Key Insights

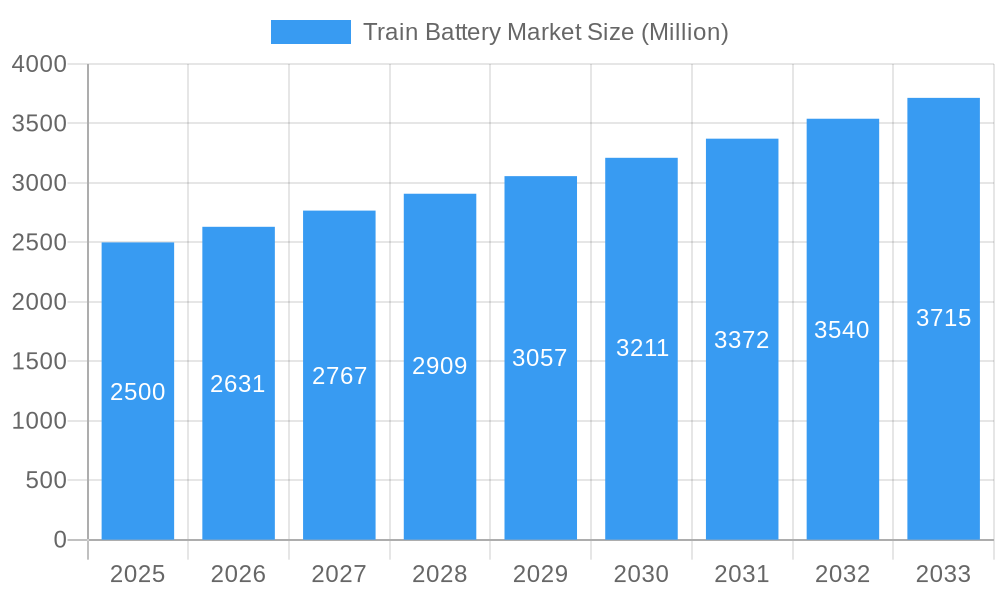

The global train battery market is poised for significant expansion, propelled by the accelerating electrification of railway networks and the increasing imperative for enhanced energy efficiency and reduced emissions in transportation. The market, estimated at 380.1 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This robust growth trajectory is attributed to several pivotal factors. Firstly, substantial government investment in modernizing railway infrastructure worldwide is driving a surge in electric train adoption, consequently boosting demand for high-performance train batteries. Secondly, advancements in battery technology, particularly the widespread integration of Lithium-ion batteries renowned for their superior energy density and extended lifespan over traditional Lead-acid batteries, are fundamentally reshaping market dynamics and accelerating expansion. Finally, a heightened global emphasis on sustainability and minimizing carbon footprints is a primary driver for electric train adoption and, by extension, the train battery market's growth.

Train Battery Market Market Size (In Million)

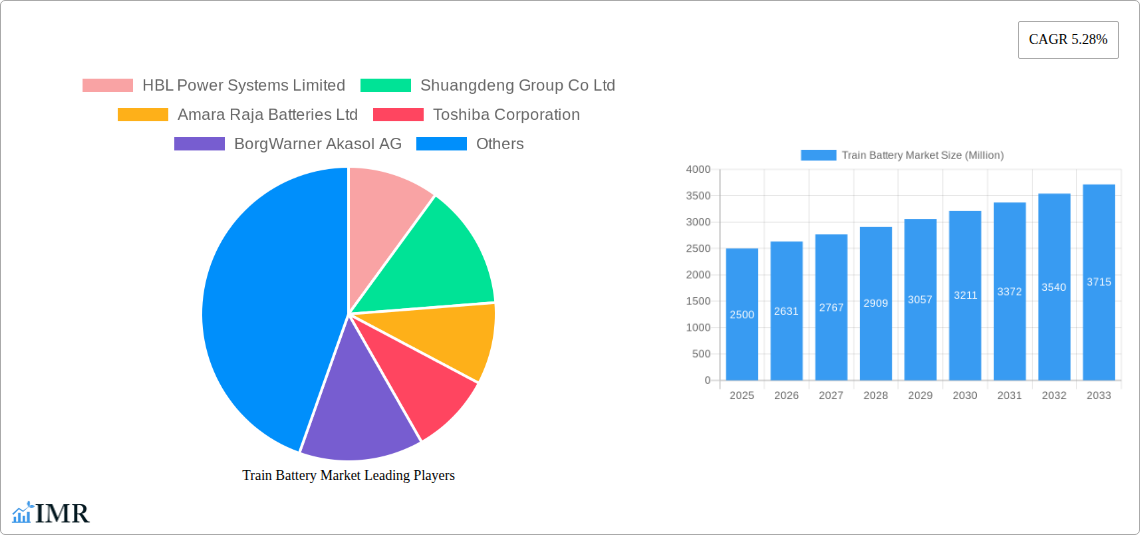

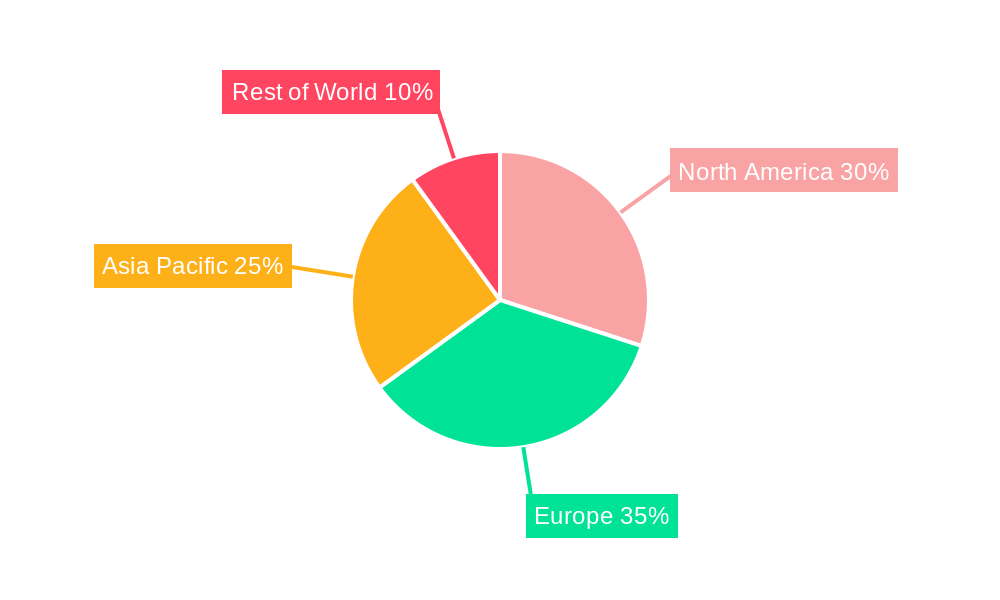

Despite this promising outlook, the market encounters certain constraints. The substantial initial investment required for adopting advanced battery technologies, notably Lithium-ion, can present a barrier for some railway operators. Additionally, the necessity for comprehensive infrastructure to support the charging and maintenance of these sophisticated battery systems poses a logistical challenge. Nevertheless, the long-term prognosis for the train battery market remains highly favorable, underpinned by consistent government support, continuous technological innovation, and an escalating commitment to sustainable transportation solutions. Market segmentation highlights diverse opportunities across various applications, including starter and auxiliary batteries, rolling stock types such as locomotives and metro trains, and different battery chemistries including Lead-acid, Nickel-Cadmium, and Lithium-ion. Leading industry players, including HBL Power Systems Limited, Shuangdeng Group Co Ltd, and Amara Raja Batteries Ltd, are strategically positioned to leverage these emerging opportunities. Geographically, North America, Europe, and Asia-Pacific are anticipated to dominate the market, driven by high electrification rates and significant investments in railway modernization initiatives within these regions.

Train Battery Market Company Market Share

Train Battery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Train Battery Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The study segments the market by application type (Starter Battery, Auxiliary Battery), rolling stock (Locomotive, Metro, Monorail, Tram, Freight Wagon, Passenger Coaches), and battery type (Lead Acid Battery, Nickel Cadmium Battery, Lithium Ion Battery). Key players analyzed include HBL Power Systems Limited, Shuangdeng Group Co Ltd, Amara Raja Batteries Ltd, Toshiba Corporation, BorgWarner Akasol AG, Enersys, East Penn Manufacturing Company, Exide Industries Limited, Hitachi Rail Limited, and GS Yuasa Corporation. The report is essential for industry professionals, investors, and strategic decision-makers seeking a complete understanding of this rapidly evolving market. The total market size is estimated at xx Million units in 2025, with a projected CAGR of xx% during the forecast period.

Train Battery Market Market Dynamics & Structure

The Train Battery Market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. Technological innovation, particularly in Lithium-ion battery technology, is a primary growth driver. Stringent environmental regulations aimed at reducing carbon emissions are also pushing the adoption of electric and hybrid trains, fueling demand for train batteries. The market faces competition from alternative energy sources for trains, but the ongoing trend towards electrification is expected to bolster market growth. Recent M&A activity in the battery sector indicates a high level of consolidation and strategic investments.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Advancements in battery energy density, lifespan, and charging technology are key drivers.

- Regulatory Framework: Government policies promoting sustainable transportation are boosting demand.

- Competitive Substitutes: Alternative energy sources for trains (e.g., hydrogen fuel cells) pose some competition.

- End-User Demographics: The growth is primarily driven by increasing urbanization and expansion of rail networks globally.

- M&A Trends: xx major M&A deals were recorded in the train battery sector between 2019 and 2024.

Train Battery Market Growth Trends & Insights

The Train Battery Market has witnessed substantial growth over the historical period (2019-2024), driven by the global shift towards sustainable transportation and increasing investments in rail infrastructure. The market size experienced a CAGR of xx% during this period. The adoption rate of advanced battery technologies, such as Lithium-ion batteries, is accelerating, replacing traditional lead-acid batteries. Consumer behavior is shifting towards environmentally friendly transportation options, further driving the demand for electric and hybrid trains, and consequently, train batteries. The forecast period (2025-2033) is expected to show continued growth, fueled by government initiatives, technological advancements, and expanding rail networks in developing economies. Market penetration of Lithium-ion batteries is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Train Battery Market

The [Region X] region is currently the leading market for train batteries, driven by extensive rail network expansion and supportive government policies promoting electric mobility. [Country Y] exhibits the highest growth rate within this region due to its robust investment in high-speed rail projects. Within the segment breakdown, the Lithium-ion battery segment demonstrates the fastest growth, surpassing lead-acid batteries due to its superior performance characteristics. Passenger coaches and metro segments show higher demand compared to other rolling stock types.

- Key Drivers in [Region X]:

- Significant investment in high-speed rail infrastructure.

- Favorable government policies and subsidies for electric transportation.

- Growing urbanization and increasing commuter traffic.

- Dominance Factors:

- Large existing rail network.

- High adoption rate of electric and hybrid trains.

- Strong government support for technological advancements.

Train Battery Market Product Landscape

The train battery market offers a diverse range of products, encompassing lead-acid, nickel-cadmium, and lithium-ion batteries, each with varying energy densities, lifespans, and charging capabilities. Recent innovations focus on enhancing energy density, extending battery lifespan, and improving fast-charging capabilities. Lithium-ion batteries are increasingly favored for their superior performance, though cost remains a factor. Manufacturers are focusing on developing high-performance, long-lasting, and cost-effective batteries to meet the growing demands of the railway industry.

Key Drivers, Barriers & Challenges in Train Battery Market

Key Drivers: The increasing adoption of electric and hybrid trains, driven by environmental concerns and government regulations, is a major driver. Technological advancements in battery technology are also improving performance and reducing costs. Growing urbanization and expansion of rail networks globally further boost market growth.

Key Challenges: High initial investment costs associated with Lithium-ion batteries can be a barrier to adoption, particularly in developing countries. Supply chain disruptions and the availability of raw materials also pose challenges. Stringent safety regulations and certification processes can increase the time and cost of product development and deployment. Competition from alternative energy sources and technological advancements in other battery chemistries represent a significant challenge.

Emerging Opportunities in Train Battery Market

Emerging opportunities include the expansion into developing countries with growing rail infrastructure projects. The development of next-generation battery technologies, such as solid-state batteries, presents significant growth potential. The integration of smart battery management systems and advanced charging infrastructure also offers significant opportunities. The growing demand for battery-electric multiple units (BEMUs) further creates opportunities in the market.

Growth Accelerators in the Train Battery Market Industry

Technological advancements in battery chemistry, particularly in Lithium-ion technology, are a key growth accelerator. Strategic partnerships between battery manufacturers and railway operators facilitate the adoption of advanced battery systems. Government policies supporting sustainable transportation and renewable energy contribute significantly to market expansion. The ongoing trend towards electrification of rail networks globally provides strong long-term growth potential.

Key Players Shaping the Train Battery Market Market

- HBL Power Systems Limited

- Shuangdeng Group Co Ltd

- Amara Raja Batteries Ltd

- Toshiba Corporation

- BorgWarner Akasol AG

- Enersys

- East Penn Manufacturing Company

- Exide Industries Limited

- Hitachi Rail Limited

- GS Yuasa Corporation

Notable Milestones in Train Battery Market Sector

- December 2022: Irish Rail's order of 18 battery-electric multiple units (BEMUs) from Alstom, totaling USD 190.27 million, signifies significant market growth in Europe.

- September 2022: Hitachi Rail's unveiling of a new battery hybrid train capable of running at 160 km/hr on battery power alone highlights technological advancements driving market expansion.

In-Depth Train Battery Market Market Outlook

The Train Battery Market is poised for significant growth in the coming years. Continued advancements in battery technology, coupled with strong government support for sustainable transportation and expanding rail networks globally, will fuel market expansion. Strategic partnerships and investments in research and development will further accelerate market growth, presenting attractive opportunities for industry players. The long-term outlook is exceptionally positive, with substantial potential for market expansion driven by technological innovation and global infrastructure development.

Train Battery Market Segmentation

-

1. Battery Type

- 1.1. Lead Acid Battery

- 1.2. Nickel Cadmium Battery

- 1.3. Lithium Ion Battery

-

2. Application Type

- 2.1. Starter Battery

- 2.2. Auxiliary Battery

-

3. Rolling Stock

- 3.1. Locomotive

- 3.2. Metro

- 3.3. Monorail

- 3.4. Tram

- 3.5. Freight Wagon

- 3.6. Passenger Coaches

Train Battery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Train Battery Market Regional Market Share

Geographic Coverage of Train Battery Market

Train Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Demand for Auxiliary Battery to Propel Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lead Acid Battery

- 5.1.2. Nickel Cadmium Battery

- 5.1.3. Lithium Ion Battery

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Starter Battery

- 5.2.2. Auxiliary Battery

- 5.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 5.3.1. Locomotive

- 5.3.2. Metro

- 5.3.3. Monorail

- 5.3.4. Tram

- 5.3.5. Freight Wagon

- 5.3.6. Passenger Coaches

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. North America Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 6.1.1. Lead Acid Battery

- 6.1.2. Nickel Cadmium Battery

- 6.1.3. Lithium Ion Battery

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Starter Battery

- 6.2.2. Auxiliary Battery

- 6.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 6.3.1. Locomotive

- 6.3.2. Metro

- 6.3.3. Monorail

- 6.3.4. Tram

- 6.3.5. Freight Wagon

- 6.3.6. Passenger Coaches

- 6.1. Market Analysis, Insights and Forecast - by Battery Type

- 7. Europe Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 7.1.1. Lead Acid Battery

- 7.1.2. Nickel Cadmium Battery

- 7.1.3. Lithium Ion Battery

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Starter Battery

- 7.2.2. Auxiliary Battery

- 7.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 7.3.1. Locomotive

- 7.3.2. Metro

- 7.3.3. Monorail

- 7.3.4. Tram

- 7.3.5. Freight Wagon

- 7.3.6. Passenger Coaches

- 7.1. Market Analysis, Insights and Forecast - by Battery Type

- 8. Asia Pacific Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 8.1.1. Lead Acid Battery

- 8.1.2. Nickel Cadmium Battery

- 8.1.3. Lithium Ion Battery

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Starter Battery

- 8.2.2. Auxiliary Battery

- 8.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 8.3.1. Locomotive

- 8.3.2. Metro

- 8.3.3. Monorail

- 8.3.4. Tram

- 8.3.5. Freight Wagon

- 8.3.6. Passenger Coaches

- 8.1. Market Analysis, Insights and Forecast - by Battery Type

- 9. Rest of the World Train Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 9.1.1. Lead Acid Battery

- 9.1.2. Nickel Cadmium Battery

- 9.1.3. Lithium Ion Battery

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Starter Battery

- 9.2.2. Auxiliary Battery

- 9.3. Market Analysis, Insights and Forecast - by Rolling Stock

- 9.3.1. Locomotive

- 9.3.2. Metro

- 9.3.3. Monorail

- 9.3.4. Tram

- 9.3.5. Freight Wagon

- 9.3.6. Passenger Coaches

- 9.1. Market Analysis, Insights and Forecast - by Battery Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 HBL Power Systems Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shuangdeng Group Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amara Raja Batteries Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toshiba Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BorgWarner Akasol AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Enersys

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 East Penn Manufacturing Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Exide Industries Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hitachi Rail Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GS Yuasa Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 HBL Power Systems Limited

List of Figures

- Figure 1: Global Train Battery Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 3: North America Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 4: North America Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 5: North America Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 7: North America Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 8: North America Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Train Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 11: Europe Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 12: Europe Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 13: Europe Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 15: Europe Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 16: Europe Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Train Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 19: Asia Pacific Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 20: Asia Pacific Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 21: Asia Pacific Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Asia Pacific Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 23: Asia Pacific Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 24: Asia Pacific Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Train Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Train Battery Market Revenue (million), by Battery Type 2025 & 2033

- Figure 27: Rest of the World Train Battery Market Revenue Share (%), by Battery Type 2025 & 2033

- Figure 28: Rest of the World Train Battery Market Revenue (million), by Application Type 2025 & 2033

- Figure 29: Rest of the World Train Battery Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Rest of the World Train Battery Market Revenue (million), by Rolling Stock 2025 & 2033

- Figure 31: Rest of the World Train Battery Market Revenue Share (%), by Rolling Stock 2025 & 2033

- Figure 32: Rest of the World Train Battery Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Train Battery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 4: Global Train Battery Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 6: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 8: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 13: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 14: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 15: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 23: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 24: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 25: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: India Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: China Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Japan Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Train Battery Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 32: Global Train Battery Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 33: Global Train Battery Market Revenue million Forecast, by Rolling Stock 2020 & 2033

- Table 34: Global Train Battery Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: South America Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Train Battery Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Train Battery Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Train Battery Market?

Key companies in the market include HBL Power Systems Limited, Shuangdeng Group Co Ltd, Amara Raja Batteries Ltd, Toshiba Corporation, BorgWarner Akasol AG, Enersys, East Penn Manufacturing Company, Exide Industries Limited, Hitachi Rail Limited, GS Yuasa Corporation.

3. What are the main segments of the Train Battery Market?

The market segments include Battery Type, Application Type, Rolling Stock.

4. Can you provide details about the market size?

The market size is estimated to be USD 380.1 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Demand for Auxiliary Battery to Propel Market Growth.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

December 2022: The Irish government approved funding for the purchase by Irish Rail of 90 new train carriages from Alstom. They will be used in the Greater Dublin Area and potentially also on the Cork Commuter network. According to Irish Rail, the new purchase means additional capacity on the network, as carriages can be redeployed. The order will consist of 18 modern 5-carriage battery-electric multiple units (BEMUs) at a cost of around 179 million euros (USD 190.27 million). The first units are expected in 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Train Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Train Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Train Battery Market?

To stay informed about further developments, trends, and reports in the Train Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence