Key Insights

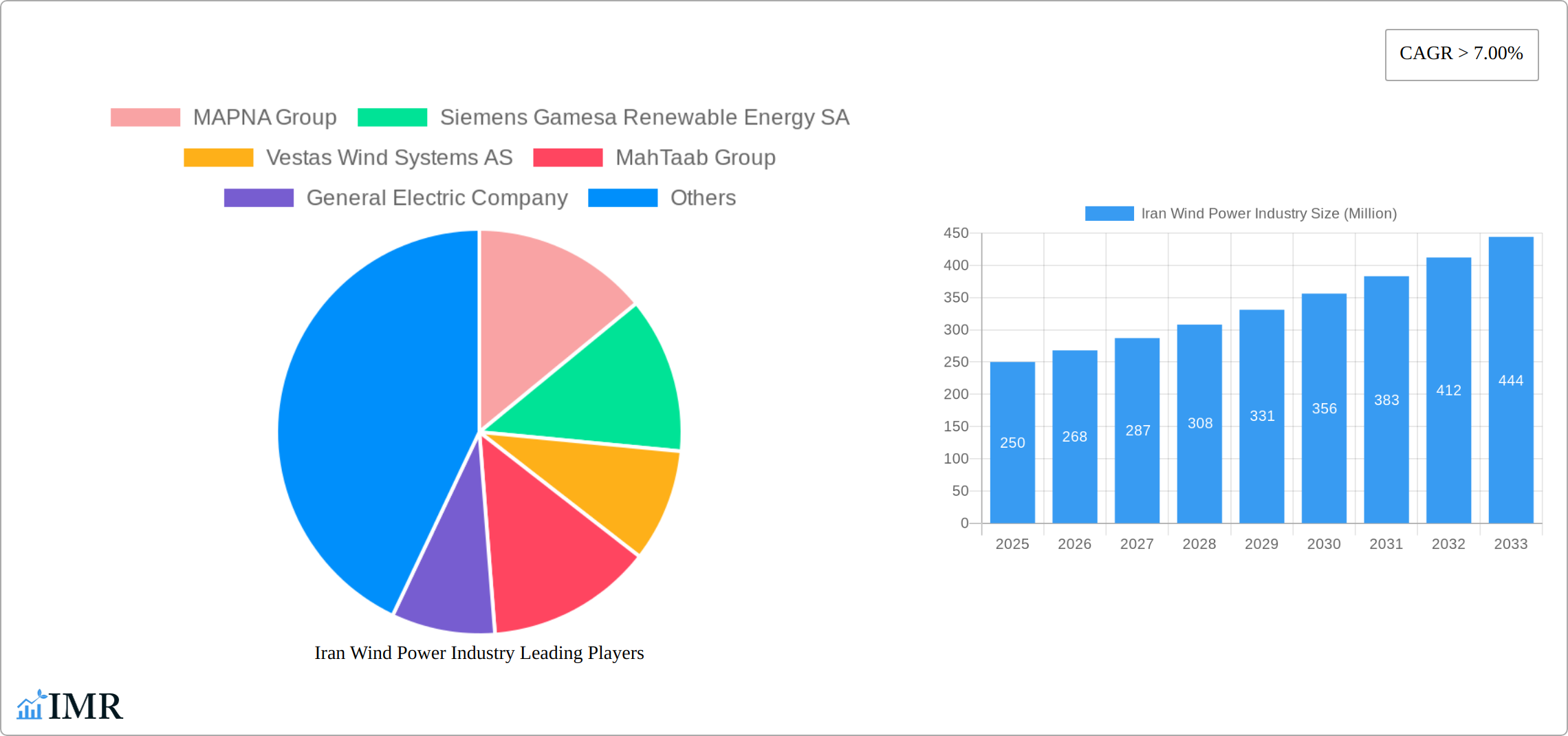

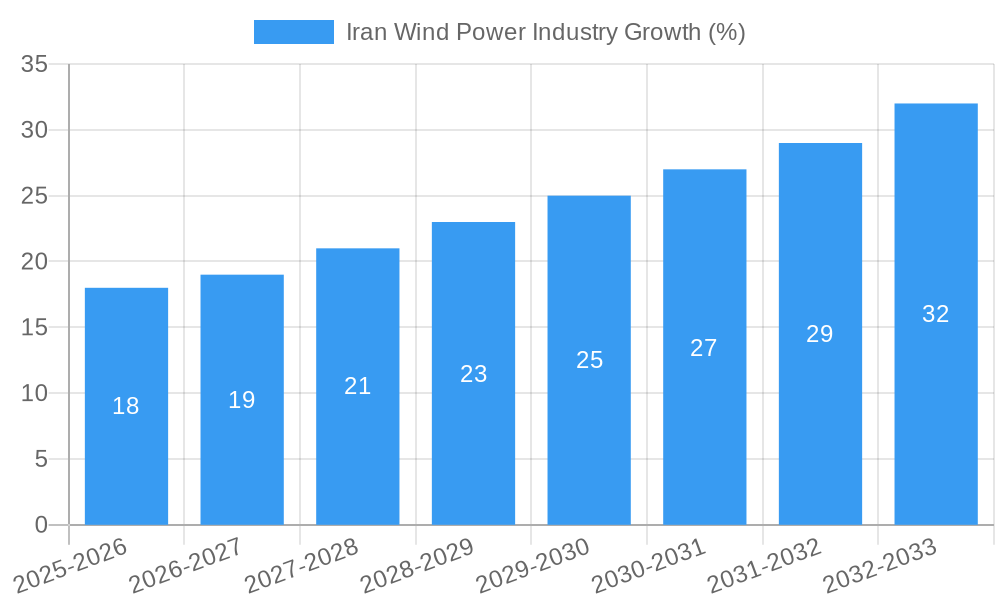

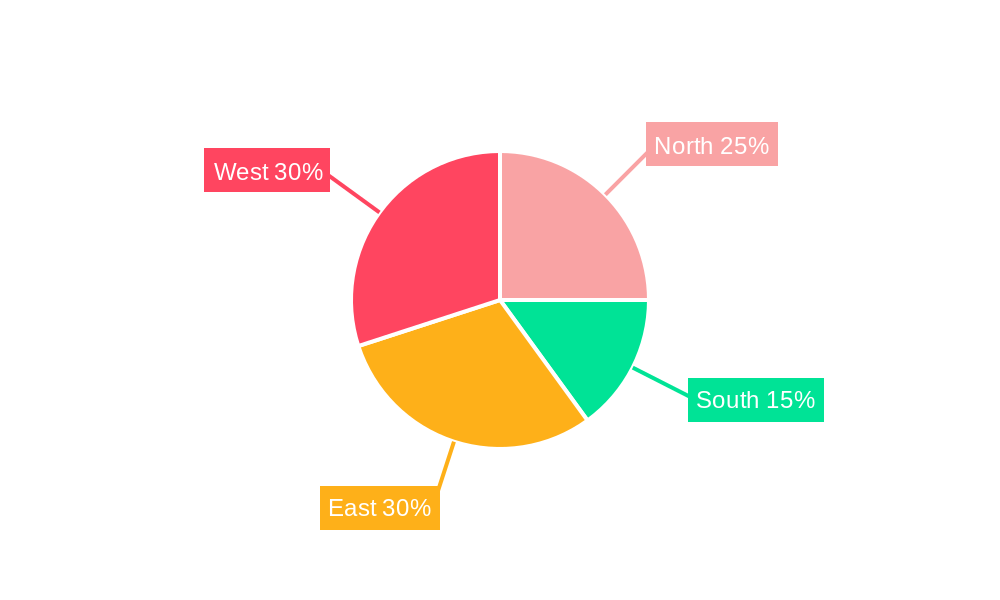

The Iranian wind power industry is poised for significant growth, driven by the country's ambitious renewable energy targets and increasing energy demands. With a Compound Annual Growth Rate (CAGR) exceeding 7% from 2019 to 2033, the market is expected to experience substantial expansion over the forecast period (2025-2033). While precise market size figures for 2025 are unavailable, considering a CAGR of over 7% and a base year of 2025, a reasonable estimation suggests the market size is likely in the hundreds of millions of USD, given the significant investment and governmental support directed towards renewable energy projects. Key drivers include government incentives aimed at diversifying energy sources, reducing reliance on fossil fuels (natural gas, coal, and oil), and mitigating climate change impacts. The development of robust grid infrastructure and supportive regulatory policies further contribute to market expansion. Market segmentation by application (residential, industrial & utilities, commercial) and fuel type (natural gas, coal, oil, other fuel types—with wind power representing a key "other" segment) allows for a granular understanding of the various market forces at play. Leading players like MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, and General Electric Company are actively participating in this growth, contributing to both project development and technological advancements within the industry. Regional variations within Iran (North, South, East, West) reflect differences in wind resource potential and infrastructure development, presenting unique opportunities and challenges for market participants.

However, the industry faces certain restraints. These may include initial high capital costs associated with wind farm construction, potential grid integration challenges, and the need for ongoing technological improvements to enhance efficiency and reduce operational costs. The ongoing geopolitical landscape and economic conditions in Iran also pose significant challenges to consistent and sustained market growth. Overcoming these challenges will require focused efforts on fostering public-private partnerships, securing international investment, and addressing technological limitations to fully realize the potential of Iran's wind power sector. Long-term success will depend on a strategic balance between government support, private sector investment, and technological innovation.

Iran Wind Power Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Iranian wind power industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both parent (Renewable Energy) and child (Wind Power) markets, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The report utilizes data from 2019-2024 (Historical Period), with a base year of 2025 and a forecast period extending to 2033. Market values are presented in Million units.

Iran Wind Power Industry Market Dynamics & Structure

The Iranian wind power industry presents a complex interplay of competitive forces, technological advancements, regulatory landscapes, and evolving market trends. This section offers a comprehensive analysis of these dynamics, focusing on market concentration, the influence of mergers and acquisitions (M&A), technological innovation, the regulatory framework, and the impact of substitute technologies and end-user demographics on market growth. We examine the market share of key players, including MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, and General Electric Company, assessing their strategic maneuvers and contributions to the overall market structure. The analysis further delves into the role of technological innovation, specifically advancements in turbine design, efficiency improvements, and the integration of smart grid technologies and energy storage solutions. We also scrutinize the governmental policies, incentives, and feed-in tariffs that shape the regulatory environment and influence investment decisions. Finally, we evaluate the competitive pressures from substitute technologies, such as solar power and other renewable energy sources, and analyze the varied adoption rates across residential, commercial, and industrial end-user sectors.

- Market Concentration (2025 Estimate): Detailed breakdown of market share held by top 5 players, including analysis of potential shifts in market dominance.

- M&A Activity (2019-2024): Comprehensive overview of recorded deals, including an assessment of their impact on market consolidation and technological transfer.

- Technological Innovation: In-depth analysis of advancements in turbine technology, emphasizing improvements in efficiency, cost reduction strategies, and the incorporation of smart grid integration capabilities.

- Regulatory Framework: Thorough examination of government incentives, feed-in tariffs, and regulatory hurdles, along with an evaluation of their effectiveness in stimulating market growth.

- Competitive Substitutes: Comparative analysis of solar power and other renewable energy sources, considering their cost competitiveness, efficiency, and overall market appeal.

- End-User Demographics: Granular breakdown of wind power adoption across residential, commercial, and industrial sectors, including projected growth in each sector and an assessment of the factors driving adoption.

Iran Wind Power Industry Growth Trends & Insights

This section presents a comprehensive analysis of the growth trajectory of the Iranian wind power market. We examine historical data and project future growth based on various factors such as government policies, technological advancements, and economic conditions. The analysis encompasses market size evolution, adoption rates across various segments, and the impact of technological disruptions on market dynamics. The report identifies key trends driving consumer behavior and their influence on wind power adoption. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration will be provided to offer deeper insights into the industry's growth.

- Market Size (MW): xx (2019), xx (2024), xx (2025), xx (2033).

- CAGR (2025-2033): xx%.

- Market Penetration: xx% (2025), xx% (2033).

Dominant Regions, Countries, or Segments in Iran Wind Power Industry

This section identifies the leading regions, countries, and market segments within the Iranian wind power industry that are driving significant market expansion. The analysis considers application segments (Residential, Industrial & Utilities, Commercial) and fuel types (Natural Gas, Coal, Oil, Other Fuel Types) to provide a comprehensive understanding of market dynamics. We investigate the underlying economic, infrastructural, and policy-related factors contributing to the dominance of specific areas. Furthermore, we provide a detailed assessment of market share and future growth potential for each segment, incorporating quantitative data and projections to support our findings and offer valuable insights into the industry's future trajectory. The analysis also includes a geographic breakdown, identifying key regions and the factors influencing their growth rates.

- Dominant Segment (Application): Industrial & Utilities (projected xx% market share in 2025) – detailed explanation of the factors contributing to this dominance, such as government policies favoring large-scale projects, grid infrastructure availability, and the need for reliable power supply for industrial operations.

- Dominant Segment (Fuel Type): Other Fuel Types (projected xx% market share in 2025) – comprehensive explanation of the reasons for growth in this segment, including the integration of renewable energy sources into the national energy mix, government incentives promoting renewable energy adoption, and the increasing awareness of the environmental benefits of wind power.

- Key Regional Drivers: Detailed explanation of regional factors affecting growth, including regional wind resource assessments, infrastructure development, proximity to transmission networks, and local government support for wind energy projects.

- Growth Potential Analysis: Specific quantitative data on growth potential for each segment/region, including detailed projections based on market research and industry trends. This would include CAGR (Compound Annual Growth Rate) projections for each segment and region.

Iran Wind Power Industry Product Landscape

This section provides an overview of the product landscape within the Iranian wind power industry. We examine the various types of wind turbines available, their applications, and their performance metrics. The analysis focuses on the unique selling propositions of different products and highlights the latest technological advancements in turbine design, manufacturing, and operation.

[Paragraph detailing product innovations, applications, performance metrics, unique selling propositions, and technological advancements. (100-150 words)]

Key Drivers, Barriers & Challenges in Iran Wind Power Industry

This section identifies the key factors driving growth in the Iranian wind power market. We examine the impact of technological advancements, economic policies, and supportive government regulations on market expansion. Furthermore, we highlight the primary challenges and restraints, including supply chain issues, regulatory hurdles, and competitive pressures, along with quantifiable impacts on market development.

Key Drivers:

- [Paragraph outlining key drivers]

Key Challenges:

- [Paragraph outlining key challenges]

Emerging Opportunities in Iran Wind Power Industry

The Iranian wind power industry is poised for significant expansion, driven by several emerging trends and opportunities. The increasing focus on renewable energy diversification within the national energy mix presents a significant opportunity for increased investment in wind power projects. The government's commitment to reducing carbon emissions and achieving energy independence creates a favourable policy environment. Technological advancements, such as improved turbine designs and enhanced energy storage solutions, offer the potential for cost reduction and increased efficiency. Furthermore, the development of hybrid renewable energy projects, integrating wind power with other renewable sources, represents a promising area for growth. Finally, growing private sector participation and international collaborations are expected to further accelerate market expansion.

Growth Accelerators in the Iran Wind Power Industry Industry

This section analyzes the catalysts that will drive long-term growth in the Iranian wind power industry. We examine the potential impact of technological breakthroughs, strategic partnerships, and market expansion strategies on future market development.

[Paragraph discussing catalysts driving long-term growth (150 words)]

Key Players Shaping the Iran Wind Power Industry Market

- MAPNA Group

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- MahTaab Group

- General Electric Company

Notable Milestones in Iran Wind Power Industry Sector

- November 2022: The Iranian government increased private companies' guaranteed purchase prices for solar and wind power generated by 20-60% compared to 2021, stimulating investment in the renewable energy sector.

- January 2022: Iran's Ministry of Energy and the Energy Efficiency Organization (SATBA) signed an MoU to install an additional 10 GW of renewable energy capacity within four years, aiming for a total of 30 GW.

In-Depth Iran Wind Power Industry Market Outlook

This section summarizes the key growth accelerators and provides a concise outlook on the future market potential and strategic opportunities within the Iranian wind power industry. The analysis highlights the significant potential for expansion driven by government support, technological advancements, and increasing demand for clean energy.

[Paragraph summarizing growth accelerators and future outlook (150 words)]

Iran Wind Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Wind Power Industry Segmentation By Geography

- 1. Iran

Iran Wind Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 MAPNA Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siemens Gamesa Renewable Energy SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Vestas Wind Systems AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MahTaab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Electric Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Wind Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Wind Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Wind Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Wind Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Iran Wind Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Iran Wind Power Industry Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Iran Wind Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Iran Wind Power Industry Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Iran Wind Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Iran Wind Power Industry Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Iran Wind Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Iran Wind Power Industry Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Iran Wind Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Iran Wind Power Industry Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Iran Wind Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Iran Wind Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 15: Iran Wind Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Iran Wind Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 17: North Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: North Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: South Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: East Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: East Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: West Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: West Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Iran Wind Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Iran Wind Power Industry Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 27: Iran Wind Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Iran Wind Power Industry Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Iran Wind Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Iran Wind Power Industry Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Iran Wind Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Iran Wind Power Industry Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Iran Wind Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: Iran Wind Power Industry Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Iran Wind Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Iran Wind Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Wind Power Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Iran Wind Power Industry?

Key companies in the market include MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, General Electric Company.

3. What are the main segments of the Iran Wind Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption.

8. Can you provide examples of recent developments in the market?

In November 2022, the Iranian government increased private companies' guaranteed purchase prices for solar and wind power generated by 20-60% compared to 2021. Iran's Ministry of Energy announced a new directive to raise tariffs (for private sector producers) to encourage investment. The Ministry's new portal cited the press release issued by the state-run Renewable Energy and Energy Efficiency Organization (SATBA). The Ministry also noted that the latest prices for generating electricity from small-scale solar power stations (with less than 20-kilowatt capacity) have risen by 20% per kilowatt, reaching 6 cents/kWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Wind Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Wind Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Wind Power Industry?

To stay informed about further developments, trends, and reports in the Iran Wind Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence