Key Insights

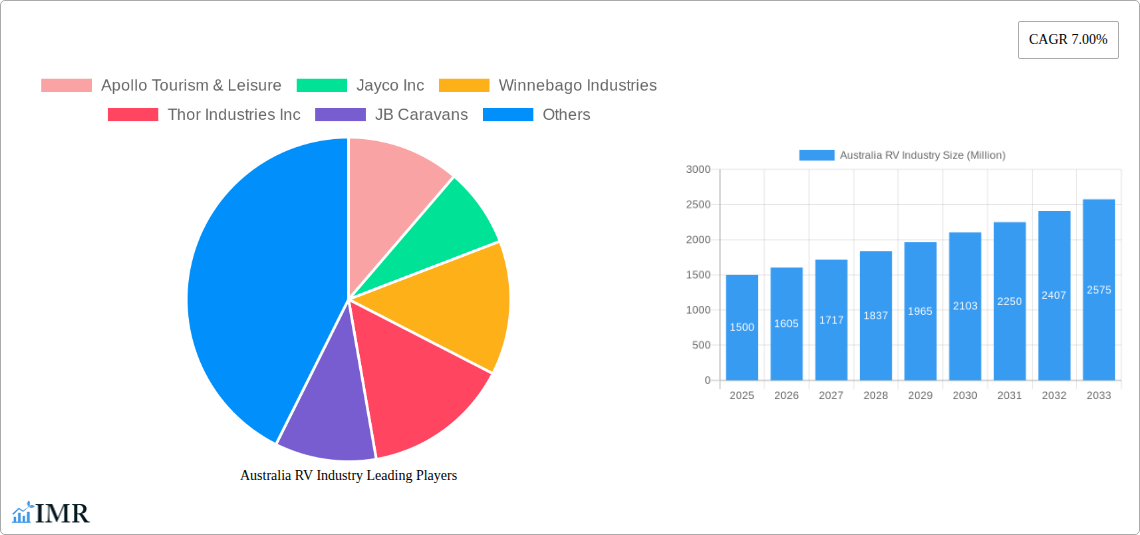

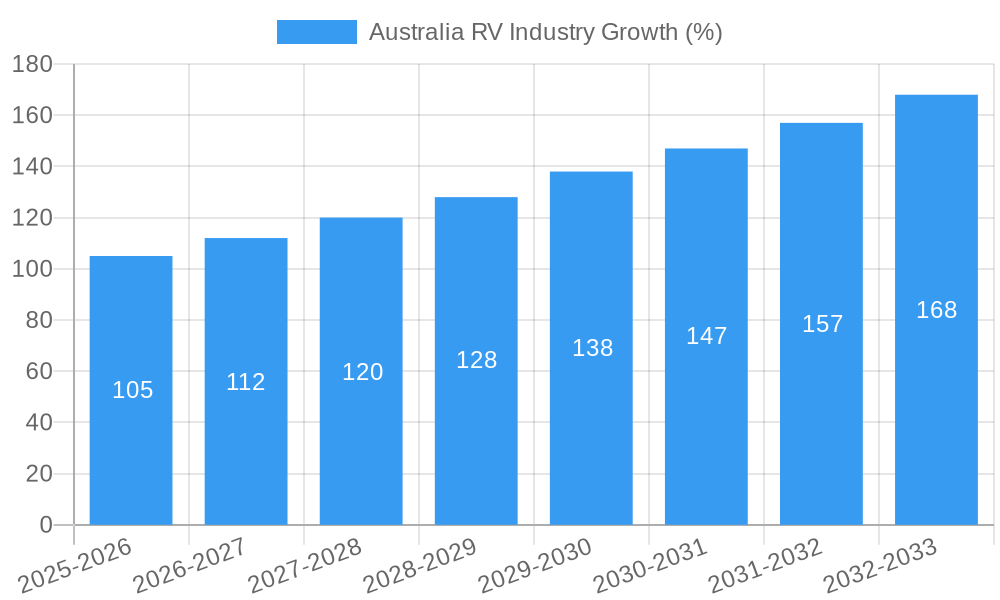

The Australian RV industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing disposable incomes amongst Australians, coupled with a growing preference for outdoor recreational activities and unique travel experiences, are significantly boosting demand for RVs. The rise of "work from anywhere" culture further contributes to this trend, as individuals seek greater flexibility and the ability to travel while maintaining their professional lives. Furthermore, improvements in RV technology, including enhanced fuel efficiency and advanced amenities, are making RVs more appealing to a broader consumer base. The market is segmented by camper type (truck campers, motorhomes, towable RVs), application (private, commercial), and is dominated by major players like Apollo Tourism & Leisure, Jayco Inc, Winnebago Industries, and Thor Industries Inc., amongst others. While the industry faces potential headwinds such as fluctuating fuel prices and the impact of economic downturns, the long-term outlook remains positive, driven by the enduring appeal of RV travel and the continued development of innovative RV products.

The Australian RV market's segmentation offers diverse growth opportunities. The motorhome segment is expected to witness significant growth due to its versatility and suitability for extended travel. Within the application segment, private use dominates, while the commercial segment (RV rentals and tours) is also showing promising expansion, particularly with the increase in tourism. The geographical distribution of the market is primarily concentrated within Australia, although there is potential for growth in niche export markets. Competitive dynamics within the industry are characterized by both established international brands and successful local manufacturers. The future success of individual companies will hinge on their ability to adapt to evolving consumer preferences, leverage technological advancements, and effectively manage supply chain complexities. Strategic partnerships and diversification into related tourism services will further enhance their market competitiveness.

Australia RV Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian RV industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the historical period (2019-2024), the base year (2025), and forecasts the market's trajectory until 2033. With a focus on motorhomes, towable RVs, and both private and commercial applications, this report is essential for industry professionals, investors, and anyone seeking to understand this dynamic market. The total market size is projected at xx Million units by 2033.

Australia RV Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the Australian RV market. The market is moderately concentrated, with key players such as Apollo Tourism & Leisure, Jayco Inc., and Avida RV holding significant market shares. Technological innovations, particularly in lightweight materials and advanced RV technologies are key drivers. Government regulations concerning safety and environmental standards also play a crucial role. The rise of alternative travel options poses a competitive threat, while increasing disposable incomes and a growing preference for experiential travel fuel market growth. M&A activity in the sector has been moderate, with xx deals recorded between 2019 and 2024, primarily focused on expanding manufacturing capacity and distribution networks.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on lightweight materials, improved fuel efficiency, and smart RV technologies.

- Regulatory Framework: Stringent safety and environmental regulations impacting manufacturing and operation.

- Competitive Substitutes: Alternative travel options like hotels, cruises, and short-term rentals.

- End-User Demographics: Primarily affluent individuals and families seeking outdoor recreational activities.

- M&A Trends: Moderate activity focused on expansion and diversification.

Australia RV Industry Growth Trends & Insights

The Australian RV market experienced significant growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing tourism, and a growing preference for outdoor recreational activities. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is expected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx Million units by 2033. Market penetration is currently at xx% and is projected to reach xx% by 2033. Technological disruptions, particularly the introduction of electric and hybrid RVs, are poised to further accelerate growth. Shifting consumer preferences toward sustainable and technologically advanced RVs are also contributing factors.

Dominant Regions, Countries, or Segments in Australia RV Industry

The Australian RV market demonstrates strong regional variations in growth. Victoria and New South Wales lead in terms of market size and growth rate, owing to established tourism infrastructure and higher disposable incomes within these regions. The motorhome segment within the Truck Campers category shows strong growth, driven by its appeal to couples and families seeking longer-duration travel. The private application segment dominates the overall market, accounting for xx% of the total, driven by leisure travel demand. Towable RVs remain a significant market segment, with a projected growth of xx% during the forecast period.

- Key Drivers (Victoria & NSW): Established tourism infrastructure, high disposable incomes, favorable climate.

- Motorhomes (Truck Campers): High demand for extended travel and family-friendly options.

- Private Application: Dominates the market due to leisure travel trends.

- Towable RVs: Significant market share driven by affordability and practicality.

Australia RV Industry Product Landscape

The Australian RV market offers a diverse range of products, including motorhomes, campervans, caravans, and fifth-wheel trailers. Manufacturers are constantly innovating, incorporating lightweight materials, advanced technologies, and improved fuel efficiency into their designs. Unique selling propositions include off-road capabilities, luxurious interiors, and smart home integration. Technological advancements are focused on enhancing comfort, safety, and sustainability.

Key Drivers, Barriers & Challenges in Australia RV Industry

Key Drivers:

- Rising disposable incomes and increased leisure time.

- Growth in domestic and international tourism.

- Government initiatives promoting outdoor recreation.

Key Challenges:

- Supply chain disruptions affecting component availability and manufacturing costs.

- Increasing material costs leading to higher RV prices.

- Intense competition from established and emerging players.

Emerging Opportunities in Australia RV Industry

- Growth in eco-friendly and sustainable RV options.

- Increasing demand for rental RVs and RV sharing platforms.

- Expansion into niche markets like luxury RVs and adventure-focused models.

Growth Accelerators in the Australia RV Industry

Technological advancements in manufacturing, improved fuel efficiency, and the integration of smart technologies will significantly accelerate growth in the coming years. Strategic partnerships between RV manufacturers and tourism operators can further boost market penetration. Expansion into untapped markets, such as regional areas with growing tourism potential, will also contribute to long-term growth.

Key Players Shaping the Australia RV Industry Market

- Apollo Tourism & Leisure

- Jayco Inc

- Winnebago Industries

- Thor Industries Inc

- JB Caravans

- Avida RV

- Road Star Caravans

- Maverick Camper

- Sunliner Recreational Vehicles

- Forest River Inc

Notable Milestones in Australia RV Industry Sector

- Sept 2022: Jayco expands its South Dandenong manufacturing facility, reflecting strong market growth and new product development.

- Apr 2021: Jayco Inc. launches a new customer experience software tool enhancing customer service and data collection.

In-Depth Australia RV Industry Market Outlook

The Australian RV industry is poised for continued growth, driven by positive economic indicators, increased interest in outdoor recreation, and ongoing technological advancements. Strategic investments in sustainable manufacturing practices and the development of innovative RV models will shape the future of this dynamic market. The focus on enhancing customer experience and expanding into new regional markets presents significant opportunities for market players.

Australia RV Industry Segmentation

-

1. Type

-

1.1. Towable RVs

- 1.1.1. Travel Trailers

- 1.1.2. Fifth-wheel Trailers

- 1.1.3. Folding Camp Trailers

- 1.1.4. Truck Campers

-

1.2. Motorhomes

- 1.2.1. Type A

- 1.2.2. Type B

- 1.2.3. Type C

-

1.1. Towable RVs

-

2. Application

- 2.1. Private

- 2.2. Commercial

Australia RV Industry Segmentation By Geography

- 1. Australia

Australia RV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Tourism Activity Drive Demand in the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Government Framework for the Usage of RVs

- 3.4. Market Trends

- 3.4.1. The Increase in Self-Contained RVs Creates a Tourism Opportunity for Small Towns

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia RV Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Towable RVs

- 5.1.1.1. Travel Trailers

- 5.1.1.2. Fifth-wheel Trailers

- 5.1.1.3. Folding Camp Trailers

- 5.1.1.4. Truck Campers

- 5.1.2. Motorhomes

- 5.1.2.1. Type A

- 5.1.2.2. Type B

- 5.1.2.3. Type C

- 5.1.1. Towable RVs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Private

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Apollo Tourism & Leisure

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jayco Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Winnebago Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thor Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JB Caravans

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Avida RV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Road Star Caravans

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maverick Camper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sunliner Recreational Vehicles

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Forest River Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Apollo Tourism & Leisure

List of Figures

- Figure 1: Australia RV Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia RV Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia RV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia RV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia RV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Australia RV Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia RV Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia RV Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia RV Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Australia RV Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia RV Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Australia RV Industry?

Key companies in the market include Apollo Tourism & Leisure, Jayco Inc, Winnebago Industries, Thor Industries Inc, JB Caravans, Avida RV, Road Star Caravans, Maverick Camper, Sunliner Recreational Vehicles, Forest River Inc.

3. What are the main segments of the Australia RV Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Tourism Activity Drive Demand in the Market.

6. What are the notable trends driving market growth?

The Increase in Self-Contained RVs Creates a Tourism Opportunity for Small Towns.

7. Are there any restraints impacting market growth?

Lack of Government Framework for the Usage of RVs.

8. Can you provide examples of recent developments in the market?

Sept 2022: Jayco, a leading caravan manufacturer, expanded its South Dandenong manufacturing facility in response to recent growth in the motorhome and campervan market in Australia, as well as implementing a number of upgrades to support new product development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia RV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia RV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia RV Industry?

To stay informed about further developments, trends, and reports in the Australia RV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence