Key Insights

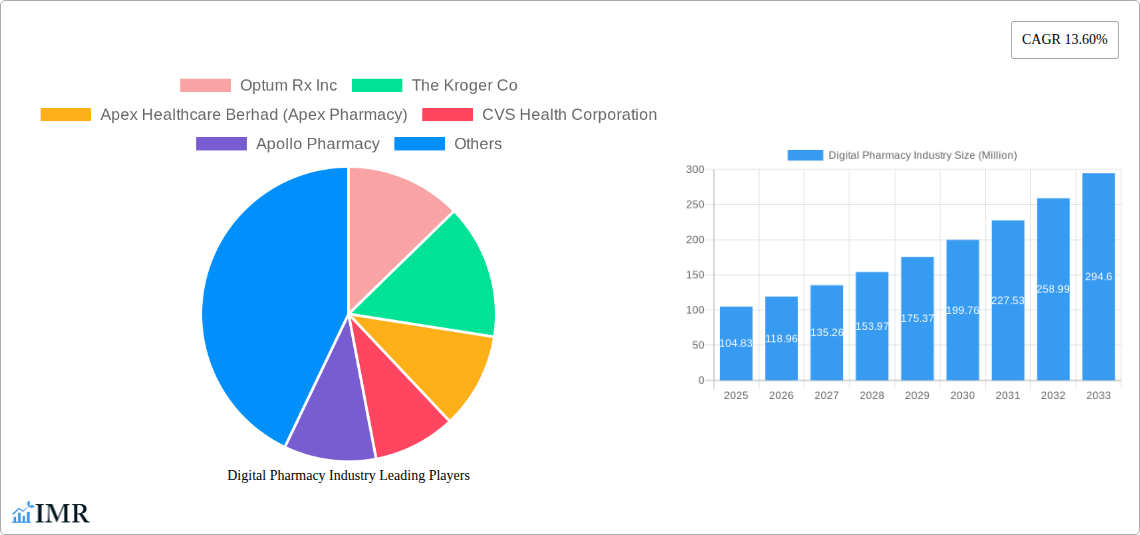

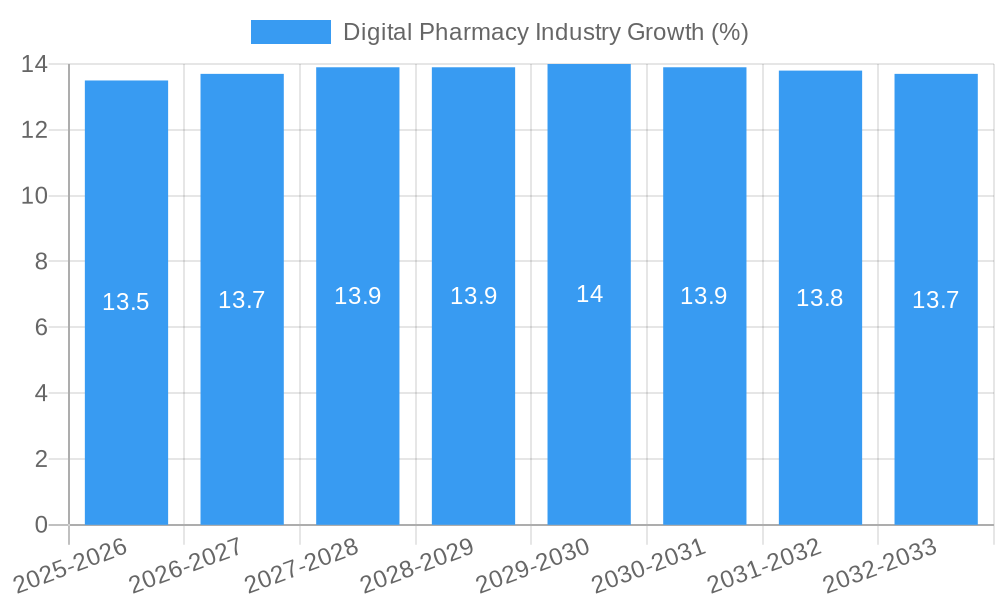

The digital pharmacy market, valued at $104.83 million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 13.60% from 2025 to 2033. This surge is driven by several key factors. Increasing internet and smartphone penetration, particularly among older demographics, facilitates greater accessibility to online prescription and OTC medication services. Convenience, coupled with the ability to compare prices and access medication delivery directly to homes, is attracting a wider customer base. Furthermore, telehealth integration is seamlessly connecting patients with healthcare providers, bolstering the demand for online prescription fulfillment. The rise of chronic diseases necessitates consistent medication management, which digital pharmacies effectively support through automated refill reminders and personalized medication tracking. Competitive pricing strategies, coupled with loyalty programs and subscription services offered by major players like OptumRx, CVS Health, and Amazon, are also stimulating market expansion. Regulatory changes aimed at streamlining online pharmaceutical sales further contribute to this growth trajectory. However, concerns surrounding data security and patient privacy, coupled with the need for robust infrastructure to ensure secure medication handling and timely delivery, pose challenges to market expansion.

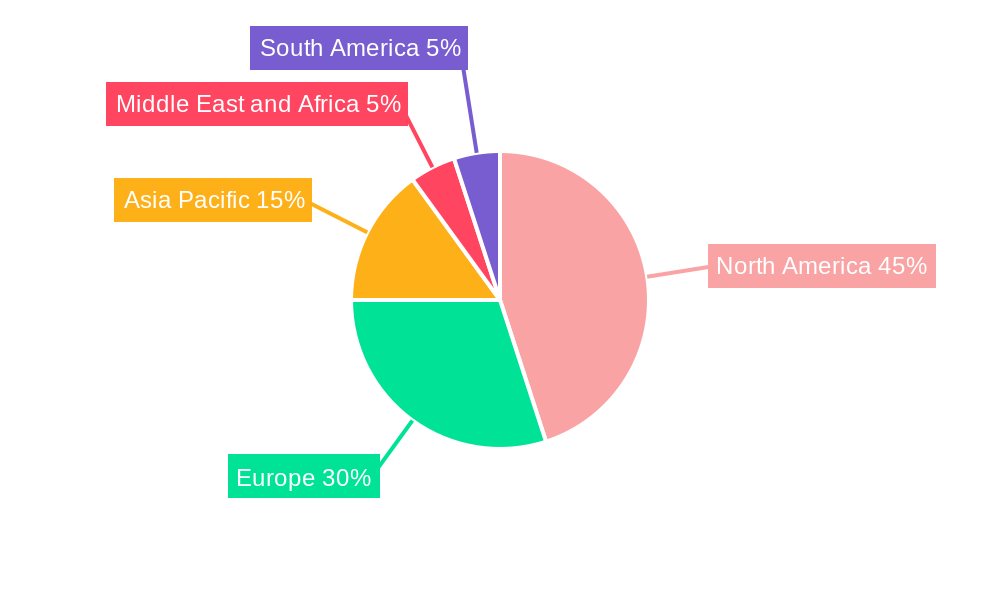

Despite these challenges, the market segmentation reveals significant opportunities. The prescription drug segment currently dominates, but the over-the-counter (OTC) segment is poised for rapid growth fueled by convenient access to everyday health products. Within product types, skin care, dental, and cold and flu remedies see the highest demand, reflecting consumer preferences for online convenience for these frequently purchased items. Geographical analysis shows North America and Europe currently hold the largest market shares, driven by advanced digital infrastructure and high healthcare expenditure. However, the Asia-Pacific region exhibits substantial growth potential, due to its expanding middle class and increasing adoption of online services. Companies are strategically focusing on expanding their digital platforms, improving customer experience, and exploring new partnerships to capitalize on this burgeoning market. The continued development of advanced technologies, such as AI-powered medication adherence programs and virtual consultations, will further shape the future landscape of the digital pharmacy industry.

Digital Pharmacy Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Digital Pharmacy Industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the rapidly evolving digital pharmacy landscape. The report segments the market by drug type (Prescription Drugs, Over-the-Counter (OTC) Drugs) and product type (Skin Care, Dental, Cold and Flu, Vitamins, Weight Loss, Other Product Types), providing granular insights into market performance across various segments.

Parent Market: Healthcare Industry Child Market: Online Pharmacy & Telemedicine

Digital Pharmacy Industry Market Dynamics & Structure

The digital pharmacy market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with several large players vying for market share alongside numerous smaller, specialized firms. Technological innovations, such as AI-powered medication management tools and telehealth platforms, are driving market growth. However, stringent regulatory frameworks and data privacy concerns pose significant challenges. The market is also witnessing increased mergers and acquisitions (M&A) activity as larger players seek to expand their reach and consolidate their market position. Substitutes include traditional brick-and-mortar pharmacies and direct-to-consumer drug delivery services. The end-user demographic is broad, encompassing individuals of all ages, but particularly appeals to tech-savvy consumers and those in underserved areas.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller competitors. xx% market share held by top 5 players (2024).

- Technological Innovation Drivers: AI, telemedicine integration, mobile apps, and personalized medication management tools.

- Regulatory Frameworks: Stringent regulations regarding data privacy, prescription drug dispensing, and online pharmacy operations vary across geographies.

- Competitive Product Substitutes: Traditional pharmacies, direct-to-consumer drug delivery services.

- End-User Demographics: Broad age range, with higher adoption rates among tech-savvy individuals and those in rural/remote areas.

- M&A Trends: Increasing M&A activity, driven by expansion strategies and market consolidation. xx M&A deals recorded in 2024.

Digital Pharmacy Industry Growth Trends & Insights

The digital pharmacy market is experiencing robust growth, fueled by increasing internet penetration, rising healthcare costs, and the growing adoption of telehealth services. The market size is projected to reach $xx million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the integration of AI and machine learning, are transforming the industry, enabling personalized medicine and improved patient outcomes. Consumer behavior is shifting towards convenience and accessibility, driving demand for online pharmacy services. Adoption rates are increasing steadily, particularly among younger demographics. Increased demand for faster and more efficient delivery services is also noted, especially with the increase of online ordering and increased demand for home delivery in the aftermath of the COVID-19 pandemic.

Dominant Regions, Countries, or Segments in Digital Pharmacy Industry

North America currently dominates the digital pharmacy market, driven by high internet penetration, advanced healthcare infrastructure, and favorable regulatory environments. Within North America, the United States exhibits the largest market share due to high adoption rates and a strong regulatory framework. However, Asia-Pacific is projected to witness the highest growth rate during the forecast period, fueled by increasing smartphone penetration and rising disposable incomes. Within drug types, prescription drugs constitute the larger segment, while within product types, the OTC drugs market, specifically cold and flu medication, is expected to grow faster owing to its ease of accessibility and non-prescription nature.

- North America: High market share driven by high internet penetration, robust healthcare infrastructure, and favorable regulatory conditions.

- Asia-Pacific: Fastest-growing region due to rising smartphone penetration and increasing disposable incomes.

- Europe: Significant market size, with growth driven by increasing adoption of telehealth services.

- Prescription Drugs Segment: Largest segment by drug type, driven by high demand for prescription medications.

- OTC Drugs Segment: Fastest-growing segment by drug type, driven by ease of accessibility and increasing self-medication.

- Skin Care & Vitamins Segment: Shows high growth potential across all regions as increasing demand for self-care products rises.

Digital Pharmacy Industry Product Landscape

Digital pharmacy platforms offer a wide range of products and services, including online prescription refills, virtual consultations, medication adherence programs, and personalized health recommendations. Key product innovations include AI-powered medication management tools, telehealth platforms integrated with pharmacy services, and mobile apps that facilitate medication ordering and tracking. These advancements enhance convenience, improve medication adherence, and contribute to better patient outcomes.

Key Drivers, Barriers & Challenges in Digital Pharmacy Industry

Key Drivers:

- Rising internet and smartphone penetration.

- Growing adoption of telehealth services.

- Increased demand for convenient healthcare solutions.

- Technological advancements like AI and machine learning.

Challenges & Restraints:

- Stringent regulatory hurdles and data privacy concerns (estimated to cause a xx million loss in revenue annually by 2030).

- Security breaches and data theft risks resulting in loss of consumer trust.

- Supply chain disruptions impacting medication availability (estimated to reduce annual growth rate by 0.5% in 2027).

- Competition from traditional pharmacies and established players.

Emerging Opportunities in Digital Pharmacy Industry

- Expansion into untapped markets in developing countries.

- Development of specialized pharmacy services for niche populations (elderly, chronic disease patients).

- Integration of AI and machine learning for personalized medication management.

- Expansion of telepharmacy services in remote areas.

Growth Accelerators in the Digital Pharmacy Industry Industry

Strategic partnerships between digital pharmacies and healthcare providers will create synergy and drive efficiency. Investment in technological innovations like AI-powered drug discovery and personalized medicine will fuel efficiency and boost effectiveness. Market expansion strategies that target underserved populations will increase market reach and profitability.

Key Players Shaping the Digital Pharmacy Industry Market

- Optum Rx Inc

- The Kroger Co

- Apex Healthcare Berhad (Apex Pharmacy)

- CVS Health Corporation

- Apollo Pharmacy

- Axelia Solutions (Pharmeasy)

- DocMorris (Zur Rose Group AG)

- Walgreen Boots Alliance (Walgreen Co)

- Amazon com Inc

- Netmeds com

- Cigna Corporation (Express Scripts Holdings)

- Giant Eagle Inc

Notable Milestones in Digital Pharmacy Industry Sector

- September 2022: Amazon announces plans to sell prescription medications online in Japan, collaborating with smaller pharmacies for online medication instruction and home delivery.

- September 2022: Walmart Canada partners with Canada Health Infoway to expand electronic prescribing services to 14 pharmacies in Ontario, Alberta, Saskatchewan, and New Brunswick, with further expansion planned.

In-Depth Digital Pharmacy Industry Market Outlook

The digital pharmacy market is poised for significant growth, driven by technological advancements, increasing consumer demand, and strategic partnerships. Future market potential is substantial, particularly in emerging economies. Opportunities for strategic expansion include focusing on personalized medicine, developing innovative service models, and leveraging telehealth integration. Companies that successfully navigate regulatory hurdles and adapt to evolving consumer preferences are best positioned to capture market share and drive long-term growth.

Digital Pharmacy Industry Segmentation

-

1. Drug Type

- 1.1. Prescription Drugs

- 1.2. Over-the-Counter (OTC) Drugs

-

2. Product Type

- 2.1. Skin Care

- 2.2. Dental

- 2.3. Cold and Flu

- 2.4. Vitamins

- 2.5. Weight Loss

- 2.6. Other Product Types

Digital Pharmacy Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Digital Pharmacy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Access to Web-based and Online Services; Rising Implementation of E-prescriptions in Hospitals and Other Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Illegal Online Pharmacies; Low Penetration in Rural Areas in Developing Countries

- 3.4. Market Trends

- 3.4.1 The Over-the-Counter Drugs Segment

- 3.4.2 under Drug Type

- 3.4.3 is Expected to Grow at the Fastest Rate during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. Prescription Drugs

- 5.1.2. Over-the-Counter (OTC) Drugs

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Skin Care

- 5.2.2. Dental

- 5.2.3. Cold and Flu

- 5.2.4. Vitamins

- 5.2.5. Weight Loss

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. North America Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. Prescription Drugs

- 6.1.2. Over-the-Counter (OTC) Drugs

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Skin Care

- 6.2.2. Dental

- 6.2.3. Cold and Flu

- 6.2.4. Vitamins

- 6.2.5. Weight Loss

- 6.2.6. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Europe Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. Prescription Drugs

- 7.1.2. Over-the-Counter (OTC) Drugs

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Skin Care

- 7.2.2. Dental

- 7.2.3. Cold and Flu

- 7.2.4. Vitamins

- 7.2.5. Weight Loss

- 7.2.6. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Asia Pacific Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. Prescription Drugs

- 8.1.2. Over-the-Counter (OTC) Drugs

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Skin Care

- 8.2.2. Dental

- 8.2.3. Cold and Flu

- 8.2.4. Vitamins

- 8.2.5. Weight Loss

- 8.2.6. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. Middle East and Africa Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 9.1.1. Prescription Drugs

- 9.1.2. Over-the-Counter (OTC) Drugs

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Skin Care

- 9.2.2. Dental

- 9.2.3. Cold and Flu

- 9.2.4. Vitamins

- 9.2.5. Weight Loss

- 9.2.6. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 10. South America Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 10.1.1. Prescription Drugs

- 10.1.2. Over-the-Counter (OTC) Drugs

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Skin Care

- 10.2.2. Dental

- 10.2.3. Cold and Flu

- 10.2.4. Vitamins

- 10.2.5. Weight Loss

- 10.2.6. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 11. North America Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Digital Pharmacy Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Optum Rx Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 The Kroger Co

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Apex Healthcare Berhad (Apex Pharmacy)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 CVS Health Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Apollo Pharmacy

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Axelia Solutions (Pharmeasy)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 DocMorris (Zur Rose Group AG)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Walgreen Boots Alliance (Walgreen Co )

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Amazon com Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Netmeds com*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Cigna Corporation (Express Scripts Holdings)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Giant Eagle Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Optum Rx Inc

List of Figures

- Figure 1: Global Digital Pharmacy Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Digital Pharmacy Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 13: North America Digital Pharmacy Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 14: North America Digital Pharmacy Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 15: North America Digital Pharmacy Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: North America Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Digital Pharmacy Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 19: Europe Digital Pharmacy Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 20: Europe Digital Pharmacy Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe Digital Pharmacy Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 25: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 26: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 27: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 28: Asia Pacific Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 31: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 32: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 33: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 34: Middle East and Africa Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Digital Pharmacy Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 37: South America Digital Pharmacy Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 38: South America Digital Pharmacy Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 39: South America Digital Pharmacy Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 40: South America Digital Pharmacy Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Digital Pharmacy Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Pharmacy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 3: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Digital Pharmacy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 32: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 38: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 39: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 47: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 48: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 56: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 57: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Digital Pharmacy Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 62: Global Digital Pharmacy Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 63: Global Digital Pharmacy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Digital Pharmacy Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Pharmacy Industry?

The projected CAGR is approximately 13.60%.

2. Which companies are prominent players in the Digital Pharmacy Industry?

Key companies in the market include Optum Rx Inc, The Kroger Co, Apex Healthcare Berhad (Apex Pharmacy), CVS Health Corporation, Apollo Pharmacy, Axelia Solutions (Pharmeasy), DocMorris (Zur Rose Group AG), Walgreen Boots Alliance (Walgreen Co ), Amazon com Inc, Netmeds com*List Not Exhaustive, Cigna Corporation (Express Scripts Holdings), Giant Eagle Inc.

3. What are the main segments of the Digital Pharmacy Industry?

The market segments include Drug Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 104.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Access to Web-based and Online Services; Rising Implementation of E-prescriptions in Hospitals and Other Healthcare Services.

6. What are the notable trends driving market growth?

The Over-the-Counter Drugs Segment. under Drug Type. is Expected to Grow at the Fastest Rate during the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Number of Illegal Online Pharmacies; Low Penetration in Rural Areas in Developing Countries.

8. Can you provide examples of recent developments in the market?

In September 2022, Amazon stated that it was planning to sell prescription medications online in Japan. To build a platform where patients can get online instructions on taking medications, it aims to collaborate with small and medium-sized pharmacies. Without visiting a pharmacy, customers could have their drugs delivered to their homes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Pharmacy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Pharmacy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Pharmacy Industry?

To stay informed about further developments, trends, and reports in the Digital Pharmacy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence