Key Insights

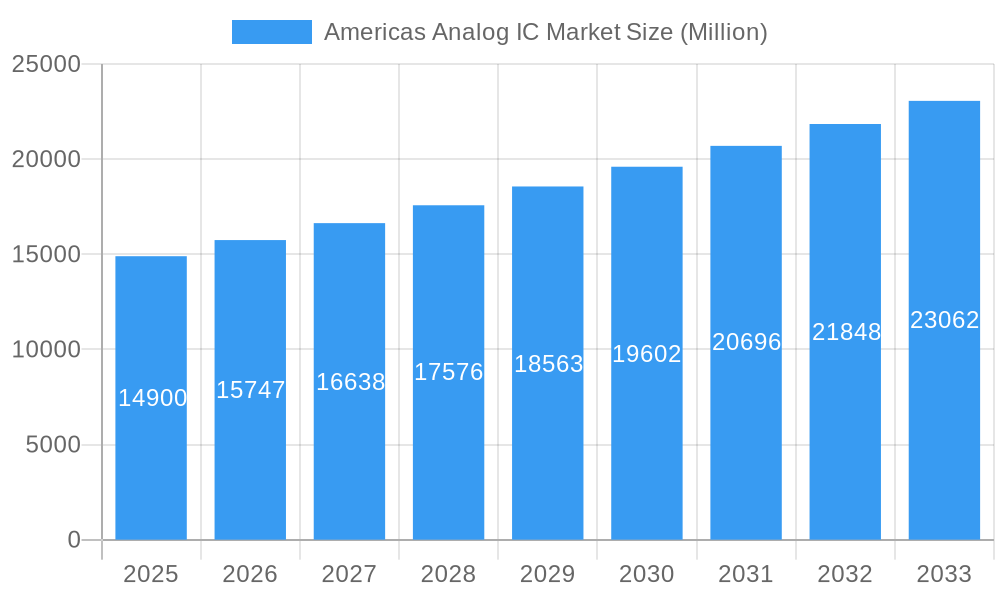

The Americas analog integrated circuit (IC) market, valued at $14.90 billion in 2025, is projected to experience robust growth, driven by the increasing demand for sophisticated electronics across various sectors. A compound annual growth rate (CAGR) of 5.56% from 2025 to 2033 indicates a significant expansion, fueled by several key factors. The automotive industry's push towards advanced driver-assistance systems (ADAS) and electric vehicles (EVs) is a major contributor, demanding high-performance analog ICs for power management, sensor integration, and communication. Furthermore, the proliferation of smart devices and the expanding Internet of Things (IoT) ecosystem contribute significantly to market growth, necessitating a wider array of analog ICs for signal processing, data acquisition, and power efficiency. Growth in the communication sector, particularly 5G infrastructure development, further bolsters demand. While supply chain constraints and potential economic downturns could pose challenges, the long-term outlook remains positive, particularly within the North American region, which is expected to maintain its dominant market share due to strong technological innovation and robust consumer electronics demand.

Americas Analog IC Market Market Size (In Billion)

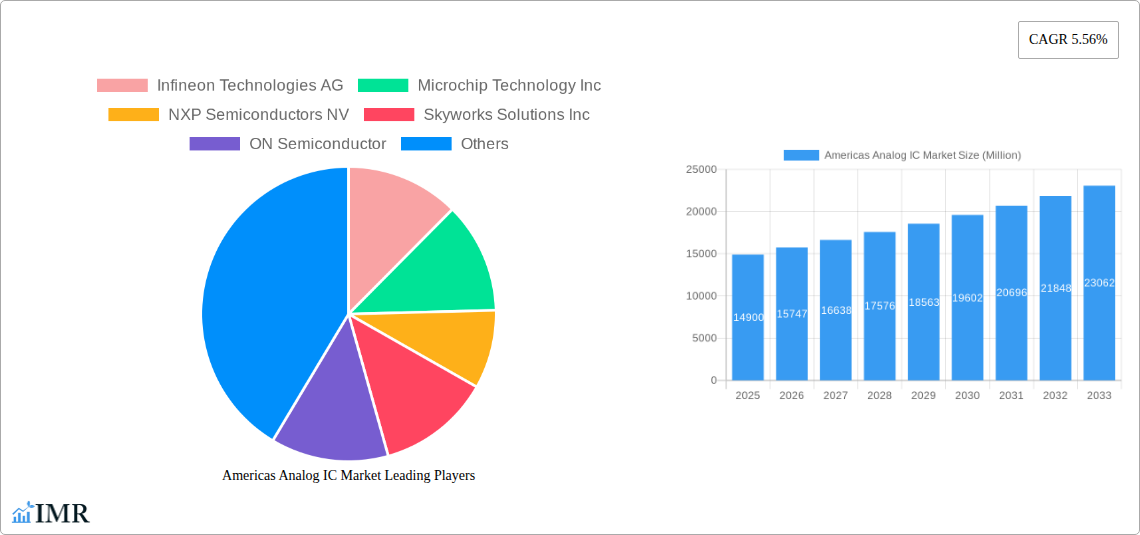

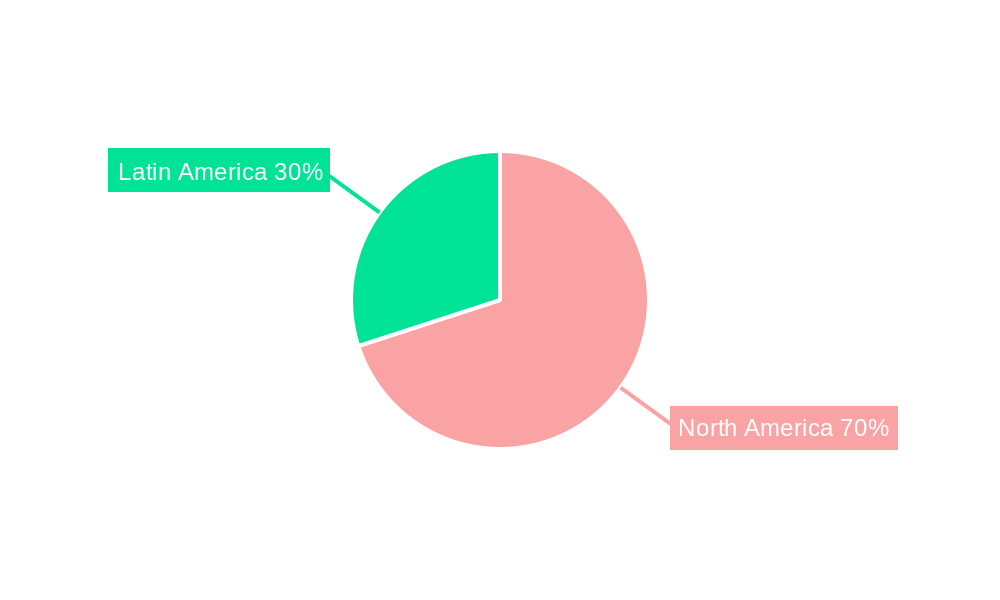

Regional variations exist, with North America (comprising the United States, Canada, and Mexico) likely holding the largest share due to its advanced technological infrastructure and substantial presence of key players like Texas Instruments, Analog Devices, and ON Semiconductor. Latin America, while experiencing slower growth compared to North America, shows potential for expansion driven by increasing smartphone penetration and the development of its automotive and industrial sectors. Market segmentation reveals that application-specific integrated circuits (ASICs) and those used in amplifiers and comparators are vital market drivers. The competitive landscape is marked by established players like Infineon, Microchip, NXP, and others, with ongoing innovations in energy efficiency, miniaturization, and performance driving future market dynamics. Strategic partnerships, acquisitions, and technological advancements are likely to shape the market's evolution in the coming years.

Americas Analog IC Market Company Market Share

Americas Analog IC Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Americas Analog IC market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report meticulously examines the parent market (Americas Semiconductor Market) and its child market (Americas Analog IC Market), offering valuable insights for industry professionals, investors, and strategic decision-makers. Market values are presented in Million units.

Americas Analog IC Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market consolidation within the Americas Analog IC market. We delve into market concentration, examining the market share held by key players such as Texas Instruments Incorporated, Analog Devices Inc, and others. The analysis also explores the impact of technological innovation, focusing on advancements in process technologies and new product features, and the influence of regulatory frameworks on market growth and expansion.

- Market Concentration: The Americas Analog IC market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Continuous advancements in low-power design, high-performance analog circuits, and integration with digital technologies are key drivers.

- Regulatory Frameworks: Compliance with industry standards and environmental regulations plays a crucial role in shaping market dynamics.

- Competitive Product Substitutes: The emergence of digital signal processors (DSPs) and other digital technologies presents some competitive pressure.

- End-User Demographics: Automotive, consumer electronics, and industrial applications are major end-user segments driving market growth.

- M&A Trends: The past five years have witnessed xx M&A deals in the Americas Analog IC market, primarily driven by efforts to expand product portfolios and enhance technological capabilities.

Americas Analog IC Market Growth Trends & Insights

This section provides a detailed analysis of the Americas Analog IC market's growth trajectory, driven by the increasing demand for advanced electronic devices across various sectors. The report utilizes rigorous methodology, including analyzing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). Key growth indicators like Compound Annual Growth Rate (CAGR) and market penetration are used to forecast market size and assess growth potential. We'll explore the impact of technological disruptions, such as the rise of IoT and AI, and evolving consumer preferences influencing adoption rates.

Dominant Regions, Countries, or Segments in Americas Analog IC Market

This section identifies the leading regions, countries, and application segments within the Americas Analog IC market. The analysis will focus on market size, growth rate, and key drivers for each region (United States, Canada, Brazil, Mexico, Rest of Latin America) and application segment (Amplifiers/Comparators (Signal Conditioning), Application-specific IC, Consumer, Automotive, Communication, Computer).

- United States: The US holds the largest market share due to its robust electronics manufacturing sector and high demand from various industries.

- Automotive Segment: This segment is projected to experience significant growth fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and electric vehicles.

- Key Drivers: Strong economic growth, technological advancements, and favorable government policies contribute to market expansion.

Americas Analog IC Market Product Landscape

The Americas Analog IC market encompasses a wide range of products, characterized by continuous innovation in performance metrics like power efficiency, precision, and integration. New products leverage advancements in process technologies such as silicon-on-insulator (SOI) and advanced packaging techniques, enabling enhanced functionality and reduced size. Unique selling propositions include improved signal integrity, lower noise levels, and broader operating temperature ranges.

Key Drivers, Barriers & Challenges in Americas Analog IC Market

Key Drivers: The market is primarily driven by the increasing demand for electronic devices across various end-use industries, coupled with technological advancements resulting in improved performance and efficiency of analog ICs. The rising popularity of IoT and AI is another key driver.

Key Challenges: The market faces challenges such as supply chain disruptions, increasing competition, and the high cost of research and development for new technologies. Fluctuations in raw material prices and geopolitical uncertainties also pose significant risks.

Emerging Opportunities in Americas Analog IC Market

Emerging opportunities exist in the growing demand for high-performance analog ICs in niche applications, such as medical devices, renewable energy, and aerospace. The increasing adoption of Industry 4.0 is also creating opportunities for smart sensors and advanced control systems, further driving demand. The untapped potential in Latin American markets presents another significant opportunity.

Growth Accelerators in the Americas Analog IC Market Industry

Long-term growth will be fueled by strategic partnerships between IC manufacturers and technology companies to develop innovative solutions. Technological advancements in materials science and manufacturing processes will enhance product performance and efficiency. Furthermore, expanding market penetration in developing economies across the Americas is another major growth accelerator.

Key Players Shaping the Americas Analog IC Market Market

Notable Milestones in Americas Analog IC Market Sector

- January 2024: Damon Motors partnered with NXP Semiconductors to integrate advanced automotive ICs into its electric motorcycles.

- April 2024: Cadence Design Systems and TSMC launched a suite of advanced technological advancements impacting AI, automotive, aerospace, hyperscale, and mobile applications.

In-Depth Americas Analog IC Market Market Outlook

The Americas Analog IC market is poised for significant growth over the forecast period, driven by ongoing technological advancements, increasing demand from various end-use industries, and the emergence of new applications. Strategic partnerships, coupled with expansion into untapped markets, will further propel market expansion. The market is expected to witness a CAGR of xx% during 2025-2033, presenting lucrative opportunities for industry players.

Americas Analog IC Market Segmentation

-

1. Type

-

1.1. General Purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumers

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cellphone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless Communication

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computers

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General Purpose IC

Americas Analog IC Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Analog IC Market Regional Market Share

Geographic Coverage of Americas Analog IC Market

Americas Analog IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones

- 3.2.2 Feature Phones

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Increasing Design Complexity of Analog IC

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General Purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumers

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cellphone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless Communication

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computers

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General Purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microchip Technology Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NXP Semiconductors NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Skyworks Solutions Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ON Semiconductor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Renesas Electronics Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Richtek Technology Corporation (MediaTek Inc )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Texas Instruments Incorporated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Analog Devices Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stmicroelectronics NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Americas Analog IC Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Americas Analog IC Market Share (%) by Company 2025

List of Tables

- Table 1: Americas Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Americas Analog IC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Americas Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Americas Analog IC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Brazil Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Argentina Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Chile Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Colombia Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Americas Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Analog IC Market?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the Americas Analog IC Market?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, Skyworks Solutions Inc, ON Semiconductor, Renesas Electronics Corporation, Richtek Technology Corporation (MediaTek Inc ), Texas Instruments Incorporated, Analog Devices Inc, Stmicroelectronics NV.

3. What are the main segments of the Americas Analog IC Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Increasing Design Complexity of Analog IC.

8. Can you provide examples of recent developments in the market?

April 2024: Cadence Design Systems, Inc., collaborated with TSMC to launch suite of cadvanced technological advancements. These innovations span from 3D-IC and advanced process nodes to design IP and photonics, aiming to expedite the design process. Notably, this collaboration is reshaping system and semiconductor design, particularly in AI, automotive, aerospace, hyperscale, and mobile applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Analog IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Analog IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Analog IC Market?

To stay informed about further developments, trends, and reports in the Americas Analog IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence