Key Insights

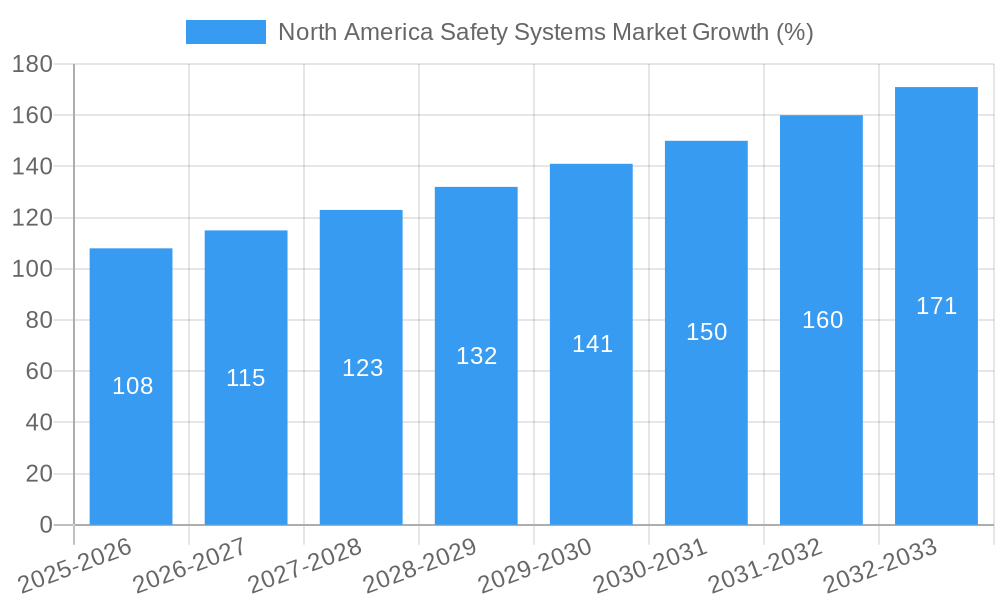

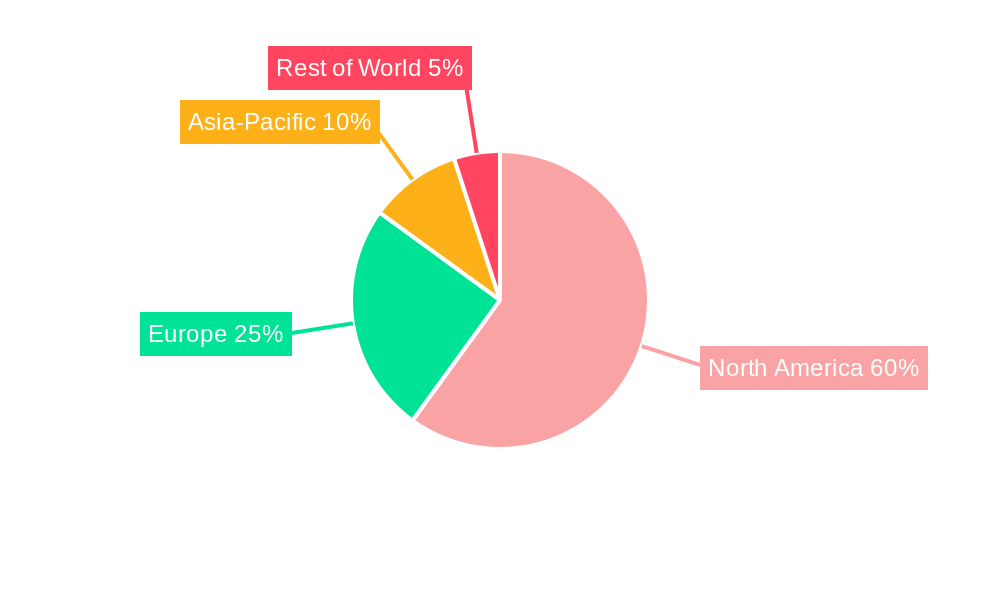

The North America safety systems market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 7.20% and the overall market size), is projected to experience robust growth throughout the forecast period (2025-2033). This growth is primarily driven by increasing industrial automation, stringent government regulations emphasizing workplace safety, and rising demand for advanced safety technologies across diverse end-user industries. The Oil & Gas, Energy & Power, and Chemicals sectors are key contributors, demanding sophisticated Process Control Systems (PCS), Process Safety Systems (PSS), and Fire & Gas Systems (FGS) to mitigate risks associated with hazardous operations. Furthermore, the increasing adoption of Industry 4.0 principles and the integration of smart sensors and data analytics are fueling the market's expansion. The integration of these technologies enables real-time monitoring, predictive maintenance, and proactive safety measures, significantly reducing downtime and enhancing overall operational efficiency.

Significant market segmentation exists within North America. While the United States dominates the regional market, Canada is also a substantial contributor. Within safety system types, Process Control Systems (PCS) currently hold the largest market share, driven by the need for comprehensive operational control. However, segments like Fire & Gas Systems (FGS) are expected to experience faster growth due to rising concerns about explosion and fire hazards. On the component side, Programmable Safety Systems and Presence Sensing Safety Sensors are seeing strong demand due to their advanced capabilities. The market's growth is, however, constrained by high initial investment costs for advanced safety technologies and the need for skilled personnel to operate and maintain these systems. Nevertheless, the long-term benefits in terms of reduced accidents, improved productivity, and compliance with safety regulations outweigh these initial challenges, ensuring continued expansion of the North American safety systems market.

North America Safety Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Safety Systems market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The market is segmented by region (United States, Canada), safety system type (Process Control Systems (PCS), Process Safety System/Shutdown System (PSS), Safety Shutdown System (SSS), Fire & Gas System (FGS), Others), component (Presence Sensing Safety Sensors, Programmable Safety Systems, Safety Controllers/Modules/Relays, Safety Interlock Switches, Emergency Stop Controls, Two-Hand Safety Controls, Others), and end-user industry (Oil & Gas, Energy & Power, Chemicals, Food & Beverage, Metals & Mining, Automotive, Others). The market size is presented in million units.

North America Safety Systems Market Dynamics & Structure

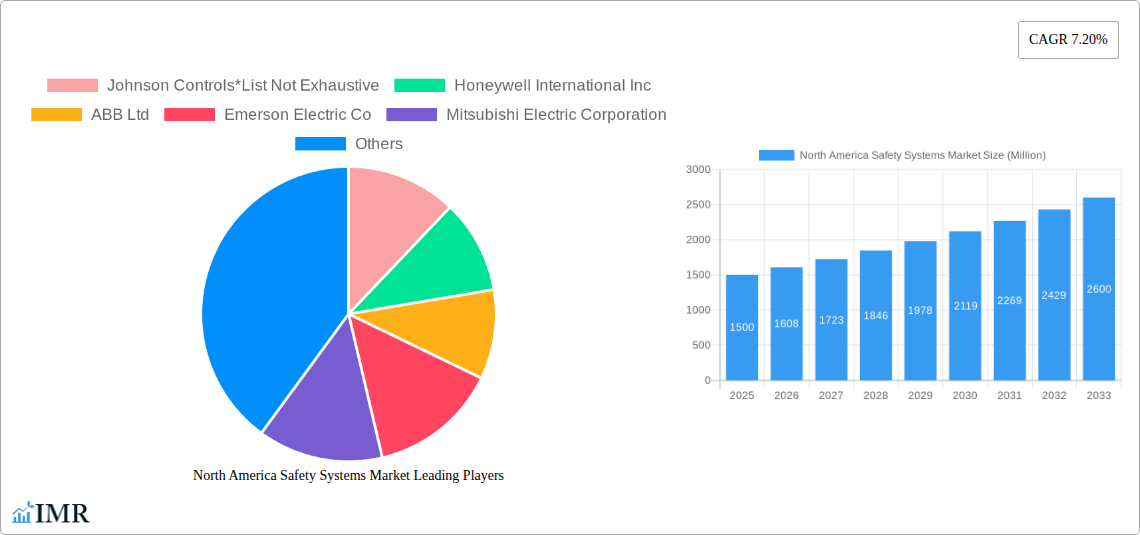

The North America safety systems market is characterized by a moderately concentrated landscape, with key players like Johnson Controls, Honeywell International Inc, ABB Ltd, Emerson Electric Co, and others holding significant market share. The exact market share distribution for 2025 is currently under assessment (xx%). Technological innovation, particularly in areas like AI-powered predictive maintenance and IoT-integrated safety solutions, is a major driver. Stringent regulatory frameworks, such as OSHA standards in the US and similar regulations in Canada, significantly influence market growth. Competitive pressure arises from the availability of substitute technologies and the constant push for cost-effective solutions. The end-user demographics are diverse, spanning various industries with varying safety needs. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, reflecting strategic acquisitions aimed at expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025 (under assessment).

- Technological Innovation: AI-powered predictive maintenance, IoT integration are key drivers.

- Regulatory Framework: Stringent safety standards drive demand.

- Competitive Substitutes: Presence of alternative technologies creates competitive pressure.

- End-User Demographics: Diverse, across various industries with varying safety needs.

- M&A Activity: Approximately xx deals between 2019-2024 (under assessment).

North America Safety Systems Market Growth Trends & Insights

The North America safety systems market is projected to witness significant growth during the forecast period (2025-2033). Driven by increasing industrial automation, stricter safety regulations, and rising awareness of workplace safety, the market is expected to register a CAGR of xx% from 2025 to 2033. Market penetration is currently at xx% in 2025 and is projected to reach xx% by 2033. Technological advancements, such as the adoption of advanced sensors and intelligent safety systems, are accelerating this growth. Consumer behavior is shifting towards safer and more efficient systems, demanding higher levels of integration and reliability. The market size is projected to reach xx million units by 2033 from xx million units in 2025. Specific regional trends, such as the expanding oil and gas sector in the US and Canada's focus on infrastructure safety, will further influence market development.

Dominant Regions, Countries, or Segments in North America Safety Systems Market

The United States dominates the North America safety systems market, accounting for approximately xx% of the market share in 2025, driven by its large industrial base and stringent safety regulations. Canada also contributes significantly with xx% market share in 2025 (under assessment). Within the safety system segments, Process Safety Systems (PSS) and Fire & Gas Systems (FGS) are the largest segments, holding approximately xx% and xx% of the market share respectively in 2025 (under assessment). The Oil & Gas and Energy & Power end-user industries are significant drivers, with strong demand for advanced safety solutions. The component segment is led by programmable safety systems.

- Key Drivers (US): Large industrial base, stringent safety regulations, robust oil & gas sector.

- Key Drivers (Canada): Focus on infrastructure safety, strong presence of energy and mining sectors.

- Dominant Segments: PSS and FGS hold largest market shares, driven by inherent risks in their respective industries.

- Dominant End-User Industries: Oil & Gas and Energy & Power industries showcase high demand.

North America Safety Systems Market Product Landscape

The North America safety systems market is witnessing continuous product innovation, with manufacturers focusing on enhancing system reliability, integration capabilities, and ease of use. Advanced features like predictive maintenance, remote monitoring, and improved human-machine interfaces are becoming increasingly prevalent. Unique selling propositions include reduced downtime, enhanced safety levels, and improved operational efficiency. Technological advancements are focused on integrating AI and IoT technologies to create intelligent safety systems capable of learning and adapting to evolving operational environments. These intelligent systems offer benefits such as predictive maintenance, automated responses to potential hazards, and real-time risk assessments.

Key Drivers, Barriers & Challenges in North America Safety Systems Market

Key Drivers: Stringent safety regulations, increasing industrial automation, rising awareness of workplace safety, and technological advancements in sensor technologies and AI/machine learning algorithms are driving market growth. Government initiatives promoting safety in various sectors also contribute significantly.

Challenges: Supply chain disruptions, particularly impacting the availability of crucial components, present a significant challenge. Regulatory hurdles and evolving compliance requirements add complexity and cost. Intense competition among established players and emerging companies adds pressure on pricing and margins. This results in a lower profit margin (xx% predicted) for 2025.

Emerging Opportunities in North America Safety Systems Market

Untapped market potential exists in sectors such as healthcare, pharmaceuticals, and aerospace & defense. Innovative applications of safety systems, such as integrating them with robotic systems and autonomous vehicles, are emerging. Evolving consumer preferences are shifting towards solutions that provide greater integration and data analytics capabilities for improved decision-making. This leads to the market expecting a growth of xx% by 2033.

Growth Accelerators in the North America Safety Systems Market Industry

Technological breakthroughs in AI, IoT, and sensor technologies will accelerate market growth. Strategic partnerships and collaborations between technology providers and end-users are paving the way for innovative solutions. Market expansion strategies, including targeting underserved sectors and geographical areas, will further fuel growth.

Key Players Shaping the North America Safety Systems Market Market

- Johnson Controls

- Honeywell International Inc

- ABB Ltd

- Emerson Electric Co

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Omron Corporation

- Baker Hughes Company

- Rockwell Automation Inc

- Yokogawa Electric Corporation

Notable Milestones in North America Safety Systems Market Sector

- June 2022: Mitsubishi Electric Corporation's US subsidiary received a contract for safety I&C systems for Holtec's SMR-160 reactor. This highlights the growing demand for advanced safety systems in the nuclear power sector.

- December 2021: Honeywell's acquisition of US Digital Designs expands its Fire and Connected Life Safety systems portfolio, strengthening its position in the public safety communications market.

In-Depth North America Safety Systems Market Outlook

The North America safety systems market is poised for sustained growth, driven by continuous technological advancements, increasing regulatory pressures, and the growing awareness of workplace safety. Strategic investments in R&D, partnerships, and expansions into emerging sectors will further unlock the market's potential, leading to robust market expansion in the long term. The market is expected to continue to expand with a CAGR of xx% (under assessment) from 2025 to 2033. Opportunities abound for companies that can innovate and adapt to the changing demands of a safety-conscious market.

North America Safety Systems Market Segmentation

-

1. Safety System

- 1.1. Process Control Systems (PCS)

- 1.2. Process

- 1.3. Safety Shutdown System (SSS)

- 1.4. Fire and Gas System (FGS)

- 1.5. Others (

-

2. Component

- 2.1. Presence Sensing Safety Sensors

- 2.2. Programmable Safety Systems

- 2.3. Safety Controllers/Modules/ Relays

- 2.4. Safety Interlock Switches

- 2.5. Emergency Stop Controls

- 2.6. Two-Hand Safety Controls

- 2.7. Others

-

3. End-User Industry

- 3.1. Oil & Gas

- 3.2. Energy & Power

- 3.3. Chemicals

- 3.4. Food & Beverage

- 3.5. Metals & Mining

- 3.6. Automotive

- 3.7. Others (

North America Safety Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Safety Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand for Reliable Safety Systems to Ensure the Protection of People and Property; Strict mandates for safety regulations

- 3.3. Market Restrains

- 3.3.1. High investments required for automation and installing industrial safety systems

- 3.4. Market Trends

- 3.4.1. The Safety Controllers/Modules/Relays Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Safety System

- 5.1.1. Process Control Systems (PCS)

- 5.1.2. Process

- 5.1.3. Safety Shutdown System (SSS)

- 5.1.4. Fire and Gas System (FGS)

- 5.1.5. Others (

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Presence Sensing Safety Sensors

- 5.2.2. Programmable Safety Systems

- 5.2.3. Safety Controllers/Modules/ Relays

- 5.2.4. Safety Interlock Switches

- 5.2.5. Emergency Stop Controls

- 5.2.6. Two-Hand Safety Controls

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Oil & Gas

- 5.3.2. Energy & Power

- 5.3.3. Chemicals

- 5.3.4. Food & Beverage

- 5.3.5. Metals & Mining

- 5.3.6. Automotive

- 5.3.7. Others (

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Safety System

- 6. United States North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Safety Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Johnson Controls*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ABB Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Emerson Electric Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Siemens AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Omron Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Baker Hughes Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yokogawa Electric Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Johnson Controls*List Not Exhaustive

List of Figures

- Figure 1: North America Safety Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Safety Systems Market Share (%) by Company 2024

List of Tables

- Table 1: North America Safety Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Safety Systems Market Revenue Million Forecast, by Safety System 2019 & 2032

- Table 3: North America Safety Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: North America Safety Systems Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: North America Safety Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Safety Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Safety Systems Market Revenue Million Forecast, by Safety System 2019 & 2032

- Table 12: North America Safety Systems Market Revenue Million Forecast, by Component 2019 & 2032

- Table 13: North America Safety Systems Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 14: North America Safety Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Safety Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Safety Systems Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Safety Systems Market?

Key companies in the market include Johnson Controls*List Not Exhaustive, Honeywell International Inc, ABB Ltd, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Omron Corporation, Baker Hughes Company, Rockwell Automation Inc, Yokogawa Electric Corporation.

3. What are the main segments of the North America Safety Systems Market?

The market segments include Safety System, Component, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Demand for Reliable Safety Systems to Ensure the Protection of People and Property; Strict mandates for safety regulations.

6. What are the notable trends driving market growth?

The Safety Controllers/Modules/Relays Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High investments required for automation and installing industrial safety systems.

8. Can you provide examples of recent developments in the market?

June 2022 - Mitsubishi Electric Corporation's U.S. subsidiary Mitsubishi Electric Power Products, Inc. (MEPPI), received a contract from Holtec International (Holtec) to expedite the design engineering of safety instrumentation and control systems (I&C) for Holtec's SMR-160 small modular reactor, an advanced small reactor with efficient safety and reliability levels, featuring a natural cooling ability in case of any accidents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Safety Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Safety Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Safety Systems Market?

To stay informed about further developments, trends, and reports in the North America Safety Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence