Key Insights

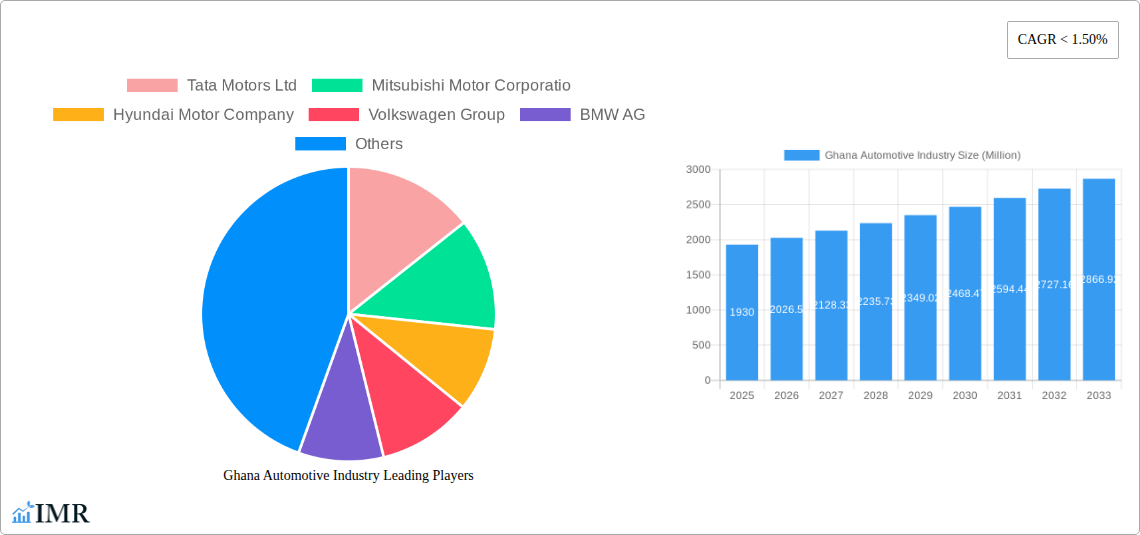

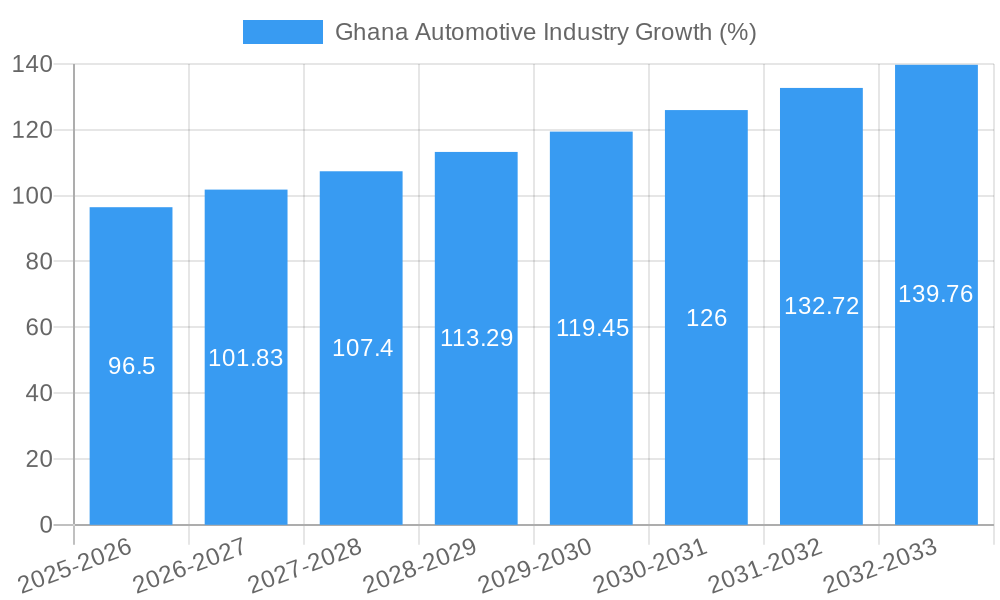

The Ghana automotive industry, valued at $1.93 billion in 2025, is poised for significant growth over the forecast period (2025-2033). Driven by factors such as increasing disposable incomes, expanding infrastructure development, and government initiatives promoting local manufacturing and assembly, the sector is expected to experience a robust Compound Annual Growth Rate (CAGR). While the precise CAGR isn't provided, considering the growth trajectory of similar developing economies and the ongoing investments in Ghana's infrastructure, a conservative estimate of 5-7% CAGR is plausible for the forecast period. This translates to a market size exceeding $3 billion by 2033. The industry is currently dominated by used vehicle imports, however, a growing middle class and government policies aimed at boosting domestic manufacturing are expected to gradually shift this balance towards new vehicle sales and local assembly. This shift will depend on the success of initiatives aimed at attracting foreign direct investment, developing a skilled workforce, and establishing robust supply chains. The market's growth is also contingent on the stability of the Ghanaian Cedi and the overall economic climate.

A key aspect of the Ghanaian automotive market is the opportunity for growth in the commercial vehicle segment, particularly light commercial vehicles (LCVs) and heavy-duty trucks needed to support infrastructure projects and the burgeoning agricultural sector. Furthermore, the potential for electric vehicle (EV) adoption, although currently limited, presents a long-term growth avenue, depending on the development of charging infrastructure and government incentives. Challenges facing the industry include import duties, logistical bottlenecks, and the need for further investment in training and skills development. Overcoming these challenges will be critical in fully realizing the market's potential.

Ghana Automotive Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Ghana automotive industry, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both the parent market (automotive) and child markets (passenger cars, commercial vehicles, two-wheelers, three-wheelers, electric vehicles, and internal combustion engine vehicles), this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market sizes are presented in million units.

Ghana Automotive Industry Market Dynamics & Structure

The Ghanaian automotive market is characterized by a fragmented landscape with a mix of international and local players. Market concentration is relatively low, with no single dominant player controlling a significant share. Technological innovation, particularly in electric vehicles (EVs), is driven by government initiatives promoting sustainable transportation and increasing consumer awareness of environmental concerns. Regulatory frameworks are evolving to support this transition, while challenges remain in terms of infrastructure development and standardization. Competition from used vehicle imports presents a significant challenge to new vehicle sales. The end-user demographic is diverse, ranging from individual consumers to businesses and government fleets. Mergers and acquisitions (M&A) activity remains limited but is expected to increase with growing investor interest in the African automotive sector.

- Market Concentration: Low, with no dominant player.

- Technological Innovation: Driven by EV adoption and government support.

- Regulatory Framework: Evolving but presents challenges.

- Competitive Substitutes: Used vehicle imports significantly impact the market.

- End-User Demographics: Diverse, including individuals, businesses, and government.

- M&A Activity: Limited currently, but potential for growth.

Ghana Automotive Industry Growth Trends & Insights

The Ghanaian automotive market experienced [xx] million unit sales in 2024. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of [xx]% during the forecast period (2025-2033), reaching [xx] million units by 2033. This growth is driven by factors such as rising disposable incomes, expanding infrastructure, and government initiatives promoting automotive manufacturing. The adoption rate of EVs is still nascent but is expected to increase significantly due to government incentives and falling battery prices. Consumer behavior is shifting towards smaller, more fuel-efficient vehicles, driven by economic considerations and growing traffic congestion.

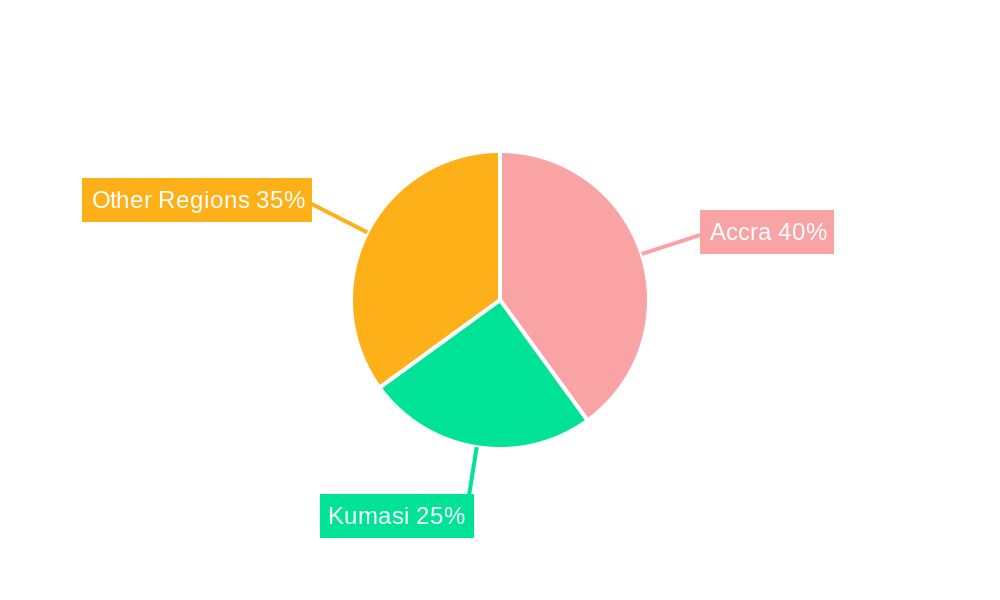

Dominant Regions, Countries, or Segments in Ghana Automotive Industry

The passenger car segment dominates the Ghanaian automotive market, accounting for [xx]% of total vehicle sales in 2024. Within passenger cars, the internal combustion engine (ICE) segment still holds the largest share, but the electric vehicle (EV) segment is experiencing rapid growth driven by government incentives and rising environmental concerns. The Accra region is the largest market for vehicles, followed by other major urban centers. Key drivers of market growth include government policies supporting automotive manufacturing, infrastructure improvements and increasing urbanization.

- Dominant Segment: Passenger Cars (ICE initially; EVs growing rapidly)

- Key Growth Drivers: Government support, infrastructure development, urbanization.

- Regional Dominance: Accra region followed by other major urban areas.

Ghana Automotive Industry Product Landscape

The Ghanaian automotive market offers a diverse range of vehicles, from entry-level passenger cars to heavy commercial vehicles and motorcycles. Innovation is focused on fuel efficiency, safety features, and affordability. Technological advancements are primarily driven by the adoption of new technologies in ICE vehicles and the increasing availability of more affordable EVs. Unique selling propositions focus on durability, reliability, and suitability for the local operating conditions.

Key Drivers, Barriers & Challenges in Ghana Automotive Industry

Key Drivers: Rising disposable incomes, government incentives for local assembly, improving infrastructure, and increasing urbanization are key drivers of growth.

Challenges: High import duties, limited access to financing, poor road infrastructure in some areas, and a lack of skilled labor are significant barriers to growth. The market is also susceptible to global economic fluctuations. Supply chain disruptions, evidenced by xx% increase in import costs in [Year], have also negatively impacted growth.

Emerging Opportunities in Ghana Automotive Industry

Opportunities exist in the expansion of the EV market, the development of localized after-sales service networks, and the provision of financing options for vehicle purchases. The growing ride-hailing industry presents significant potential for the adoption of EVs and three-wheelers. Furthermore, the government's focus on sustainable transportation provides an environment for growth in the green vehicle segment.

Growth Accelerators in the Ghana Automotive Industry

The long-term growth of the Ghanaian automotive market will be driven by further government support for local assembly and investment in infrastructure. Technological advancements in battery technology, leading to more affordable and higher-performing EVs, will also be crucial. Strategic partnerships between local and international players can accelerate market expansion and technology transfer.

Key Players Shaping the Ghana Automotive Industry Market

- Tata Motors Ltd

- Mitsubishi Motor Corporation

- Hyundai Motor Company

- Volkswagen Group

- BMW AG

- Mercedes-Benz Group AG

- Nissan Motor Co Ltd

- Toyota Motor Corporation

- Honda Motor Company Ltd

- Bajaj Motors

- Kantaka Group

- Volvo Group

- Ford Motor Company

Notable Milestones in Ghana Automotive Industry Sector

- March 2023: TVS Motor Company launched the TVS King Series three-wheelers, expanding its market reach.

- March 2023: Toyota Manufacturing Ghana Co. Limited commissioned its first locally assembled Suzuki Swift, signaling increased local production.

- October 2022: SIXAI and Musashi Seimitsu announced plans to produce and lease electric motorcycles, boosting the EV sector.

- March 2022: SolarTaxi launched Africa's first electric car on a ride-hailing app, promoting green mobility options.

In-Depth Ghana Automotive Industry Market Outlook

The Ghanaian automotive market holds significant long-term potential, driven by continued economic growth, urbanization, and government support for the sector. Strategic investments in infrastructure and technology, coupled with supportive policies, are crucial for unlocking this potential and positioning Ghana as a regional automotive hub. The increasing adoption of EVs presents significant opportunities for both local and international players.

Ghana Automotive Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Two-wheelers

- 1.4. Three-wheelers

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric Vehicles

-

3. Type

- 3.1. New Vehicles

- 3.2. Used Vehicles

Ghana Automotive Industry Segmentation By Geography

- 1. Ghana

Ghana Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market

- 3.3. Market Restrains

- 3.3.1. High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Hold Majority of the Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ghana Automotive Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Two-wheelers

- 5.1.4. Three-wheelers

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. New Vehicles

- 5.3.2. Used Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ghana

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tata Motors Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Motor Corporatio

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Motor Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BMW AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes-Benz Group AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan Motor Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honda Motor Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bajaj Motors

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kantaka Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Volvo Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Ford Motor Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Tata Motors Ltd

List of Figures

- Figure 1: Ghana Automotive Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ghana Automotive Industry Share (%) by Company 2024

List of Tables

- Table 1: Ghana Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ghana Automotive Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Ghana Automotive Industry Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 4: Ghana Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Ghana Automotive Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Ghana Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Ghana Automotive Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Ghana Automotive Industry Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 9: Ghana Automotive Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Ghana Automotive Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ghana Automotive Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Ghana Automotive Industry?

Key companies in the market include Tata Motors Ltd, Mitsubishi Motor Corporatio, Hyundai Motor Company, Volkswagen Group, BMW AG, Mercedes-Benz Group AG, Nissan Motor Co Ltd, Toyota Motor Corporation, Honda Motor Company Ltd, Bajaj Motors, Kantaka Group, Volvo Group, Ford Motor Company.

3. What are the main segments of the Ghana Automotive Industry?

The market segments include Vehicle Type, Propulsion, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market.

6. What are the notable trends driving market growth?

Passenger Car Segment to Hold Majority of the Market Share.

7. Are there any restraints impacting market growth?

High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion.

8. Can you provide examples of recent developments in the market?

March 2023: TVS Motor Company announced the launch of new three-wheeler products in Ghana, the TVS King Series. The launch aims to expand the company’s reach and develop new avenues for growth in the African market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ghana Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ghana Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ghana Automotive Industry?

To stay informed about further developments, trends, and reports in the Ghana Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence