Key Insights

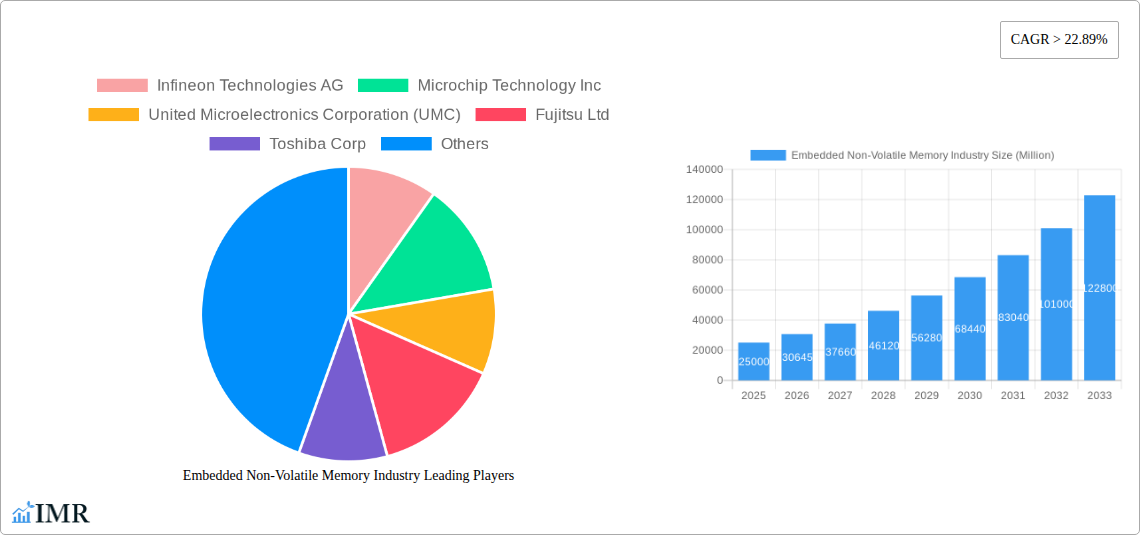

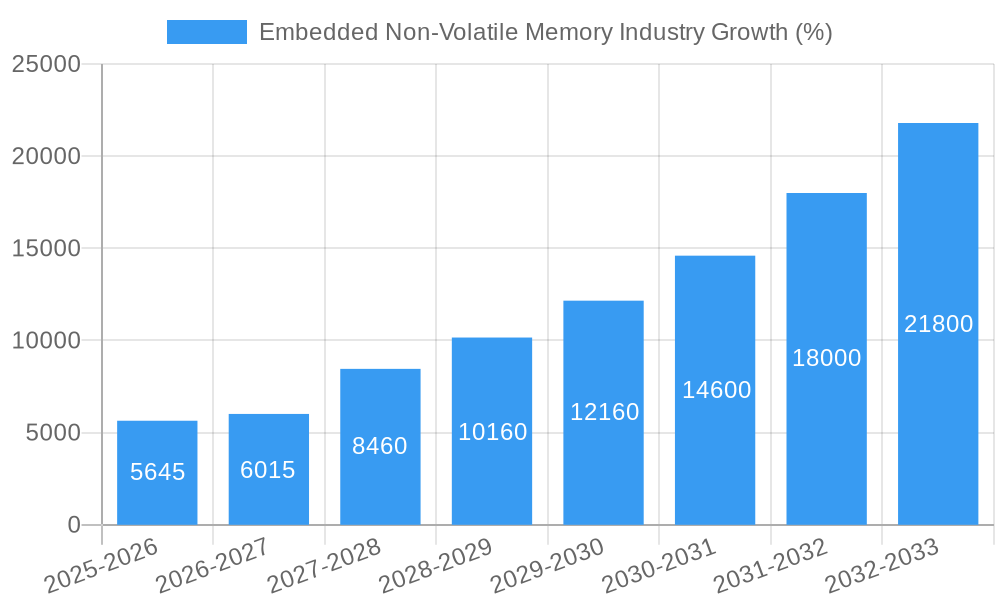

The embedded non-volatile memory (NVM) market is experiencing robust growth, driven by the increasing demand for data storage in various applications across diverse sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 22.89% from 2019-2024 indicates significant expansion. This growth is fueled by several key factors: the proliferation of IoT devices requiring reliable and persistent data storage, the rise of edge computing necessitating local data processing and storage capabilities, and the increasing adoption of advanced automotive electronics featuring sophisticated embedded systems. The demand for higher storage density and faster read/write speeds is also driving innovation in NVM technologies, pushing the market forward. Segmentation reveals strong growth across both end-user industries (industrial automation, consumer electronics, and enterprise solutions leading the charge) and memory types (standalone and embedded solutions demonstrating comparable market shares, reflecting different application needs). Key players, including Infineon, Microchip, and Samsung, are aggressively investing in R&D and strategic partnerships to maintain their competitive edge, further contributing to market expansion.

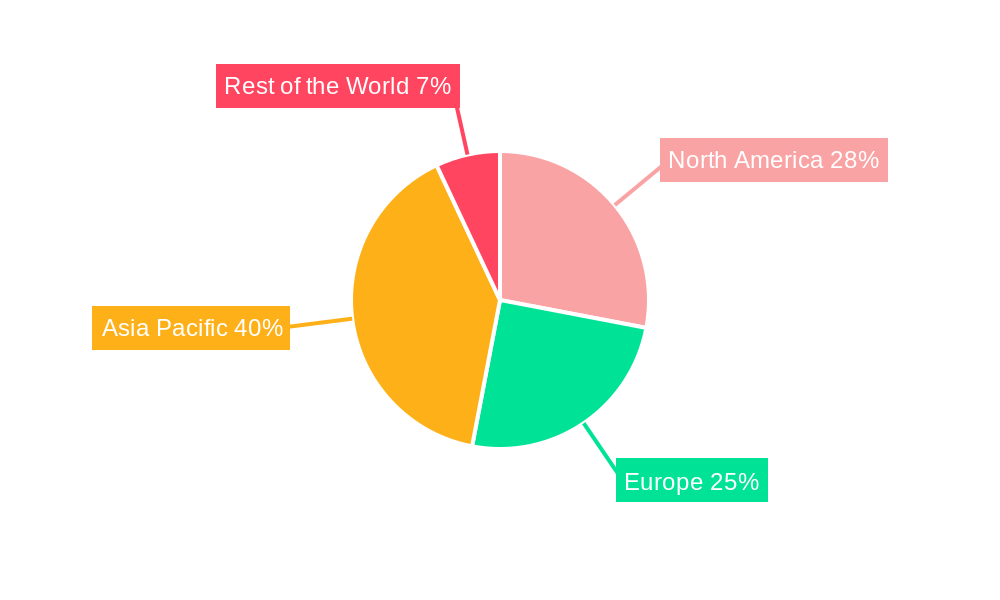

Looking ahead to 2025-2033, the embedded NVM market is projected to maintain its strong trajectory. Continued advancements in memory technologies, such as 3D NAND and emerging non-volatile memory solutions, will further enhance storage capacity, performance, and power efficiency. This will lead to broader adoption in applications like industrial automation (smart factories and robotics), autonomous vehicles, and wearable technology. While potential restraints, such as supply chain disruptions and fluctuating raw material prices, could temporarily impact growth, the underlying demand drivers remain powerful, ensuring sustained expansion of the embedded NVM market over the forecast period. The market is expected to reach a substantial size, with steady growth anticipated across all geographic regions, though Asia-Pacific is likely to maintain a leading market share due to its strong manufacturing base and burgeoning electronics industry.

Embedded Non-Volatile Memory Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Embedded Non-Volatile Memory (eNVM) market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It examines market dynamics, growth trends, regional dominance, product landscapes, and key players, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers both the parent market (Non-Volatile Memory) and the child market (Embedded Non-Volatile Memory), providing a holistic view of this rapidly evolving sector. The total market size is projected to reach xx Million units by 2033.

Embedded Non-Volatile Memory Industry Market Dynamics & Structure

The embedded non-volatile memory market is characterized by moderate concentration, with key players like Infineon Technologies AG, Microchip Technology Inc., Samsung Electronics Co Ltd, and others holding significant market share. Technological innovation, particularly in areas like STT-MRAM and Ferroelectric RAM (FRAM), is a major driver. Stringent regulatory compliance requirements concerning data security and reliability also influence market dynamics. The emergence of advanced, low-power, and high-speed memory solutions is driving the substitution of traditional SRAM in numerous applications. Consolidation through mergers and acquisitions (M&A) is expected to continue, further shaping the market landscape.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Significant advancements in STT-MRAM, FRAM, and other emerging technologies are reshaping market competitiveness.

- Regulatory Framework: Growing emphasis on data security and reliability standards impacts product design and adoption.

- M&A Activity: Moderate level of M&A activity observed in recent years, with xx deals recorded between 2019-2024.

- Competitive Substitutes: SRAM, Flash memory, and other NVM technologies are competitive substitutes.

- Innovation Barriers: High R&D costs and complexities associated with advanced memory technologies.

Embedded Non-Volatile Memory Industry Growth Trends & Insights

The eNVM market experienced substantial growth during 2019-2024, driven by increasing demand from various end-user industries. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), fueled by factors such as the proliferation of IoT devices, the growing adoption of embedded systems in automotive and industrial automation, and the increasing demand for high-performance, low-power memory solutions. Technological disruptions, like the introduction of STT-MRAM, are expected to accelerate market growth and reshape the competitive dynamics. Consumer preferences for smaller, faster, and more energy-efficient devices are also impacting market trends.

- Market Size Evolution: The market size grew from xx Million units in 2019 to xx Million units in 2024 and is estimated to reach xx Million units in 2025.

- Adoption Rates: High adoption rates observed in industrial and consumer electronics segments are expected to continue.

- Technological Disruptions: The introduction of new memory technologies is changing the market dynamics and expanding applications.

- Consumer Behavior Shifts: Increased demand for smaller, faster, and more efficient devices influences product development and market growth.

Dominant Regions, Countries, or Segments in Embedded Non-Volatile Memory Industry

The industrial sector currently dominates the eNVM market, followed by consumer electronics and enterprise segments. North America and Asia-Pacific are the leading regions, driven by robust technological advancements, strong government support for technological innovation, and a large manufacturing base. Within Asia-Pacific, China and Japan are key growth markets. The embedded segment dominates the overall type-based market due to the increasing use of microcontrollers and embedded systems in a vast array of applications.

- Leading Region: Asia-Pacific, driven by strong manufacturing activity and technological innovation.

- Leading Country: China and Japan within Asia-Pacific, with high demand across various applications.

- Leading Segment (End-user): Industrial, due to the increasing adoption of embedded systems in industrial automation and control systems.

- Leading Segment (Type): Embedded, due to the prevalence of microcontrollers and embedded systems in various applications.

- Key Drivers (Regional): Government support for technological innovation, strong manufacturing base, and increased adoption of IoT devices.

Embedded Non-Volatile Memory Industry Product Landscape

The eNVM market offers a diverse range of products, including various types of flash memory, FRAM, and emerging technologies like STT-MRAM. These products are characterized by varying density, speed, power consumption, and endurance. Key features include high density, low power consumption, fast read/write speeds, and enhanced data retention capabilities. These technologies are designed for use in resource-constrained devices, demanding high reliability and long-term data retention, distinguishing them from other memory types.

Key Drivers, Barriers & Challenges in Embedded Non-Volatile Memory Industry

Key Drivers: The growing adoption of IoT devices, increasing demand for high-performance and low-power memory solutions, advancement in memory technologies (e.g., STT-MRAM, FRAM), and governmental support for technological innovations are major drivers.

Challenges & Restraints: High research and development costs, competition from established memory technologies (e.g., SRAM, Flash), potential supply chain disruptions, and regulatory hurdles relating to data security and environmental concerns pose significant challenges. The competitive landscape presents a constant challenge, necessitating continuous innovation to stay ahead. The impact of these restraints on market growth is estimated to be approximately xx% cumulatively over the forecast period.

Emerging Opportunities in Embedded Non-Volatile Memory Industry

Emerging opportunities lie in untapped markets, particularly within the automotive and healthcare sectors. The growth of AI and machine learning is driving demand for advanced memory solutions. New applications in wearables, smart home devices, and industrial automation present significant opportunities for expansion. The development of innovative memory solutions tailored to specific applications and the utilization of advanced packaging technologies will create further opportunities for market growth.

Growth Accelerators in the Embedded Non-Volatile Memory Industry

Technological breakthroughs in areas such as 3D stacking and new memory cell architectures are key growth accelerators. Strategic partnerships and collaborations between memory manufacturers and system integrators are further fostering growth. Expansion into new and emerging applications, coupled with a focus on cost reduction and improved energy efficiency, will drive market expansion in the long term. Government initiatives supporting the development and adoption of advanced technologies further boost this growth.

Key Players Shaping the Embedded Non-Volatile Memory Industry Market

- Infineon Technologies AG

- Microchip Technology Inc

- United Microelectronics Corporation (UMC)

- Fujitsu Ltd

- Toshiba Corp

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- Western Digital Corp

- CrossBar Inc

- SK Hynix Inc

- TSMC

- Intel Corporation

- Nantero Inc

- GlobalFoundries Inc

Notable Milestones in Embedded Non-Volatile Memory Industry Sector

- November 2021: Fujitsu Ltd. launched the 8Mbit FRAM MB85R8M2TA, offering 100 trillion read/write cycles, 10% lower power consumption, and 30% faster access speed than previous models. This significantly enhances the performance of industrial machines needing high-speed operations.

- May 2021: Micross Components Inc. partnered exclusively with Avalanche Technology to supply die and hermetically sealed devices using Avalanche's next-gen STT-MRAM, signifying a significant advancement in high-performance, non-volatile memory technology.

In-Depth Embedded Non-Volatile Memory Industry Market Outlook

The future of the eNVM market is exceptionally promising. Continued technological innovation, coupled with the expanding application landscape across diverse sectors, will drive significant growth. Strategic partnerships and collaborations, focused on developing energy-efficient and high-performance memory solutions, will further contribute to market expansion. The market's potential is immense, with opportunities for significant gains in market share and profitability for companies that can successfully adapt to the evolving technological and market demands.

Embedded Non-Volatile Memory Industry Segmentation

-

1. Type

- 1.1. Stand-alone

- 1.2. Embedded

-

2. End-user Industry

- 2.1. Industrial

- 2.2. Consumer Electronics

- 2.3. Enterprise

- 2.4. Others

Embedded Non-Volatile Memory Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Embedded Non-Volatile Memory Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 22.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for fast access and low power consuming memory devices; Increasing demand for non-volatile memory in connected and wearable devices

- 3.3. Market Restrains

- 3.3.1. High complexity in designing and manufacturing emerging non-volatile memory devices

- 3.4. Market Trends

- 3.4.1. Growing Demand for Data Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stand-alone

- 5.1.2. Embedded

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Industrial

- 5.2.2. Consumer Electronics

- 5.2.3. Enterprise

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Stand-alone

- 6.1.2. Embedded

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Industrial

- 6.2.2. Consumer Electronics

- 6.2.3. Enterprise

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Stand-alone

- 7.1.2. Embedded

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Industrial

- 7.2.2. Consumer Electronics

- 7.2.3. Enterprise

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Stand-alone

- 8.1.2. Embedded

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Industrial

- 8.2.2. Consumer Electronics

- 8.2.3. Enterprise

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Stand-alone

- 9.1.2. Embedded

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Industrial

- 9.2.2. Consumer Electronics

- 9.2.3. Enterprise

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Embedded Non-Volatile Memory Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Infineon Technologies AG

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Microchip Technology Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 United Microelectronics Corporation (UMC)

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Fujitsu Ltd

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Toshiba Corp

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Texas Instruments Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Samsung Electronics Co Ltd

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Western Digital Corp

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 CrossBar Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 SK Hynix Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 TSMC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Intel Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Nantero Inc *List Not Exhaustive

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 GlobalFoundries Inc

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Embedded Non-Volatile Memory Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Embedded Non-Volatile Memory Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Embedded Non-Volatile Memory Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Embedded Non-Volatile Memory Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Embedded Non-Volatile Memory Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Embedded Non-Volatile Memory Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Embedded Non-Volatile Memory Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Embedded Non-Volatile Memory Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Embedded Non-Volatile Memory Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Embedded Non-Volatile Memory Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Embedded Non-Volatile Memory Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Embedded Non-Volatile Memory Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific Embedded Non-Volatile Memory Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Embedded Non-Volatile Memory Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World Embedded Non-Volatile Memory Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World Embedded Non-Volatile Memory Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of the World Embedded Non-Volatile Memory Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of the World Embedded Non-Volatile Memory Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Embedded Non-Volatile Memory Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Embedded Non-Volatile Memory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Embedded Non-Volatile Memory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Embedded Non-Volatile Memory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Embedded Non-Volatile Memory Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Embedded Non-Volatile Memory Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Embedded Non-Volatile Memory Industry?

The projected CAGR is approximately > 22.89%.

2. Which companies are prominent players in the Embedded Non-Volatile Memory Industry?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, United Microelectronics Corporation (UMC), Fujitsu Ltd, Toshiba Corp, Texas Instruments Inc, Samsung Electronics Co Ltd, Western Digital Corp, CrossBar Inc, SK Hynix Inc, TSMC, Intel Corporation, Nantero Inc *List Not Exhaustive, GlobalFoundries Inc.

3. What are the main segments of the Embedded Non-Volatile Memory Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for fast access and low power consuming memory devices; Increasing demand for non-volatile memory in connected and wearable devices.

6. What are the notable trends driving market growth?

Growing Demand for Data Centers.

7. Are there any restraints impacting market growth?

High complexity in designing and manufacturing emerging non-volatile memory devices.

8. Can you provide examples of recent developments in the market?

November 2021 - Fujitsu Ltd. launched a new 8Mbit FRAM MB85R8M2TA with a parallel interface, which guarantees 100 trillion read/write cycle times in Fujitsu's FRAM product family. The new product attains low power consumption, around 10% less operating current, and high-speed operations, nearly 30% faster access speed compared to Fujitsu's conventional products. This memory IC is the best replacement for SRAM in industrial machines which need a high-speed operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Embedded Non-Volatile Memory Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Embedded Non-Volatile Memory Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Embedded Non-Volatile Memory Industry?

To stay informed about further developments, trends, and reports in the Embedded Non-Volatile Memory Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence