Key Insights

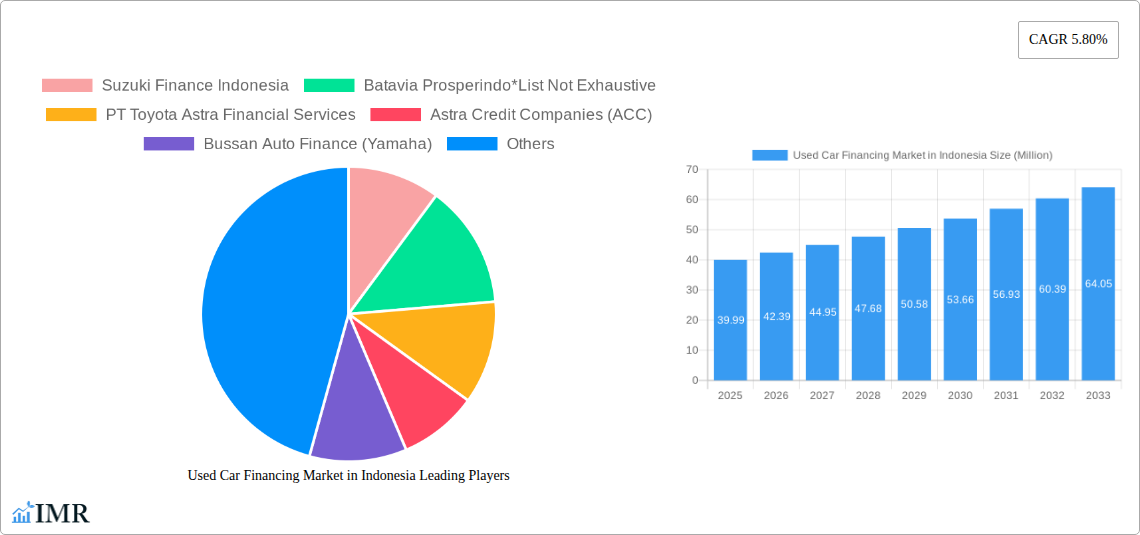

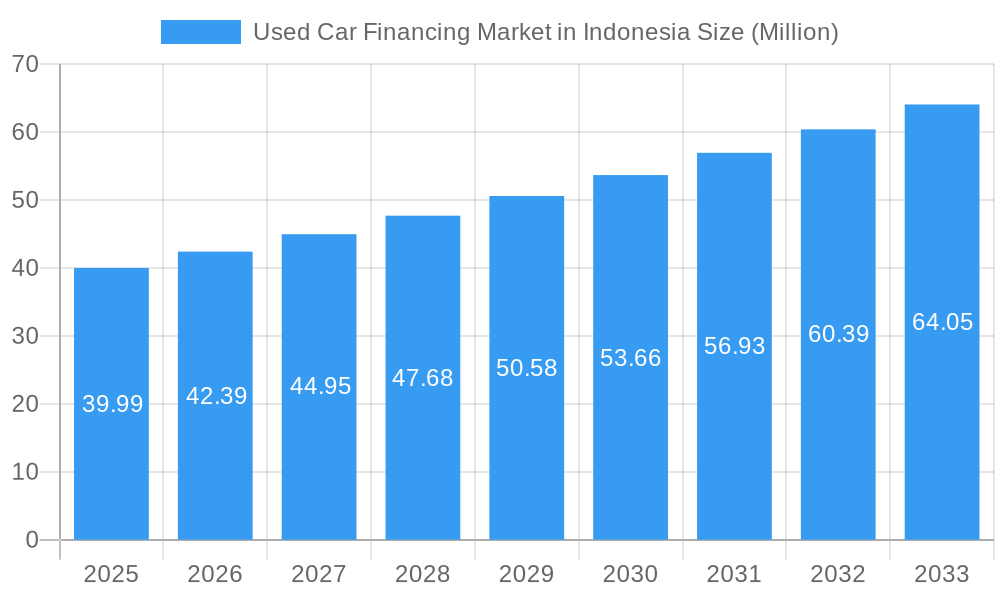

The Indonesian used car financing market presents a robust opportunity, exhibiting a market size of $39.99 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and a burgeoning middle class are driving increased demand for personal vehicles, with used cars offering a more affordable entry point than new vehicles. The expanding availability of online financing platforms simplifies the borrowing process, making used car purchases more accessible to a wider range of consumers. Furthermore, the diverse range of financing providers, including OEMs, banks, and Non-Banking Financial Companies (NBFCs), fosters competition and enhances consumer choice, contributing to market expansion. Different vehicle segments, such as hatchbacks, sedans, SUVs, and MPVs, cater to varied consumer preferences, further broadening the market's appeal. While challenges such as fluctuating interest rates and potential economic uncertainty could pose some restraints, the overall outlook remains positive, indicating significant growth potential in the coming years.

Used Car Financing Market in Indonesia Market Size (In Million)

The competitive landscape is characterized by a mix of established players like Suzuki Finance Indonesia, PT Toyota Astra Financial Services, and Astra Credit Companies (ACC), alongside other prominent financial institutions. The increasing penetration of digital technologies is reshaping the sector, with online booking channels gaining traction alongside traditional dealerships. The strategic expansion of financing options and the continued development of robust digital platforms are likely to be crucial for companies aiming to capture a larger share of this growing market. The segmentation by financing provider, booking channel, and vehicle type provides a granular understanding of consumer behavior and market dynamics, allowing for targeted marketing and product development strategies. The continued focus on improving customer service and offering flexible financing solutions will be vital in maintaining market competitiveness and driving future growth.

Used Car Financing Market in Indonesia Company Market Share

Used Car Financing Market in Indonesia: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Used Car Financing Market in Indonesia, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The Indonesian used car financing market is segmented by financing providers (OEMs, Banks, Non-Banking Financial Companies), booking channels (Online, OEM Certified/Authorized Dealerships, Multi Brand Dealerships), and vehicle types (Hatchback, Sedan, SUV, MPV).

Used Car Financing Market in Indonesia Market Dynamics & Structure

The Indonesian used car financing market is experiencing significant growth driven by rising vehicle ownership, increasing disposable incomes, and the expansion of financing options. Market concentration is moderate, with several key players competing alongside numerous smaller firms. Technological innovation, particularly in digital lending platforms and risk assessment tools, is transforming the industry. The regulatory framework, while evolving, plays a crucial role in shaping market practices and consumer protection. Competitive substitutes include personal savings and informal lending channels, but these are often less accessible or favorable. End-user demographics are expanding to include a younger, digitally-savvy generation. M&A activity is on the rise, with strategic acquisitions shaping the competitive landscape.

- Market Concentration: Moderately concentrated, with a few dominant players holding xx% of the market share.

- Technological Innovation: Rapid adoption of digital lending platforms and AI-powered credit scoring systems. Key barriers include data availability and infrastructure limitations in certain regions.

- Regulatory Framework: The Indonesian government is actively working on improving regulations related to consumer protection and lending practices.

- Competitive Substitutes: Personal savings and informal lending remain alternative options, impacting the market penetration of formal financing.

- End-User Demographics: Growing middle class and younger generation are key drivers of market expansion.

- M&A Trends: Increasing consolidation through acquisitions, reflecting the desire for market expansion and diversification. xx M&A deals were recorded between 2019-2024, with an average deal value of xx Million USD.

Used Car Financing Market in Indonesia Growth Trends & Insights

The Indonesian used car financing market demonstrates strong growth, fuelled by the expanding middle class and increasing affordability of used vehicles. The market size expanded from xx Million units in 2019 to xx Million units in 2024, reflecting a CAGR of xx%. This growth is expected to continue, reaching xx Million units by 2033, driven by factors like enhanced digital platforms, evolving consumer preferences towards used vehicles, and improved access to financing. Technological disruptions, particularly the emergence of online lending platforms, are accelerating market expansion and enhancing customer convenience. Furthermore, consumer behavior shifts towards online research and digital transactions are impacting the distribution channels.

Dominant Regions, Countries, or Segments in Used Car Financing Market in Indonesia

Java remains the dominant region for used car financing in Indonesia, accounting for xx% of the market in 2024, due to its higher population density and greater economic activity. Within the financing provider segment, Non-Banking Financial Companies (NBFCs) hold the largest market share (xx%), followed by Banks (xx%) and OEMs (xx%). Online booking channels are gaining traction, with their share expected to increase from xx% in 2024 to xx% by 2033. The MPV segment dominates the vehicle type category with xx% market share in 2024, followed by SUVs (xx%) and Hatchbacks (xx%).

- Key Drivers: Increasing disposable incomes, robust economic growth, government initiatives to support the automotive sector, and expanding digital infrastructure.

- Dominance Factors: High population density in Java, established presence of NBFCs, and increasing popularity of online financing platforms.

- Growth Potential: Significant untapped potential in less-developed regions of Indonesia, and further expansion of online channels.

Used Car Financing Market in Indonesia Product Landscape

The product landscape is characterized by a range of financing options, including conventional loans, balloon payments, and lease-to-own schemes, tailored to diverse consumer needs and financial capabilities. Innovative products incorporating digital technology, such as online loan applications and automated risk assessment, are gaining popularity, improving efficiency and accessibility. Key performance metrics include loan approval rates, default rates, and customer satisfaction levels. Unique selling propositions often involve competitive interest rates, flexible repayment terms, and convenient digital platforms.

Key Drivers, Barriers & Challenges in Used Car Financing Market in Indonesia

Key Drivers:

- Increasing affordability of used cars.

- Growing middle class and young population.

- Expanding digital infrastructure.

- Government initiatives to promote financial inclusion.

Challenges:

- High interest rates impacting affordability.

- Risk assessment and fraud prevention in the informal sector.

- Regulatory complexity and varying lending standards across provinces.

- Limited access to financing in remote areas and for low-income borrowers.

Emerging Opportunities in Used Car Financing Market in Indonesia

- Untapped market potential: Expansion into less developed regions of Indonesia offers significant growth opportunity.

- Innovative financing solutions: Developing tailored products for specific segments, such as young professionals or small business owners.

- Partnerships: Collaborations with technology companies to improve efficiency and customer experience.

Growth Accelerators in the Used Car Financing Market in Indonesia Industry

The Indonesian used car financing market's growth will be propelled by advancements in fintech, expanding digital financial literacy, and strategic partnerships among financial institutions and automotive companies. Government initiatives to improve financial inclusion and infrastructure development will further enhance market accessibility and penetration. The increasing adoption of innovative risk assessment tools and streamlined loan application processes will reduce friction and encourage greater participation.

Key Players Shaping the Used Car Financing Market in Indonesia Market

- Suzuki Finance Indonesia

- Batavia Prosperindo

- PT Toyota Astra Financial Services

- Astra Credit Companies (ACC)

- Bussan Auto Finance (Yamaha)

- Dipo Star Finance (Mitsubishi)

- Oto Multiartha

- PT JACCS Mitra Pinasthika Mustika Finance Indonesia (MPM Finance)

Notable Milestones in Used Car Financing Market in Indonesia Sector

- October 2023: Hyundai Capital Services enters the Indonesian market through a joint venture with Shinhan Bank and Sinar Mas Group, increasing competition and expanding financing options.

- June 2023: MUFG's acquisition of Mandala Multifinance for USD 467 million expands its auto loan business in Indonesia, targeting the emerging middle class.

In-Depth Used Car Financing Market in Indonesia Market Outlook

The future of the Indonesian used car financing market looks promising. Continued economic growth, rising disposable incomes, and ongoing technological advancements will drive further expansion. Strategic partnerships and the development of innovative financial products catering to diverse consumer needs will be key to unlocking the market's full potential. The increasing adoption of digital channels and enhanced risk assessment methodologies will ensure responsible and sustainable growth, leading to significant market expansion in the coming years.

Used Car Financing Market in Indonesia Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicle (SUV)

- 1.4. Multi-purpose Vehicle (MPV)

-

2. Financing Providers

- 2.1. OEMs

- 2.2. Banks

- 2.3. Non-banking Financial Companies

-

3. Province

- 3.1. West Java

- 3.2. East Java

- 3.3. Central Java

- 3.4. North Sumatra

- 3.5. Banten

- 3.6. Jakarta

- 3.7. Other Provinces

Used Car Financing Market in Indonesia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Car Financing Market in Indonesia Regional Market Share

Geographic Coverage of Used Car Financing Market in Indonesia

Used Car Financing Market in Indonesia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Sport Utility Vehicles are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Car Financing Market in Indonesia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicle (SUV)

- 5.1.4. Multi-purpose Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Financing Providers

- 5.2.1. OEMs

- 5.2.2. Banks

- 5.2.3. Non-banking Financial Companies

- 5.3. Market Analysis, Insights and Forecast - by Province

- 5.3.1. West Java

- 5.3.2. East Java

- 5.3.3. Central Java

- 5.3.4. North Sumatra

- 5.3.5. Banten

- 5.3.6. Jakarta

- 5.3.7. Other Provinces

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Car Financing Market in Indonesia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchback

- 6.1.2. Sedan

- 6.1.3. Sport Utility Vehicle (SUV)

- 6.1.4. Multi-purpose Vehicle (MPV)

- 6.2. Market Analysis, Insights and Forecast - by Financing Providers

- 6.2.1. OEMs

- 6.2.2. Banks

- 6.2.3. Non-banking Financial Companies

- 6.3. Market Analysis, Insights and Forecast - by Province

- 6.3.1. West Java

- 6.3.2. East Java

- 6.3.3. Central Java

- 6.3.4. North Sumatra

- 6.3.5. Banten

- 6.3.6. Jakarta

- 6.3.7. Other Provinces

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Car Financing Market in Indonesia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchback

- 7.1.2. Sedan

- 7.1.3. Sport Utility Vehicle (SUV)

- 7.1.4. Multi-purpose Vehicle (MPV)

- 7.2. Market Analysis, Insights and Forecast - by Financing Providers

- 7.2.1. OEMs

- 7.2.2. Banks

- 7.2.3. Non-banking Financial Companies

- 7.3. Market Analysis, Insights and Forecast - by Province

- 7.3.1. West Java

- 7.3.2. East Java

- 7.3.3. Central Java

- 7.3.4. North Sumatra

- 7.3.5. Banten

- 7.3.6. Jakarta

- 7.3.7. Other Provinces

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Car Financing Market in Indonesia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchback

- 8.1.2. Sedan

- 8.1.3. Sport Utility Vehicle (SUV)

- 8.1.4. Multi-purpose Vehicle (MPV)

- 8.2. Market Analysis, Insights and Forecast - by Financing Providers

- 8.2.1. OEMs

- 8.2.2. Banks

- 8.2.3. Non-banking Financial Companies

- 8.3. Market Analysis, Insights and Forecast - by Province

- 8.3.1. West Java

- 8.3.2. East Java

- 8.3.3. Central Java

- 8.3.4. North Sumatra

- 8.3.5. Banten

- 8.3.6. Jakarta

- 8.3.7. Other Provinces

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Car Financing Market in Indonesia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchback

- 9.1.2. Sedan

- 9.1.3. Sport Utility Vehicle (SUV)

- 9.1.4. Multi-purpose Vehicle (MPV)

- 9.2. Market Analysis, Insights and Forecast - by Financing Providers

- 9.2.1. OEMs

- 9.2.2. Banks

- 9.2.3. Non-banking Financial Companies

- 9.3. Market Analysis, Insights and Forecast - by Province

- 9.3.1. West Java

- 9.3.2. East Java

- 9.3.3. Central Java

- 9.3.4. North Sumatra

- 9.3.5. Banten

- 9.3.6. Jakarta

- 9.3.7. Other Provinces

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Car Financing Market in Indonesia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchback

- 10.1.2. Sedan

- 10.1.3. Sport Utility Vehicle (SUV)

- 10.1.4. Multi-purpose Vehicle (MPV)

- 10.2. Market Analysis, Insights and Forecast - by Financing Providers

- 10.2.1. OEMs

- 10.2.2. Banks

- 10.2.3. Non-banking Financial Companies

- 10.3. Market Analysis, Insights and Forecast - by Province

- 10.3.1. West Java

- 10.3.2. East Java

- 10.3.3. Central Java

- 10.3.4. North Sumatra

- 10.3.5. Banten

- 10.3.6. Jakarta

- 10.3.7. Other Provinces

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Suzuki Finance Indonesia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Batavia Prosperindo*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Toyota Astra Financial Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Astra Credit Companies (ACC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bussan Auto Finance (Yamaha)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dipo Star Finance (Mitsubishi)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oto Multiartha

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PT JACCS Mitra Pinasthika Mustika Finance Indonesia (MPM Finance)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Suzuki Finance Indonesia

List of Figures

- Figure 1: Global Used Car Financing Market in Indonesia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Used Car Financing Market in Indonesia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Car Financing Market in Indonesia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Car Financing Market in Indonesia Revenue (Million), by Financing Providers 2025 & 2033

- Figure 5: North America Used Car Financing Market in Indonesia Revenue Share (%), by Financing Providers 2025 & 2033

- Figure 6: North America Used Car Financing Market in Indonesia Revenue (Million), by Province 2025 & 2033

- Figure 7: North America Used Car Financing Market in Indonesia Revenue Share (%), by Province 2025 & 2033

- Figure 8: North America Used Car Financing Market in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Used Car Financing Market in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Used Car Financing Market in Indonesia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: South America Used Car Financing Market in Indonesia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: South America Used Car Financing Market in Indonesia Revenue (Million), by Financing Providers 2025 & 2033

- Figure 13: South America Used Car Financing Market in Indonesia Revenue Share (%), by Financing Providers 2025 & 2033

- Figure 14: South America Used Car Financing Market in Indonesia Revenue (Million), by Province 2025 & 2033

- Figure 15: South America Used Car Financing Market in Indonesia Revenue Share (%), by Province 2025 & 2033

- Figure 16: South America Used Car Financing Market in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Used Car Financing Market in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Used Car Financing Market in Indonesia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Europe Used Car Financing Market in Indonesia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Europe Used Car Financing Market in Indonesia Revenue (Million), by Financing Providers 2025 & 2033

- Figure 21: Europe Used Car Financing Market in Indonesia Revenue Share (%), by Financing Providers 2025 & 2033

- Figure 22: Europe Used Car Financing Market in Indonesia Revenue (Million), by Province 2025 & 2033

- Figure 23: Europe Used Car Financing Market in Indonesia Revenue Share (%), by Province 2025 & 2033

- Figure 24: Europe Used Car Financing Market in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Used Car Financing Market in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Used Car Financing Market in Indonesia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East & Africa Used Car Financing Market in Indonesia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East & Africa Used Car Financing Market in Indonesia Revenue (Million), by Financing Providers 2025 & 2033

- Figure 29: Middle East & Africa Used Car Financing Market in Indonesia Revenue Share (%), by Financing Providers 2025 & 2033

- Figure 30: Middle East & Africa Used Car Financing Market in Indonesia Revenue (Million), by Province 2025 & 2033

- Figure 31: Middle East & Africa Used Car Financing Market in Indonesia Revenue Share (%), by Province 2025 & 2033

- Figure 32: Middle East & Africa Used Car Financing Market in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Used Car Financing Market in Indonesia Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Used Car Financing Market in Indonesia Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 35: Asia Pacific Used Car Financing Market in Indonesia Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 36: Asia Pacific Used Car Financing Market in Indonesia Revenue (Million), by Financing Providers 2025 & 2033

- Figure 37: Asia Pacific Used Car Financing Market in Indonesia Revenue Share (%), by Financing Providers 2025 & 2033

- Figure 38: Asia Pacific Used Car Financing Market in Indonesia Revenue (Million), by Province 2025 & 2033

- Figure 39: Asia Pacific Used Car Financing Market in Indonesia Revenue Share (%), by Province 2025 & 2033

- Figure 40: Asia Pacific Used Car Financing Market in Indonesia Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Used Car Financing Market in Indonesia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Financing Providers 2020 & 2033

- Table 3: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Province 2020 & 2033

- Table 4: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Financing Providers 2020 & 2033

- Table 7: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Province 2020 & 2033

- Table 8: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Financing Providers 2020 & 2033

- Table 14: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Province 2020 & 2033

- Table 15: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Financing Providers 2020 & 2033

- Table 21: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Province 2020 & 2033

- Table 22: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Financing Providers 2020 & 2033

- Table 34: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Province 2020 & 2033

- Table 35: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 43: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Financing Providers 2020 & 2033

- Table 44: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Province 2020 & 2033

- Table 45: Global Used Car Financing Market in Indonesia Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Used Car Financing Market in Indonesia Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Car Financing Market in Indonesia?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Used Car Financing Market in Indonesia?

Key companies in the market include Suzuki Finance Indonesia, Batavia Prosperindo*List Not Exhaustive, PT Toyota Astra Financial Services, Astra Credit Companies (ACC), Bussan Auto Finance (Yamaha), Dipo Star Finance (Mitsubishi), Oto Multiartha, PT JACCS Mitra Pinasthika Mustika Finance Indonesia (MPM Finance).

3. What are the main segments of the Used Car Financing Market in Indonesia?

The market segments include Vehicle Type, Financing Providers, Province.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Sport Utility Vehicles are Dominating the Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

October 2023: Hyundai Capital Services, the financing unit under the South Korean auto giant Hyundai Motor Group, joined forces with Shinhan Bank and Sinar Mas Group to enter Indonesia's credit finance market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Car Financing Market in Indonesia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Car Financing Market in Indonesia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Car Financing Market in Indonesia?

To stay informed about further developments, trends, and reports in the Used Car Financing Market in Indonesia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence