Key Insights

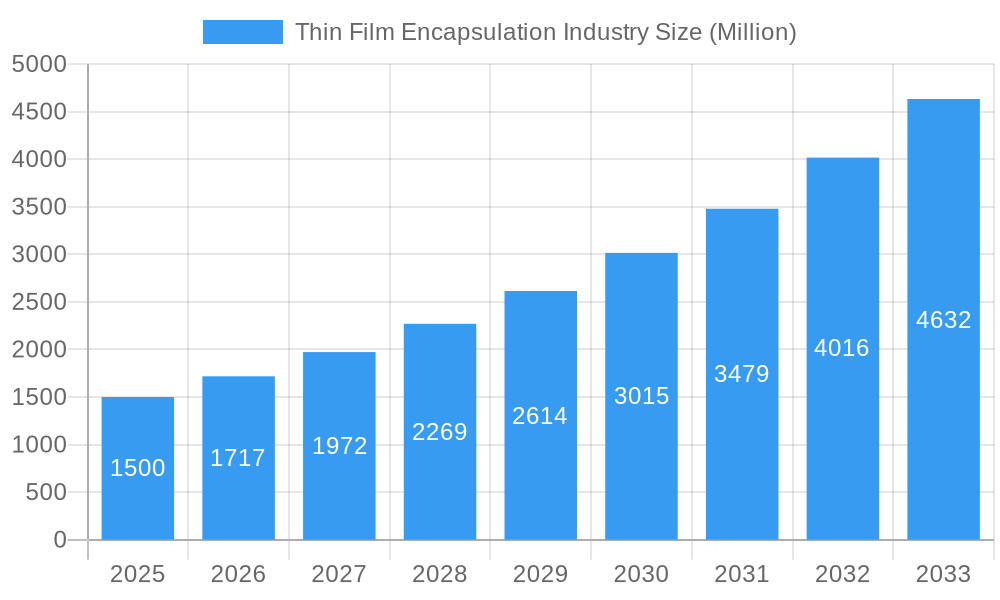

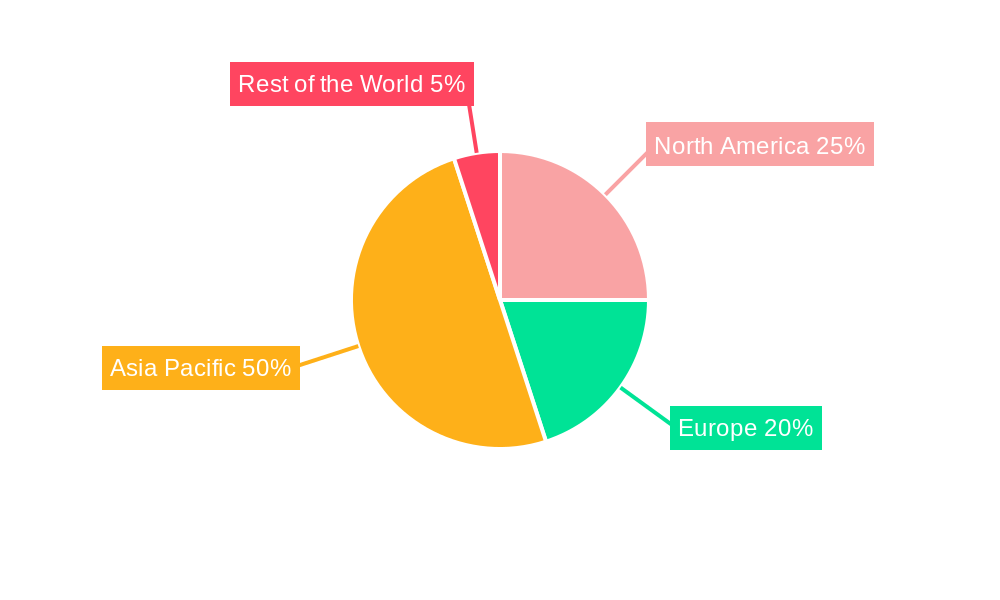

The Thin Film Encapsulation (TFE) market is poised for substantial growth, propelled by the escalating demand for flexible displays in consumer electronics, the expansion of thin-film photovoltaics within the renewable energy sector, and the burgeoning flexible OLED lighting market. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 14.80% from 2019-2033. Key enabling technologies include Plasma-Enhanced Chemical Vapor Deposition (PECVD), Atomic Layer Deposition (ALD), and inkjet printing, offering advantages in cost-effectiveness, scalability, and material performance. While Vacuum Thermal Evaporation (VTE) remains prevalent, ongoing advancements in alternative techniques are expected to reshape market dynamics. Market segmentation reveals flexible OLED displays as the leading application, followed by thin-film photovoltaics and flexible OLED lighting. The "other applications" segment, encompassing wearable technology and flexible sensors, represents a significant area for future expansion. Geographically, the Asia Pacific region is anticipated to lead due to its robust manufacturing base and high consumer electronics demand. North America and Europe are also expected to witness considerable growth driven by renewable energy investments and technological innovation.

Thin Film Encapsulation Industry Market Size (In Million)

The TFE market is significantly influenced by the trend towards miniaturized electronics, the development of lightweight and flexible devices, and the global imperative for sustainable energy solutions. Key growth drivers include continued technological advancements, increasing adoption across diverse applications, and favorable market trends. Challenges such as enhancing material durability and implementing cost-reduction strategies are critical for broader market penetration. The development of eco-friendly encapsulation materials will also be pivotal. Successfully navigating these challenges while capitalizing on emerging opportunities will be crucial for market leaders. The forecast period of 2025-2033 is expected to witness substantial market expansion, with projected increases in market value and diversification across applications and regions. The synergy between technological progress, market demand, and regulatory landscapes will dictate the TFE market's future trajectory. The market size is estimated at $0.2 billion in the base year of 2025, with a projected market size of $0.2 billion by 2033.

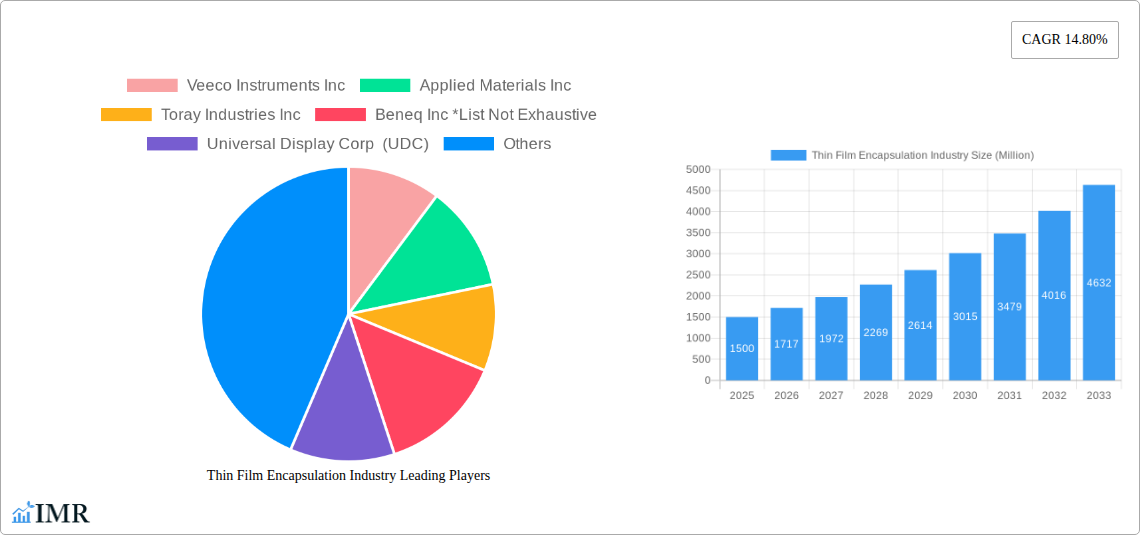

Thin Film Encapsulation Industry Company Market Share

Thin Film Encapsulation (TFE) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Thin Film Encapsulation (TFE) industry, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report's detailed analysis will equip industry professionals with crucial insights for strategic decision-making in this rapidly evolving market. The parent market is Flexible Electronics and the child market is Display and Energy.

Thin Film Encapsulation Industry Market Dynamics & Structure

The TFE market is characterized by moderate concentration, with key players like Applied Materials Inc, Veeco Instruments Inc, and 3M holding significant market share (estimated at xx% collectively in 2025). Technological innovation, driven by advancements in flexible electronics and renewable energy, is a major driver. Stringent regulatory frameworks regarding material safety and environmental impact also shape market dynamics. Competitive substitutes, such as alternative encapsulation methods, pose challenges. The end-user demographics are primarily concentrated in the electronics and energy sectors. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on technology acquisition and market expansion.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Technological Innovation: Key drivers include advancements in flexible OLED displays and thin-film photovoltaics.

- Regulatory Framework: Stringent regulations regarding material safety and environmental compliance influence market growth.

- Competitive Substitutes: Alternative encapsulation technologies present competitive pressure.

- End-User Demographics: Primarily electronics and energy sectors.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Thin Film Encapsulation Industry Growth Trends & Insights

The global TFE market experienced robust growth during the historical period (2019-2024), expanding from xx Million units in 2019 to xx Million units in 2024, representing a CAGR of xx%. This growth is primarily fueled by the increasing demand for flexible displays, particularly in consumer electronics and wearable technology. The adoption rate of TFE technology is also rising in thin-film photovoltaics due to its ability to enhance cell efficiency and durability. Technological disruptions, such as the advancement of inkjet printing techniques and improvements in material properties, contribute to market expansion. Consumer preference for lightweight, flexible, and durable electronic devices further fuels market growth. The forecast period (2025-2033) projects a continued expansion, reaching an estimated xx Million units by 2033, with a projected CAGR of xx%. Market penetration in key applications like flexible OLED displays is expected to increase significantly during this period.

Dominant Regions, Countries, or Segments in Thin Film Encapsulation Industry

Asia-Pacific, specifically, China, South Korea, and Japan, currently dominates the TFE market, driven by the thriving electronics manufacturing industry and significant investments in renewable energy infrastructure. Within applications, flexible OLED displays hold the largest market share (estimated at xx% in 2025) owing to the rising demand for foldable smartphones and large-area displays. Among technologies, Plasma-enhanced chemical vapor deposition (PECVD) currently leads due to its scalability and established market presence, though Inkjet Printing is rapidly gaining traction.

Key Regional Drivers:

- Asia-Pacific: High concentration of electronics manufacturing and renewable energy investment.

- North America: Growing adoption in flexible electronics and specialized applications.

- Europe: Focus on sustainable energy solutions and advanced material research.

Dominant Application Segment: Flexible OLED displays (xx% market share in 2025).

Dominant Technology Segment: Plasma-enhanced chemical vapor deposition (PECVD).

Thin Film Encapsulation Industry Product Landscape

The TFE product landscape is characterized by continuous innovation in materials and processes. Manufacturers are focusing on developing barrier films with enhanced moisture and oxygen resistance, improved flexibility, and better thermal stability. Advances in deposition techniques, such as inkjet printing, are allowing for improved resolution, lower cost, and enhanced scalability. Unique selling propositions include enhanced device lifetimes, improved flexibility, and compatibility with various substrates. Technological advancements in barrier materials and deposition methods are key drivers of product innovation.

Key Drivers, Barriers & Challenges in Thin Film Encapsulation Industry

Key Drivers: Increasing demand for flexible displays in consumer electronics; rising adoption of thin-film solar cells in renewable energy; government initiatives promoting renewable energy adoption; advancements in deposition techniques enabling cost reduction and improved performance.

Key Challenges: High production costs of some TFE materials; stringent environmental regulations; competitive pressures from alternative encapsulation methods; potential supply chain disruptions related to raw materials. The estimated impact of supply chain issues on market growth is approximately xx% in 2025.

Emerging Opportunities in Thin Film Encapsulation Industry

Emerging opportunities lie in the expanding market for flexible and wearable electronics, including smartwatches, e-readers, and other IoT devices. Innovative applications in sensors, healthcare devices, and smart packaging are also expected to drive growth. The increasing demand for high-efficiency, lightweight, and flexible solar cells presents another significant opportunity. Expanding into emerging markets and developing cost-effective TFE solutions will be crucial for capturing these opportunities.

Growth Accelerators in the Thin Film Encapsulation Industry

Long-term growth will be driven by technological breakthroughs in materials science, leading to improved barrier properties and reduced costs. Strategic partnerships between material suppliers, equipment manufacturers, and end-users will accelerate innovation and market penetration. Expansion into new application areas and geographical markets will also propel long-term growth.

Key Players Shaping the Thin Film Encapsulation Industry Market

- Veeco Instruments Inc

- Applied Materials Inc

- Toray Industries Inc

- Beneq Inc

- Universal Display Corp (UDC)

- 3M

- Meyer Burger Technology Limited

- LG Chem

- Aixtron SE

- Kateeva

- BASF (Rolic) AG

- Lotus Applied Technology

- Samsung SDI

- Bystronic Glass

- Angstrom Engineering Inc

- AMS Technologies

Notable Milestones in Thin Film Encapsulation Industry Sector

- December 2021: Unijet supplied inkjet equipment for micro OLED thin-film encapsulation to China's Sidtek.

- April 2022: Samsung Display initiated development of a thinner QD-OLED panel, aiming for a rollable format.

In-Depth Thin Film Encapsulation Industry Market Outlook

The future of the TFE market looks promising, driven by sustained growth in flexible electronics and renewable energy sectors. Strategic investments in R&D, focusing on cost reduction and performance enhancement, will be crucial for maintaining a competitive edge. Expanding into untapped markets and developing innovative applications will unlock significant growth potential, making the TFE industry an attractive investment opportunity for the coming decade.

Thin Film Encapsulation Industry Segmentation

-

1. Technology

- 1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 1.2. Atomic layer deposition (ALD)

- 1.3. Inkjet Printing

- 1.4. Vacuum Thermal Evaporation (VTE)

- 1.5. Other Technologies

-

2. Application

- 2.1. Flexible OLED Display

- 2.2. Thin-Film Photovoltaics

- 2.3. Flexible OLED Lighting

- 2.4. Other Applications

Thin Film Encapsulation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Thin Film Encapsulation Industry Regional Market Share

Geographic Coverage of Thin Film Encapsulation Industry

Thin Film Encapsulation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Microelectronics and Consumer Electronics Products; Increased Adoption of Flexible OLED Displays for Smartphones and Smart Wearables

- 3.3. Market Restrains

- 3.3.1. High Capital Investment in R&D for Developing Upgraded Products; Augmented Growth of Flexible Glass

- 3.4. Market Trends

- 3.4.1. Flexible OLED Display Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 5.1.2. Atomic layer deposition (ALD)

- 5.1.3. Inkjet Printing

- 5.1.4. Vacuum Thermal Evaporation (VTE)

- 5.1.5. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Flexible OLED Display

- 5.2.2. Thin-Film Photovoltaics

- 5.2.3. Flexible OLED Lighting

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 6.1.2. Atomic layer deposition (ALD)

- 6.1.3. Inkjet Printing

- 6.1.4. Vacuum Thermal Evaporation (VTE)

- 6.1.5. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Flexible OLED Display

- 6.2.2. Thin-Film Photovoltaics

- 6.2.3. Flexible OLED Lighting

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 7.1.2. Atomic layer deposition (ALD)

- 7.1.3. Inkjet Printing

- 7.1.4. Vacuum Thermal Evaporation (VTE)

- 7.1.5. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Flexible OLED Display

- 7.2.2. Thin-Film Photovoltaics

- 7.2.3. Flexible OLED Lighting

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 8.1.2. Atomic layer deposition (ALD)

- 8.1.3. Inkjet Printing

- 8.1.4. Vacuum Thermal Evaporation (VTE)

- 8.1.5. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Flexible OLED Display

- 8.2.2. Thin-Film Photovoltaics

- 8.2.3. Flexible OLED Lighting

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Thin Film Encapsulation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Plasma-enhanced chemical vapor deposition (PECVD)

- 9.1.2. Atomic layer deposition (ALD)

- 9.1.3. Inkjet Printing

- 9.1.4. Vacuum Thermal Evaporation (VTE)

- 9.1.5. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Flexible OLED Display

- 9.2.2. Thin-Film Photovoltaics

- 9.2.3. Flexible OLED Lighting

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Veeco Instruments Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Applied Materials Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toray Industries Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Beneq Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Universal Display Corp (UDC)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3M

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Meyer Burger Technology Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LG Chem

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Aixtron SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kateeva

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BASF (Rolic) AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Lotus Applied Technology

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Samsung SDI

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bystronic Glass

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Angstrom Engineering Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 AMS Technologies

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Veeco Instruments Inc

List of Figures

- Figure 1: Global Thin Film Encapsulation Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 9: Europe Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Asia Pacific Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Thin Film Encapsulation Industry Revenue (billion), by Technology 2025 & 2033

- Figure 21: Rest of the World Thin Film Encapsulation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest of the World Thin Film Encapsulation Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Thin Film Encapsulation Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Thin Film Encapsulation Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Thin Film Encapsulation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Thin Film Encapsulation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Film Encapsulation Industry?

The projected CAGR is approximately 20%.

2. Which companies are prominent players in the Thin Film Encapsulation Industry?

Key companies in the market include Veeco Instruments Inc, Applied Materials Inc, Toray Industries Inc, Beneq Inc *List Not Exhaustive, Universal Display Corp (UDC), 3M, Meyer Burger Technology Limited, LG Chem, Aixtron SE, Kateeva, BASF (Rolic) AG, Lotus Applied Technology, Samsung SDI, Bystronic Glass, Angstrom Engineering Inc, AMS Technologies.

3. What are the main segments of the Thin Film Encapsulation Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Microelectronics and Consumer Electronics Products; Increased Adoption of Flexible OLED Displays for Smartphones and Smart Wearables.

6. What are the notable trends driving market growth?

Flexible OLED Display Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Capital Investment in R&D for Developing Upgraded Products; Augmented Growth of Flexible Glass.

8. Can you provide examples of recent developments in the market?

April 2022 - Samsung Display started working on developing a thinner version of its quantum dot (QD)-OLED panel with the aim is to reduce the use of glass substrates to one. The project's success will enable the company to launch the new version of QD-OLED in a rollable format.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Film Encapsulation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Film Encapsulation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Film Encapsulation Industry?

To stay informed about further developments, trends, and reports in the Thin Film Encapsulation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence