Key Insights

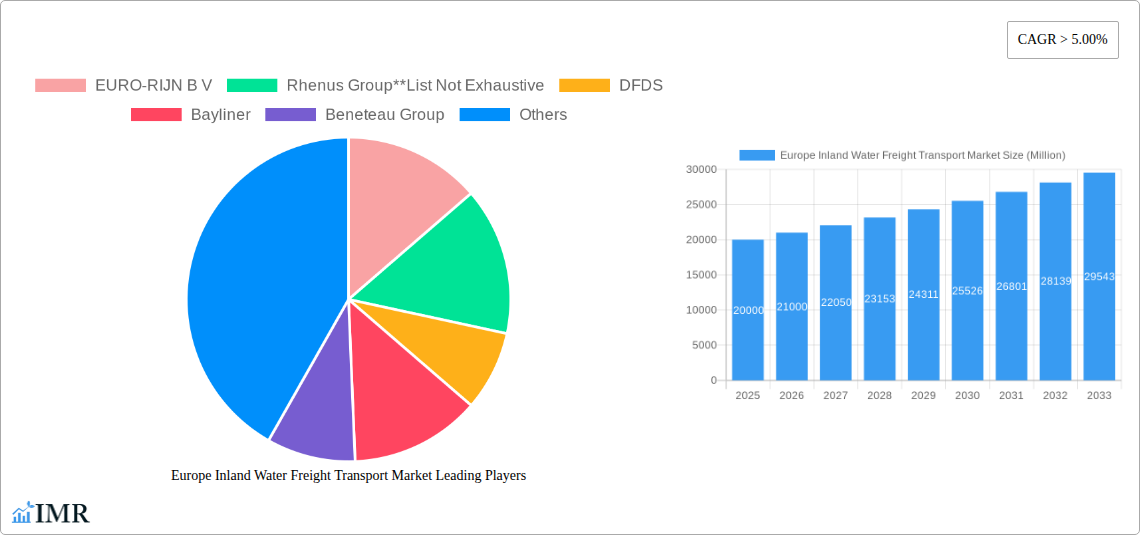

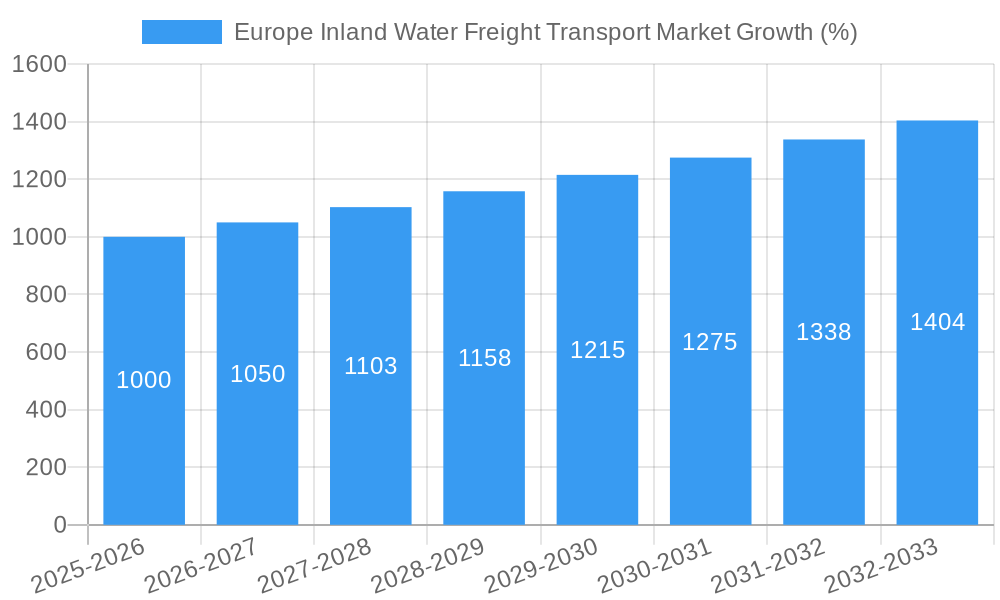

The European inland water freight transport market, valued at approximately €20 billion in 2025, is projected to experience robust growth, exceeding a 5% compound annual growth rate (CAGR) through 2033. This expansion is driven by several key factors. Firstly, increasing demand for efficient and sustainable transportation solutions is pushing businesses to adopt inland waterways, a more environmentally friendly alternative to road and rail. Secondly, government initiatives promoting waterway infrastructure development and modernization across major European nations like Germany, France, and the Netherlands are fostering growth. The rising cost of fuel and stricter emission regulations for road transport further incentivize the shift towards inland waterways. The market is segmented by transportation type (liquid bulk and dry bulk) and vessel type (cargo ships, container ships, tankers, and others). While liquid bulk transportation currently dominates, the dry bulk segment is expected to witness significant growth fueled by increasing agricultural and industrial goods movement. Key players like EURO-RIJN B.V., Rhenus Group, DFDS, and CMA CGM are strategically investing in fleet expansion and technological upgrades to capitalize on this expanding market. Competition is expected to intensify, driving innovation and efficiency improvements within the sector.

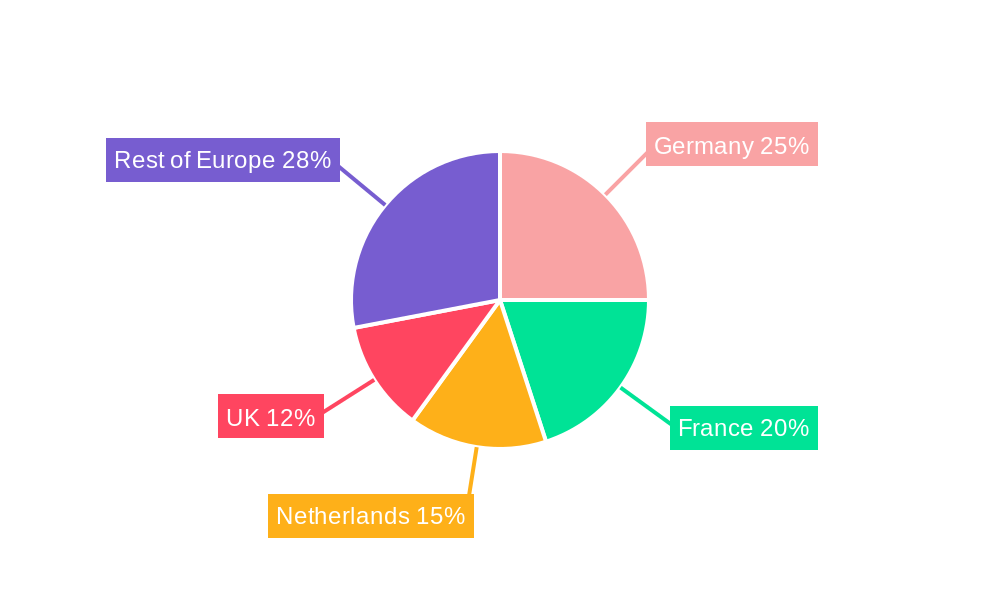

The geographical distribution of the market is heavily concentrated in Western Europe, with Germany, France, the Netherlands, and the UK representing the most significant national markets. However, growth potential exists in other European regions, particularly as infrastructure improves and awareness of the advantages of inland water freight increases. Despite the positive outlook, market growth may be tempered by challenges, including seasonal fluctuations in water levels, potential infrastructure bottlenecks, and the need for ongoing investment in modernizing waterways and port facilities. Despite these restraints, the long-term outlook remains positive, suggesting a continuous expansion of the European inland water freight transport market over the forecast period.

Europe Inland Water Freight Transport Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Inland Water Freight Transport Market, encompassing historical data (2019-2024), the base year (2025), and a forecast period extending to 2033. The report segments the market by Type of Transportation (Liquid Bulk Transportation, Dry Bulk Transportation) and Vessel Type (Cargo Ships, Container Ships, Tankers, Other Vessel Types), offering a granular understanding of market dynamics and growth prospects. Key players such as EURO-RIJN B V, Rhenus Group, DFDS, Bayliner, Beneteau Group, EUROPEAN CRUISE SERVICE, MSC Mediterranean Shipping Company S A, Construction Navale Bordeaux, MEYER WERFT GmbH & Co KG, and CMA CGM Group are profiled, providing insights into their market strategies and contributions. This report is an invaluable resource for industry professionals, investors, and strategic planners seeking to navigate the complexities of this evolving market. The total market size is projected to reach xx Million by 2033.

Europe Inland Water Freight Transport Market Dynamics & Structure

The European inland water freight transport market exhibits a moderately consolidated structure, with a few large players commanding significant market share. However, a considerable number of smaller operators also contribute significantly to the overall market volume. The market is characterized by intense competition, driven by factors including pricing pressures and the need for continuous operational efficiency improvements. Technological innovation is a key driver, with advancements in vessel design, navigation systems, and logistics optimization software leading to enhanced efficiency and environmental sustainability.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, with the remaining share distributed among numerous smaller operators.

- Technological Innovation: Adoption of autonomous navigation technologies and alternative fuels (e.g., LNG, hydrogen) is gradually increasing, though significant investment and regulatory hurdles remain.

- Regulatory Framework: Stringent environmental regulations, focusing on emissions reduction and waterway maintenance, are shaping market dynamics and influencing investment decisions.

- Competitive Product Substitutes: Road and rail transport remain major competitors, but inland waterways offer advantages in terms of cost-effectiveness and reduced congestion for certain cargo types and routes.

- End-User Demographics: The primary end-users are industrial manufacturers, agricultural businesses, and logistics providers involved in the transport of bulk goods and containers.

- M&A Trends: Consolidation is expected to continue, with larger players seeking to expand their market reach and optimize their logistics networks. The number of M&A deals in the period 2019-2024 was estimated at xx.

Europe Inland Water Freight Transport Market Growth Trends & Insights

The European inland water freight transport market has witnessed steady growth over the past few years, driven by increasing demand for efficient and environmentally friendly freight solutions. The market size grew from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This growth is expected to continue throughout the forecast period, with a projected CAGR of xx% between 2025 and 2033, reaching a market value of xx Million by 2033. The adoption of sustainable practices, driven by governmental incentives and a growing focus on reducing carbon emissions, is significantly impacting market growth. Shifts in consumer behavior, emphasizing environmentally conscious choices, are further bolstering the adoption of inland waterways as a preferred mode of transport for both liquid and dry bulk goods. Technological disruptions, such as the introduction of autonomous vessels and improved logistics platforms, are also expected to improve efficiency and reduce costs, driving further market expansion.

Dominant Regions, Countries, or Segments in Europe Inland Water Freight Transport Market

The Rhine River basin remains the dominant region for inland water freight transport in Europe, accounting for a significant share of the overall market volume. Germany, Netherlands, and France are the leading countries in this region, benefitting from well-developed infrastructure and high cargo volumes.

- Type of Transportation: Dry bulk transportation currently holds a larger market share than liquid bulk transportation, largely due to the significant volumes of agricultural products and industrial materials transported via inland waterways. However, liquid bulk transportation is experiencing steady growth, driven by the increasing demand for fuel and chemical products.

- Vessel Type: Cargo ships and barges continue to dominate the vessel type segment, given their suitability for handling bulk goods. However, the market for container ships is also growing, driven by the increasing demand for containerized freight.

- Key Drivers: Favorable government policies promoting sustainable transport, investment in waterway infrastructure upgrades, and the increasing focus on reducing road congestion are driving the growth of this segment.

Europe Inland Water Freight Transport Market Product Landscape

The product landscape is characterized by a diverse range of vessels, from traditional barges and push boats to more advanced, technologically sophisticated vessels equipped with autonomous navigation systems and optimized cargo handling capabilities. Key performance indicators include cargo capacity, fuel efficiency, and speed. The focus is on increasing efficiency, reducing environmental impact, and improving safety. Recent innovations include the implementation of hybrid propulsion systems and the development of specialized vessels for handling specific types of cargo.

Key Drivers, Barriers & Challenges in Europe Inland Water Freight Transport Market

Key Drivers:

- Increased demand for sustainable transportation solutions.

- Government initiatives and funding for inland waterway infrastructure improvements.

- Growing need for efficient and cost-effective freight transport solutions.

Challenges & Restraints:

- High initial investment costs for new vessels and technologies.

- Infrastructure limitations in certain regions.

- Seasonal variations in water levels can disrupt operations.

- Competition from road and rail transport.

- xx% of the market is challenged by fluctuating fuel prices.

Emerging Opportunities in Europe Inland Water Freight Transport Market

- Expansion into new regions with less-developed inland waterway infrastructure.

- Development of specialized vessels for niche cargo types.

- Integration of digital technologies to enhance efficiency and transparency in logistics.

- Growth of intermodal transport solutions, combining inland waterways with other modes of transportation.

Growth Accelerators in the Europe Inland Water Freight Transport Market Industry

Technological advancements, such as the development of autonomous vessels and improved navigation systems, are poised to significantly enhance operational efficiency and reduce costs. Strategic partnerships between logistics providers and waterway operators are crucial for optimizing transport networks. Market expansion into underserved regions and the exploration of new cargo types will further drive long-term growth.

Key Players Shaping the Europe Inland Water Freight Transport Market Market

- EURO-RIJN B V

- Rhenus Group

- DFDS

- Bayliner

- Beneteau Group

- EUROPEAN CRUISE SERVICE

- MSC Mediterranean Shipping Company S A

- Construction Navale Bordeaux

- MEYER WERFT GmbH & Co KG

- CMA CGM Group

Notable Milestones in Europe Inland Water Freight Transport Market Sector

- October 2022: The European Commission approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support shifting freight transport from road to inland waterways and rail, promoting greener transport.

- June 2022: Rhenus PartnerShip announced investment in sustainable articulated push barge units (Rhenus Mannheim I+II and Rhenus Wörth I+II), using alternative fuels and reducing environmental impact.

In-Depth Europe Inland Water Freight Transport Market Outlook

The future of the European inland water freight transport market appears promising, driven by strong growth trends, technological advancements, and supportive government policies. Strategic investments in infrastructure development and the adoption of innovative technologies will be key to unlocking the market’s full potential. Expanding into new markets and exploring new cargo opportunities will further enhance long-term growth prospects. The market is expected to experience sustained growth, driven by increasing demand for sustainable logistics solutions and continuous improvements in efficiency and capacity.

Europe Inland Water Freight Transport Market Segmentation

-

1. Type of Transportation

- 1.1. Liquid Bulk Transportation

- 1.2. Dry Bulk Transportation

-

2. Vessel Type

- 2.1. Cargo Ships

- 2.2. Container Ships

- 2.3. Tankers

- 2.4. Other Vessel Types

Europe Inland Water Freight Transport Market Segmentation By Geography

- 1. Netherland

- 2. Germany

- 3. Begium

- 4. France

- 5. Romania

- 6. Bulgaria

- 7. Rest of Europe

Europe Inland Water Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Digitization of inland-waterway transport

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 5.1.1. Liquid Bulk Transportation

- 5.1.2. Dry Bulk Transportation

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Cargo Ships

- 5.2.2. Container Ships

- 5.2.3. Tankers

- 5.2.4. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Netherland

- 5.3.2. Germany

- 5.3.3. Begium

- 5.3.4. France

- 5.3.5. Romania

- 5.3.6. Bulgaria

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6. Netherland Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 6.1.1. Liquid Bulk Transportation

- 6.1.2. Dry Bulk Transportation

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Cargo Ships

- 6.2.2. Container Ships

- 6.2.3. Tankers

- 6.2.4. Other Vessel Types

- 6.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 7.1.1. Liquid Bulk Transportation

- 7.1.2. Dry Bulk Transportation

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Cargo Ships

- 7.2.2. Container Ships

- 7.2.3. Tankers

- 7.2.4. Other Vessel Types

- 7.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8. Begium Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 8.1.1. Liquid Bulk Transportation

- 8.1.2. Dry Bulk Transportation

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Cargo Ships

- 8.2.2. Container Ships

- 8.2.3. Tankers

- 8.2.4. Other Vessel Types

- 8.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 9.1.1. Liquid Bulk Transportation

- 9.1.2. Dry Bulk Transportation

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Cargo Ships

- 9.2.2. Container Ships

- 9.2.3. Tankers

- 9.2.4. Other Vessel Types

- 9.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10. Romania Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 10.1.1. Liquid Bulk Transportation

- 10.1.2. Dry Bulk Transportation

- 10.2. Market Analysis, Insights and Forecast - by Vessel Type

- 10.2.1. Cargo Ships

- 10.2.2. Container Ships

- 10.2.3. Tankers

- 10.2.4. Other Vessel Types

- 10.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11. Bulgaria Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 11.1.1. Liquid Bulk Transportation

- 11.1.2. Dry Bulk Transportation

- 11.2. Market Analysis, Insights and Forecast - by Vessel Type

- 11.2.1. Cargo Ships

- 11.2.2. Container Ships

- 11.2.3. Tankers

- 11.2.4. Other Vessel Types

- 11.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 12.1.1. Liquid Bulk Transportation

- 12.1.2. Dry Bulk Transportation

- 12.2. Market Analysis, Insights and Forecast - by Vessel Type

- 12.2.1. Cargo Ships

- 12.2.2. Container Ships

- 12.2.3. Tankers

- 12.2.4. Other Vessel Types

- 12.1. Market Analysis, Insights and Forecast - by Type of Transportation

- 13. Germany Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Inland Water Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 EURO-RIJN B V

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Rhenus Group**List Not Exhaustive

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 DFDS

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Bayliner

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Beneteau Group

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 EUROPEAN CRUISE SERVICE

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 MSC Mediterranean Shipping Company S A

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Construction Navale Bordeaux

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 MEYER WERFT GmbH & Co KG

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 CMA CGM Group

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 EURO-RIJN B V

List of Figures

- Figure 1: Europe Inland Water Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Inland Water Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 3: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 4: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Inland Water Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 14: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 15: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 17: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 18: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 20: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 21: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 23: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 24: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 26: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 27: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 29: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 30: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Type of Transportation 2019 & 2032

- Table 32: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 33: Europe Inland Water Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Inland Water Freight Transport Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Inland Water Freight Transport Market?

Key companies in the market include EURO-RIJN B V, Rhenus Group**List Not Exhaustive, DFDS, Bayliner, Beneteau Group, EUROPEAN CRUISE SERVICE, MSC Mediterranean Shipping Company S A, Construction Navale Bordeaux, MEYER WERFT GmbH & Co KG, CMA CGM Group.

3. What are the main segments of the Europe Inland Water Freight Transport Market?

The market segments include Type of Transportation, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

Digitization of inland-waterway transport.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

October 2022: The European Commission (EC) has approved a EUR 22.5 million (USD 23.91 million) Dutch scheme to support the shifting of freight transport from road to inland waterways and rail. The new scheme is part of an initiative to encourage a greener mode of transport. Designed to run until the end of January 2026, the scheme will enable shippers and logistics operators to secure non-refundable grants for cutting down external costs, including pollution, noise, congestion, and accidents, using inland waterways and rail.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Inland Water Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Inland Water Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Inland Water Freight Transport Market?

To stay informed about further developments, trends, and reports in the Europe Inland Water Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence