Key Insights

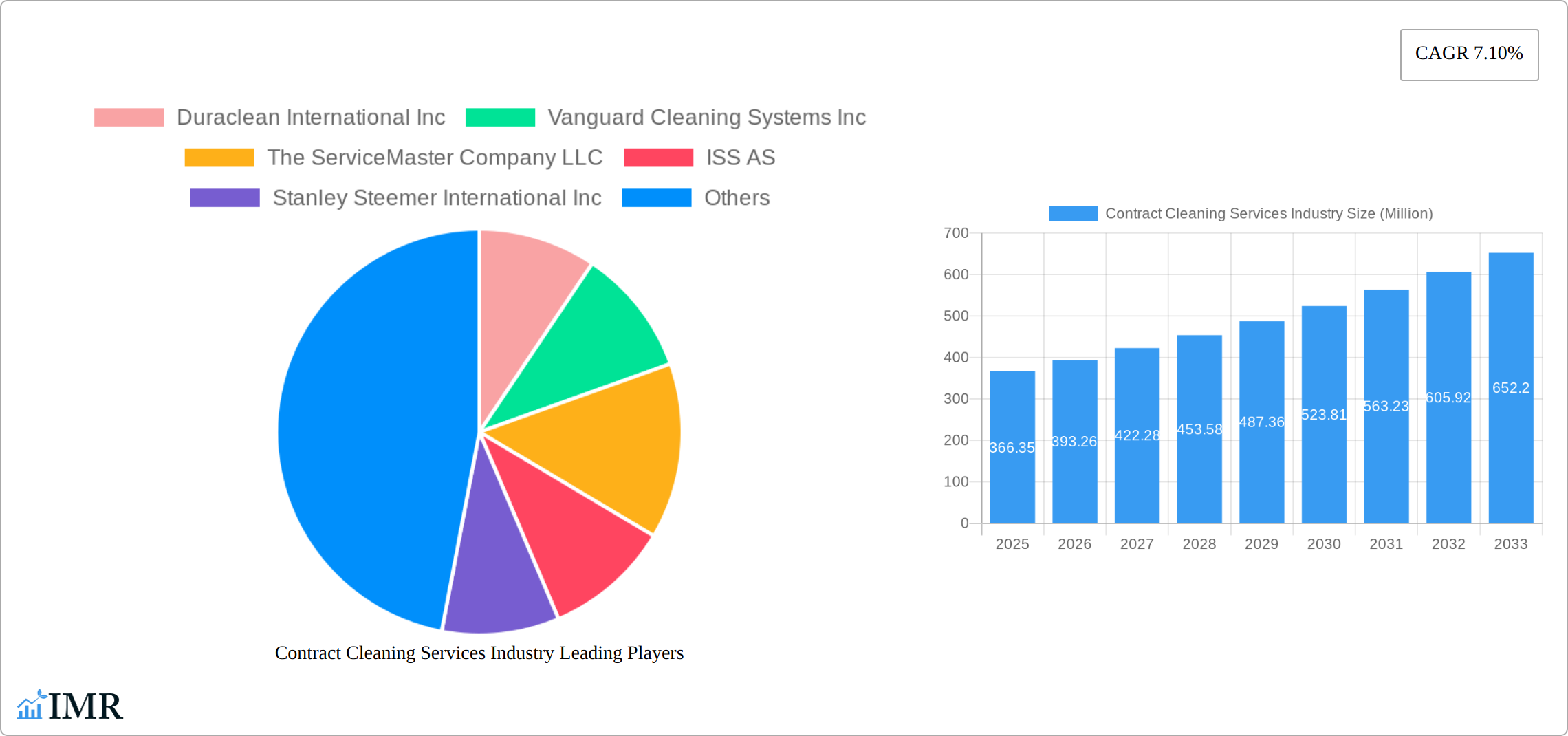

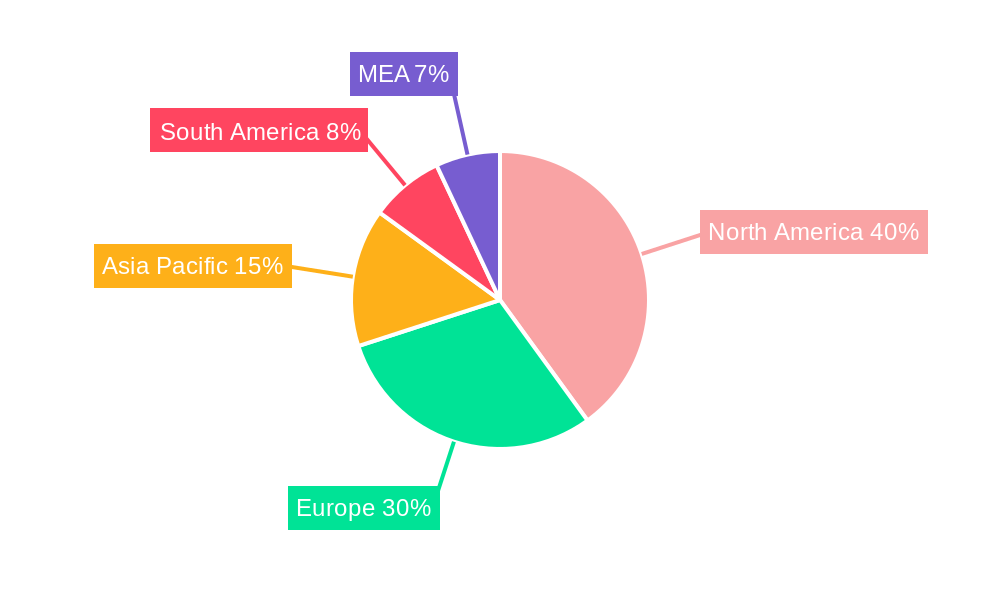

The contract cleaning services market, valued at $366.35 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.10% from 2025 to 2033. This expansion is fueled by several key factors. Increasing urbanization and the concentration of businesses in densely populated areas necessitate professional cleaning services to maintain hygiene and safety standards. Furthermore, a growing awareness of health and hygiene, particularly post-pandemic, has significantly boosted demand for contract cleaning in various sectors – residential, commercial, and industrial. The rising adoption of advanced cleaning technologies, such as robotic cleaning systems and eco-friendly cleaning agents, is further accelerating market growth. Stringent government regulations regarding workplace safety and hygiene in several regions also contribute to the market's upward trajectory. Competition within the industry is strong, with established players like Duraclean International, ServiceMaster, and ISS competing alongside smaller, regional firms. The market is segmented by end-user (residential, commercial, industrial) and geographically diverse, with North America and Europe currently holding significant market share.

However, market growth may face certain challenges. Economic fluctuations can impact spending on non-essential services like contract cleaning, particularly impacting the residential segment during periods of economic downturn. The availability and cost of skilled labor represent another constraint. Attracting and retaining qualified cleaning personnel is crucial for maintaining service quality and meeting growing demand. Furthermore, fluctuating raw material costs for cleaning supplies could put pressure on profit margins. Future market growth will likely depend on the industry's ability to innovate, adapt to changing economic conditions, and address labor market challenges through advancements in technology and workforce training initiatives. Companies are likely focusing on offering specialized services, such as green cleaning or biohazard remediation, to differentiate themselves and attract a wider customer base.

Contract Cleaning Services Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Contract Cleaning Services industry, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is segmented by end-user (Residential, Commercial, Industrial) and includes analysis of major players such as Duraclean International Inc, Vanguard Cleaning Systems Inc, The ServiceMaster Company LLC, ISS AS, Stanley Steemer International Inc, Pritchard Industries Inc, Sodexo Group, ABM Industries Incorporated, Anago Cleaning Systems Inc, and Jani-King International Inc. The total market size is projected to reach xx Million by 2033.

Contract Cleaning Services Industry Market Dynamics & Structure

The contract cleaning services market is characterized by a moderately concentrated structure with a few large multinational players and numerous smaller regional companies. Technological innovation, driven by automation and sustainable practices, is a key driver, while regulatory frameworks related to hygiene and safety significantly impact operations. Competitive pressures arise from both established players and new entrants offering specialized services. The market is also influenced by end-user demographics, particularly the growth of commercial real estate and industrial facilities. Mergers and acquisitions (M&A) activity has been significant, with larger firms acquiring smaller companies to expand their service offerings and geographical reach.

- Market Concentration: The top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: Increased adoption of robotic cleaning systems and smart cleaning solutions.

- Regulatory Framework: Stringent hygiene and safety regulations drive demand for professional cleaning services.

- Competitive Substitutes: In-house cleaning teams and self-service cleaning technologies.

- End-User Demographics: Growing commercial and industrial sectors fuel market expansion.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024, representing a xx% increase compared to the previous period.

Contract Cleaning Services Industry Growth Trends & Insights

The contract cleaning services market experienced significant growth during the historical period (2019-2024), driven by increasing awareness of hygiene and sanitation, coupled with the expansion of commercial and industrial sectors. Technological disruptions, including the introduction of robotic cleaning solutions and data-driven cleaning management systems, have influenced market dynamics and adoption rates. Consumer behavior shifts towards prioritizing hygiene and cleanliness further boost market demand. The market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration in key segments like commercial and industrial sectors is expected to increase significantly, with adoption rates improving due to technological advancements.

Dominant Regions, Countries, or Segments in Contract Cleaning Services Industry

The commercial segment dominates the contract cleaning services market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily driven by the expanding commercial real estate sector, increased focus on workplace hygiene and productivity, and the rising demand for professional cleaning services in offices, retail spaces, and hospitality establishments. North America and Europe represent the largest regional markets due to high levels of commercial development and stringent regulatory frameworks.

Key Drivers in Commercial Segment:

- Expanding commercial real estate market.

- Growing awareness of workplace hygiene and its impact on productivity.

- Stringent regulatory requirements related to workplace safety and sanitation.

- Increased outsourcing of cleaning services by businesses.

Dominance Factors:

- High market share of the commercial segment.

- Strong growth potential driven by continuous expansion of the commercial real estate sector and increased outsourcing trends.

- Favorable regulatory environment pushing businesses to adopt professional cleaning services.

Contract Cleaning Services Industry Product Landscape

The contract cleaning services market offers a diverse range of products, encompassing basic cleaning services to specialized cleaning solutions for various industries and settings. Product innovation focuses on enhancing efficiency, sustainability, and hygiene, particularly through the adoption of advanced cleaning technologies, such as robotic vacuum cleaners, automated floor scrubbers, and specialized cleaning agents. Unique selling propositions (USPs) include specialized training for cleaning staff, advanced equipment, and data-driven service optimization. Technological advancements like AI-powered cleaning robots and smart cleaning management systems are transforming the industry, allowing for greater efficiency, cost optimization, and improved hygiene.

Key Drivers, Barriers & Challenges in Contract Cleaning Services Industry

Key Drivers:

- Growing demand for hygiene and sanitation.

- Expanding commercial and industrial sectors.

- Technological advancements in cleaning equipment and techniques.

- Increasing outsourcing of cleaning services.

Challenges and Restraints:

- Labor shortages and increasing labor costs.

- Intense competition from smaller, local cleaning companies.

- Fluctuating raw material prices.

- Regulatory compliance requirements.

- Supply chain disruptions can impact the availability of cleaning supplies.

Emerging Opportunities in Contract Cleaning Services Industry

- Expansion into untapped markets, such as specialized cleaning for healthcare facilities and data centers.

- Development of green and sustainable cleaning solutions to meet growing environmental concerns.

- Increased adoption of technology for enhanced efficiency, data analytics, and automation.

- Offering specialized cleaning services, such as disinfection and sanitization, in response to emerging health concerns.

Growth Accelerators in the Contract Cleaning Services Industry

The contract cleaning services market is poised for sustained growth due to several key factors. Technological advancements, such as robotic cleaning systems and smart cleaning solutions, continue to enhance efficiency and reduce operational costs. Strategic partnerships and mergers & acquisitions are expanding the market reach and service offerings of major players. Government regulations promoting workplace hygiene and sanitation further fuel market expansion.

Key Players Shaping the Contract Cleaning Services Industry Market

- Duraclean International Inc

- Vanguard Cleaning Systems Inc

- The ServiceMaster Company LLC

- ISS AS

- Stanley Steemer International Inc

- Pritchard Industries Inc

- Sodexo Group

- ABM Industries Incorporated

- Anago Cleaning Systems Inc

- Jani-King International Inc

Notable Milestones in Contract Cleaning Services Industry Sector

- October 2022: SBFM secures a five-year contract with PureGym, the UK's largest gym operator, to provide cleaning services across all its UK locations. This signifies a significant deal in the commercial cleaning sector.

- July 2022: Gausium and Diversey-TASKI form a global partnership to integrate cleaning robotics with advanced cleaning technologies, marking a significant step towards automation in the industry.

In-Depth Contract Cleaning Services Industry Market Outlook

The contract cleaning services market is expected to witness robust growth over the forecast period, driven by technological advancements, increased outsourcing, and a heightened focus on hygiene. Strategic acquisitions and expansion into niche segments, such as healthcare and specialized industrial cleaning, will shape the competitive landscape. Companies that effectively leverage technology and focus on sustainability will be best positioned to capture significant market share and drive long-term growth.

Contract Cleaning Services Industry Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Contract Cleaning Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Contract Cleaning Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Hygienic Consciousness

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Commercial Cleaning is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. North America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. South America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. North America Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. MEA Contract Cleaning Services Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Duraclean International Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Vanguard Cleaning Systems Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 The ServiceMaster Company LLC

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 ISS AS

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Stanley Steemer International Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Pritchard Industries Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sodexo Group

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 ABM Industries Incorporated

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Anago Cleaning Systems Inc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Jani-King International Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Duraclean International Inc

List of Figures

- Figure 1: Global Contract Cleaning Services Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Contract Cleaning Services Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 28: North America Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 29: North America Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: North America Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 31: North America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 32: North America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 33: North America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: North America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 36: Europe Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 37: Europe Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 38: Europe Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 39: Europe Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 41: Europe Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 43: Asia Pacific Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 44: Asia Pacific Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 45: Asia Pacific Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 46: Asia Pacific Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 47: Asia Pacific Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 49: Asia Pacific Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 52: Latin America Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 53: Latin America Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 54: Latin America Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 55: Latin America Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 56: Latin America Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 57: Latin America Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 58: Latin America Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

- Figure 59: Middle East and Africa Contract Cleaning Services Industry Revenue (Million), by End User 2024 & 2032

- Figure 60: Middle East and Africa Contract Cleaning Services Industry Volume (K Unit), by End User 2024 & 2032

- Figure 61: Middle East and Africa Contract Cleaning Services Industry Revenue Share (%), by End User 2024 & 2032

- Figure 62: Middle East and Africa Contract Cleaning Services Industry Volume Share (%), by End User 2024 & 2032

- Figure 63: Middle East and Africa Contract Cleaning Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 64: Middle East and Africa Contract Cleaning Services Industry Volume (K Unit), by Country 2024 & 2032

- Figure 65: Middle East and Africa Contract Cleaning Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 66: Middle East and Africa Contract Cleaning Services Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Contract Cleaning Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 5: Global Contract Cleaning Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 21: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 25: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 29: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 33: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Global Contract Cleaning Services Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Contract Cleaning Services Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 37: Global Contract Cleaning Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Contract Cleaning Services Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Cleaning Services Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Contract Cleaning Services Industry?

Key companies in the market include Duraclean International Inc, Vanguard Cleaning Systems Inc, The ServiceMaster Company LLC, ISS AS, Stanley Steemer International Inc, Pritchard Industries Inc, Sodexo Group, ABM Industries Incorporated, Anago Cleaning Systems Inc, Jani-King International Inc.

3. What are the main segments of the Contract Cleaning Services Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 366.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Hygienic Consciousness.

6. What are the notable trends driving market growth?

Commercial Cleaning is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce.

8. Can you provide examples of recent developments in the market?

October 2022 - With a five-year deal, SBFM plans to provide a full range of commercial cleaning services to PureGym, the largest gym operator in the United Kingdom, at all its UK locations. The contract began on September 1, 2022, and SBFM and PureGym have their main offices in Leeds. With 1.7 million members spread across 525 clubs, primarily in the United Kingdom and Europe, PureGym's venues are usually open. The group recently revealed ambitions to increase the number of clubs in its portfolio by a factor of two, intending to have more than 1,000 clubs worldwide by 2030..

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Cleaning Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Cleaning Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Cleaning Services Industry?

To stay informed about further developments, trends, and reports in the Contract Cleaning Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence