Key Insights

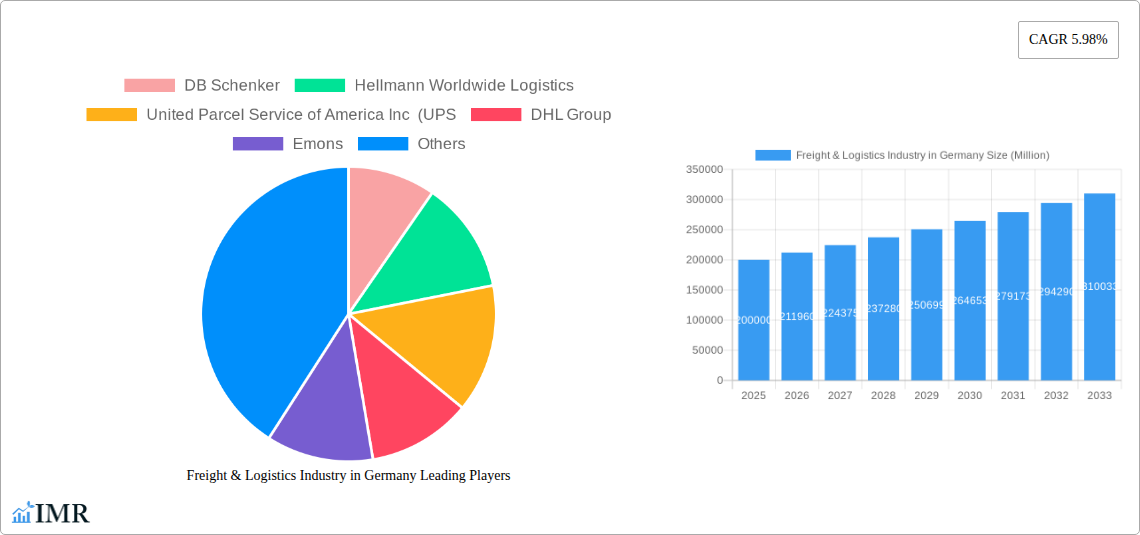

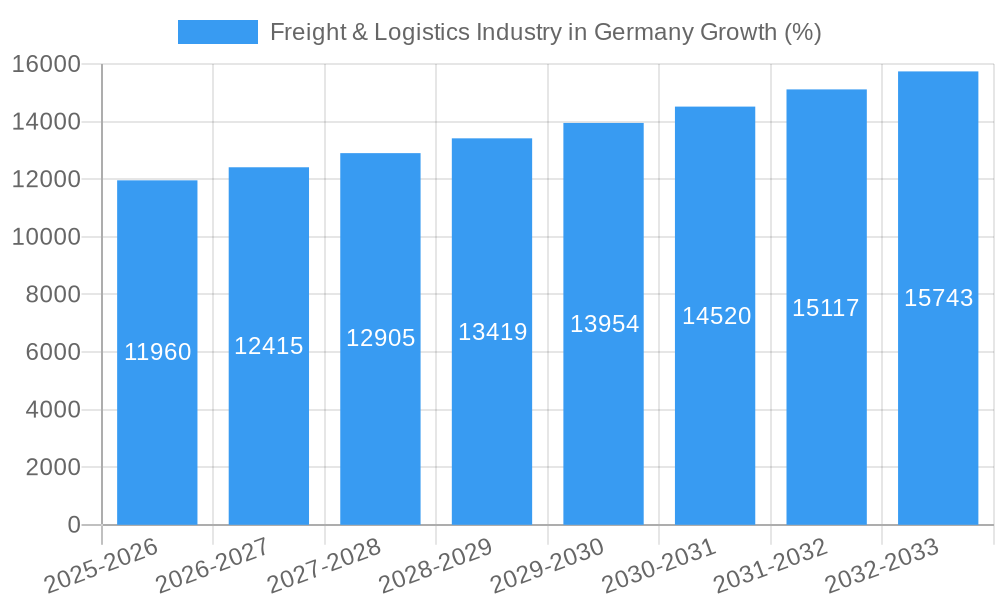

The German freight and logistics market, a cornerstone of Europe's economic engine, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is driven by several key factors. The country's robust manufacturing sector, particularly in automotive, machinery, and chemicals, fuels significant demand for efficient transportation and warehousing solutions. E-commerce's relentless growth further intensifies this demand, necessitating sophisticated logistics networks to handle increased parcel volumes and shorter delivery times. Furthermore, investments in infrastructure modernization, including improved road networks and intermodal facilities, are enhancing operational efficiency and facilitating smoother goods movement. The burgeoning renewable energy sector and associated supply chains also contribute to market expansion. Segment-wise, temperature-controlled logistics, catering to the food and pharmaceutical industries, exhibits strong growth potential, while the courier, express, and parcel (CEP) segment is experiencing a surge due to e-commerce. Germany's strategic location within Europe, making it a crucial logistics hub for both intra-European and global trade, reinforces its market prominence. However, challenges remain, including the ongoing driver shortage, rising fuel costs, and the need for sustainable and environmentally friendly logistics solutions.

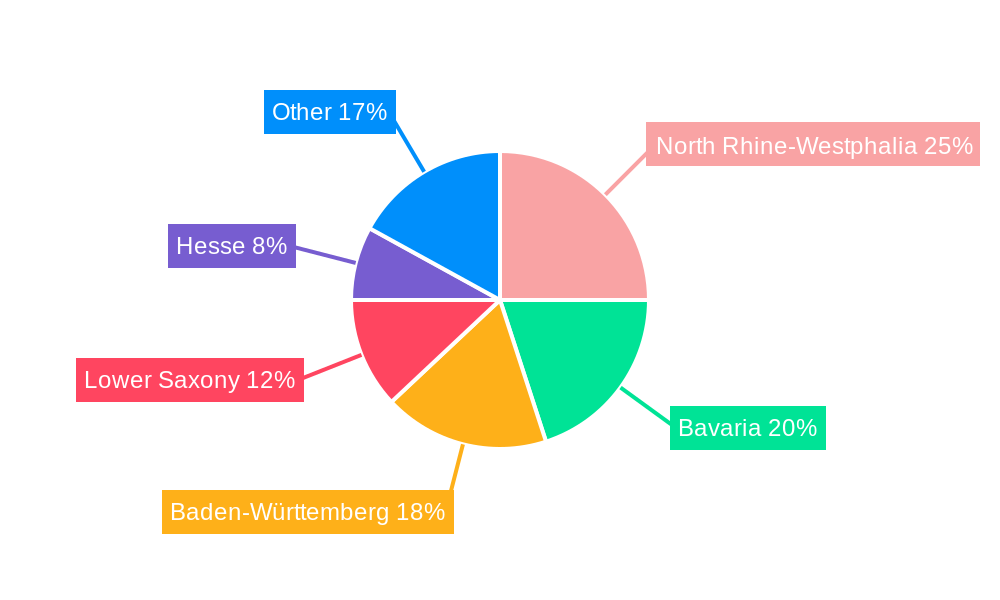

The market's competitive landscape is highly concentrated, with established players like DHL, UPS, and DB Schenker dominating. These large-scale operators possess extensive networks and technological capabilities. However, smaller, specialized logistics providers are also flourishing, focusing on niche areas like temperature-controlled transport or specific industry sectors. This suggests a trend towards greater market segmentation and specialization. Regional variations exist, with strong growth expected in industrial hubs like North Rhine-Westphalia, Bavaria, and Baden-Württemberg. Government initiatives promoting sustainable logistics and digitalization are likely to shape the industry's future trajectory, encouraging investment in innovative solutions and fostering a more efficient and environmentally conscious freight and logistics ecosystem. While challenges related to infrastructure limitations and regulatory changes persist, the overall outlook for the German freight and logistics market remains positive, promising continued expansion and opportunity for both established players and new entrants.

Freight & Logistics Industry in Germany: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the German freight and logistics industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. With a focus on key segments and incorporating recent industry developments, this report is an essential resource for industry professionals, investors, and strategic planners. The report leverages extensive data analysis to offer actionable insights and forecasts for the German freight and logistics market.

Study Period: 2019-2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033; Historical Period: 2019-2024

Freight & Logistics Industry in Germany Market Dynamics & Structure

The German freight and logistics market, valued at xx million EUR in 2024, is characterized by a high level of market concentration amongst major players like DB Schenker, DHL Group, and Dachser, alongside a significant number of smaller specialized companies. Technological innovation, particularly in areas like automation, digitalization, and sustainable solutions, is a key driver. Stringent regulatory frameworks, including environmental regulations and data privacy laws, significantly impact market operations. The market faces competition from alternative transportation methods (e.g., increased rail usage) and experiences ongoing mergers and acquisitions (M&A) activity aimed at consolidating market share and expanding service offerings.

- Market Concentration: High, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on automation (warehousing, trucking), digitalization (supply chain visibility, route optimization), and sustainable logistics (electric vehicles, alternative fuels).

- Regulatory Framework: Stringent environmental regulations (emissions standards), data protection laws (GDPR compliance), and transport regulations.

- Competitive Substitutes: Increased rail freight, intermodal transportation, and the rise of e-commerce influencing last-mile delivery solutions.

- M&A Activity: Significant M&A activity observed in the historical period, with xx deals valued at xx million EUR in 2019-2024 (estimated).

- End-User Demographics: Growing e-commerce sector driving demand for last-mile delivery and express services; increasing focus on sustainability influencing demand for eco-friendly logistics solutions.

Freight & Logistics Industry in Germany Growth Trends & Insights

The German freight and logistics market experienced robust growth during the historical period (2019-2024), driven by strong economic activity and increasing e-commerce penetration. This growth is projected to continue throughout the forecast period (2025-2033), albeit at a slightly moderated pace. Technological disruptions, such as the implementation of autonomous vehicles and the expansion of smart logistics solutions, are expected to significantly influence market dynamics. Shifting consumer behavior, including a growing preference for faster and more sustainable delivery options, will also shape market trends. The market is expected to reach xx million EUR by 2033, exhibiting a CAGR of xx% during the forecast period.

(This section would contain 600 words of detailed analysis based on data. Replace XXX with the specific data source used)

Dominant Regions, Countries, or Segments in Freight & Logistics Industry in Germany

The German freight & logistics market shows strength across various segments and regions. While detailed regional breakdowns are needed for a conclusive answer, Manufacturing and Wholesale & Retail Trade are expected to be the leading end-user industries, fueled by robust industrial production and the booming e-commerce sector. Within logistics functions, Courier, Express, and Parcel (CEP) services are expected to maintain significant dominance, driven by the increasing demand for fast and reliable delivery.

- Key Drivers:

- Manufacturing: High industrial output and strong export-oriented economy.

- Wholesale & Retail Trade: Growth of e-commerce, demanding efficient last-mile delivery solutions.

- CEP Services: Rapid growth of e-commerce and increased consumer expectations for fast deliveries.

- Economic Policies: Government investments in infrastructure and support for logistics innovation.

(This section would contain 600 words of detailed analysis with specific data for market share and growth potential, including sub-segments)

Freight & Logistics Industry in Germany Product Landscape

The German freight and logistics industry offers a wide range of services, including traditional freight forwarding, warehousing, and distribution, as well as specialized offerings such as temperature-controlled transportation and value-added services. Recent innovations focus on digital platforms for real-time tracking, route optimization software powered by AI, and integrated supply chain management solutions. These technological advancements enhance efficiency, visibility, and sustainability, creating unique selling propositions for providers and adding significant value to end-users. Furthermore, there is a growing emphasis on sustainable solutions, such as electric and alternative fuel vehicles, reducing the environmental impact of logistics operations.

Key Drivers, Barriers & Challenges in Freight & Logistics Industry in Germany

Key Drivers: Strong domestic and international trade, growth of e-commerce, technological advancements in automation and digitization, government investments in infrastructure, and a focus on sustainability initiatives.

Key Challenges and Restraints: Driver shortages, increasing fuel costs, rising labor costs, intense competition, regulatory complexities (e.g., emissions standards and border controls), and disruptions in global supply chains resulting in xx million EUR in losses in 2024 (estimated).

Emerging Opportunities in Freight & Logistics Industry in Germany

Emerging opportunities include expansion into niche markets (e.g., specialized healthcare logistics), leveraging emerging technologies (e.g., blockchain for enhanced security and transparency), and meeting the growing demand for sustainable and environmentally friendly logistics solutions. Further opportunity lies in expanding into last-mile delivery services optimized for e-commerce and utilizing advanced route optimization and AI-based solutions to minimize delivery costs.

Growth Accelerators in the Freight & Logistics Industry in Germany Industry

The long-term growth of the German freight and logistics sector is fueled by technological innovations that boost efficiency and sustainability, strategic partnerships that expand service offerings, and market expansion strategies targeting new customer segments and geographical areas. Furthermore, investments in digital infrastructure and talent development programs are crucial for sustaining growth in this competitive industry.

Key Players Shaping the Freight & Logistics Industry in Germany Market

- DB Schenker

- Hellmann Worldwide Logistics

- United Parcel Service of America Inc (UPS)

- DHL Group

- Emons

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Dachser

- FedEx

- Kuehne + Nagel

- Röhlig Logistics

- A Hartrodt

- BLG Logistics

- Rhenus Logistics

Notable Milestones in Freight & Logistics Industry in Germany Sector

- January 2024: Dachser’s Müller Fresh Food Logistics joined the European Food Network (EFN), strengthening its European food distribution network.

- January 2024: Dachser launched "Targo on-site fix," expanding its B2C delivery services and supporting omnichannel concepts.

- January 2024: Kuehne + Nagel announced its Book & Claim insetting solution for electric vehicles, enhancing its decarbonization efforts.

In-Depth Freight & Logistics Industry in Germany Market Outlook

The future of the German freight and logistics market is bright, driven by continued growth in e-commerce, increasing demand for sustainable solutions, and ongoing technological advancements. Strategic partnerships, investments in infrastructure, and a focus on talent development will be crucial for capitalizing on the significant growth opportunities projected for the coming years. The market is poised for significant expansion, with substantial potential for companies that can adapt to changing market dynamics and embrace innovative technologies.

Freight & Logistics Industry in Germany Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Freight & Logistics Industry in Germany Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Freight & Logistics Industry in Germany REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. North Rhine-Westphalia Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 12. Bavaria Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 13. Baden-Württemberg Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 14. Lower Saxony Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 15. Hesse Freight & Logistics Industry in Germany Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 DB Schenker

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Hellmann Worldwide Logistics

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 United Parcel Service of America Inc (UPS

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DHL Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Emons

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Dachser

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 FedEx

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kuehne + Nagel

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Röhlig Logistics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 A Hartrodt

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 BLG Logistics

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Rhenus Logistics

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 DB Schenker

List of Figures

- Figure 1: Global Freight & Logistics Industry in Germany Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Germany Freight & Logistics Industry in Germany Revenue (Million), by Country 2024 & 2032

- Figure 3: Germany Freight & Logistics Industry in Germany Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Freight & Logistics Industry in Germany Revenue (Million), by End User Industry 2024 & 2032

- Figure 5: North America Freight & Logistics Industry in Germany Revenue Share (%), by End User Industry 2024 & 2032

- Figure 6: North America Freight & Logistics Industry in Germany Revenue (Million), by Logistics Function 2024 & 2032

- Figure 7: North America Freight & Logistics Industry in Germany Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 8: North America Freight & Logistics Industry in Germany Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Freight & Logistics Industry in Germany Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Freight & Logistics Industry in Germany Revenue (Million), by End User Industry 2024 & 2032

- Figure 11: South America Freight & Logistics Industry in Germany Revenue Share (%), by End User Industry 2024 & 2032

- Figure 12: South America Freight & Logistics Industry in Germany Revenue (Million), by Logistics Function 2024 & 2032

- Figure 13: South America Freight & Logistics Industry in Germany Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 14: South America Freight & Logistics Industry in Germany Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Freight & Logistics Industry in Germany Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Freight & Logistics Industry in Germany Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: Europe Freight & Logistics Industry in Germany Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: Europe Freight & Logistics Industry in Germany Revenue (Million), by Logistics Function 2024 & 2032

- Figure 19: Europe Freight & Logistics Industry in Germany Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 20: Europe Freight & Logistics Industry in Germany Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Freight & Logistics Industry in Germany Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Freight & Logistics Industry in Germany Revenue (Million), by End User Industry 2024 & 2032

- Figure 23: Middle East & Africa Freight & Logistics Industry in Germany Revenue Share (%), by End User Industry 2024 & 2032

- Figure 24: Middle East & Africa Freight & Logistics Industry in Germany Revenue (Million), by Logistics Function 2024 & 2032

- Figure 25: Middle East & Africa Freight & Logistics Industry in Germany Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 26: Middle East & Africa Freight & Logistics Industry in Germany Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Freight & Logistics Industry in Germany Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Freight & Logistics Industry in Germany Revenue (Million), by End User Industry 2024 & 2032

- Figure 29: Asia Pacific Freight & Logistics Industry in Germany Revenue Share (%), by End User Industry 2024 & 2032

- Figure 30: Asia Pacific Freight & Logistics Industry in Germany Revenue (Million), by Logistics Function 2024 & 2032

- Figure 31: Asia Pacific Freight & Logistics Industry in Germany Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 32: Asia Pacific Freight & Logistics Industry in Germany Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Freight & Logistics Industry in Germany Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Rhine-Westphalia Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Bavaria Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Baden-Württemberg Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Lower Saxony Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Hesse Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 13: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 19: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 24: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 25: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 36: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 37: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 45: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 46: Global Freight & Logistics Industry in Germany Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Freight & Logistics Industry in Germany Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight & Logistics Industry in Germany?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Freight & Logistics Industry in Germany?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, United Parcel Service of America Inc (UPS, DHL Group, Emons, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dachser, FedEx, Kuehne + Nagel, Röhlig Logistics, A Hartrodt, BLG Logistics, Rhenus Logistics.

3. What are the main segments of the Freight & Logistics Industry in Germany?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: Dachser’s subsidiary for food logistics, Müller Fresh Food Logistics, officially became a partner in the European Food Network (EFN) on January 1, 2024. DACHSER acquired the company at the beginning of 2023. This move was part of its plan to strengthen its Europe-wide food distribution network.January 2024: Dachser has launched a new product throughout Europe, "Targo on-site fix", which supports its customers’ omnichannel concepts and allows for complete flexibility when arranging delivery dates. It was a part of its plan to expand its B2C delivery services in Europe.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Freight & Logistics Industry in Germany," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Freight & Logistics Industry in Germany report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Freight & Logistics Industry in Germany?

To stay informed about further developments, trends, and reports in the Freight & Logistics Industry in Germany, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence