Key Insights

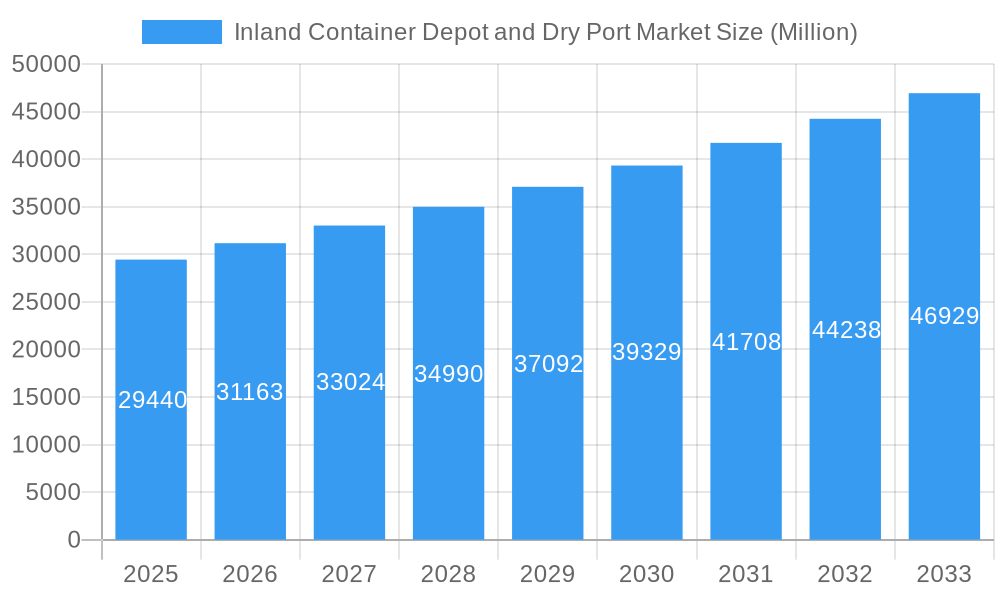

The Inland Container Depot (ICD) and Dry Port market is experiencing robust growth, projected to reach \$29.44 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 5.45% from 2025 to 2033. This expansion is fueled by several key factors. The rise in global trade and e-commerce necessitates efficient logistics solutions, driving demand for ICDs and dry ports as crucial nodes in the supply chain. Increased infrastructure development, particularly in emerging economies, further contributes to market growth. Furthermore, government initiatives aimed at streamlining customs procedures and improving port efficiency are creating a more favorable environment for ICD and dry port operators. The adoption of advanced technologies, such as automation and digitalization, is enhancing operational efficiency and reducing costs, further boosting market attractiveness. Major players like Boasso Global, Maersk, and DP World are strategically investing in expanding their capacities and optimizing their operations to capitalize on this growth. Competition is intensifying, pushing companies to offer innovative solutions and superior services to secure market share.

Inland Container Depot and Dry Port Market Market Size (In Billion)

However, challenges remain. Geopolitical uncertainties and trade disputes can disrupt supply chains and impact market growth. Fluctuations in fuel prices and currency exchange rates add to the operational complexities. Furthermore, the need for substantial upfront investment in infrastructure development and skilled labor can pose barriers to entry for smaller players. Despite these challenges, the long-term outlook for the ICD and dry port market remains positive, driven by the sustained growth of global trade and the continuous need for efficient and reliable logistics solutions. The market is expected to see significant expansion in regions with developing economies and improving infrastructure. The competitive landscape is dynamic, with existing players focusing on expansion and consolidation, while new entrants seek to carve out a niche.

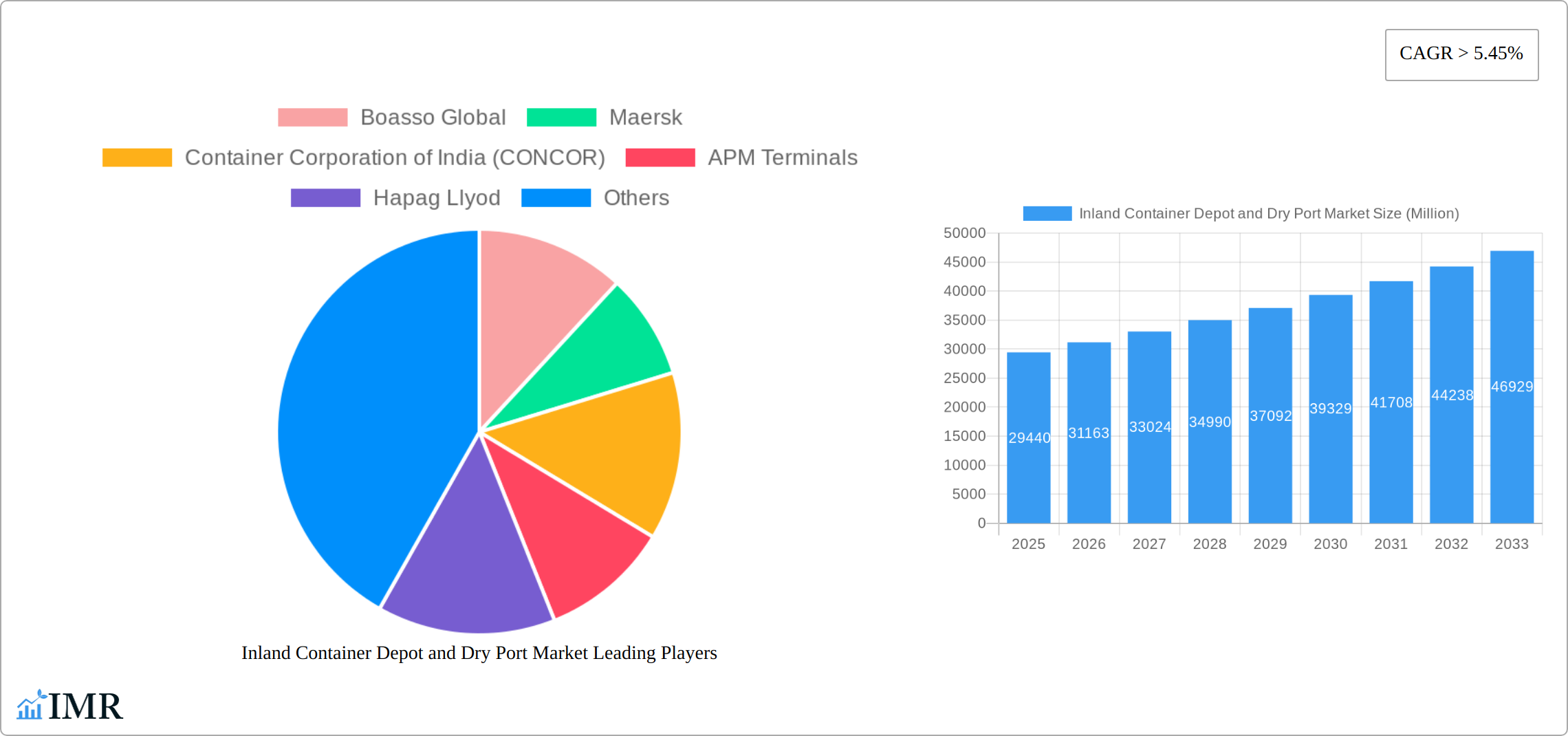

Inland Container Depot and Dry Port Market Company Market Share

Inland Container Depot and Dry Port Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Inland Container Depot and Dry Port market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The parent market is the global logistics and transportation industry, while the child market focuses specifically on inland container depots and dry ports. The report projects a market size of xx Million in 2025 and xx Million by 2033.

Inland Container Depot and Dry Port Market Market Dynamics & Structure

This section provides a comprehensive analysis of the Inland Container Depot and Dry Port market, examining its competitive environment, the impact of technological advancements, regulatory influences, and emerging market trends. The market exhibits a moderately concentrated structure, with a few prominent players like Boasso Global, Maersk, Container Corporation of India (CONCOR), APM Terminals, Hapag-Lloyd, Hutchison Ports, GAC, DP World, Abu Dhabi Terminals, and Freightliner Group Ltd. commanding a significant portion of the market share. However, the presence of a substantial number of smaller operators signifies a more fragmented competitive landscape.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for this market is estimated at xx, indicating a moderately concentrated market. This suggests that while a few players hold a notable share, there is still room for competition and smaller entities to operate and grow.

Technological Innovation: Key drivers of innovation within the sector include the implementation of automation, digitization (including the strategic use of blockchain technology for enhanced transparency and traceability of goods), and continuous infrastructure improvements. Despite these advancements, significant barriers to widespread adoption persist, primarily due to the substantial initial investment costs and the complexities associated with integrating new technologies into existing operational frameworks.

Regulatory Frameworks: Government policies are instrumental in shaping the market. Initiatives focused on trade facilitation, robust infrastructure development, and the creation of efficient logistics networks play a crucial role in driving market growth. Conversely, variations in regulatory approaches across different geographical regions can present both lucrative opportunities and considerable challenges for businesses operating in the sector.

Competitive Product Substitutes: Traditional warehousing and transportation methods continue to pose a competitive threat, particularly in regions where infrastructure development lags behind. Nevertheless, the inherent efficiency, cost-effectiveness, and streamlined processes offered by inland container depots and dry ports are increasingly driving their adoption and market penetration.

End-User Demographics: The primary end-users of these services are entities within the manufacturing, retail, and e-commerce sectors, all of whom depend on highly efficient and reliable supply chain management. The sustained growth and expansion of these industries directly translate into increased demand for inland container depot and dry port services.

M&A Trends: The sector is witnessing ongoing consolidation, exemplified by the recent acquisition of Mainport Tank Cleaning BV by Quala and Boasso Global in February 2024. These mergers and acquisitions are often driven by the pursuit of economies of scale, market expansion into new territories, and the acquisition of complementary technologies or service offerings. The projected M&A deal volume for 2025 is estimated at xx deals, indicating continued strategic activity within the industry.

Inland Container Depot and Dry Port Market Growth Trends & Insights

The Inland Container Depot and Dry Port market has experienced robust growth over the historical period from 2019 to 2024. This expansion has been propelled by several key factors, including a significant increase in global trade volumes, the exponential rise in e-commerce activities, and substantial improvements in logistical infrastructure. The market size has grown from xx Million in 2019 to xx Million in 2024, achieving a Compound Annual Growth Rate (CAGR) of xx%. This positive trajectory is anticipated to continue into the forecast period (2025-2033), with the market size projected to reach an impressive xx Million by 2033, demonstrating an expected CAGR of xx%. The increasing integration of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) for enhancing operational efficiency and inventory management, coupled with the strategic development of inland container depots and dry ports in key locations, are significant contributors to this substantial growth. Furthermore, evolving consumer behavior, characterized by a demand for faster delivery times and greater transparency in supply chains, is a key driver fueling market demand. Technological disruptions, particularly in the realms of automation and sophisticated data analytics, are actively contributing to improved efficiency and optimized resource allocation, thereby underpinning the market's ongoing expansion.

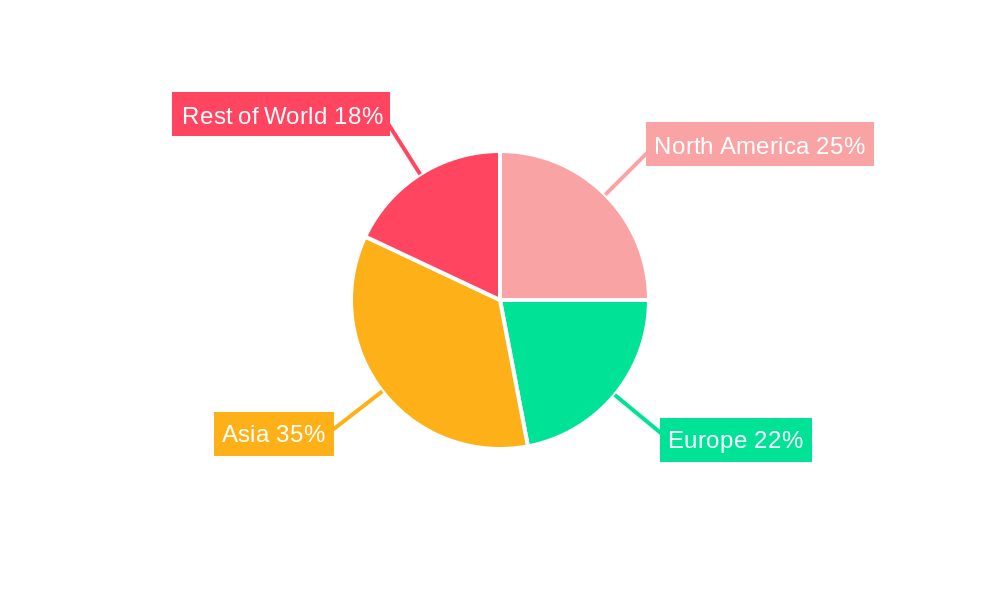

Dominant Regions, Countries, or Segments in Inland Container Depot and Dry Port Market

Asia-Pacific dominates the Inland Container Depot and Dry Port market, driven by strong economic growth, increasing manufacturing activities, and significant infrastructure investments in countries like China, India, and Singapore. Europe and North America also represent substantial markets, influenced by robust e-commerce growth and the focus on streamlining logistics networks.

Asia-Pacific: High population density, rapid industrialization, and strategic location in global trade routes contribute to its market dominance. Government initiatives to improve infrastructure further enhance growth potential. Market share: xx% in 2025; projected growth of xx% CAGR 2025-2033.

Europe: Well-established logistics networks, proximity to major ports, and significant investments in infrastructure contribute to steady market growth. Market share: xx% in 2025; projected growth of xx% CAGR 2025-2033.

North America: High levels of e-commerce activity, the need for efficient supply chain management, and government support for infrastructure development boost market expansion. Market share: xx% in 2025; projected growth of xx% CAGR 2025-2033.

The segment of inland container depots focusing on handling specialized cargo (e.g., refrigerated containers, hazardous materials) exhibits particularly robust growth due to rising demand for temperature-sensitive products and specialized handling requirements.

Inland Container Depot and Dry Port Market Product Landscape

The product and service landscape within the Inland Container Depot and Dry Port market is diverse and evolving. It encompasses a comprehensive suite of offerings, including efficient container handling, secure storage solutions, streamlined customs clearance procedures, and a range of value-added services such as specialized packaging and precise labeling. The integration of technological advancements is a defining characteristic, leading to the development and deployment of automated container handling systems, sophisticated real-time tracking capabilities, and advanced warehouse management systems (WMS). These innovations are crucial for enhancing operational efficiency, significantly reducing overhead costs, and bolstering security measures. Collectively, these improvements serve as compelling unique selling propositions that differentiate service providers in a competitive market.

Key Drivers, Barriers & Challenges in Inland Container Depot and Dry Port Market

Key Drivers:

- Growing global trade volumes

- Rise of e-commerce

- Increasing demand for efficient supply chain solutions

- Government initiatives promoting infrastructure development

Key Challenges:

- High initial investment costs for infrastructure development

- Regulatory hurdles and customs procedures

- Competition from traditional warehousing and transportation methods

- Supply chain disruptions (e.g., port congestion, geopolitical instability) impacting efficiency and leading to increased costs. The impact is estimated to reduce market growth by xx% in certain regions.

Emerging Opportunities in Inland Container Depot and Dry Port Market

- Expansion into underserved markets in developing economies

- Development of specialized services for niche cargo segments (e.g., pharmaceuticals, perishable goods)

- Integration of innovative technologies (e.g., AI, blockchain) to improve efficiency and transparency

- Strategic partnerships between inland container depots and other logistics service providers.

Growth Accelerators in the Inland Container Depot and Dry Port Market Industry

The Inland Container Depot and Dry Port industry is experiencing significant growth acceleration fueled by several key factors. Paramount among these are technological advancements, with a particular emphasis on automation and digitization, which are revolutionizing operational processes. The formation of strategic partnerships between inland container depots, transportation logistics providers, and technology firms is instrumental in the development of integrated and seamless logistics solutions. Furthermore, the strategic expansion into emerging markets and the proactive diversification of service offerings are critical strategies that contribute to sustained and robust market growth.

Key Players Shaping the Inland Container Depot and Dry Port Market Market

- Boasso Global

- Maersk

- Container Corporation of India (CONCOR)

- APM Terminals

- Hapag-Lloyd

- Hutchison Ports

- GAC

- DP World

- Abu Dhabi Terminals

- Freightliner Group Ltd

- 73 Other Companies

Notable Milestones in Inland Container Depot and Dry Port Market Sector

February 2024: Quala and Boasso Global acquire Mainport Tank Cleaning BV, significantly expanding their capacity in tank cleaning and ISO tank container depot services. This acquisition enhances their market position and strengthens their service offerings.

January 2024: Maersk's establishment of a 'center of excellence' at the East Midlands Gateway campus showcases a commitment to streamlined logistics and highlights the strategic importance of integrated inland container depots. This initiative exemplifies innovation and strategic market positioning.

In-Depth Inland Container Depot and Dry Port Market Market Outlook

The outlook for the Inland Container Depot and Dry Port market is exceptionally positive, characterized by expectations of sustained and significant growth. This optimistic forecast is underpinned by the continuous advancement of technology, ongoing investments in critical infrastructure development, and a steadily increasing demand for highly efficient and integrated supply chain solutions. Market participants have substantial opportunities arising from strategic investments in automation and digitization, as well as from the strategic expansion into new and burgeoning geographic markets. The market is projected to witness a considerable increase in both its market size and overall value throughout the forecast period, thereby creating an environment that is highly conducive for the success and growth of both established industry leaders and ambitious new entrants.

Inland Container Depot and Dry Port Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Handling

- 1.3. Maintenance and Repair

-

2. Type of Container

- 2.1. General

- 2.2. Refrigerated (Reefer)

Inland Container Depot and Dry Port Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Chile

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Inland Container Depot and Dry Port Market Regional Market Share

Geographic Coverage of Inland Container Depot and Dry Port Market

Inland Container Depot and Dry Port Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Multimodal Connectivity Boosts Demand for Inland Container Depots

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Handling

- 5.1.3. Maintenance and Repair

- 5.2. Market Analysis, Insights and Forecast - by Type of Container

- 5.2.1. General

- 5.2.2. Refrigerated (Reefer)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Handling

- 6.1.3. Maintenance and Repair

- 6.2. Market Analysis, Insights and Forecast - by Type of Container

- 6.2.1. General

- 6.2.2. Refrigerated (Reefer)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Handling

- 7.1.3. Maintenance and Repair

- 7.2. Market Analysis, Insights and Forecast - by Type of Container

- 7.2.1. General

- 7.2.2. Refrigerated (Reefer)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Handling

- 8.1.3. Maintenance and Repair

- 8.2. Market Analysis, Insights and Forecast - by Type of Container

- 8.2.1. General

- 8.2.2. Refrigerated (Reefer)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Handling

- 9.1.3. Maintenance and Repair

- 9.2. Market Analysis, Insights and Forecast - by Type of Container

- 9.2.1. General

- 9.2.2. Refrigerated (Reefer)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East Inland Container Depot and Dry Port Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Handling

- 10.1.3. Maintenance and Repair

- 10.2. Market Analysis, Insights and Forecast - by Type of Container

- 10.2.1. General

- 10.2.2. Refrigerated (Reefer)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boasso Global

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Maersk

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Container Corporation of India (CONCOR)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 APM Terminals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hapag Llyod

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hutchison Ports

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GAC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DP World

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abu Dhabi Terminals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Freightliner Group Ltd**List Not Exhaustive 7 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boasso Global

List of Figures

- Figure 1: Global Inland Container Depot and Dry Port Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Inland Container Depot and Dry Port Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 4: North America Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 5: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 7: North America Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 8: North America Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 9: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 10: North America Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 11: North America Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 16: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 17: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 19: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 20: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 21: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 22: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 23: Europe Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 28: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 29: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 31: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 32: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 33: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 34: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 35: Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 40: South America Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 41: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: South America Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 43: South America Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 44: South America Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 45: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 46: South America Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 47: South America Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Service 2025 & 2033

- Figure 52: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Service 2025 & 2033

- Figure 53: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Service 2025 & 2033

- Figure 55: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Type of Container 2025 & 2033

- Figure 56: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Type of Container 2025 & 2033

- Figure 57: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Type of Container 2025 & 2033

- Figure 58: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Type of Container 2025 & 2033

- Figure 59: Middle East Inland Container Depot and Dry Port Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Inland Container Depot and Dry Port Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East Inland Container Depot and Dry Port Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Inland Container Depot and Dry Port Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 4: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 5: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 9: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 10: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 11: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 19: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 20: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 21: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: Germany Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: UK Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: UK Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Spain Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 36: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 37: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 38: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 39: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 41: India Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: China Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Japan Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 50: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 51: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 52: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 53: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Brazil Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Chile Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Chile Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Service 2020 & 2033

- Table 60: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Service 2020 & 2033

- Table 61: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Type of Container 2020 & 2033

- Table 62: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Type of Container 2020 & 2033

- Table 63: Global Inland Container Depot and Dry Port Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Inland Container Depot and Dry Port Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: United Arab Emirates Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: United Arab Emirates Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Saudi Arabia Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Saudi Arabia Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East Inland Container Depot and Dry Port Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East Inland Container Depot and Dry Port Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Inland Container Depot and Dry Port Market?

The projected CAGR is approximately > 5.45%.

2. Which companies are prominent players in the Inland Container Depot and Dry Port Market?

Key companies in the market include Boasso Global, Maersk, Container Corporation of India (CONCOR), APM Terminals, Hapag Llyod, Hutchison Ports, GAC, DP World, Abu Dhabi Terminals, Freightliner Group Ltd**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Inland Container Depot and Dry Port Market?

The market segments include Service, Type of Container.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.44 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Multimodal Connectivity Boosts Demand for Inland Container Depots.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2024: Quala and Boasso Global, key players in the tank trailer and ISO tank container industry specializing in cleaning, maintenance, storage, and transportation services, completed the acquisition of Mainport Tank Cleaning BV, Mainport Tank Container Services Botlek BV, and Mainport Tank Container Services Moerdijk BV – collectively referred to as "MTC" – from Matrans Holding BV, headquartered in Rotterdam, Netherlands. MTC is renowned for its excellence in tank cleaning and ISO tank container depot services.January 2024: Maersk established a 'center of excellence' at the East Midlands Gateway campus. The campus, featuring a 695,000 sq ft warehouse, a rail terminal managed by Maritime, and a 14-acre container depot, all situated within a freeport, is well-positioned to champion this streamlined approach. Moreover, its strategic location, near major UK ports like Felixstowe, Liverpool, and Southampton, alongside easy access to the nation's rail, road network, and key airports, enhances its allure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Inland Container Depot and Dry Port Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Inland Container Depot and Dry Port Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Inland Container Depot and Dry Port Market?

To stay informed about further developments, trends, and reports in the Inland Container Depot and Dry Port Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence