Key Insights

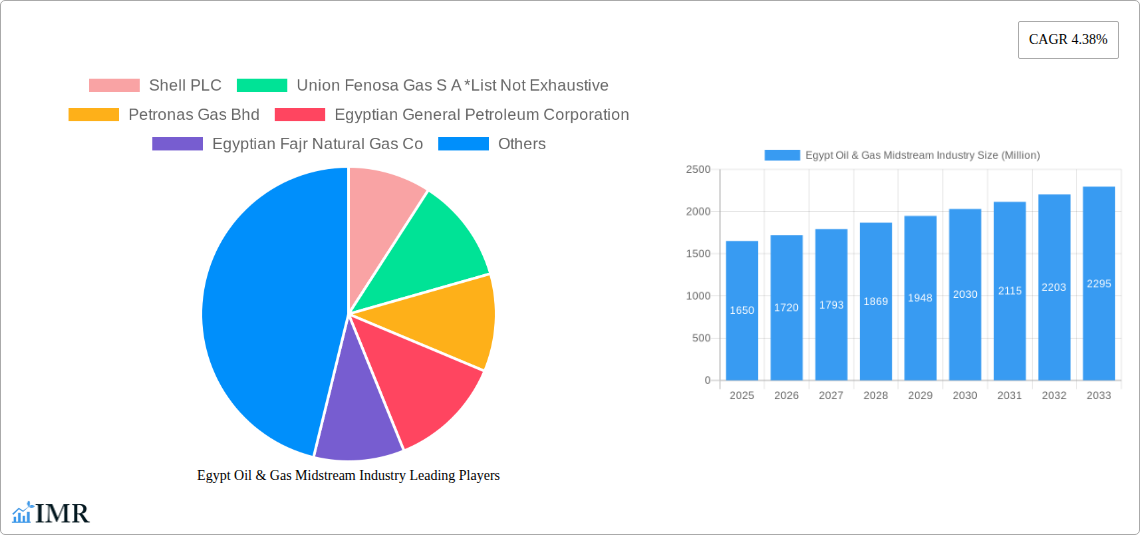

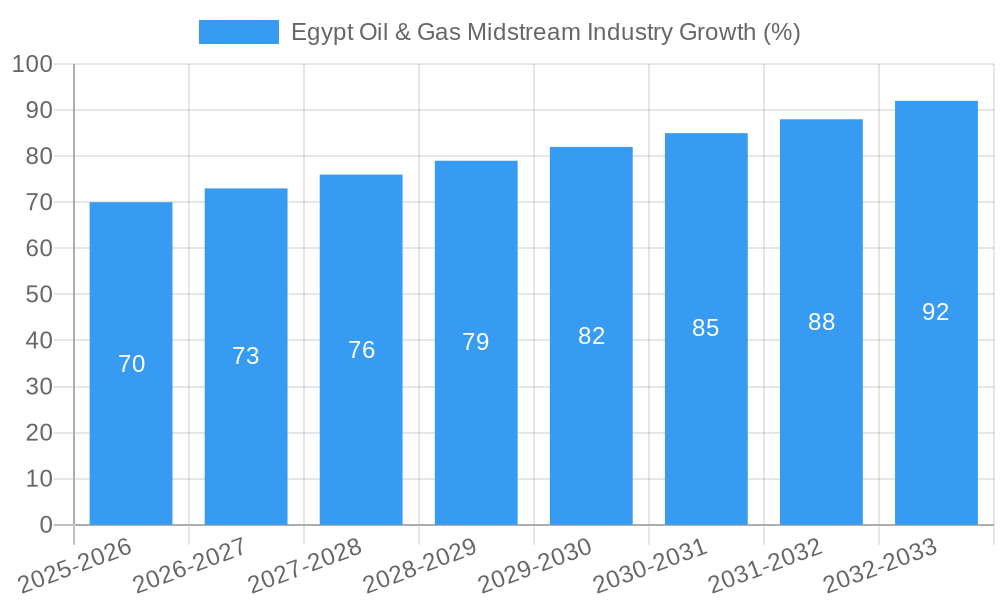

The Egypt Oil & Gas Midstream industry, valued at $1.65 billion in 2025, is projected to experience steady growth, driven by increasing domestic energy demand and strategic investments in infrastructure development. A Compound Annual Growth Rate (CAGR) of 4.38% from 2025 to 2033 indicates a positive outlook for the sector. Key drivers include the expansion of Egypt's LNG export capabilities, fueled by significant gas discoveries and government initiatives aimed at enhancing energy security and attracting foreign investment. Growth is further propelled by ongoing modernization of storage and transportation infrastructure, improving efficiency and reliability within the midstream value chain. While potential regulatory hurdles and fluctuations in global energy prices present some challenges, the long-term outlook remains optimistic, particularly considering Egypt's strategic location and growing role as a regional energy hub. Major players like Shell, BP, and Eni are actively involved, contributing to the sector's development and competitiveness. The segmentation into LNG terminals, transportation, and storage reflects the diverse facets of this crucial industry segment, each with its own growth trajectory and investment opportunities.

The significant players in the Egyptian Oil & Gas Midstream market are leveraging their expertise and resources to capitalize on the growth opportunities. The focus on expanding LNG export capacity, coupled with the modernization of existing infrastructure, positions Egypt as a key player in the global energy market. Growth will likely be influenced by factors such as the success of ongoing exploration activities, government policy regarding energy pricing and investment incentives, and the broader geopolitical landscape. Competition among existing players and potential new entrants will shape market dynamics, with a likely increase in mergers and acquisitions as companies seek to consolidate their position and expand their operational footprint. Analyzing the performance of individual segments—LNG terminals, transportation, and storage—will provide valuable insights into specific investment areas within this rapidly evolving industry. Further research into the intricacies of each segment will provide a comprehensive understanding of the market's potential.

This comprehensive report provides an in-depth analysis of the Egypt Oil & Gas Midstream Industry, covering the period 2019-2033, with a focus on the year 2025. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities for industry professionals, investors, and stakeholders. This report examines the parent market of Oil & Gas and the child market of Midstream operations within Egypt, providing a granular view of this dynamic sector.

Egypt Oil & Gas Midstream Industry Market Dynamics & Structure

This section analyzes the Egyptian oil & gas midstream market's competitive landscape, technological advancements, regulatory environment, and market trends. The study period is 2019-2033, with 2025 as the base and estimated year.

Market Concentration: The Egyptian midstream market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The market share of the top 5 players is estimated at xx%, reflecting both domestic and international participation. Smaller, specialized companies also contribute significantly to niche segments.

Technological Innovation: Technological innovation focuses on enhancing efficiency and safety across the value chain. This includes the adoption of advanced pipeline monitoring systems, automated storage facilities, and the integration of digital technologies for improved operational management. However, barriers to innovation include high capital expenditure requirements and limited access to cutting-edge technologies.

Regulatory Framework: The regulatory framework is undergoing continuous evolution, with a focus on attracting foreign investment and boosting domestic energy security. Recent reforms aim to streamline licensing procedures, strengthen safety standards, and enhance transparency. These regulatory changes impact investment decisions and operational strategies across the midstream segment.

Competitive Product Substitutes: Limited substitutes exist within the core midstream services (LNG terminals, transportation, storage). However, competition arises from alternative energy sources and innovative storage technologies, creating pressure on traditional midstream operations.

End-User Demographics: The primary end-users of midstream services are domestic power generation companies, industrial consumers, and LNG export terminals. The evolving demand patterns of these end-users are directly linked to Egypt’s energy policy and economic growth.

M&A Trends: The midstream sector has witnessed a moderate level of M&A activity in recent years. A total of xx M&A deals were recorded between 2019 and 2024, with a total value of xx Million USD. Further consolidation is anticipated as companies seek economies of scale and geographic expansion.

- Key Factors: Investment in infrastructure, regulatory reforms, and demand from growing industrial sectors drive market growth.

Egypt Oil & Gas Midstream Industry Growth Trends & Insights

Leveraging extensive data analysis, this section presents a comprehensive overview of the Egyptian oil & gas midstream market’s growth trajectory. The market size, expressed in Million USD, is projected to grow from xx Million in 2019 to xx Million in 2025, achieving a CAGR of xx% during the historical period (2019-2024) and an estimated CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors including rising domestic energy demand, increased LNG imports, and investments in pipeline infrastructure modernization. The adoption rate of new technologies, such as smart pipelines and automated storage systems, is gradually increasing, although the rate of implementation lags behind global averages. Consumer behavior is shifting towards greater demand for energy reliability and security, creating a favorable environment for midstream services providers to enhance their offerings.

Dominant Regions, Countries, or Segments in Egypt Oil & Gas Midstream Industry

This section identifies the dominant regions and segments within the Egyptian midstream market.

LNG Terminals: The Ain Sokhna LNG terminal is currently the leading LNG import facility. Other terminals are also operating or under construction, enhancing the overall receiving capacity.

- Key Drivers: Egypt’s increasing reliance on LNG imports to meet domestic energy needs is a primary driver of growth in this segment.

Transportation: Pipelines dominate the transportation segment, transporting both natural gas and crude oil across the country. Existing pipelines are being upgraded and expanded to meet growing demands, whilst new pipelines are under development.

- Key Drivers: Government initiatives to expand the pipeline network and increase transportation capacity are key drivers of market growth.

Storage: The expansion of storage facilities for both crude oil and natural gas is crucial for meeting the country’s energy demands. The government is actively investing in new storage facilities to enhance supply security and stability.

- Key Drivers: Concerns about energy security and supply disruptions drive investment in storage infrastructure.

Egypt Oil & Gas Midstream Industry Product Landscape

The Egyptian midstream market features a range of products and services, including LNG regasification, pipeline transportation, and storage solutions. Technological advancements are enhancing the efficiency and safety of these services. Key product innovations include the implementation of advanced pipeline monitoring systems to prevent leaks and optimize operational performance. The unique selling propositions are concentrated on service reliability, safety, and regulatory compliance, which are paramount concerns for clients in this industry.

Key Drivers, Barriers & Challenges in Egypt Oil & Gas Midstream Industry

Key Drivers:

- Growing Domestic Energy Demand: Egypt's rapidly growing economy and population require a significant increase in energy supply.

- Government Investments: Significant government investments in infrastructure development create opportunities for midstream companies.

- Regional Energy Cooperation: Regional collaborations, such as the Jordan-Egypt agreement on FSRU utilization, open new market avenues.

Key Challenges:

- High Capital Expenditure: Investing in new infrastructure demands significant capital investment, deterring smaller players. This is estimated to represent xx Million USD annually in needed investment.

- Regulatory Hurdles: Navigating the regulatory landscape can be complex, impacting project timelines and investment decisions.

- Geopolitical Risks: Regional geopolitical instability can affect pipeline security and operations.

Emerging Opportunities in Egypt Oil & Gas Midstream Industry

Emerging opportunities include expanding LNG import capacity to meet the rise in domestic demand, investing in gas storage facilities, and exploring cross-border pipeline projects. Further opportunities arise from developing innovative pipeline monitoring systems and deploying smart technologies to enhance the efficiency and safety of gas transportation and storage.

Growth Accelerators in the Egypt Oil & Gas Midstream Industry Industry

Long-term growth is accelerated by continuous investment in infrastructure modernization, strategic partnerships between domestic and international players, and the successful implementation of regulatory reforms. Technological innovations, such as the adoption of advanced pipeline monitoring systems, are expected to further enhance efficiency and improve safety standards.

Key Players Shaping the Egypt Oil & Gas Midstream Industry Market

- Shell PLC

- Union Fenosa Gas S A

- Petronas Gas Bhd

- Egyptian General Petroleum Corporation

- Egyptian Fajr Natural Gas Co

- Eni S p A

- Egyptian Natural Gas Holding Company

- BP p l c

- Spanish Egyptian Gas Company

Notable Milestones in Egypt Oil & Gas Midstream Industry Sector

- June 2023: Egypt and Jordan collaborate on FSRU utilization at the Sheikh Sabah port.

- July 2022: Egyptian petroleum ministry announces plans for a new crude oil storage area in El-Tebbin (USD 96.21 Million investment).

In-Depth Egypt Oil & Gas Midstream Industry Market Outlook

The Egyptian oil & gas midstream market is poised for robust growth in the coming years, driven by strong domestic demand and strategic investments. This presents significant opportunities for industry players to expand their operations, implement innovative technologies, and participate in large-scale infrastructure projects. The ongoing efforts to improve the regulatory framework and attract foreign investment will further stimulate market growth and enhance the overall energy security of the nation.

Egypt Oil & Gas Midstream Industry Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in pipeline

- 1.1.3. Upcoming projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in pipeline

- 2.1.3. Upcoming projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in pipeline

- 3.1.3. Upcoming projects

-

3.1. Overview

Egypt Oil & Gas Midstream Industry Segmentation By Geography

- 1. Egypt

Egypt Oil & Gas Midstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing investment in the Midstream Sector4.; Increasing Production of Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Inadequate Infrastructure in the Country

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in pipeline

- 5.1.1.3. Upcoming projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in pipeline

- 5.2.1.3. Upcoming projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in pipeline

- 5.3.1.3. Upcoming projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Union Fenosa Gas S A *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Petronas Gas Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Egyptian General Petroleum Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Egyptian Fajr Natural Gas Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eni S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptian Natural Gas Holding Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BP p l c

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Spanish Egyptian Gas Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Egypt Oil & Gas Midstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Oil & Gas Midstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 3: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 4: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 5: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Transportation 2019 & 2032

- Table 8: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Storage 2019 & 2032

- Table 9: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 10: Egypt Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Oil & Gas Midstream Industry?

The projected CAGR is approximately 4.38%.

2. Which companies are prominent players in the Egypt Oil & Gas Midstream Industry?

Key companies in the market include Shell PLC, Union Fenosa Gas S A *List Not Exhaustive, Petronas Gas Bhd, Egyptian General Petroleum Corporation, Egyptian Fajr Natural Gas Co, Eni S p A, Egyptian Natural Gas Holding Company, BP p l c, Spanish Egyptian Gas Company.

3. What are the main segments of the Egypt Oil & Gas Midstream Industry?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.65 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing investment in the Midstream Sector4.; Increasing Production of Oil and Natural Gas.

6. What are the notable trends driving market growth?

Transportation Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Inadequate Infrastructure in the Country.

8. Can you provide examples of recent developments in the market?

In June 2023, Egypt and Jordan entered into a collaboration agreement that allows the North African nation to use the floating storage regasification unit (FSRU) at the Sheikh Sabah port in Aqaba. FSRU terminals are crucial in the liquefied natural gas value chain, forming the interface between LNG carriers and the local gas supply infrastructure. As part of the agreement, the Jordanian side will receive LNG from Egypt and pump back some of the gas through transborder pipelines to the country if needed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Oil & Gas Midstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Oil & Gas Midstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Oil & Gas Midstream Industry?

To stay informed about further developments, trends, and reports in the Egypt Oil & Gas Midstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence