Key Insights

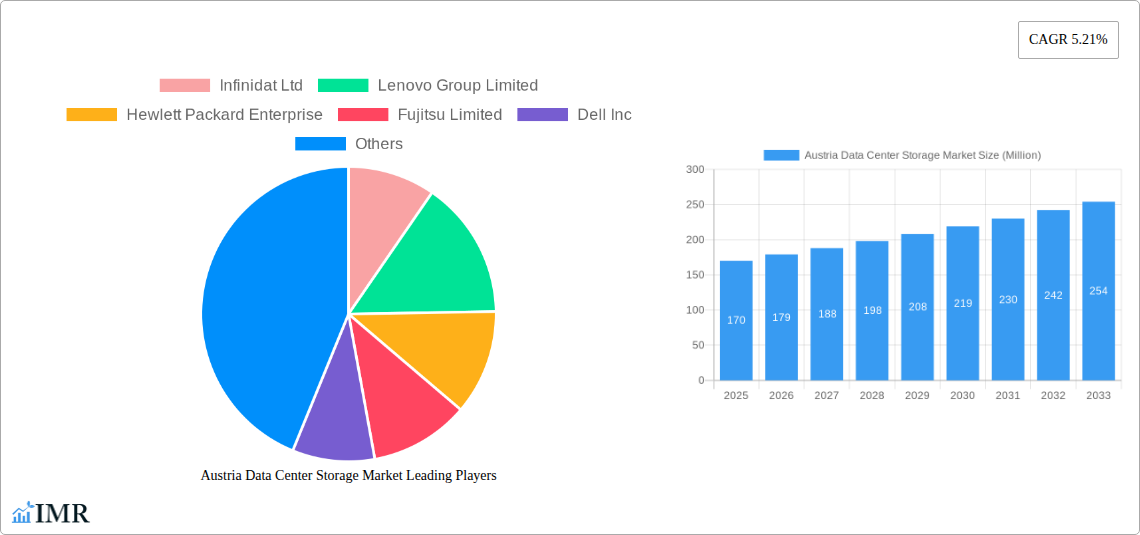

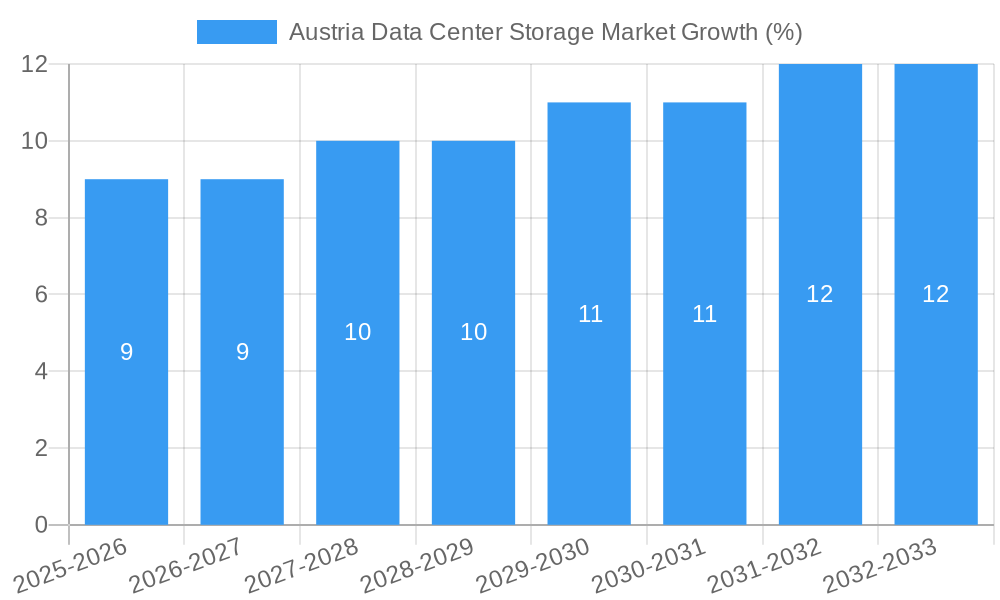

The Austria Data Center Storage market, valued at €170 million in 2025, is projected to experience robust growth, driven by increasing digitalization, cloud adoption, and the burgeoning need for robust data management solutions within various sectors. The market's Compound Annual Growth Rate (CAGR) of 5.21% from 2019-2024 indicates a steady upward trajectory, expected to continue throughout the forecast period (2025-2033). Key drivers include the rising adoption of high-performance computing (HPC) solutions in research and development, along with the expanding data volumes generated by the IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), and Government sectors. The increasing demand for advanced storage technologies, including All-Flash and Hybrid storage solutions, is further fueling market expansion. While data center consolidation and potential economic fluctuations could pose some restraints, the overall market outlook remains positive. The diverse range of storage technologies deployed – NAS, SAN, and DAS – caters to varied organizational needs and preferences. Leading vendors like Hewlett Packard Enterprise, NetApp, and Dell are well-positioned to capitalize on these trends, constantly innovating to meet the evolving demands of Austrian businesses.

The segmental breakdown reveals a significant reliance on traditional storage solutions, although the All-Flash and Hybrid storage segments are demonstrating substantial growth, driven by their superior performance and efficiency. Within the end-user segment, the IT & Telecommunications sector dominates the market share, owing to their large-scale data processing and storage requirements. However, significant growth is projected from the BFSI and Government sectors in the coming years, as they increasingly invest in advanced data center infrastructure to support crucial operations and enhance cybersecurity measures. The Austrian market's relatively small size, in comparison to larger European economies, presents opportunities for niche players focusing on specialized solutions tailored to the unique needs of the regional landscape. The consistent CAGR and significant industry investment predict a sustained period of growth for the Austria Data Center Storage Market.

Austria Data Center Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Austria Data Center Storage Market, encompassing market dynamics, growth trends, key players, and future projections from 2019 to 2033. The report segments the market by storage technology (Network Attached Storage (NAS), Storage Area Network (SAN), Direct Attached Storage (DAS), Other Technologies), storage type (Traditional Storage, All-Flash Storage, Hybrid Storage), and end-user (IT & Telecommunication, BFSI, Government, Media & Entertainment, Other End-Users), offering a granular view of this dynamic sector. With a base year of 2025 and a forecast period extending to 2033, this report is an invaluable resource for businesses, investors, and industry professionals seeking to navigate the complexities of the Austrian data center storage landscape. The market value is presented in Million units throughout the report.

Austria Data Center Storage Market Dynamics & Structure

The Austrian data center storage market is characterized by a moderately concentrated landscape, with a few major international players holding significant market share (xx%). Technological innovation, driven by the increasing demand for high-performance computing and cloud services, is a key driver. Stringent data privacy regulations within Austria influence storage solutions adoption, favoring secure and compliant technologies. The market also faces competition from alternative data storage solutions, including cloud-based services. End-user demographics are shifting towards increased adoption across sectors, notably IT & Telecommunication and BFSI. M&A activity in the sector has been moderate in recent years, with approximately xx deals concluded between 2019 and 2024 (xx Million total transaction value).

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Driven by demands for speed, capacity, and security; focus on AI and machine learning integration.

- Regulatory Framework: Stringent data privacy regulations impacting storage solution choices.

- Competitive Substitutes: Cloud storage services pose a significant competitive threat.

- End-User Demographics: Growth driven by IT & Telecommunication and BFSI sectors.

- M&A Trends: Moderate activity with xx deals between 2019-2024.

Austria Data Center Storage Market Growth Trends & Insights

The Austria Data Center Storage Market experienced steady growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. Market size is estimated to reach xx Million in 2025, driven by increasing digitalization across various sectors and the rising adoption of advanced storage technologies like All-Flash Storage. Technological disruptions, including the emergence of NVMe and advancements in cloud-based storage solutions, are reshaping market dynamics. Consumer behavior is shifting towards cloud-based storage and demand for improved data security and scalability. The forecast period (2025-2033) projects a CAGR of xx%, reaching a projected market size of xx Million by 2033. Market penetration of All-Flash storage is expected to increase from xx% in 2025 to xx% by 2033. This growth is further fuelled by governmental initiatives promoting digital transformation and increased investment in data center infrastructure within Austria.

Dominant Regions, Countries, or Segments in Austria Data Center Storage Market

Within Austria, the Vienna region demonstrates the highest concentration of data centers and hence drives the largest segment of the market (xx%). This dominance is attributed to superior infrastructure, a skilled workforce, and proximity to major business hubs. Amongst the storage technology segments, SAN (Storage Area Network) currently holds the largest market share (xx%), followed by NAS (Network Attached Storage) (xx%), reflecting the strong demand for reliable and high-performance storage solutions in enterprise environments. All-Flash storage is the fastest-growing storage type segment, experiencing significant adoption due to its performance advantages. Within the end-user segment, IT & Telecommunications dominate, exhibiting the highest market share (xx%), followed by BFSI (xx%).

- Vienna Region Dominance: Superior infrastructure and skilled workforce drive growth.

- SAN Segment Leadership: High demand for reliable, high-performance storage solutions.

- All-Flash Storage Growth: Driven by its performance benefits and increased adoption.

- IT & Telecommunication Sector Leadership: High digitalization and robust IT infrastructure.

Austria Data Center Storage Market Product Landscape

The Austrian data center storage market showcases a wide range of products, from traditional disk-based storage to cutting-edge all-flash arrays and hybrid solutions. Significant advancements in NVMe technology are increasing data transfer speeds, while software-defined storage solutions offer greater flexibility and scalability. Products are differentiated based on factors such as performance, capacity, security features, and management capabilities. Unique selling propositions often involve enhanced data protection features, simplified management interfaces, and seamless integration with cloud platforms.

Key Drivers, Barriers & Challenges in Austria Data Center Storage Market

Key Drivers: The increasing adoption of cloud computing, Big Data analytics, and the growing need for data security are major drivers. Government initiatives promoting digital transformation and investments in data center infrastructure further accelerate market growth. Furthermore, rising adoption of AI and machine learning applications requires robust storage solutions, fueling demand.

Challenges: Supply chain disruptions caused by geopolitical instability can impact the availability and pricing of storage components. Stringent data privacy regulations add complexity and cost. Intense competition from established players and emerging cloud storage providers creates pressure on pricing and margins. The overall impact of these challenges is estimated to reduce the market growth rate by approximately xx% over the next five years.

Emerging Opportunities in Austria Data Center Storage Market

Emerging opportunities lie in the increasing adoption of edge computing, which requires distributed storage solutions near data sources. The growing demand for data analytics and machine learning applications necessitates high-performance storage with increased capacity. Furthermore, the rising adoption of hyperconverged infrastructure (HCI) presents opportunities for vendors offering integrated storage and compute solutions. The development of sustainable data centers and the increased focus on energy efficiency open avenues for innovative and eco-friendly storage solutions.

Growth Accelerators in the Austria Data Center Storage Market Industry

Technological breakthroughs in areas such as NVMe and high-density storage technologies will accelerate market growth. Strategic partnerships between storage vendors and cloud providers will expand market reach and adoption. Furthermore, market expansion strategies focused on serving niche sectors, such as healthcare and education, will unlock new growth potential. Government support for digital transformation initiatives and investments in data center infrastructure will create a favorable environment for market expansion.

Key Players Shaping the Austria Data Center Storage Market Market

- Infinidat Ltd

- Lenovo Group Limited (Lenovo)

- Hewlett Packard Enterprise (HPE)

- Fujitsu Limited (Fujitsu)

- Dell Inc (Dell)

- NetApp Inc (NetApp)

- Kingston Technology Company Inc (Kingston)

- Huawei Technologies Co Ltd (Huawei)

- Oracle Corporation (Oracle)

- Commvault Systems Inc (Commvault)

- Pure Storage Inc (Pure Storage)

- Hitachi Vantara LLC (Hitachi Vantara)

Notable Milestones in Austria Data Center Storage Market Sector

- June 2023: Hitachi Vantara announced two new global partnership agreements with Cisco, enhancing its data center infrastructure offerings and hybrid cloud capabilities.

- June 2023: Huawei launched its F2F2X data center data infrastructure architecture, designed to address the challenges faced by financial institutions.

In-Depth Austria Data Center Storage Market Market Outlook

The Austria Data Center Storage Market is poised for continued growth, driven by technological advancements, increasing digitalization, and government support. The long-term outlook is positive, with significant opportunities for vendors offering innovative, secure, and scalable storage solutions. Strategic partnerships and expansion into new market segments will be crucial for success in this competitive landscape. The market’s future potential lies in addressing the growing demand for high-performance computing, edge computing, and AI-driven applications. Strategic focus on sustainability and energy efficiency will also be key differentiators.

Austria Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-Users

Austria Data Center Storage Market Segmentation By Geography

- 1. Austria

Austria Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase in the Demand for Energy-Efficient and Cost-Effective Data Centers Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Skilled Workforce Availability and Security Concerns

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds the Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Infinidat Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lenovo Group Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fujitsu Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NetApp Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Commvault Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pure Storage Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hitachi Vantara LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Infinidat Ltd

List of Figures

- Figure 1: Austria Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austria Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Austria Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austria Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Austria Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Austria Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Austria Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Austria Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Austria Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 8: Austria Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 9: Austria Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Austria Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Data Center Storage Market?

The projected CAGR is approximately 5.21%.

2. Which companies are prominent players in the Austria Data Center Storage Market?

Key companies in the market include Infinidat Ltd, Lenovo Group Limited, Hewlett Packard Enterprise, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Commvault Systems Inc , Pure Storage Inc, Hitachi Vantara LLC.

3. What are the main segments of the Austria Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase in the Demand for Energy-Efficient and Cost-Effective Data Centers Drives the Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds the Major Share.

7. Are there any restraints impacting market growth?

Skilled Workforce Availability and Security Concerns.

8. Can you provide examples of recent developments in the market?

June 2023: Hitachi Vantara, a prominent infrastructure, data management, and digital solutions subsidiary of Hitachi, Ltd., disclosed two new global partnership agreements with Cisco. These agreements will facilitate the seamless integration of Cisco technologies into Hitachi Vantara's storage products, positioning it as a leading provider of data center infrastructure and hybrid cloud-managed services. This strategic move brings Hitachi Vantara into the Vantara Service Provider and Technology Integrator (STI) Partner programs, further solidifying its industry standing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Austria Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence