Key Insights

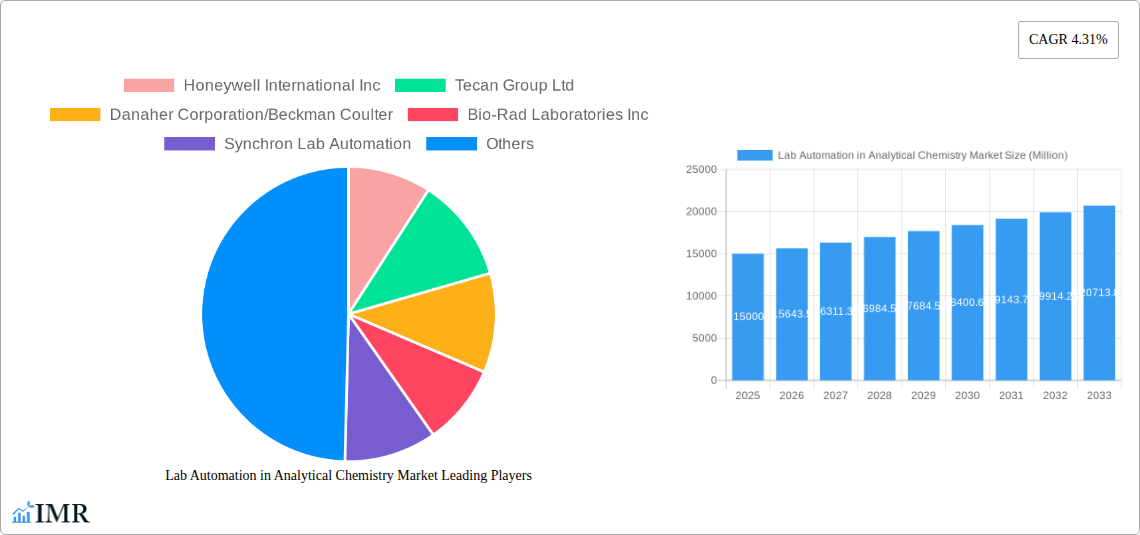

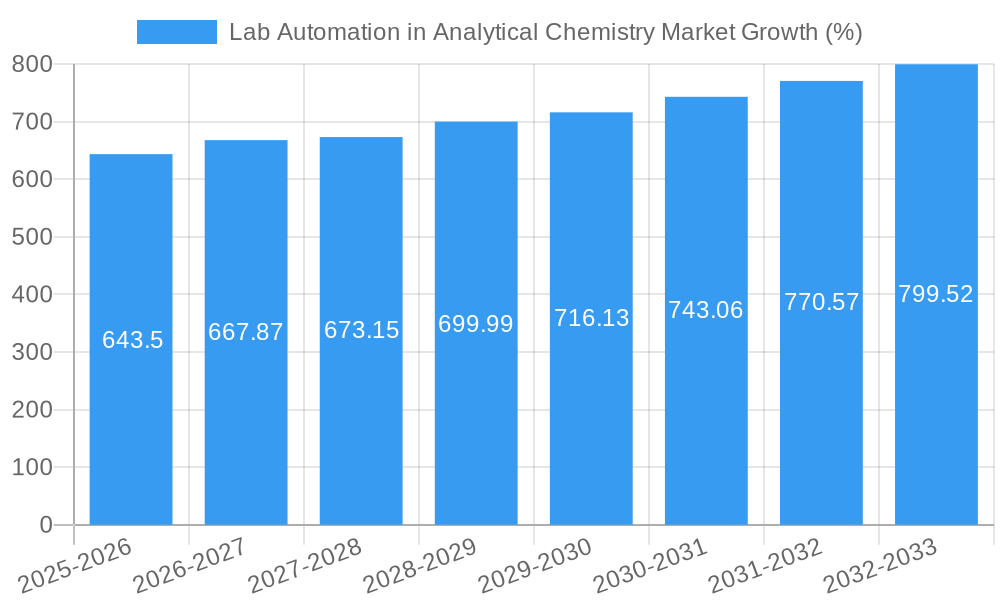

The global lab automation in analytical chemistry market is experiencing robust growth, driven by the increasing demand for high-throughput screening, improved accuracy and precision in analytical tests, and the rising adoption of automation in various industries like pharmaceuticals, biotechnology, and food & beverage. The market's 4.31% CAGR indicates a steady expansion, projected to continue through 2033. Key drivers include the need for enhanced efficiency and reduced operational costs in laboratories, coupled with the increasing complexity of analytical techniques. The rising prevalence of chronic diseases and the growing focus on personalized medicine are further fueling the demand for automated solutions capable of handling large sample volumes and complex workflows. Automation in analytical chemistry is transforming laboratory operations, streamlining processes from sample preparation to data analysis. The integration of advanced technologies like AI and machine learning is further enhancing the capabilities of lab automation systems, improving data interpretation and accelerating research and development cycles. This shift towards automation is evident in the increasing adoption of automated liquid handlers, robotic arms, and advanced software solutions across various geographical regions.

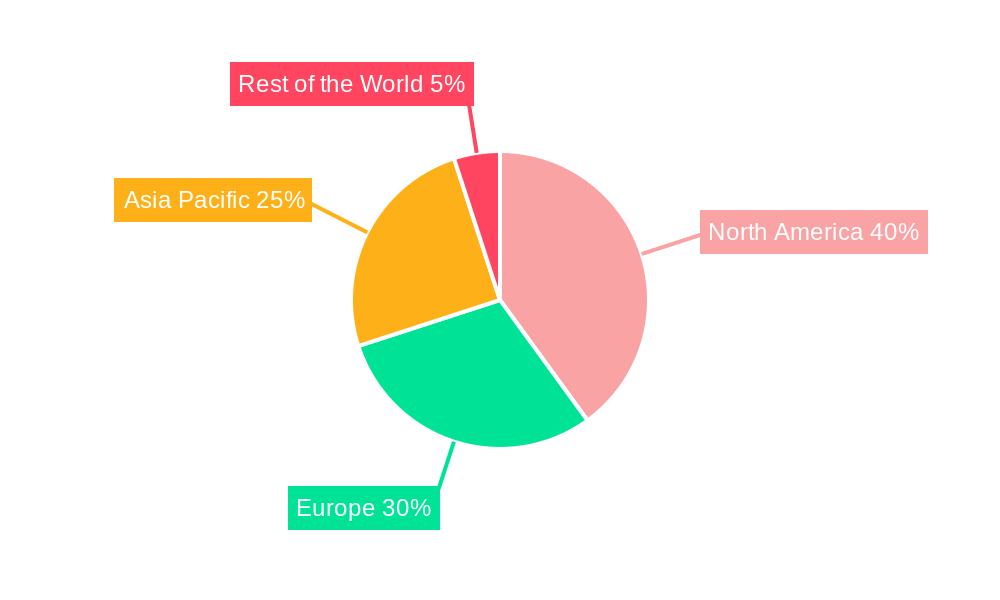

The market segmentation reveals a significant contribution from automated liquid handlers and automated plate handlers, reflecting the core needs of high-throughput experimentation. Leading companies like Thermo Fisher Scientific, Danaher Corporation, and Tecan Group are at the forefront of innovation, continuously developing and improving their offerings. While North America currently holds a significant market share, driven by robust research and development activities and early adoption of advanced technologies, the Asia-Pacific region is poised for substantial growth, fueled by increasing investments in healthcare infrastructure and a burgeoning pharmaceutical industry. The market faces certain restraints, including the high initial investment costs associated with implementing automation systems and the need for skilled personnel to operate and maintain these sophisticated technologies. However, the long-term benefits in terms of cost savings, improved efficiency, and reduced human error are outweighing these initial challenges, ensuring the continued growth trajectory of the lab automation in analytical chemistry market.

Lab Automation in Analytical Chemistry Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lab Automation in Analytical Chemistry Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key drivers and challenges, emerging opportunities, and key players. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The parent market is the broader analytical chemistry market, while the child market is the specific niche of lab automation within analytical chemistry. The market size is projected to reach xx Million by 2033.

Lab Automation in Analytical Chemistry Market Market Dynamics & Structure

The Lab Automation in Analytical Chemistry market is characterized by moderate concentration, with several key players holding significant market share. The market is driven by technological innovations like AI-powered analytics and miniaturized systems, alongside increasing regulatory pressures for data accuracy and efficiency. Competitive substitutes include manual laboratory techniques, but automation offers significant advantages in speed, precision, and reduced human error. End-users predominantly include pharmaceutical and biotechnology companies, research institutions, and contract research organizations (CROs). M&A activity is relatively frequent, with larger players strategically acquiring smaller companies to expand their product portfolios and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2025.

- Technological Drivers: Artificial intelligence (AI), miniaturization, cloud integration, improved software analytics.

- Regulatory Frameworks: Stringent quality control standards (e.g., GLP, GMP) driving adoption of automated systems for enhanced traceability and data integrity.

- Competitive Substitutes: Manual laboratory processes, however, automation's advantages in terms of efficiency and accuracy are increasing its adoption.

- End-User Demographics: Pharmaceutical & biotech companies (xx%), research institutions (xx%), CROs (xx%), other (xx%).

- M&A Trends: An average of xx M&A deals per year between 2019 and 2024, with a focus on expanding product lines and geographical reach.

Lab Automation in Analytical Chemistry Market Growth Trends & Insights

The Lab Automation in Analytical Chemistry market experienced substantial growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to the increasing demand for high-throughput screening, rising R&D investments in the pharmaceutical and biotechnology industries, and the growing adoption of automation to improve efficiency and reduce human error. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by factors such as technological advancements, increasing demand for personalized medicine, and the growing prevalence of chronic diseases. Market penetration remains relatively low in certain segments, presenting significant opportunities for future growth. Technological disruptions, such as the integration of AI and machine learning, are further accelerating market expansion. Consumer behavior shifts toward prioritizing speed, accuracy, and cost-effectiveness in analytical testing are also driving demand. By 2033, the market is projected to reach xx Million, with a CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in Lab Automation in Analytical Chemistry Market

North America currently dominates the Lab Automation in Analytical Chemistry market, driven by strong R&D investment, advanced technological infrastructure, and a high concentration of pharmaceutical and biotechnology companies. Europe follows as a significant market, with strong growth potential in emerging economies in Asia-Pacific. Within the market segments, Automated Liquid Handlers hold the largest market share, followed by Automated Plate Handlers. This is largely due to their widespread application in various analytical chemistry workflows. However, the Software segment is expected to witness the highest growth rate during the forecast period, driven by increasing demand for data management and analysis solutions.

- North America: High adoption rates driven by advanced infrastructure, R&D investments, and a large pharmaceutical industry.

- Europe: Strong regulatory frameworks and increasing adoption of automation in various industries.

- Asia-Pacific: Rapid growth potential due to increasing R&D spending and expanding healthcare infrastructure.

- Segment Dominance: Automated Liquid Handlers (xx% market share), followed by Automated Plate Handlers (xx%), with Software exhibiting the highest growth potential.

- Key Drivers: Robust healthcare infrastructure, supportive government policies, technological advancements.

Lab Automation in Analytical Chemistry Market Product Landscape

The Lab Automation in Analytical Chemistry market offers a diverse range of products, including automated liquid handlers, automated plate handlers, robotic arms, automated storage and retrieval systems, specialized software, and analyzers. Recent innovations focus on miniaturization, increased throughput, improved accuracy, and seamless integration with existing laboratory information management systems (LIMS). Unique selling propositions often center on speed, precision, reduced error rates, and ease of use. Technological advancements such as AI-powered data analysis and cloud connectivity are driving the development of increasingly sophisticated and user-friendly systems.

Key Drivers, Barriers & Challenges in Lab Automation in Analytical Chemistry Market

Key Drivers:

- Increasing demand for high-throughput screening and faster turnaround times in analytical testing.

- Growing adoption of automation to improve efficiency, reduce costs, and enhance data quality.

- Stringent regulatory requirements driving the need for robust and traceable analytical methods.

- Technological advancements like AI and machine learning improving the capabilities of automation systems.

Challenges:

- High initial investment costs associated with implementing automation systems.

- Complexity of integrating automated systems with existing laboratory workflows.

- Skill gap in operating and maintaining sophisticated automated equipment.

- Potential for supply chain disruptions impacting the availability of components and reagents. This has resulted in a xx% increase in lead times in 2024.

Emerging Opportunities in Lab Automation in Analytical Chemistry Market

Emerging opportunities include the integration of artificial intelligence and machine learning for advanced data analysis, the development of miniaturized and portable automation systems for point-of-care diagnostics, and the expansion into untapped markets such as environmental monitoring and food safety testing. The growing demand for personalized medicine is also creating new opportunities for automation in targeted therapeutic development and patient-specific diagnostics.

Growth Accelerators in the Lab Automation in Analytical Chemistry Market Industry

Technological breakthroughs in areas such as microfluidics and lab-on-a-chip technologies are poised to significantly accelerate market growth. Strategic partnerships between automation providers and analytical instrument manufacturers are enhancing the integration and usability of automated systems. Expansion into emerging markets through targeted marketing and distribution strategies is also creating new growth opportunities.

Key Players Shaping the Lab Automation in Analytical Chemistry Market Market

- Honeywell International Inc

- Tecan Group Ltd

- Danaher Corporation/Beckman Coulter

- Bio-Rad Laboratories Inc

- Synchron Lab Automation

- Thermo Fisher Scientific Inc

- Eppendorf AG

- Siemens Healthineers AG

- Shimadzu Corp

- Agilent Technologies Inc

- Becton Dickinson & Co

- PerkinElmer Inc

- Hudson Robotics Inc

- Roche Holding AG

- Aurora Biomed Inc

- List Not Exhaustive

Notable Milestones in Lab Automation in Analytical Chemistry Market Sector

- 2021: Thermo Fisher Scientific launched a new automated liquid handler with AI-powered capabilities.

- 2022: Beckman Coulter acquired a smaller automation company, expanding its product portfolio.

- 2023: Tecan Group introduced a novel automated plate handler with increased throughput.

- 2024: Significant supply chain disruptions impacting the availability of components for automated systems.

In-Depth Lab Automation in Analytical Chemistry Market Market Outlook

The Lab Automation in Analytical Chemistry market is poised for continued strong growth, driven by technological advancements, increasing demand for high-throughput screening, and the expanding application of automation in various industries. Strategic partnerships, focused investments in R&D, and expansion into untapped markets present significant opportunities for market players. The future growth will be significantly influenced by the successful integration of AI and machine learning, leading to more sophisticated and adaptable automation solutions. This will result in greater efficiency, higher data quality, and cost reductions across the analytical chemistry sector.

Lab Automation in Analytical Chemistry Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (ASRS)

- 1.5. Software

- 1.6. Analyzers

Lab Automation in Analytical Chemistry Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Analytical Chemistry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Investments in R&D by Pharmaceutical and Biotechnology Companies; Rising Demand from Drug Discovery and Genomics

- 3.3. Market Restrains

- 3.3.1. Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (ASRS)

- 5.1.5. Software

- 5.1.6. Analyzers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (ASRS)

- 6.1.5. Software

- 6.1.6. Analyzers

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (ASRS)

- 7.1.5. Software

- 7.1.6. Analyzers

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (ASRS)

- 8.1.5. Software

- 8.1.6. Analyzers

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (ASRS)

- 9.1.5. Software

- 9.1.6. Analyzers

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. North America Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Lab Automation in Analytical Chemistry Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Honeywell International Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Tecan Group Ltd

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Danaher Corporation/Beckman Coulter

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Bio-Rad Laboratories Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Synchron Lab Automation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Thermo Fisher Scientific Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Eppendorf AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Siemens Healthineers AG

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Shimadzu Corp

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Agilent Technologies Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Becton Dickinson & Co

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 PerkinElmer Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Hudson Robotics Inc

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Roche Holding AG

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Aurora Biomed Inc *List Not Exhaustive

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Lab Automation in Analytical Chemistry Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Analytical Chemistry Market Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Analytical Chemistry Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Analytical Chemistry Market Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Analytical Chemistry Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Lab Automation in Analytical Chemistry Market Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Pacific Lab Automation in Analytical Chemistry Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Pacific Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Lab Automation in Analytical Chemistry Market Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Rest of the World Lab Automation in Analytical Chemistry Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Rest of the World Lab Automation in Analytical Chemistry Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Lab Automation in Analytical Chemistry Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Analytical Chemistry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Analytical Chemistry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Analytical Chemistry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Analytical Chemistry Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Analytical Chemistry Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Analytical Chemistry Market?

The projected CAGR is approximately 4.31%.

2. Which companies are prominent players in the Lab Automation in Analytical Chemistry Market?

Key companies in the market include Honeywell International Inc, Tecan Group Ltd, Danaher Corporation/Beckman Coulter, Bio-Rad Laboratories Inc, Synchron Lab Automation, Thermo Fisher Scientific Inc, Eppendorf AG, Siemens Healthineers AG, Shimadzu Corp, Agilent Technologies Inc, Becton Dickinson & Co, PerkinElmer Inc, Hudson Robotics Inc, Roche Holding AG, Aurora Biomed Inc *List Not Exhaustive.

3. What are the main segments of the Lab Automation in Analytical Chemistry Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Investments in R&D by Pharmaceutical and Biotechnology Companies; Rising Demand from Drug Discovery and Genomics.

6. What are the notable trends driving market growth?

Automated Liquid Handlers to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Analytical Chemistry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Analytical Chemistry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Analytical Chemistry Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Analytical Chemistry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence