Key Insights

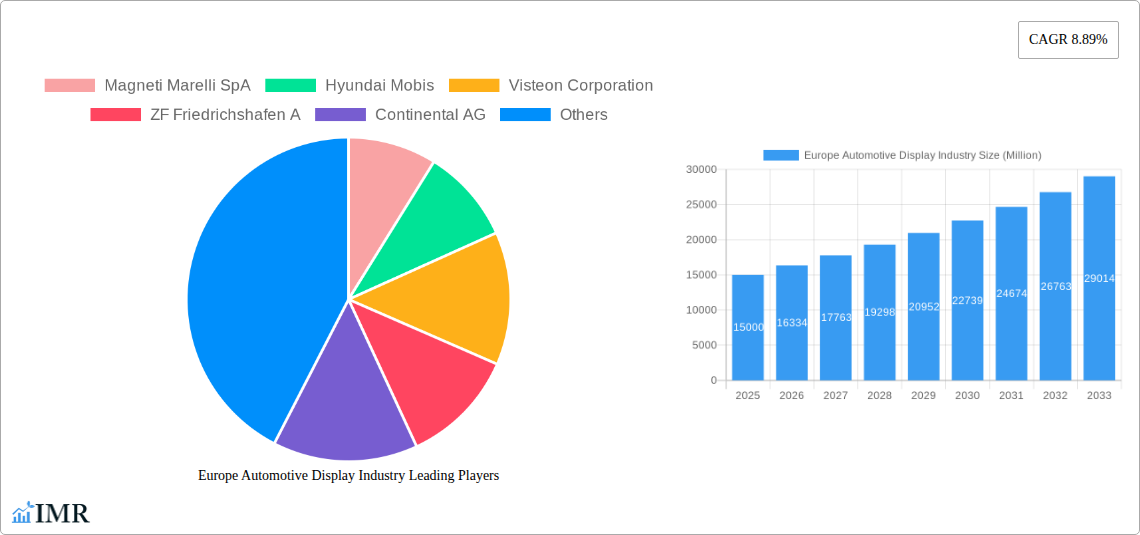

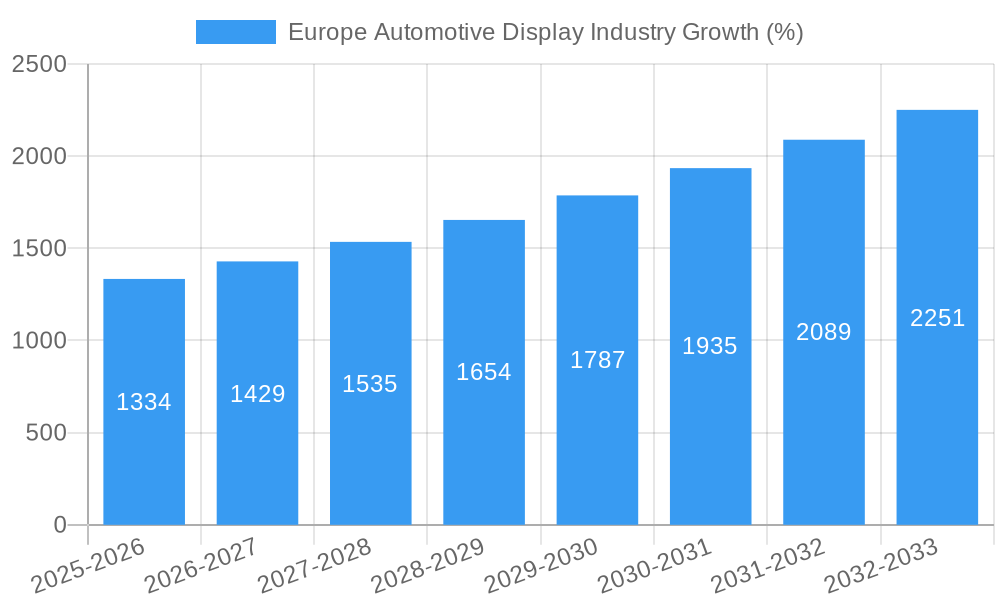

The European automotive display market is experiencing robust growth, driven by increasing demand for advanced driver-assistance systems (ADAS) and infotainment features. The market, valued at approximately €X billion in 2025 (assuming a logical extrapolation based on the provided CAGR and market size, a precise figure requires the missing "XX" value), is projected to exhibit a compound annual growth rate (CAGR) of 8.89% from 2025 to 2033. This expansion is fueled by several key factors. The rising adoption of larger, higher-resolution displays, particularly in premium vehicle segments, is a significant driver. Furthermore, the transition towards electric vehicles (EVs) and autonomous driving technologies necessitates sophisticated and larger display systems for driver information and in-car entertainment, further stimulating market growth. Technological advancements, such as the increasing popularity of OLED displays over LCD due to their superior image quality and energy efficiency, are shaping the market landscape. The segment breakdown reveals significant opportunities across various product types including center stack displays, instrument cluster displays, and heads-up displays. OEMs currently dominate the sales channel, however, the aftermarket segment is poised for growth as consumers seek upgrades and customization options.

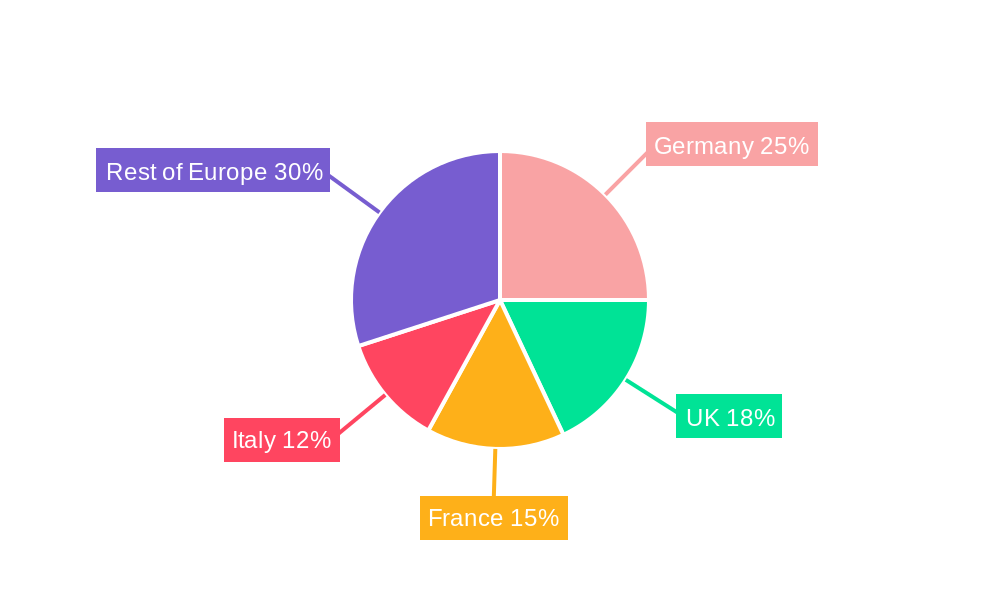

Within the European region, Germany, the United Kingdom, France, and Italy represent the largest national markets, contributing a significant share to the overall regional revenue. However, growth is anticipated across all major European countries. While the market faces potential restraints such as supply chain disruptions and fluctuating component costs, the long-term outlook remains positive. The increasing integration of connectivity features within vehicles and the rising consumer preference for technologically advanced cars are expected to offset these challenges and fuel continued market expansion throughout the forecast period. The presence of established automotive manufacturers and Tier-1 suppliers within Europe creates a strong foundation for continued innovation and market leadership in the automotive display sector.

Europe Automotive Display Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the European automotive display market, covering the period from 2019 to 2033. It segments the market by vehicle type (passenger cars and commercial vehicles), technology type (LCD and OLED), product type (center stack display, instrument cluster display, heads-up display, and other product types), sales type (OEM and aftermarket), and country (Germany, United Kingdom, Italy, France, Spain, and Rest of Europe). Key players analyzed include Magneti Marelli SpA, Hyundai Mobis, Visteon Corporation, ZF Friedrichshafen AG, Continental AG, Robert Bosch GmbH, MTA SpA, JDI Europe GmbH, DENSO Corporation, and LG Electronics. The report utilizes data from 2019-2024 as historical data, 2025 as the base and estimated year, and projects the market from 2025-2033. All values are presented in million units.

Europe Automotive Display Industry Market Dynamics & Structure

The European automotive display market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, driven by the demand for advanced driver-assistance systems (ADAS) and infotainment features, is a key driver. Stringent regulatory frameworks regarding safety and emissions are shaping industry practices. Competitive product substitutes, such as augmented reality (AR) displays, are emerging. The end-user demographic is shifting towards younger, tech-savvy drivers who value advanced features. M&A activity has been moderate, with strategic alliances and joint ventures becoming increasingly prevalent.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Investment in OLED and mini-LED technologies is driving market growth.

- Regulatory Framework: EU regulations on vehicle safety and emissions are influencing display adoption.

- M&A Activity: xx major M&A deals were recorded between 2019 and 2024.

- Innovation Barriers: High R&D costs and the need for specialized manufacturing capabilities present barriers to entry.

Europe Automotive Display Industry Growth Trends & Insights

The European automotive display market experienced steady growth during the historical period (2019-2024), driven by increasing vehicle production and rising consumer demand for advanced features. The market size is projected to experience a CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. The adoption rate of advanced display technologies, such as OLED and HUD, is expected to increase significantly during the forecast period. Technological disruptions, such as the introduction of flexible displays and holographic projections, are anticipated to further shape market dynamics. Consumer behavior is shifting towards personalized and interactive in-car experiences, fueling demand for larger and more sophisticated displays. Market penetration of advanced displays like OLED is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Europe Automotive Display Industry

Germany is the leading market in Europe, driven by a strong automotive manufacturing base and high consumer spending on premium vehicles. The passenger car segment dominates the market due to the higher adoption rate of advanced displays compared to commercial vehicles. The OEM sales channel holds the largest market share, representing xx% in 2025. The center stack display and instrument cluster display segments are currently the largest, accounting for xx% and xx% of the market, respectively, in 2025. LCD technology still dominates the market share in 2025 at xx%, but OLED technology is showing significant growth potential.

- Key Drivers in Germany: Strong automotive manufacturing sector, high disposable incomes, and early adoption of advanced technologies.

- Passenger Car Segment Dominance: Higher demand for advanced infotainment and safety features in passenger cars.

- OEM Sales Channel: Majority of displays are directly integrated by original equipment manufacturers.

- Center Stack & Instrument Cluster: These product types account for the largest share of the market owing to their necessity in almost every vehicle.

- Growth Potential of OLED: Improved image quality, higher contrast ratios, and better power efficiency are driving OLED adoption.

Europe Automotive Display Industry Product Landscape

The European automotive display market offers a diverse range of products, from basic LCD displays to sophisticated OLED and HUD systems. Recent innovations include curved displays, transparent displays, and displays with improved resolution and brightness. These advancements enhance driver experience, improve safety, and offer unique selling propositions focused on improved visibility and driver comfort. The integration of AR and haptic feedback is further enhancing user interaction.

Key Drivers, Barriers & Challenges in Europe Automotive Display Industry

Key Drivers: Growing demand for advanced driver-assistance systems (ADAS), increasing vehicle electrification, rising consumer preference for in-car entertainment and connectivity, and government regulations promoting road safety are key drivers.

Key Challenges: Fluctuating raw material prices, supply chain disruptions, competition from Asian manufacturers, and the high cost of developing and implementing new technologies pose challenges. The high cost of R&D and manufacturing may hinder market penetration of newer technologies.

Emerging Opportunities in Europe Automotive Display Industry

Emerging opportunities include the increasing adoption of AR/VR technologies in vehicles, the growth of the autonomous driving market, increasing demand for in-car entertainment and connectivity, and the development of flexible displays. The integration of 5G connectivity will further enhance opportunities in the market.

Growth Accelerators in the Europe Automotive Display Industry

Technological advancements, particularly in OLED and micro-LED displays, coupled with strategic partnerships between display manufacturers and automotive OEMs, are accelerating market growth. Expansion into new markets and applications, such as commercial vehicles and public transportation, will further drive market expansion.

Key Players Shaping the Europe Automotive Display Industry Market

- Magneti Marelli SpA

- Hyundai Mobis

- Visteon Corporation

- ZF Friedrichshafen AG

- Continental AG

- Robert Bosch GmbH

- MTA SpA

- JDI Europe GmbH

- DENSO Corporation

- LG Electronics

Notable Milestones in Europe Automotive Display Industry Sector

- 2021-Q3: Launch of a new OLED display technology by Visteon Corporation.

- 2022-Q1: Partnership between Continental AG and a major automotive OEM for HUD development.

- 2023-Q2: Acquisition of a smaller display manufacturer by Robert Bosch GmbH. (Further milestones can be added based on actual data)

In-Depth Europe Automotive Display Industry Market Outlook

The future of the European automotive display market looks promising, with significant growth potential driven by technological innovations and the expanding electric vehicle market. Strategic partnerships and investments in R&D will be crucial for companies to stay competitive. The increasing demand for customized and personalized in-car experiences will create new opportunities for innovative display solutions. The market is poised for substantial growth, with significant opportunities for players that can adapt to the evolving technological landscape and consumer preferences.

Europe Automotive Display Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Technology Type

- 2.1. LCD

- 2.2. OLED

-

3. Product Type

- 3.1. Center Stack Display

- 3.2. Instrument Cluster Display

- 3.3. Heads-up Display

- 3.4. Other Product Types

-

4. Sales Type

- 4.1. OEM

- 4.2. Aftermarket

Europe Automotive Display Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Display Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Sales of Passenger Cars

- 3.3. Market Restrains

- 3.3.1. Failure in Garage Equipment may Result in Downtime of the Repair Work

- 3.4. Market Trends

- 3.4.1. Autonomous and Electric Vehicles Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. LCD

- 5.2.2. OLED

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Center Stack Display

- 5.3.2. Instrument Cluster Display

- 5.3.3. Heads-up Display

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Sales Type

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Automotive Display Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Magneti Marelli SpA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hyundai Mobis

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Visteon Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ZF Friedrichshafen A

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Continental AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Robert Bosch GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 MTA SpA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 JDI Europe GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DENSO Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LG Electronics

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Magneti Marelli SpA

List of Figures

- Figure 1: Europe Automotive Display Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Automotive Display Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Automotive Display Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Automotive Display Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Automotive Display Industry Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 4: Europe Automotive Display Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Europe Automotive Display Industry Revenue Million Forecast, by Sales Type 2019 & 2032

- Table 6: Europe Automotive Display Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Europe Automotive Display Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Germany Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italy Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Netherlands Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Sweden Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Europe Automotive Display Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 16: Europe Automotive Display Industry Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 17: Europe Automotive Display Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Europe Automotive Display Industry Revenue Million Forecast, by Sales Type 2019 & 2032

- Table 19: Europe Automotive Display Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Belgium Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Norway Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Poland Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Denmark Europe Automotive Display Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Display Industry?

The projected CAGR is approximately 8.89%.

2. Which companies are prominent players in the Europe Automotive Display Industry?

Key companies in the market include Magneti Marelli SpA, Hyundai Mobis, Visteon Corporation, ZF Friedrichshafen A, Continental AG, Robert Bosch GmbH, MTA SpA, JDI Europe GmbH, DENSO Corporation, LG Electronics.

3. What are the main segments of the Europe Automotive Display Industry?

The market segments include Vehicle Type, Technology Type, Product Type, Sales Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Sales of Passenger Cars.

6. What are the notable trends driving market growth?

Autonomous and Electric Vehicles Driving the Market.

7. Are there any restraints impacting market growth?

Failure in Garage Equipment may Result in Downtime of the Repair Work.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Display Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Display Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Display Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Display Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence