Key Insights

The European DC Distribution Network market is poised for significant expansion, propelled by the escalating adoption of renewable energy, the continuous growth of data center infrastructure, and the increasing demand for efficient power distribution across industrial and commercial sectors. With a projected Compound Annual Growth Rate (CAGR) of 8%, the market is expected to reach a size of $13.6 billion by 2025, building upon robust historical growth from the base year 2024. Key growth drivers include the imperative for enhanced energy efficiency, the inherent advantages of reduced transmission losses with DC power, and the seamless integration of distributed energy resources such as solar and wind power. The high-voltage segment is anticipated to lead market dominance, driven by large-scale data center and industrial deployments. Concurrently, low and medium-voltage segments offer substantial growth prospects, particularly within commercial and residential applications, as smart and microgrid technologies gain traction. Germany, France, and the UK currently lead the European market, supported by mature infrastructure and favorable government policies promoting renewable energy and grid modernization. Emerging European economies are also exhibiting rapid growth, fueled by investments in renewable energy projects and technological innovation. The market is actively contested by leading players including ABB, Vertiv, Siemens, Schneider Electric, and Eaton, who are pursuing market share through innovation and strategic alliances.

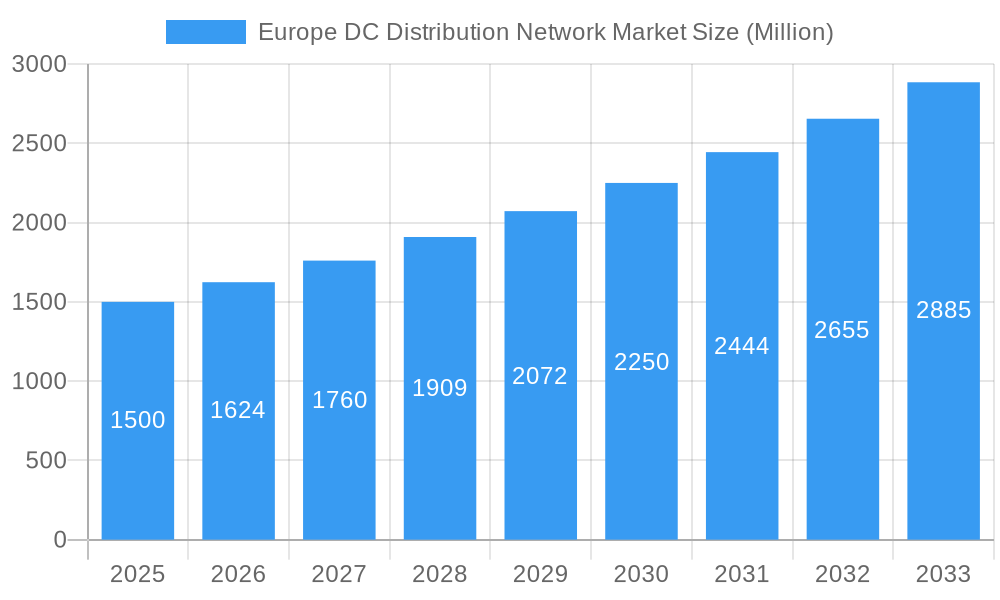

Europe DC Distribution Network Market Market Size (In Billion)

Market growth faces potential constraints from high initial investment costs for DC distribution networks, the necessity for standardization and interoperability, and the complexities of integrating DC sources with existing AC grids. Nevertheless, the enduring benefits of improved efficiency and reduced environmental impact are stimulating substantial investments in DC distribution network development and deployment. Ongoing advancements in power electronics are further enhancing the cost-effectiveness and reliability of DC-based solutions. The sustained expansion of data centers and the persistent demand for dependable power across diverse sectors will continue to fuel market growth throughout the forecast period, particularly in rapidly developing European regions, contributing to a considerable market valuation by 2033. Analysis of historical data up to the base year 2024, coupled with the projected CAGR, provides a solid foundation for estimating future market trajectory and size.

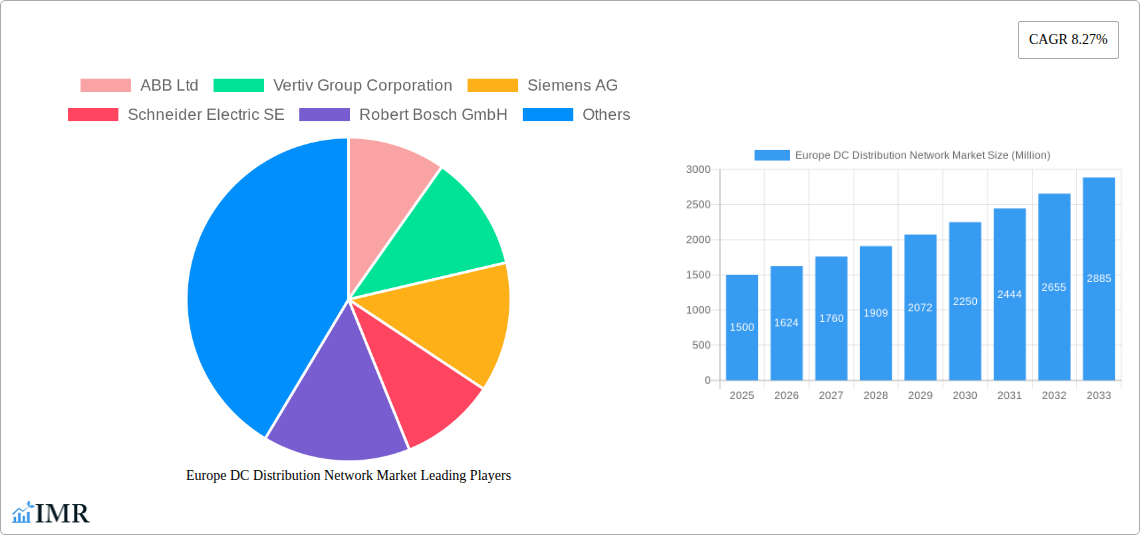

Europe DC Distribution Network Market Company Market Share

Europe DC Distribution Network Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe DC Distribution Network Market, covering market dynamics, growth trends, key players, and future outlook. The report segments the market by voltage (High Voltage, Low and Medium Voltage) and end-user (Residential, Commercial, and Industrial), offering granular insights into this vital sector. The market size is projected to reach xx Million by 2033. This report is crucial for industry professionals, investors, and strategists seeking a clear understanding of this rapidly evolving market.

The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024.

Europe DC Distribution Network Market Dynamics & Structure

The European DC distribution network market is characterized by a moderately concentrated landscape, with key players like ABB Ltd, Vertiv Group Corporation, Siemens AG, Schneider Electric SE, Robert Bosch GmbH, Alpha Technologies Inc, Secheron SA, and Eaton Corporation Plc vying for market share. The market's structure is influenced by several factors:

- Technological Innovation: Continuous advancements in power electronics, particularly HVDC technology, are driving market growth. The shift towards renewable energy sources necessitates efficient and reliable DC distribution networks.

- Regulatory Frameworks: Stringent environmental regulations and policies promoting renewable energy integration are shaping market dynamics. Government incentives and support for grid modernization initiatives are significant catalysts.

- Competitive Product Substitutes: While AC remains dominant, the increasing efficiency and cost-effectiveness of DC solutions are posing a challenge to traditional AC infrastructure. The market is witnessing a gradual shift towards hybrid AC/DC systems.

- End-User Demographics: The increasing adoption of electric vehicles (EVs) and the growing demand for data centers are fueling the demand for robust and scalable DC distribution networks, particularly in urban and commercial areas.

- M&A Trends: Strategic mergers and acquisitions are reshaping the competitive landscape, with larger players acquiring smaller companies to expand their product portfolios and geographic reach. The number of M&A deals in this sector averaged xx per year during the historical period (2019-2024), with an estimated xx% market share concentrated in the top 5 players in 2025. Innovation barriers include high initial investment costs for new technologies and the need for skilled workforce.

Europe DC Distribution Network Market Growth Trends & Insights

The European DC distribution network market has witnessed a steady growth trajectory over the historical period (2019-2024). Driven by factors like renewable energy integration, urbanization, and digitalization, the market is expected to continue its expansion throughout the forecast period (2025-2033). The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024 and is projected to grow at a CAGR of xx% from 2025-2033, reaching a market value of xx Million by 2033. This growth is underpinned by increasing adoption rates of DC microgrids, smart grids, and advanced energy storage solutions. Technological disruptions, such as the advancement of power semiconductor technologies and the emergence of next-generation grid architectures, are significantly influencing market growth. Consumer behavior shifts, particularly towards sustainable and energy-efficient solutions, are further driving market expansion. Market penetration of DC distribution systems within the residential sector remains relatively low compared to commercial and industrial applications; however, government incentives are expected to drive substantial growth in this segment over the forecast period.

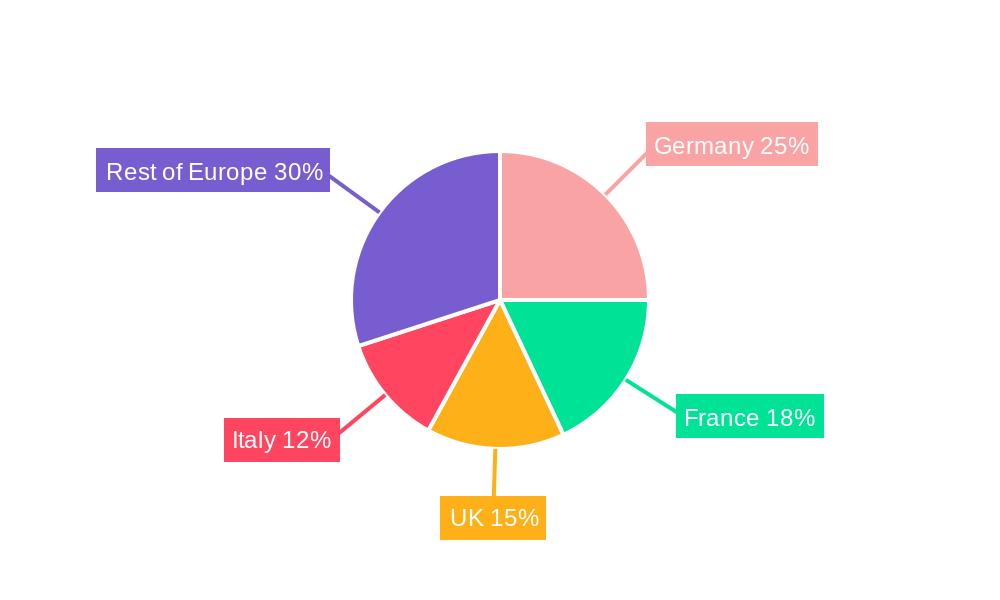

Dominant Regions, Countries, or Segments in Europe DC Distribution Network Market

Germany, the United Kingdom, and France are the leading markets within Europe, owing to strong government support for renewable energy integration, robust industrial sectors, and advanced infrastructure. The high voltage segment currently dominates the market, driven by large-scale renewable energy projects and long-distance power transmission needs. However, the low and medium voltage segment is projected to experience faster growth owing to the increased penetration of EVs and DC microgrids. Germany's dominance is fueled by:

- Government Policies: Significant investments in renewable energy infrastructure and grid modernization.

- Strong Industrial Base: High demand for reliable power supply from various sectors, particularly manufacturing and data centers.

- Technological Leadership: Significant advancements in HVDC technology and grid integration solutions.

The commercial and industrial sectors are the largest end-users of DC distribution networks, driven by the need for reliable and efficient power solutions for data centers, manufacturing facilities, and commercial buildings. The residential sector, while showing slower growth, has significant future potential due to government incentives and the increased adoption of renewable energy systems in homes.

Europe DC Distribution Network Market Product Landscape

The market offers a diverse range of products, including HVDC converters, low and medium voltage DC switches, and DC circuit breakers. Innovations focus on enhancing efficiency, reliability, and safety. The emphasis is on compact designs, improved power density, and advanced monitoring capabilities. Unique selling propositions include modular designs, intelligent grid management features, and seamless integration with renewable energy sources. Technological advancements such as wide bandgap semiconductor technology and advanced power electronic control systems are improving the performance and reliability of DC distribution equipment.

Key Drivers, Barriers & Challenges in Europe DC Distribution Network Market

Key Drivers:

- Increased adoption of renewable energy sources, necessitating efficient DC distribution.

- Growing demand from data centers and the electrification of transportation.

- Government initiatives and incentives promoting grid modernization and energy efficiency.

- Technological advancements leading to cost reductions and performance improvements.

Key Challenges:

- High initial investment costs associated with DC infrastructure development can act as a barrier for some users.

- Interoperability challenges between different DC technologies and existing AC infrastructure can delay wider adoption.

- Lack of standardized regulations and codes across different countries can hinder the market's growth. This results in approximately xx Million in lost revenue annually due to project delays and increased costs.

Emerging Opportunities in Europe DC Distribution Network Market

- Microgrids: The development and deployment of DC microgrids offer opportunities for localized energy generation and distribution, enhancing resilience and efficiency.

- Smart Grid Technologies: Integration of smart grid technologies into DC distribution networks enables better monitoring, control, and optimization of energy flow.

- EV Charging Infrastructure: The widespread adoption of electric vehicles necessitates the development of robust and scalable DC fast-charging infrastructure.

Growth Accelerators in the Europe DC Distribution Network Market Industry

The long-term growth of the European DC distribution network market will be propelled by continued technological advancements in power electronics, the increasing penetration of renewable energy sources, and government policies supporting grid modernization. Strategic partnerships between equipment manufacturers, grid operators, and renewable energy developers will further accelerate market growth.

Key Players Shaping the Europe DC Distribution Network Market Market

- ABB Ltd

- Vertiv Group Corporation

- Siemens AG

- Schneider Electric SE

- Robert Bosch GmbH

- Alpha Technologies Inc

- Secheron SA

- Eaton Corporation Plc

Notable Milestones in Europe DC Distribution Network Market Sector

- April 2023: Siemens Energy and Dragados Offshore secure an USD 8.4 billion contract with TenneT for HVDC technology for three German North Sea grid connections, enabling 6 GW of offshore wind power integration.

- April 2022: Asda extends its five-year contract with Vanderlande for life-cycle services at its Warrington distribution center, highlighting the growing adoption of automated solutions in the DC network sector.

In-Depth Europe DC Distribution Network Market Market Outlook

The future of the European DC distribution network market appears bright, driven by sustained growth in renewable energy, digitalization, and the electrification of transportation. The market presents substantial opportunities for companies focused on innovation, strategic partnerships, and efficient project execution. The increasing focus on sustainability and energy efficiency will further propel market expansion, creating a robust and resilient energy infrastructure for the future.

Europe DC Distribution Network Market Segmentation

-

1. Voltage

- 1.1. High Voltage

- 1.2. Low and Medium Voltage

-

2. End-User

- 2.1. Residential

- 2.2. Commercial and Industrial

Europe DC Distribution Network Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. Rest of Europe

Europe DC Distribution Network Market Regional Market Share

Geographic Coverage of Europe DC Distribution Network Market

Europe DC Distribution Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Lack Of Investor Confidence Due To Sociopolitical Instability In Some Countries

- 3.4. Market Trends

- 3.4.1. Low and Medium Voltage Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 5.1.1. High Voltage

- 5.1.2. Low and Medium Voltage

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Voltage

- 6. Germany Europe DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 6.1.1. High Voltage

- 6.1.2. Low and Medium Voltage

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial and Industrial

- 6.1. Market Analysis, Insights and Forecast - by Voltage

- 7. United Kingdom Europe DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 7.1.1. High Voltage

- 7.1.2. Low and Medium Voltage

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial and Industrial

- 7.1. Market Analysis, Insights and Forecast - by Voltage

- 8. Italy Europe DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 8.1.1. High Voltage

- 8.1.2. Low and Medium Voltage

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial and Industrial

- 8.1. Market Analysis, Insights and Forecast - by Voltage

- 9. Rest of Europe Europe DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 9.1.1. High Voltage

- 9.1.2. Low and Medium Voltage

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial and Industrial

- 9.1. Market Analysis, Insights and Forecast - by Voltage

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vertiv Group Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siemens AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alpha Technologies Inc *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Secheron SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eaton Corporation Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Europe DC Distribution Network Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe DC Distribution Network Market Share (%) by Company 2025

List of Tables

- Table 1: Europe DC Distribution Network Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 2: Europe DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe DC Distribution Network Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe DC Distribution Network Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 5: Europe DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe DC Distribution Network Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 8: Europe DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Europe DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe DC Distribution Network Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 11: Europe DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe DC Distribution Network Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 14: Europe DC Distribution Network Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Europe DC Distribution Network Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe DC Distribution Network Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Europe DC Distribution Network Market?

Key companies in the market include ABB Ltd, Vertiv Group Corporation, Siemens AG, Schneider Electric SE, Robert Bosch GmbH, Alpha Technologies Inc *List Not Exhaustive, Secheron SA, Eaton Corporation Plc.

3. What are the main segments of the Europe DC Distribution Network Market?

The market segments include Voltage, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Low and Medium Voltage Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Lack Of Investor Confidence Due To Sociopolitical Instability In Some Countries.

8. Can you provide examples of recent developments in the market?

In April 2023, Siemens Energy and Dragados Offshore have signed a framework agreement with TenneT, the German-Dutch transmission system operator, to provide high-voltage direct current (HVDC) transmitting technology for three grid connections in the German Northern Sea. The projects made available by the agreement will allow a total of 6 gigatonnes (GW) of offshore wind power to be transferred onshore. The contract is worth close to USD 8.4 billion to the consortium of Siemens Energy and Dragados Offshore.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe DC Distribution Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe DC Distribution Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe DC Distribution Network Market?

To stay informed about further developments, trends, and reports in the Europe DC Distribution Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence