Key Insights

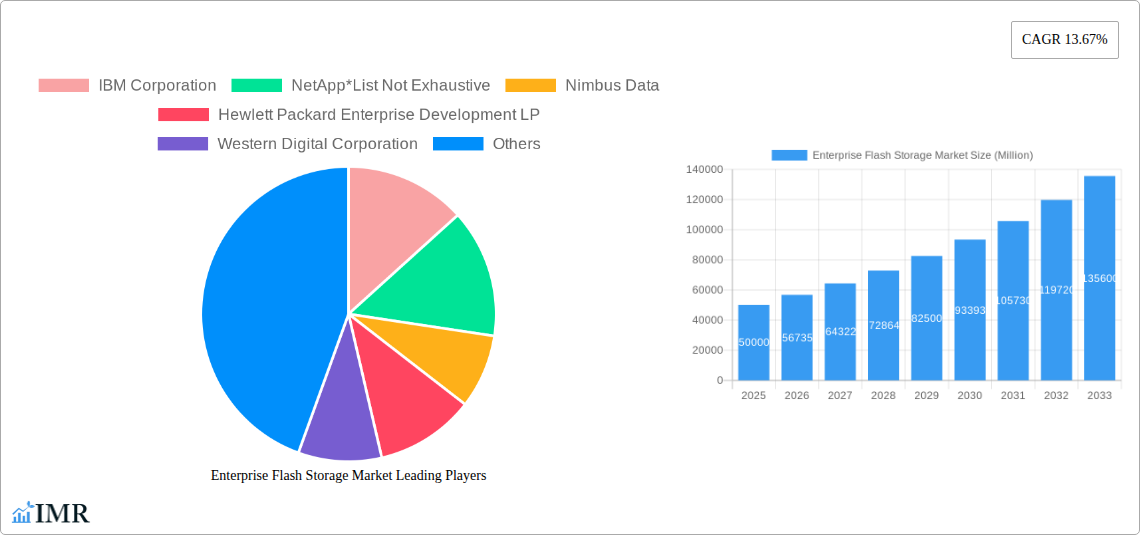

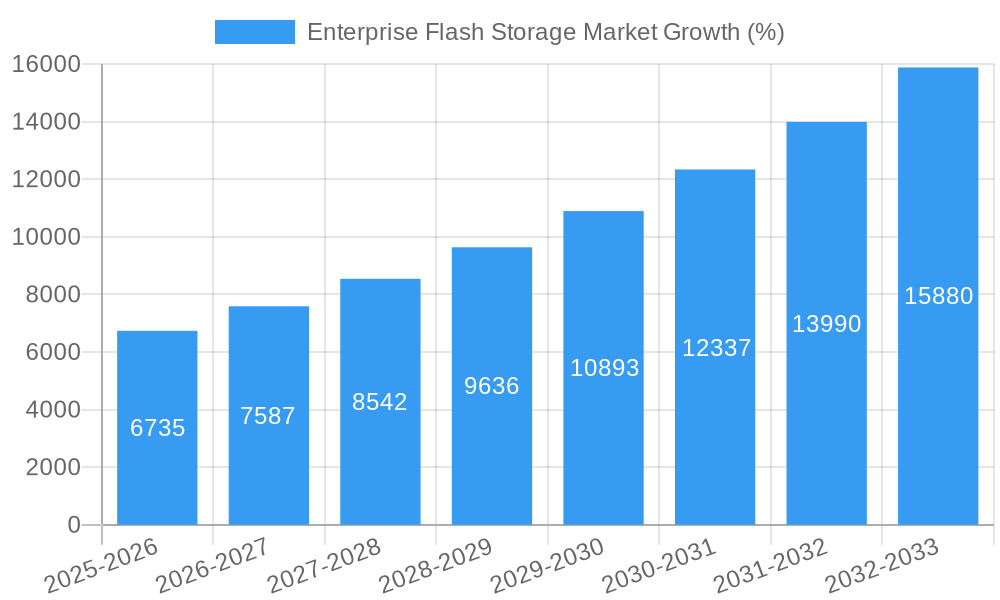

The Enterprise Flash Storage market is experiencing robust growth, driven by the increasing demand for high-performance, low-latency data storage solutions across diverse industries. The market's Compound Annual Growth Rate (CAGR) of 13.67% from 2019 to 2024 indicates a significant upward trajectory, projected to continue throughout the forecast period (2025-2033). Key drivers include the proliferation of big data, the rise of cloud computing and associated data center expansion, and the growing adoption of AI and machine learning applications, all demanding faster and more efficient storage capabilities. The market is segmented by type (All-Flash Arrays and Hybrid Flash Arrays) and end-user industry (IT & Telecom, Automotive, BFSI, Healthcare, Defense, and Others), with the IT & Telecom sector currently dominating. Technological advancements, such as NVMe (Non-Volatile Memory Express) technology and advancements in storage density, are further fueling market expansion. While some restraints, such as the relatively high initial investment cost associated with flash storage and the potential for data loss if not properly managed, exist, these are likely to be mitigated by decreasing prices and improved reliability over time. The competitive landscape features both established players like IBM, NetApp, Hewlett Packard Enterprise, and Dell, and emerging innovative companies, indicating a dynamic and evolving market.

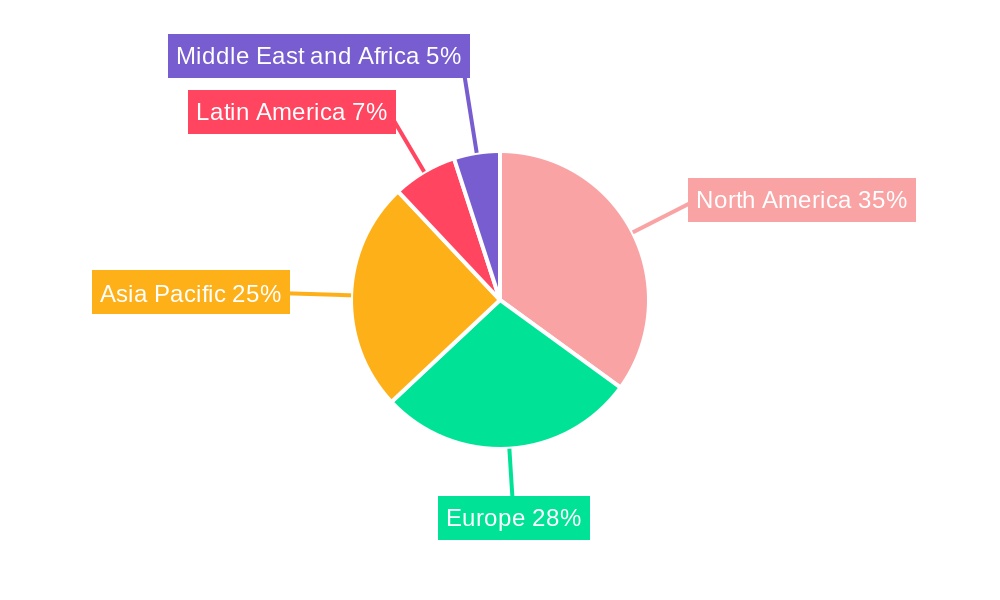

The geographical distribution of the market showcases strong growth across all regions, with North America and Europe currently holding significant market share due to high technological adoption and established digital infrastructure. However, the Asia-Pacific region is expected to exhibit substantial growth in the coming years driven by rising digitalization and investment in data centers across developing economies. The forecast period (2025-2033) anticipates continued market expansion driven by ongoing technological innovation, increasing data volumes, and the growing adoption of enterprise flash storage across various industries and geographies. The market's projected size in 2025 serves as a robust baseline for anticipating future growth. Assuming a conservative market size estimate of $50 billion in 2025 based on the provided CAGR and industry trends, the projected growth will lead to considerable market expansion in the next decade. This presents significant opportunities for existing and emerging players in the sector.

Enterprise Flash Storage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Enterprise Flash Storage Market, covering the period from 2019 to 2033. With a focus on market dynamics, growth trends, key players, and future opportunities, this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on this rapidly evolving sector. The report segments the market by type (All-Flash Array, Hybrid Flash Array) and end-user industry (IT & Telecom, Automotive, BFSI, Healthcare, Defense, Other End-user Industries), offering granular insights into market size and growth potential across various segments. The base year for this analysis is 2025, with an estimated market size of xx Million units and a forecast period extending to 2033.

Enterprise Flash Storage Market Market Dynamics & Structure

The Enterprise Flash Storage market is characterized by a moderately concentrated landscape with a few major players holding significant market share. Technological innovation, particularly in NVMe technology and advancements in data security features, is a major driver. Stringent data privacy regulations across various industries influence market dynamics, while the emergence of cloud storage represents a key competitive substitute. End-user demographics are shifting towards increased adoption across sectors like IT & Telecom and BFSI, fueled by the need for faster data processing and improved storage efficiency. M&A activity has been moderate, with a recorded xx number of deals in the historical period (2019-2024), indicating consolidation within the industry.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Significant advancements in NVMe technology and improved data security features are driving market growth.

- Regulatory Frameworks: Data privacy regulations (e.g., GDPR, CCPA) are influencing market dynamics and driving demand for secure solutions.

- Competitive Substitutes: Cloud storage services present a competitive threat, particularly for smaller enterprises.

- End-User Demographics: Strong growth observed in IT & Telecom and BFSI sectors, driving demand for high-performance solutions.

- M&A Trends: Moderate M&A activity in the historical period (2019-2024), with xx deals recorded. Consolidation is expected to continue.

Enterprise Flash Storage Market Growth Trends & Insights

The Enterprise Flash Storage market has exhibited robust growth over the historical period (2019-2024), expanding from xx Million units in 2019 to an estimated xx Million units in 2025. This growth is primarily attributed to increased adoption of flash storage across diverse industries due to its superior performance, reliability, and efficiency compared to traditional HDD-based storage systems. The market is expected to maintain a significant CAGR of xx% during the forecast period (2025-2033), driven by the increasing demand for high-performance computing, big data analytics, and the growth of cloud computing. Technological disruptions, such as the rise of NVMe and advancements in flash memory technology, further contribute to this growth. The market penetration rate is expected to reach xx% by 2033. Consumer behavior shows a clear preference for high-speed, reliable, and secure storage solutions.

Dominant Regions, Countries, or Segments in Enterprise Flash Storage Market

North America currently holds the largest market share in the enterprise flash storage market, driven by the high adoption rates in the IT & Telecom and BFSI sectors. This region is characterized by strong technological advancements, robust economic growth, and substantial investments in IT infrastructure. Europe is also a significant market, with growth driven by increasing data storage requirements across multiple industries. Within the segment breakdown, the All-Flash Array segment dominates, accounting for xx% of the market in 2024 due to its superior performance and scalability compared to Hybrid Flash Arrays. The IT & Telecom sector remains the largest end-user industry, driven by its high data processing and storage needs.

- Key Drivers in North America: Strong technological innovation, substantial investments in IT infrastructure, and high adoption rates in key sectors.

- Key Drivers in Europe: Growing data storage requirements across various industries, increasing investments in digital transformation initiatives, and stringent data privacy regulations.

- All-Flash Array Dominance: Superior performance, scalability, and ease of management compared to hybrid arrays.

- IT & Telecom Sector Leadership: High data processing and storage needs drive the demand for high-performance flash storage solutions.

Enterprise Flash Storage Market Product Landscape

The Enterprise Flash Storage market offers a diverse range of products, including All-Flash Arrays and Hybrid Flash Arrays, each catering to varying performance and cost requirements. All-Flash Arrays provide superior speed and performance, while Hybrid Flash Arrays offer a balance between performance and cost-effectiveness. Product innovations are focused on increasing storage capacity, improving performance metrics like IOPS and latency, enhancing data security features, and simplifying management through software-defined storage solutions. Unique selling propositions frequently include advanced data reduction techniques, integrated security features, and simplified management interfaces.

Key Drivers, Barriers & Challenges in Enterprise Flash Storage Market

Key Drivers: The increasing demand for high-performance computing, Big Data analytics, cloud computing, and the need for improved data security and reliability are driving the market. Advancements in NVMe technology and improved flash memory density are also key drivers. Government initiatives promoting digital transformation are fostering adoption across various sectors.

Key Barriers and Challenges: High initial investment costs for enterprise-grade flash storage solutions can present a significant barrier to entry, particularly for smaller businesses. Supply chain disruptions, particularly concerning flash memory components, can impact availability and pricing. Competition from cloud storage services also represents a significant challenge. The impact of these challenges is estimated to reduce the market growth by approximately xx% in 2025.

Emerging Opportunities in Enterprise Flash Storage Market

Emerging opportunities lie in the growing adoption of flash storage in edge computing environments, the expanding demand for AI and machine learning applications, and the increasing need for disaster recovery and business continuity solutions. Untapped markets include sectors with limited flash storage adoption, like certain industrial segments and government agencies. The focus on data security and compliance will open opportunities for solutions with advanced security and encryption features.

Growth Accelerators in the Enterprise Flash Storage Market Industry

Strategic partnerships between flash storage vendors and cloud service providers are creating new growth opportunities, expanding the market reach and offering hybrid cloud solutions. Technological breakthroughs like the development of faster and more energy-efficient flash memory technologies are also accelerating market growth. Expansion into new geographical markets and vertical industries, particularly in developing economies, will contribute to further growth.

Key Players Shaping the Enterprise Flash Storage Market Market

- IBM Corporation

- NetApp

- Nimbus Data

- Hewlett Packard Enterprise Development LP

- Western Digital Corporation

- Dell Inc

- StorCentric Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc

- Hitachi Vantara LLC

Notable Milestones in Enterprise Flash Storage Market Sector

- June 2022: Pure Storage Inc. launched Evergreen//One, a consumption-based storage service offering flexibility, transparency, and simplicity with proactive monitoring and non-disruptive upgrades. This significantly enhances the value proposition of Pure Storage solutions.

- April 2022: StorCentric launched the Nexsan Unity NV10000, an enterprise-class NVMe All-Flash platform with enhanced data security features, aimed at addressing the needs of modern applications and enhancing data protection against ransomware.

In-Depth Enterprise Flash Storage Market Market Outlook

The Enterprise Flash Storage market is poised for continued robust growth, driven by sustained demand for high-performance computing and increasing data volumes across all sectors. Strategic partnerships, technological advancements, and expansion into new markets and segments will propel future growth. The market is expected to experience a sustained CAGR of xx% throughout the forecast period, offering significant opportunities for existing players and new entrants to capitalize on the increasing demand for high-performance, reliable, and secure storage solutions.

Enterprise Flash Storage Market Segmentation

-

1. Type

- 1.1. All-Flash Array

- 1.2. Hybrid Flash Array

-

2. End-user Industry

- 2.1. IT & Telecom

- 2.2. Automotive

- 2.3. BFSI

- 2.4. Healthcare

- 2.5. Defense

- 2.6. Other End-user Industries

Enterprise Flash Storage Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Enterprise Flash Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Hybrid Flash Arrays and Increased Sales of All Flash Arrays; Increased Storage Capacity and Price Reduction Leading to Preference Over HDDs

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Designing the Composition of Adhesives

- 3.4. Market Trends

- 3.4.1. IT & Telecom Sector to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. All-Flash Array

- 5.1.2. Hybrid Flash Array

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. IT & Telecom

- 5.2.2. Automotive

- 5.2.3. BFSI

- 5.2.4. Healthcare

- 5.2.5. Defense

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. All-Flash Array

- 6.1.2. Hybrid Flash Array

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. IT & Telecom

- 6.2.2. Automotive

- 6.2.3. BFSI

- 6.2.4. Healthcare

- 6.2.5. Defense

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. All-Flash Array

- 7.1.2. Hybrid Flash Array

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. IT & Telecom

- 7.2.2. Automotive

- 7.2.3. BFSI

- 7.2.4. Healthcare

- 7.2.5. Defense

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. All-Flash Array

- 8.1.2. Hybrid Flash Array

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. IT & Telecom

- 8.2.2. Automotive

- 8.2.3. BFSI

- 8.2.4. Healthcare

- 8.2.5. Defense

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. All-Flash Array

- 9.1.2. Hybrid Flash Array

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. IT & Telecom

- 9.2.2. Automotive

- 9.2.3. BFSI

- 9.2.4. Healthcare

- 9.2.5. Defense

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. All-Flash Array

- 10.1.2. Hybrid Flash Array

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. IT & Telecom

- 10.2.2. Automotive

- 10.2.3. BFSI

- 10.2.4. Healthcare

- 10.2.5. Defense

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Enterprise Flash Storage Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 IBM Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 NetApp*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Nimbus Data

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Hewlett Packard Enterprise Development LP

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Western Digital Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dell Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 StorCentric Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Huawei Technologies Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Oracle Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Pure Storage Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Hitachi Vantara LLC

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 IBM Corporation

List of Figures

- Figure 1: Global Enterprise Flash Storage Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Enterprise Flash Storage Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Enterprise Flash Storage Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Enterprise Flash Storage Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Enterprise Flash Storage Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Enterprise Flash Storage Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Enterprise Flash Storage Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Enterprise Flash Storage Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Enterprise Flash Storage Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Enterprise Flash Storage Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Enterprise Flash Storage Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Enterprise Flash Storage Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Enterprise Flash Storage Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Enterprise Flash Storage Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Enterprise Flash Storage Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Enterprise Flash Storage Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Enterprise Flash Storage Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Enterprise Flash Storage Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Enterprise Flash Storage Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Enterprise Flash Storage Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Enterprise Flash Storage Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Enterprise Flash Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Enterprise Flash Storage Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Enterprise Flash Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise Flash Storage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Enterprise Flash Storage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Enterprise Flash Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Enterprise Flash Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Enterprise Flash Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Enterprise Flash Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Enterprise Flash Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Enterprise Flash Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Enterprise Flash Storage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Enterprise Flash Storage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Enterprise Flash Storage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Enterprise Flash Storage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Enterprise Flash Storage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Enterprise Flash Storage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Enterprise Flash Storage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Enterprise Flash Storage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Enterprise Flash Storage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Enterprise Flash Storage Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Enterprise Flash Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Flash Storage Market?

The projected CAGR is approximately 13.67%.

2. Which companies are prominent players in the Enterprise Flash Storage Market?

Key companies in the market include IBM Corporation, NetApp*List Not Exhaustive, Nimbus Data, Hewlett Packard Enterprise Development LP, Western Digital Corporation, Dell Inc, StorCentric Inc, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc, Hitachi Vantara LLC.

3. What are the main segments of the Enterprise Flash Storage Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Hybrid Flash Arrays and Increased Sales of All Flash Arrays; Increased Storage Capacity and Price Reduction Leading to Preference Over HDDs.

6. What are the notable trends driving market growth?

IT & Telecom Sector to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; Difficulties in Designing the Composition of Adhesives.

8. Can you provide examples of recent developments in the market?

June 2022: Pure Storage Inc. announced the introduction of Evergreen/Flex. This new fleet-level Evergreen architecture extends the power of Pure's Evergreen technology to the entire Pure portfolio. Evergreen//One offers organizations an accurate consumption-based service model for storage, delivering flexibility, transparency, and simplicity along with proactive monitoring and non-disruptive upgrades while satisfying performance and usage SLAs. With Evergreen//One, Pure takes on the responsibility of delivering storage where it is required, offering on-demand storage service with the flexibility of on-premises deployment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Flash Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Flash Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Flash Storage Market?

To stay informed about further developments, trends, and reports in the Enterprise Flash Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence