limited to supply 20 million liters of blended renewable aviation fuel from 2025. The blended fuel will be produced at a facility in California and will primarily be used to power Boeing and Airbus planes being operated between the countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Renewable Aviation Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Renewable Aviation Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Renewable Aviation Fuel Market?

To stay informed about further developments, trends, and reports in the North America Renewable Aviation Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence