Key Insights

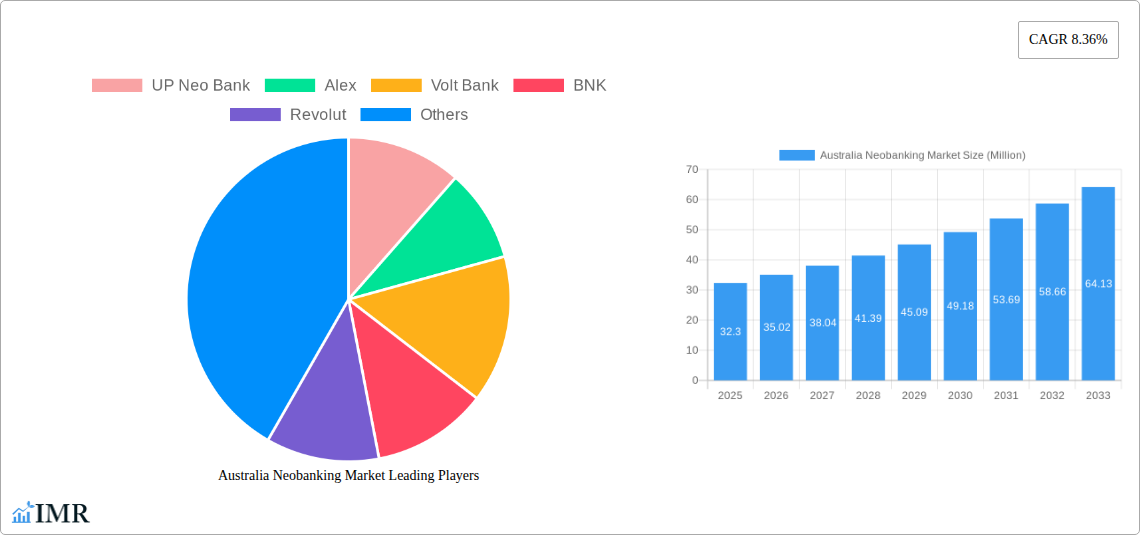

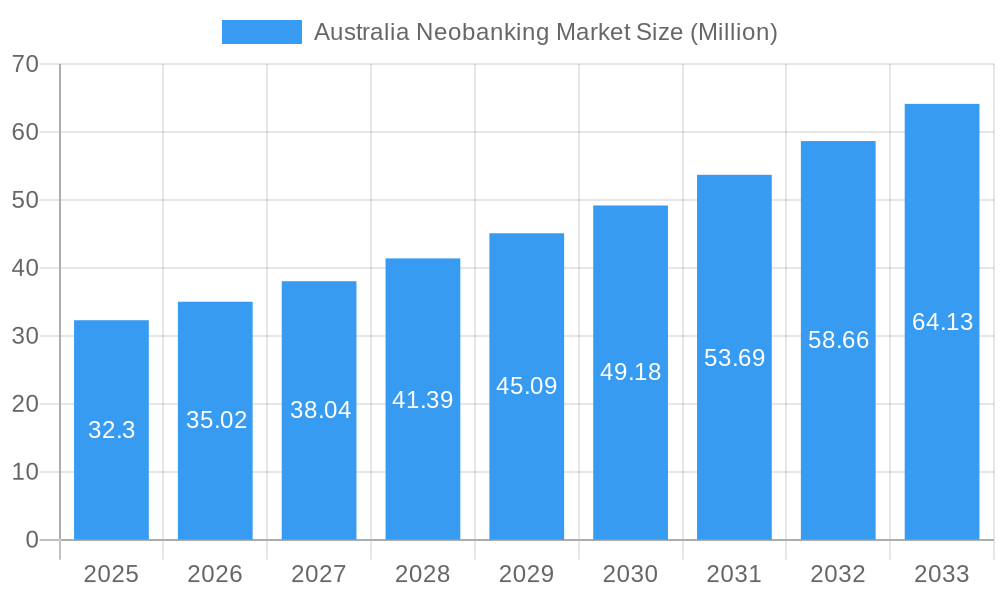

The Australian neobanking market is experiencing robust growth, projected to reach a market size of $32.30 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.36% from 2019 to 2033. This expansion is fueled by several key drivers. Increased smartphone penetration and digital literacy among Australians are creating a receptive market for convenient, mobile-first financial services. Furthermore, a growing dissatisfaction with traditional banking models, characterized by high fees and complex processes, is pushing consumers towards the streamlined and often fee-free offerings of neobanks. The competitive landscape is dynamic, with established players like UP Neo Bank, Alex, Volt Bank, and Revolut vying for market share alongside newer entrants. The market's segmentation likely includes personal banking, business banking, and potentially specialized niches such as student or expat banking. Regulatory changes in Australia, fostering fintech innovation, are further catalyzing market growth. However, challenges remain. Security concerns related to online banking and the need to build trust and brand recognition among consumers represent significant hurdles for neobanks. Competition from established financial institutions investing heavily in digital capabilities also poses a challenge. The overall market trajectory suggests a promising future, but sustained growth will depend on effective risk management, robust customer acquisition strategies, and continuous adaptation to evolving technological and regulatory landscapes. The forecast period of 2025-2033 suggests a continued upward trend, though the exact figures for each year would require more granular data. We can assume, based on the provided CAGR, continued growth in line with the projected 8.36%.

Australia Neobanking Market Market Size (In Million)

To maintain a competitive edge, neobanks must prioritize user experience, offering seamless and personalized financial management tools. Strategic partnerships with other fintech companies could also contribute to growth by expanding service offerings and enhancing customer value. Additionally, neobanks need to continually refine their security measures to address consumer concerns and ensure regulatory compliance. Focusing on specific customer segments with tailored offerings may also prove effective in capturing and retaining market share. Ultimately, the success of neobanks in Australia will depend on their ability to balance innovation with responsible financial practices, build lasting customer trust, and adapt to the ever-changing dynamics of the financial technology industry.

Australia Neobanking Market Company Market Share

Australia Neobanking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Australia neobanking market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategists seeking to navigate this rapidly evolving sector. The report includes detailed analysis of parent markets (financial services) and child markets (digital banking, mobile payments).

Australia Neobanking Market Dynamics & Structure

This section analyzes the structure and dynamics of the Australian neobanking market, considering market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activity. The Australian neobanking market is characterized by [xx]% market concentration in 2024, with the top 5 players holding [xx]% market share.

- Market Concentration: High levels of competition are observed, with both established players and new entrants vying for market share. The market is witnessing increased consolidation through mergers and acquisitions (M&A).

- Technological Innovation: Open banking initiatives and advancements in AI and machine learning are driving innovation, allowing neobanks to offer personalized and efficient services. Key barriers include data security concerns and the need for robust infrastructure.

- Regulatory Framework: The Australian Prudential Regulation Authority (APRA) plays a key role in shaping the regulatory landscape, impacting compliance costs and market entry barriers. Recent regulatory changes have focused on [mention specific regulation details, e.g., open banking implementation].

- Competitive Substitutes: Traditional banks pose a significant competitive threat, particularly those adapting to digital channels. Other substitutes include fintech companies providing specific financial services.

- End-User Demographics: The primary target demographic includes digitally savvy millennials and Gen Z consumers seeking convenient and personalized financial solutions.

- M&A Trends: The number of M&A deals in the Australian neobanking market reached [xx] in 2024, indicating a trend towards consolidation. [xx]% of these deals involved strategic acquisitions by larger players.

Australia Neobanking Market Growth Trends & Insights

The Australian neobanking market experienced significant growth between 2019 and 2024, expanding from [xx] Million in 2019 to [xx] Million in 2024. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of [xx]% from 2025 to 2033, reaching [xx] Million by 2033. Several factors contribute to this expansion:

- The rising adoption of smartphones and increased internet penetration are driving the shift towards digital banking.

- Consumer preference for personalized and seamless financial experiences is fuelling the growth of neobanks.

- Technological disruptions, such as open banking and AI, are enabling neobanks to offer innovative services.

- Increasing financial inclusion initiatives and the rise of the gig economy are also contributing factors.

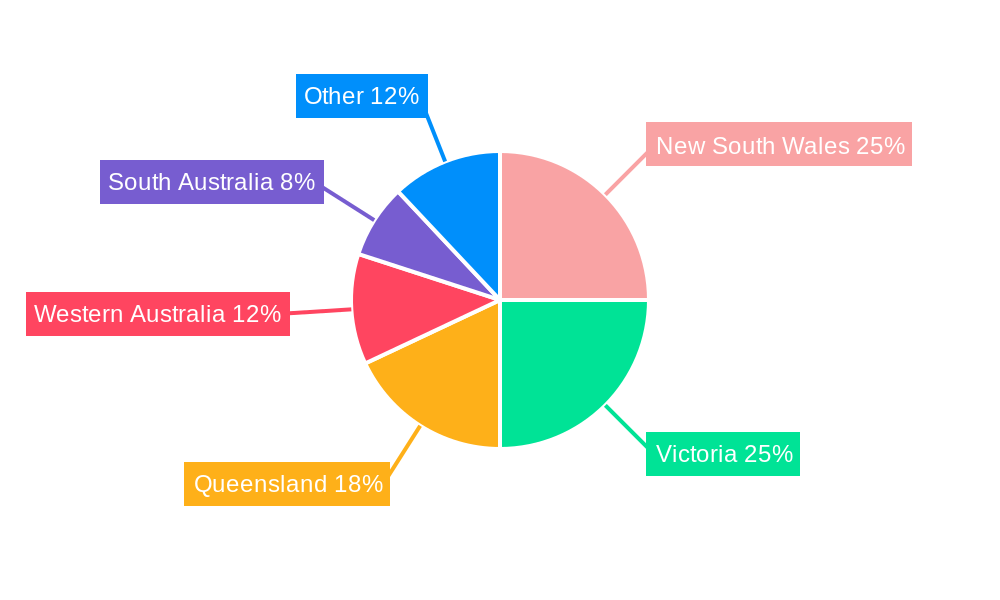

Dominant Regions, Countries, or Segments in Australia Neobanking Market

[Replace this section with a detailed analysis of the dominant regions/segments. The following is a template; you must fill in the data and details. For example, you could focus on population density in urban centers, specific state-level regulations that favor certain neobanks, etc. The analysis must be supported by relevant data and insights.]

The Australian neobanking market is largely concentrated in [mention dominant region/state], driven by factors such as [mention key drivers e.g., high population density, technological infrastructure]. This region accounts for [xx]% of the total market share in 2024 and is projected to maintain its dominance throughout the forecast period.

- Key Drivers:

- [Driver 1 - e.g., High smartphone penetration]

- [Driver 2 - e.g., Pro-innovation regulatory environment]

- [Driver 3 - e.g., Strong digital infrastructure]

- [Paragraph analyzing dominance factors, including market share and growth potential. Mention specific cities if relevant.]

Australia Neobanking Market Product Landscape

Neobanks in Australia offer a range of products, including transaction accounts, savings accounts, credit cards, and lending services, often integrated with budgeting and investment tools. These products leverage cutting-edge technologies, such as AI-powered chatbots for customer service and personalized financial advice. Key features frequently include mobile-first interfaces, transparent fee structures, and superior customer experience.

Key Drivers, Barriers & Challenges in Australia Neobanking Market

The Australian neobanking landscape is being shaped by a confluence of powerful forces. On the driver side, rapid technological advancements, including the maturation of AI and the implementation of open banking, are fundamentally altering how consumers interact with financial services. This is complemented by a burgeoning consumer demand for seamless, intuitive, and digitally-native banking solutions. Furthermore, a supportive regulatory environment has been instrumental in fostering innovation and enabling new entrants to challenge traditional banking models.

However, this dynamic market is not without its hurdles. Neobanks face intense competition not only from established banking giants with vast customer bases and resources but also from a growing ecosystem of agile fintech players. Building and maintaining customer trust is paramount, necessitating robust cybersecurity measures and unwavering commitment to data privacy. The costs associated with regulatory compliance, coupled with the operational complexities of scaling a digital-first banking operation, present significant challenges. Moreover, attracting and retaining top-tier talent with specialized skills in technology, finance, and compliance is a constant battle.

Emerging Opportunities in Australia Neobanking Market

- Inclusion and Reach: Expansion into historically underserved segments, such as small and medium-sized enterprises (SMEs) and communities in rural and remote areas, presents a significant opportunity for neobanks to fill critical gaps in financial access.

- Hyper-Personalized Offerings: The development of niche products and tailored financial solutions designed to meet the specific needs and preferences of diverse consumer groups, from gig economy workers to specific age demographics, will drive deeper engagement.

- Ecosystem Integration: Strategic partnerships and collaborations with other innovative fintech firms can create comprehensive financial ecosystems, offering customers a broader suite of integrated services beyond traditional banking.

- Blockchain Innovation: Leveraging the transformative potential of blockchain technology can lead to enhanced security, greater transparency in transactions, and the development of novel financial instruments.

- Embedded Finance: Integrating financial services directly into non-financial platforms and customer journeys offers a powerful channel for acquisition and service delivery.

Growth Accelerators in the Australia Neobanking Market Industry

The long-term trajectory of the Australian neobanking market is poised for significant acceleration, driven by several key factors. The continued evolution and adoption of open banking capabilities are creating a more interconnected financial ecosystem, fostering greater innovation and competition. Strategic alliances between nimble neobanks and established financial institutions can unlock synergistic opportunities, combining digital agility with market reach and trust. Furthermore, the strategic expansion of neobanking services into new geographical markets and untapped demographic segments will broaden their customer base. Crucially, advancements in artificial intelligence and machine learning will be pivotal in delivering hyper-personalized financial products, proactive financial advice, and a superior customer experience, further solidifying the appeal of neobanking solutions.

Key Players Shaping the Australia Neobanking Market Market

- UP Neo Bank

- Alex

- Volt Bank

- BNK

- Revolut

- Hay

- Judo Bank

- Tyro

- Douugh

- DayTek

- List Not Exhaustive

Notable Milestones in Australia Neobanking Market Sector

- December 2023: Ubank and designer Jordan Gogos collaborated to launch custom fashion pieces and introduce the Feel-Good Fashion Fund initiative for emerging designers. This collaboration enhanced brand awareness and showcased Ubank's commitment to innovation.

- May 2022: Australia’s first digital bank, UBank, revealed a new look and feel after merging with smart bank, 86400. This merger signified a significant step in the consolidation of the neobanking sector.

In-Depth Australia Neobanking Market Outlook

The Australian neobanking market presents significant growth potential in the coming years. Continued technological innovation, coupled with strategic partnerships and expansion into new market segments, will drive further market expansion. Opportunities exist for neobanks to offer more personalized and integrated financial solutions, catering to the evolving needs of consumers and businesses alike. The market is poised for sustained growth, presenting attractive opportunities for both established players and new entrants.

Australia Neobanking Market Segmentation

-

1. Account

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments & Money transfer

- 2.3. Savings account

- 2.4. Loans

- 2.5. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

Australia Neobanking Market Segmentation By Geography

- 1. Australia

Australia Neobanking Market Regional Market Share

Geographic Coverage of Australia Neobanking Market

Australia Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Next Generation Technologies.

- 3.3. Market Restrains

- 3.3.1. Next Generation Technologies.

- 3.4. Market Trends

- 3.4.1. Rising Investment in Fintech in Australia Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments & Money transfer

- 5.2.3. Savings account

- 5.2.4. Loans

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Account

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UP Neo Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volt Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BNK

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Revolut

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Judo Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tyro

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Douugh

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DayTek**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UP Neo Bank

List of Figures

- Figure 1: Australia Neobanking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Neobanking Market Revenue Million Forecast, by Account 2020 & 2033

- Table 2: Australia Neobanking Market Volume Billion Forecast, by Account 2020 & 2033

- Table 3: Australia Neobanking Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Australia Neobanking Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Australia Neobanking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Australia Neobanking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Australia Neobanking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Australia Neobanking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Australia Neobanking Market Revenue Million Forecast, by Account 2020 & 2033

- Table 10: Australia Neobanking Market Volume Billion Forecast, by Account 2020 & 2033

- Table 11: Australia Neobanking Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Australia Neobanking Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Australia Neobanking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Neobanking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Australia Neobanking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Neobanking Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Neobanking Market?

The projected CAGR is approximately 8.36%.

2. Which companies are prominent players in the Australia Neobanking Market?

Key companies in the market include UP Neo Bank, Alex, Volt Bank, BNK, Revolut, Hay, Judo Bank, Tyro, Douugh, DayTek**List Not Exhaustive.

3. What are the main segments of the Australia Neobanking Market?

The market segments include Account, Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Next Generation Technologies..

6. What are the notable trends driving market growth?

Rising Investment in Fintech in Australia Driving the Market.

7. Are there any restraints impacting market growth?

Next Generation Technologies..

8. Can you provide examples of recent developments in the market?

December 2023: Ubank and designer Jordan Gogos collaborated to launch custom fashion pieces and introduce the Feel-Good Fashion Fund initiative for emerging designers. Jordan Gogos is known for his innovative and boundary-pushing work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Neobanking Market?

To stay informed about further developments, trends, and reports in the Australia Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence