Key Insights

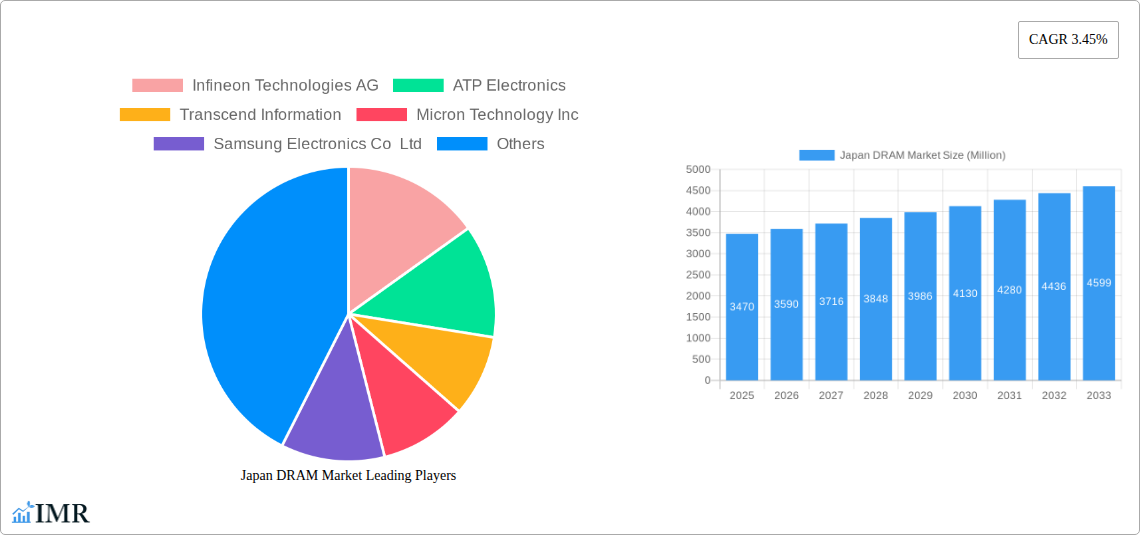

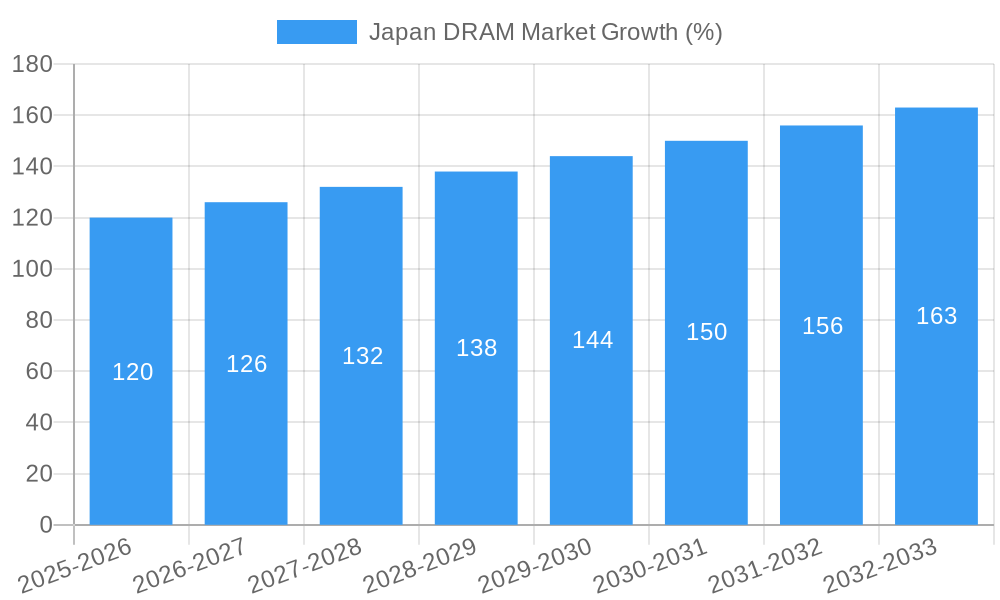

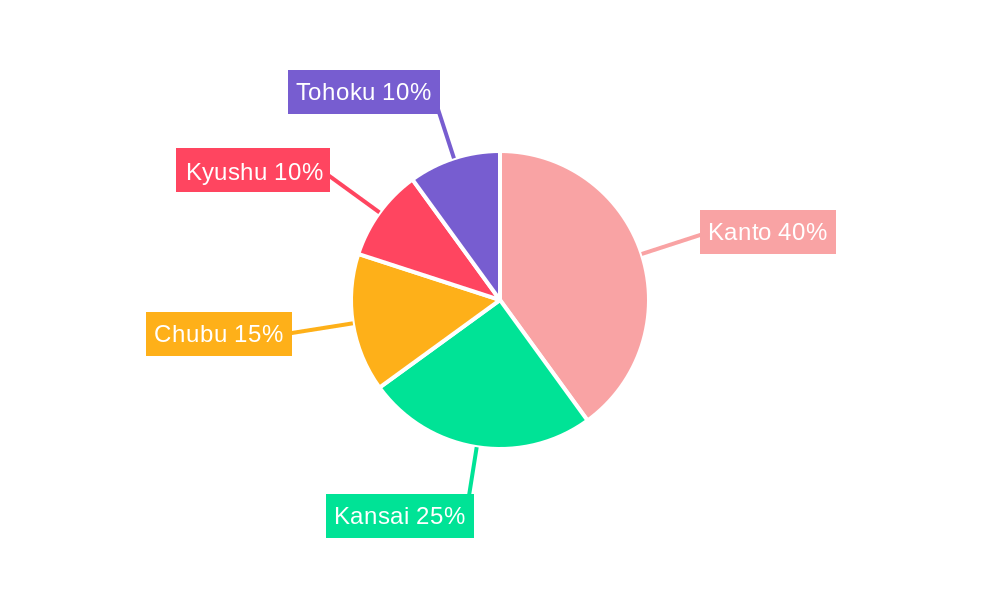

The Japan DRAM market, valued at approximately $3.47 billion in 2025, is projected to experience steady growth, driven primarily by increasing demand from the smartphone, PC/laptop, and datacenter sectors within the country. The 3.45% CAGR indicates a consistent, albeit moderate, expansion over the forecast period (2025-2033). Key growth drivers include the ongoing adoption of advanced technologies like 5G and the increasing prevalence of cloud computing, which fuels the need for high-performance DRAM in data centers. Trends point towards a continued shift towards higher-density DRAM modules to cater to the rising data storage requirements of modern applications. While potential restraints such as global economic fluctuations and cyclical industry downturns exist, the overall positive outlook for the Japanese electronics sector and government initiatives promoting technological advancement are expected to mitigate these challenges. Market segmentation reveals a significant proportion of demand originating from the smartphone/tablet segment, followed closely by PC/laptop and datacenter applications. Major players like Samsung Electronics, SK Hynix, Micron Technology, and Infineon Technologies are actively competing within this market, each leveraging their technological expertise and manufacturing capabilities to capture market share. The regional distribution within Japan reflects the concentration of technological hubs in areas such as Kanto and Kansai, which will likely continue to be significant growth areas.

The competitive landscape is marked by established global players alongside domestic firms. The market's evolution will be shaped by technological advancements in DRAM architecture, including the ongoing transition to more advanced DDR generations. Strategic partnerships and mergers & acquisitions could significantly alter the competitive balance in the coming years. Furthermore, the increasing focus on environmental sustainability and energy efficiency in electronics manufacturing will likely influence the development and adoption of new DRAM technologies. The continued growth of the automotive and other application segments, while currently smaller, represents untapped potential for future expansion. Overall, the Japan DRAM market presents a promising investment opportunity for companies capable of innovating and adapting to the evolving technological landscape.

Japan DRAM Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan DRAM market, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is an invaluable resource for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic market. The report analyzes the parent market of Semiconductor Memory and the child market of DRAM within the Japanese context. Market values are presented in Million units.

Japan DRAM Market Market Dynamics & Structure

The Japan DRAM market is characterized by a complex interplay of factors influencing its structure and growth trajectory. Market concentration is relatively high, with a few major global players holding significant market share. Technological innovation, particularly in areas like DDR5 and advanced process nodes, is a key driver, while regulatory frameworks and government initiatives play a crucial role in shaping the industry landscape. The presence of competitive product substitutes, like other memory technologies (e.g., flash memory), influences market dynamics. End-user demographics, especially the growing demand from data centers and automotive sectors, are reshaping the market's demand profile. Furthermore, M&A activity, while not excessively frequent, can significantly alter the competitive landscape.

- Market Concentration: High, with top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Driven by the need for higher bandwidth, lower power consumption, and increased density.

- Regulatory Framework: Government support and incentives for domestic semiconductor production influence market dynamics.

- Competitive Substitutes: Flash memory and other memory technologies pose a competitive threat.

- End-User Demographics: Strong growth driven by data centers, automotive, and consumer electronics.

- M&A Trends: Moderate activity, with a few significant deals observed in the historical period (2019-2024), totaling approximately xx deals.

Japan DRAM Market Growth Trends & Insights

The Japan DRAM market has experienced significant growth over the historical period (2019-2024). The market size has grown from xx million units in 2019 to xx million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to the increasing adoption of DRAM in various applications, particularly in data centers and smartphones. Technological advancements, such as the introduction of higher-density DRAM modules, have further fueled market expansion. However, cyclical fluctuations in demand and pricing pressures remain key factors influencing market growth. Consumer behavior shifts toward higher-capacity devices and cloud computing services are also driving market expansion. We project a CAGR of xx% during the forecast period (2025-2033), with the market size reaching xx million units by 2033. Market penetration is expected to increase significantly in the automotive and industrial sectors.

Dominant Regions, Countries, or Segments in Japan DRAM Market

While the Japan DRAM market is largely national in scope, the dominance of specific segments is noteworthy. Within the application segments, data centers exhibit the highest growth rate and market share due to the increasing demand for cloud computing and big data applications. The smartphone/tablet segment also shows strong growth potential. In terms of architecture, DDR4 currently holds a dominant share, while DDR5 adoption is rapidly increasing, poised to become a dominant architecture in the coming years. Specific regions within Japan, particularly those with strong concentrations of semiconductor manufacturing and technology hubs, will show higher growth rates. Government initiatives and investments play a critical role in regional growth.

Key Drivers:

- Strong growth in data center applications.

- Increasing demand from the automotive industry.

- Government support for domestic semiconductor manufacturing.

- Advancement in DDR5 technology adoption.

Dominant Segments:

- Data Center (Market share: xx%, CAGR: xx%)

- Smartphones/Tablets (Market share: xx%, CAGR: xx%)

- DDR4 Architecture (Market share: xx%, Transitioning to DDR5)

Japan DRAM Market Product Landscape

The Japan DRAM market showcases a range of DRAM products with varying capacities, speeds, and power consumption. Innovations focus on increasing density, enhancing performance, and reducing power consumption. The latest DDR5 modules offer significantly improved speed and bandwidth compared to their predecessors. Products are tailored to meet the specific needs of different applications, from high-performance computing in data centers to power-efficient solutions for mobile devices. Unique selling propositions include enhanced reliability, superior performance, and optimized power efficiency.

Key Drivers, Barriers & Challenges in Japan DRAM Market

Key Drivers:

- Increasing demand from data centers and high-performance computing.

- Growing adoption of AI and machine learning applications.

- Government initiatives to boost domestic semiconductor production.

- Technological advancements in DRAM architecture and manufacturing processes.

Key Challenges:

- Volatility in commodity prices and supply chain disruptions.

- Intense competition from global DRAM manufacturers.

- High capital expenditure requirements for advanced manufacturing processes.

- Dependence on imports for certain raw materials and components.

Emerging Opportunities in Japan DRAM Market

The Japan DRAM market presents several emerging opportunities. Untapped potential exists in specialized applications, such as automotive electronics and industrial automation. The growing demand for edge computing and IoT devices creates opportunities for smaller, low-power DRAM solutions. Innovative applications in areas like artificial intelligence and machine learning require high-bandwidth, high-capacity DRAM modules, providing substantial growth potential. Shifting consumer preferences towards higher-capacity devices and cloud-based services are also generating growth.

Growth Accelerators in the Japan DRAM Market Industry

Long-term growth in the Japan DRAM market will be fueled by technological breakthroughs in memory technology, particularly the transition to next-generation DRAM architectures like DDR5 and beyond. Strategic partnerships between DRAM manufacturers and other players in the semiconductor ecosystem are crucial for boosting innovation and expanding market reach. Aggressive investments in advanced manufacturing facilities, along with government support, will play a significant role in strengthening Japan's position in the global DRAM market.

Key Players Shaping the Japan DRAM Market Market

- Infineon Technologies AG

- ATP Electronics

- Transcend Information

- Micron Technology Inc

- Samsung Electronics Co Ltd

- SK Hynix

- Kingston Technology

- Nanya Technology Corporation

- Elpida Memory Inc

- Winbond Electronics Corporation

Notable Milestones in Japan DRAM Market Sector

- March 2023: Micron Technology Inc. announced a JPY 500 billion (USD 3.70 billion) investment in DRAM and EUV technology.

- May 2023: TSMC announced plans to invest USD 8.6 billion in a new foundry in Kumamoto Prefecture, Japan.

In-Depth Japan DRAM Market Market Outlook

The future of the Japan DRAM market appears promising, driven by strong growth in key application segments and continuous technological advancements. Strategic partnerships, investments in R&D, and government support will be critical for maintaining competitiveness. The market is expected to see sustained growth throughout the forecast period, fueled by the increasing demand for high-performance computing, the expansion of data centers, and the growing adoption of advanced technologies across various industries. Significant opportunities exist for companies that can innovate and offer cost-effective, high-performance DRAM solutions to meet evolving market demands.

Japan DRAM Market Segmentation

-

1. Architecture

- 1.1. DDR3

- 1.2. DDR4

- 1.3. DDR5

- 1.4. DDR2/Other Architecture

-

2. Application

- 2.1. Smartphones/Tablets

- 2.2. PC/Laptop

- 2.3. Datacenter

- 2.4. Graphics

- 2.5. Consumer Products

- 2.6. Automotive

- 2.7. Other Applications

Japan DRAM Market Segmentation By Geography

- 1. Japan

Japan DRAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of High-End Smartphones and Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Design and Complexity Challenges for the Development of High-Efficiency Microphones

- 3.4. Market Trends

- 3.4.1. Automotive Sector Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. DDR3

- 5.1.2. DDR4

- 5.1.3. DDR5

- 5.1.4. DDR2/Other Architecture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones/Tablets

- 5.2.2. PC/Laptop

- 5.2.3. Datacenter

- 5.2.4. Graphics

- 5.2.5. Consumer Products

- 5.2.6. Automotive

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. Kanto Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan DRAM Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ATP Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Transcend Information

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Micron Technology Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SK Hynix

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kingston Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nanya Technology Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Elpida Memory Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Winbond Electronics Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Japan DRAM Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan DRAM Market Share (%) by Company 2024

List of Tables

- Table 1: Japan DRAM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan DRAM Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 3: Japan DRAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan DRAM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan DRAM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan DRAM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan DRAM Market Revenue Million Forecast, by Architecture 2019 & 2032

- Table 12: Japan DRAM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Japan DRAM Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan DRAM Market?

The projected CAGR is approximately 3.45%.

2. Which companies are prominent players in the Japan DRAM Market?

Key companies in the market include Infineon Technologies AG, ATP Electronics, Transcend Information, Micron Technology Inc, Samsung Electronics Co Ltd, SK Hynix, Kingston Technology, Nanya Technology Corporation, Elpida Memory Inc *List Not Exhaustive, Winbond Electronics Corporation.

3. What are the main segments of the Japan DRAM Market?

The market segments include Architecture, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of High-End Smartphones and Consumer Electronics.

6. What are the notable trends driving market growth?

Automotive Sector Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Design and Complexity Challenges for the Development of High-Efficiency Microphones.

8. Can you provide examples of recent developments in the market?

May 2023: Taiwan Semiconductor Manufacturing Co. (TSMC) announced plans to further expand its investments in Japan and strengthen its collaboration with semiconductor partners in the country. Currently, TSMC is in the process of building its inaugural foundry in Kumamoto Prefecture, located in Southern Japan, in partnership with Sony Group Corp. This ambitious venture, expected to require an investment of USD 8.6 billion, is on track to commence chip production next year. TSMC will leverage advanced technologies, including 12nm, 16nm, and 22nm processes, as well as the specialized 28nm technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan DRAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan DRAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan DRAM Market?

To stay informed about further developments, trends, and reports in the Japan DRAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence