Key Insights

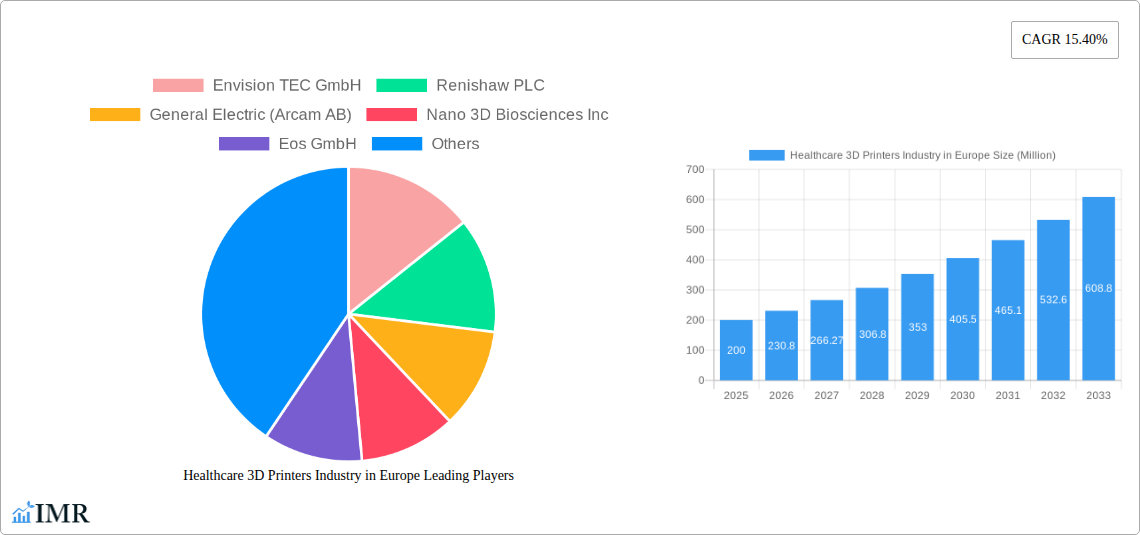

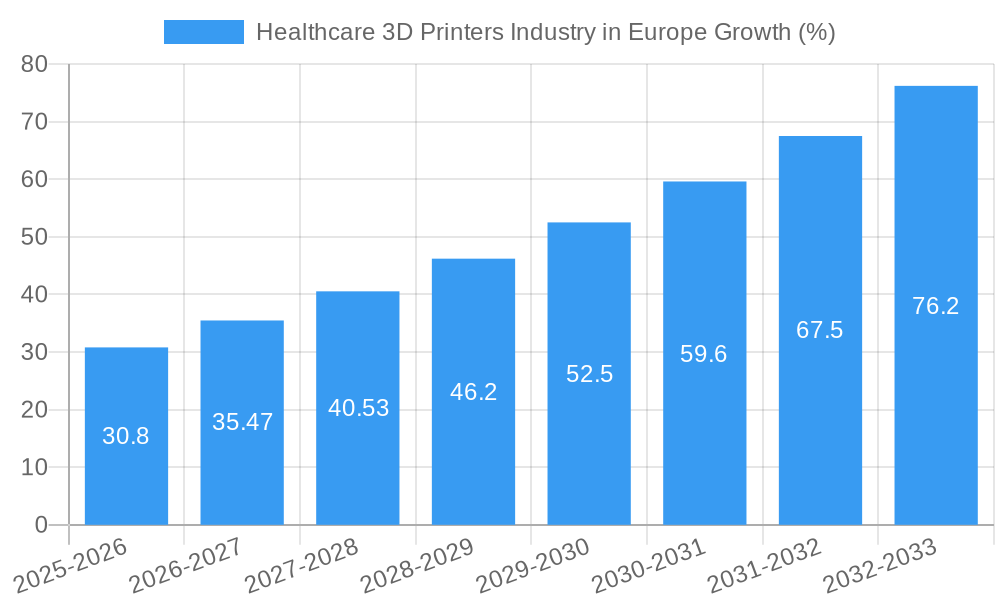

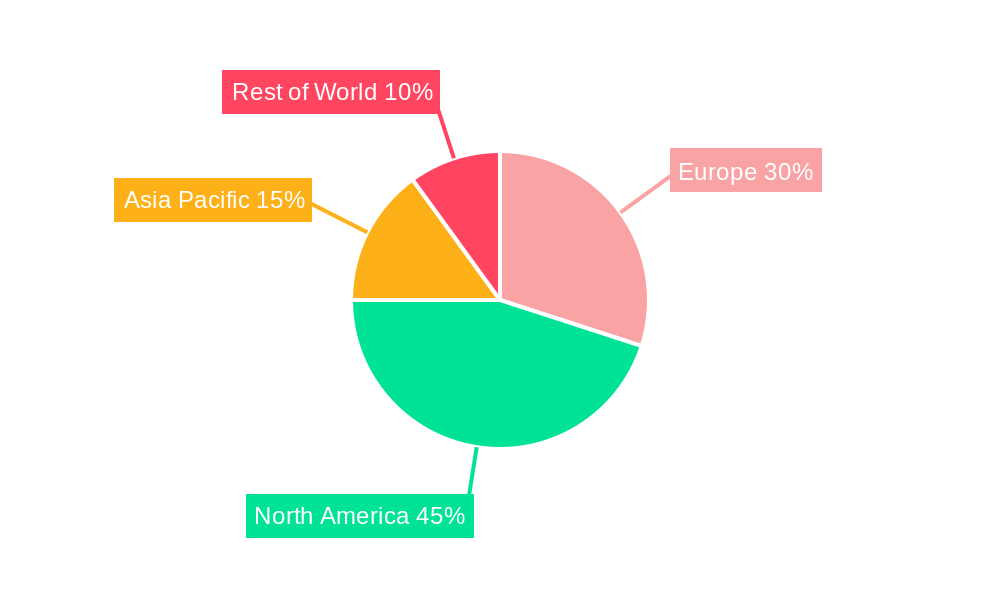

The European healthcare 3D printing market is experiencing robust growth, driven by increasing demand for personalized medicine, advancements in additive manufacturing technologies, and a rising prevalence of chronic diseases requiring customized implants and prosthetics. The market, estimated at €[Estimate based on market size XX and value unit Million - Assume XX is a number like 200; then estimate would be 200 Million Euros for 2025. Adjust this based on your actual XX value.] in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 15.40% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the adoption of 3D printing for creating patient-specific implants and prosthetics is accelerating, leading to improved surgical outcomes and reduced recovery times. Secondly, the bioprinting segment is witnessing significant advancements, enabling the creation of functional tissues and organs for transplantation, a field with immense future potential. Furthermore, the increasing availability of advanced materials, such as biocompatible polymers and metals, is broadening the applications of 3D printing in healthcare. Germany, France, and the United Kingdom are expected to remain dominant markets within Europe, contributing significantly to the overall regional growth.

However, market growth is not without its challenges. The high initial investment costs associated with 3D printing equipment and the need for skilled professionals to operate and maintain these systems can act as restraints. Regulatory hurdles and the need for rigorous quality control procedures also present obstacles to widespread adoption. Despite these limitations, the long-term prospects for the European healthcare 3D printing market remain positive, with continuous technological innovations and increasing government support expected to drive further expansion in the coming years. The market segmentation by technology (Stereolithography, Selective Laser Melting etc.), application (bioprinting, implants, dentistry etc.), and materials (metals, polymers, ceramics) offers various investment opportunities for companies involved in research, development, and manufacturing within this dynamic sector.

Healthcare 3D Printers Industry in Europe: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European healthcare 3D printing market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It segments the market by technology (Stereo Lithography, Deposition Modeling, Electron Beam Melting, Laser Sintering, Jetting Technology, Laminated Object Manufacturing, Other Technologies), applications (Bioprinting, Implants, Prosthetics, Dentistry, Other Applications), and materials (Metals and Alloys, Polymers, Ceramics, Other Materials). Key players analyzed include Envision TEC GmbH, Renishaw PLC, General Electric (Arcam AB), Nano 3D Biosciences Inc, Eos GmbH, Organovo Holding Inc, 3D Systems Corporation, Materialise NV, Stratasys Ltd, and Oxford Performance Materials. The report provides valuable insights for industry professionals, investors, and strategic decision-makers.

Healthcare 3D Printers Industry in Europe Market Dynamics & Structure

The European healthcare 3D printing market is characterized by moderate concentration, with several key players competing alongside smaller, specialized firms. Technological innovation, driven by advancements in materials science and printing techniques, is a major growth driver. Stringent regulatory frameworks, particularly concerning medical device approvals, present both challenges and opportunities. Competitive substitutes, such as traditional manufacturing methods, continue to exert pressure, but 3D printing's advantages in customization and speed are increasingly attractive. The end-user demographic is diverse, encompassing hospitals, research institutions, and medical device manufacturers. M&A activity has been relatively modest (xx deals in the last 5 years), reflecting a market still in its growth phase.

- Market Concentration: Moderately concentrated, with a top 5 market share of approximately 65%.

- Technological Innovation: Strong driver, focused on improving resolution, speed, and material biocompatibility.

- Regulatory Framework: Stringent, requiring extensive testing and approvals for medical devices.

- Competitive Substitutes: Traditional manufacturing processes pose a competitive challenge.

- End-User Demographics: Hospitals, research institutions, and medical device manufacturers.

- M&A Trends: Moderate activity, with xx deals recorded between 2019 and 2024.

Healthcare 3D Printers Industry in Europe Growth Trends & Insights

The European healthcare 3D printing market has experienced significant growth from 2019 to 2024, reaching an estimated market size of xx Million units in 2024. This growth is attributed to the increasing adoption of 3D printing technologies in various medical applications, fueled by technological advancements that enhance precision, speed, and material biocompatibility. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), driven by factors such as the rising demand for personalized medicine, increasing investments in research and development, and the growing awareness of 3D printing's benefits in healthcare. The market penetration rate for 3D printing in healthcare is expected to reach xx% by 2033, reflecting substantial growth potential. Consumer behavior is shifting towards greater acceptance of 3D-printed medical devices and implants due to their improved functionality and personalized design. Technological disruptions, such as the development of novel biocompatible materials and advanced printing techniques, further contribute to market expansion.

Dominant Regions, Countries, or Segments in Healthcare 3D Printers Industry in Europe

Germany and the UK are currently the leading markets in Europe for healthcare 3D printing, driven by strong technological capabilities, established healthcare infrastructure, and significant investments in R&D. Within the application segments, Implants and Prosthetics hold the largest market share, owing to the increasing demand for customized medical devices. The Metals and Alloys materials segment is also prominent due to its suitability for creating strong and biocompatible implants.

- Key Drivers: Strong healthcare infrastructure, substantial R&D investments, government support for innovation, and a growing demand for personalized medicine.

- Germany: Leading market due to its strong manufacturing base and presence of several key players.

- United Kingdom: Significant market due to its robust healthcare system and active research community.

- Implants & Prosthetics: Largest application segment due to increasing demand for customized devices.

- Metals & Alloys: Dominant materials segment due to its biocompatibility and strength properties.

Healthcare 3D Printers Industry in Europe Product Landscape

The healthcare 3D printing product landscape is characterized by continuous innovation in printer technology, materials, and software. Recent advancements include higher-resolution printing, improved biomaterial compatibility, and the integration of AI for automated design and manufacturing processes. These improvements enable the creation of more complex and intricate medical devices, leading to enhanced functionality and improved patient outcomes. Key selling propositions center around customization, speed of production, reduced costs, and improved accuracy compared to traditional manufacturing methods.

Key Drivers, Barriers & Challenges in Healthcare 3D Printers Industry in Europe

Key Drivers: Increasing demand for personalized medicine, advancements in materials science and printing technology, government support for innovation, and rising healthcare expenditure. For example, the growing adoption of bioprinting for organ regeneration is driving substantial growth.

Challenges and Restraints: Stringent regulatory approvals for medical devices create significant hurdles. High initial investment costs and the need for skilled personnel pose barriers to entry. Supply chain disruptions and the competition from traditional manufacturing processes also present challenges. The estimated impact of regulatory hurdles on market growth is approximately xx% annually.

Emerging Opportunities in Healthcare 3D Printers Industry in Europe

Emerging opportunities exist in bioprinting for organ regeneration, personalized prosthetics tailored to individual patient needs, and the development of novel biocompatible materials. Expansion into underserved markets in Eastern Europe and the development of innovative applications, such as 3D-printed surgical tools, also offer substantial potential.

Growth Accelerators in the Healthcare 3D Printers Industry in Europe Industry

Technological advancements, particularly in materials science and printing techniques, are key drivers of long-term growth. Strategic partnerships between technology providers, healthcare institutions, and regulatory bodies will further accelerate market expansion. Government initiatives promoting innovation and investment in the healthcare sector also provide a significant boost to market growth.

Key Players Shaping the Healthcare 3D Printers Industry in Europe Market

- Envision TEC GmbH

- Renishaw PLC

- General Electric (Arcam AB)

- Nano 3D Biosciences Inc

- Eos GmbH

- Organovo Holding Inc

- 3D Systems Corporation

- Materialise NV

- Stratasys Ltd

- Oxford Performance Materials

Notable Milestones in Healthcare 3D Printers Industry in Europe Sector

- July 2022: Sculpteo and Daniel Robert Orthopedic launched a bio-sourced 3D-printed orthopedic device, signifying a move towards sustainable materials in medical device manufacturing.

- June 2021: Stratasys launched the J5 MediJet Medical 3D printer, enhancing the capabilities for creating detailed anatomical models and surgical guides.

In-Depth Healthcare 3D Printers Industry in Europe Market Outlook

The European healthcare 3D printing market is poised for significant growth in the coming years, driven by continued technological advancements, increasing demand for personalized medicine, and supportive regulatory frameworks. Strategic partnerships and collaborations among industry players, research institutions, and regulatory bodies will be crucial in unlocking the full potential of this transformative technology. The market's long-term prospects are bright, offering substantial opportunities for innovation and expansion.

Healthcare 3D Printers Industry in Europe Segmentation

-

1. Technology

- 1.1. Stereo Lithography

- 1.2. Deposition Modeling

- 1.3. Electron Beam Melting

- 1.4. Laser Sintering

- 1.5. Jetting Technology

- 1.6. Laminated Object Manufacturing

- 1.7. Other Technologies

-

2. Applications

- 2.1. Bioprinting

- 2.2. Implants

- 2.3. Prosthetics

- 2.4. Dentistry

- 2.5. Other Applications

-

3. Materials

- 3.1. Metals and Alloys

- 3.2. Polymers

- 3.3. Ceramics

- 3.4. Other Materials

Healthcare 3D Printers Industry in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Healthcare 3D Printers Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Leading to Enhanced Application; Increasing Demand for Customized 3D Printing

- 3.3. Market Restrains

- 3.3.1. Lack of Trained Professionals; Absence of Specific Regulatory Guidelines

- 3.4. Market Trends

- 3.4.1. Metal and Alloy Segment is Dominating the European Healthcare 3D Printing Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereo Lithography

- 5.1.2. Deposition Modeling

- 5.1.3. Electron Beam Melting

- 5.1.4. Laser Sintering

- 5.1.5. Jetting Technology

- 5.1.6. Laminated Object Manufacturing

- 5.1.7. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Bioprinting

- 5.2.2. Implants

- 5.2.3. Prosthetics

- 5.2.4. Dentistry

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Materials

- 5.3.1. Metals and Alloys

- 5.3.2. Polymers

- 5.3.3. Ceramics

- 5.3.4. Other Materials

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereo Lithography

- 6.1.2. Deposition Modeling

- 6.1.3. Electron Beam Melting

- 6.1.4. Laser Sintering

- 6.1.5. Jetting Technology

- 6.1.6. Laminated Object Manufacturing

- 6.1.7. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Applications

- 6.2.1. Bioprinting

- 6.2.2. Implants

- 6.2.3. Prosthetics

- 6.2.4. Dentistry

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Materials

- 6.3.1. Metals and Alloys

- 6.3.2. Polymers

- 6.3.3. Ceramics

- 6.3.4. Other Materials

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United Kingdom Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereo Lithography

- 7.1.2. Deposition Modeling

- 7.1.3. Electron Beam Melting

- 7.1.4. Laser Sintering

- 7.1.5. Jetting Technology

- 7.1.6. Laminated Object Manufacturing

- 7.1.7. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Applications

- 7.2.1. Bioprinting

- 7.2.2. Implants

- 7.2.3. Prosthetics

- 7.2.4. Dentistry

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Materials

- 7.3.1. Metals and Alloys

- 7.3.2. Polymers

- 7.3.3. Ceramics

- 7.3.4. Other Materials

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereo Lithography

- 8.1.2. Deposition Modeling

- 8.1.3. Electron Beam Melting

- 8.1.4. Laser Sintering

- 8.1.5. Jetting Technology

- 8.1.6. Laminated Object Manufacturing

- 8.1.7. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Applications

- 8.2.1. Bioprinting

- 8.2.2. Implants

- 8.2.3. Prosthetics

- 8.2.4. Dentistry

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Materials

- 8.3.1. Metals and Alloys

- 8.3.2. Polymers

- 8.3.3. Ceramics

- 8.3.4. Other Materials

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Italy Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereo Lithography

- 9.1.2. Deposition Modeling

- 9.1.3. Electron Beam Melting

- 9.1.4. Laser Sintering

- 9.1.5. Jetting Technology

- 9.1.6. Laminated Object Manufacturing

- 9.1.7. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Applications

- 9.2.1. Bioprinting

- 9.2.2. Implants

- 9.2.3. Prosthetics

- 9.2.4. Dentistry

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Materials

- 9.3.1. Metals and Alloys

- 9.3.2. Polymers

- 9.3.3. Ceramics

- 9.3.4. Other Materials

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Spain Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stereo Lithography

- 10.1.2. Deposition Modeling

- 10.1.3. Electron Beam Melting

- 10.1.4. Laser Sintering

- 10.1.5. Jetting Technology

- 10.1.6. Laminated Object Manufacturing

- 10.1.7. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Applications

- 10.2.1. Bioprinting

- 10.2.2. Implants

- 10.2.3. Prosthetics

- 10.2.4. Dentistry

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Materials

- 10.3.1. Metals and Alloys

- 10.3.2. Polymers

- 10.3.3. Ceramics

- 10.3.4. Other Materials

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Rest of Europe Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Stereo Lithography

- 11.1.2. Deposition Modeling

- 11.1.3. Electron Beam Melting

- 11.1.4. Laser Sintering

- 11.1.5. Jetting Technology

- 11.1.6. Laminated Object Manufacturing

- 11.1.7. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Applications

- 11.2.1. Bioprinting

- 11.2.2. Implants

- 11.2.3. Prosthetics

- 11.2.4. Dentistry

- 11.2.5. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Materials

- 11.3.1. Metals and Alloys

- 11.3.2. Polymers

- 11.3.3. Ceramics

- 11.3.4. Other Materials

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Germany Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Healthcare 3D Printers Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Envision TEC GmbH

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Renishaw PLC

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 General Electric (Arcam AB)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Nano 3D Biosciences Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Eos GmbH

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Organovo Holding Inc

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 3D Systems Corporation

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Materialise NV

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Stratasys Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Oxford Performance Materials

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Envision TEC GmbH

List of Figures

- Figure 1: Healthcare 3D Printers Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Healthcare 3D Printers Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 4: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 5: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Healthcare 3D Printers Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 15: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 16: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 17: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 19: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 20: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 21: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 23: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 24: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 25: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 28: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 29: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 31: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 32: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 33: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Technology 2019 & 2032

- Table 35: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Applications 2019 & 2032

- Table 36: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Materials 2019 & 2032

- Table 37: Healthcare 3D Printers Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare 3D Printers Industry in Europe?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Healthcare 3D Printers Industry in Europe?

Key companies in the market include Envision TEC GmbH, Renishaw PLC, General Electric (Arcam AB), Nano 3D Biosciences Inc, Eos GmbH, Organovo Holding Inc, 3D Systems Corporation, Materialise NV, Stratasys Ltd, Oxford Performance Materials.

3. What are the main segments of the Healthcare 3D Printers Industry in Europe?

The market segments include Technology, Applications, Materials.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Leading to Enhanced Application; Increasing Demand for Customized 3D Printing.

6. What are the notable trends driving market growth?

Metal and Alloy Segment is Dominating the European Healthcare 3D Printing Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Trained Professionals; Absence of Specific Regulatory Guidelines.

8. Can you provide examples of recent developments in the market?

July 2022: Sculpteo and Daniel Robert Orthopedic launched a Bio-sourced 3D printed device. The collaboration will produce orthopedic devices from a bio-sourced material that will be made possible by 3D printing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare 3D Printers Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare 3D Printers Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare 3D Printers Industry in Europe?

To stay informed about further developments, trends, and reports in the Healthcare 3D Printers Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence