Key Insights

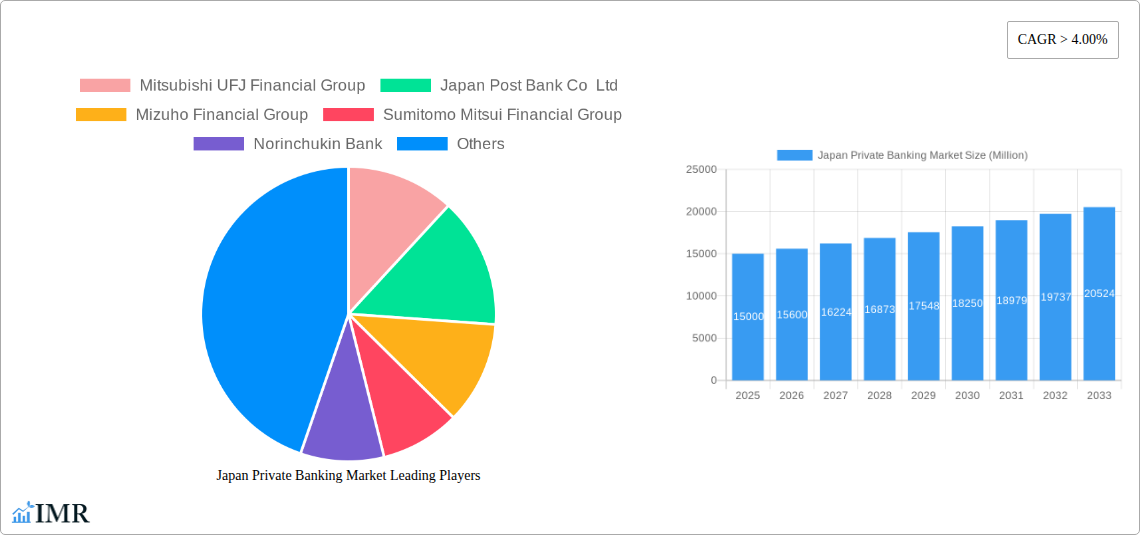

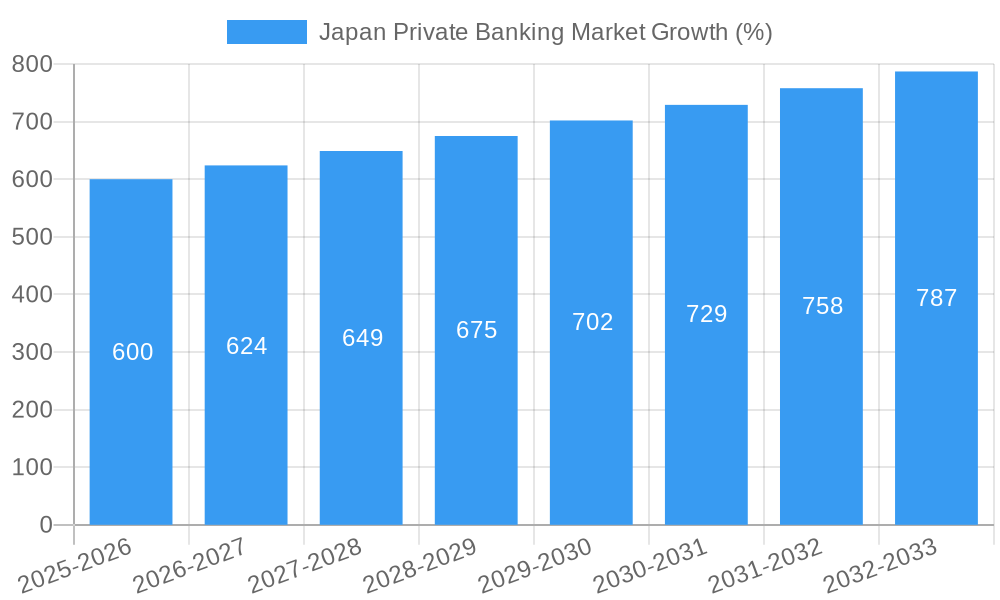

The Japan private banking market, currently experiencing robust growth with a CAGR exceeding 4%, presents a compelling investment opportunity. The market's expansion is fueled by several key drivers, including Japan's aging population and the resulting surge in high-net-worth individuals (HNWIs) seeking sophisticated wealth management solutions. Furthermore, a rising entrepreneurial class and increased international investment flows are contributing to market expansion. While regulatory changes and economic fluctuations pose potential restraints, the overall outlook remains positive due to the increasing demand for personalized financial planning, investment advisory services, and estate planning solutions. The market is segmented based on various factors such as service offerings (wealth management, investment advisory, trust services), client demographics (HNWIs, ultra-high-net-worth individuals), and geographical location. Major players like Mitsubishi UFJ Financial Group, Japan Post Bank, and Mizuho Financial Group dominate the market, vying for market share through competitive offerings and technological advancements. The forecast period of 2025-2033 is projected to witness significant growth, driven by increasing financial literacy and a growing preference for professional wealth management among affluent Japanese.

The competitive landscape is characterized by a mix of established banks with extensive networks and newer entrants leveraging technology to offer innovative solutions. Growth opportunities exist in areas like digital wealth management platforms, personalized investment strategies catering to specific risk profiles, and specialized services for succession planning. As the Japanese economy continues to evolve, private banks will need to adapt their strategies to meet the evolving needs of their clients, including offering sustainable investment options and incorporating ESG (Environmental, Social, and Governance) factors into investment decisions. The market is expected to consolidate further as banks seek to enhance their service offerings and expand their client base. Sustained economic growth in Japan and continued favorable regulatory conditions will play a vital role in shaping the trajectory of this market over the forecast period.

Japan Private Banking Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan Private Banking market, encompassing market dynamics, growth trends, key players, and future outlook. The study covers the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market to provide a granular understanding of its various components. The total market size is expected to reach xx Million by 2033.

Japan Private Banking Market Dynamics & Structure

The Japanese private banking market is characterized by a high degree of concentration, with a few major players dominating the landscape. Technological innovation, while present, faces barriers such as regulatory hurdles and the conservative nature of some clients. The regulatory framework, shaped by the Financial Services Agency (FSA), plays a significant role in shaping market practices. While direct substitutes are limited, competition from other wealth management services and investment platforms exists. The end-user demographic is skewed towards high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), often with a preference for established institutions. M&A activity has been moderate, reflecting a cautious approach among players.

- Market Concentration: High, with top 5 banks controlling xx% of market share in 2024.

- Technological Innovation: Driven by digitalization, but adoption is gradual due to regulatory and client preference factors.

- Regulatory Framework: Stringent regulations from FSA impact product offerings and client onboarding processes.

- Competitive Substitutes: Limited direct substitutes, but competition from other wealth management approaches.

- End-User Demographics: Predominantly HNWIs and UHNWIs, with a focus on risk-averse investment strategies.

- M&A Trends: Moderate M&A activity, with strategic acquisitions primarily focusing on expanding regional presence or specialized service offerings. An estimated xx M&A deals occurred between 2019 and 2024.

Japan Private Banking Market Growth Trends & Insights

The Japan Private Banking market experienced a [CAGR] growth rate between 2019 and 2024, driven by factors such as increasing HNWIs, a growing awareness of wealth management solutions, and government initiatives promoting financial literacy. While technological advancements are transforming the landscape, traditional banking remains a key channel. Adoption of digital solutions is gradual, with clients valuing personalized services and trusted relationships. Market penetration of digital private banking solutions is currently at xx%, expected to reach xx% by 2033. Shifting consumer behaviors toward more sophisticated investment strategies and increasing internationalization also contribute to market expansion. The market size is projected to reach xx Million by 2028 and xx Million by 2033.

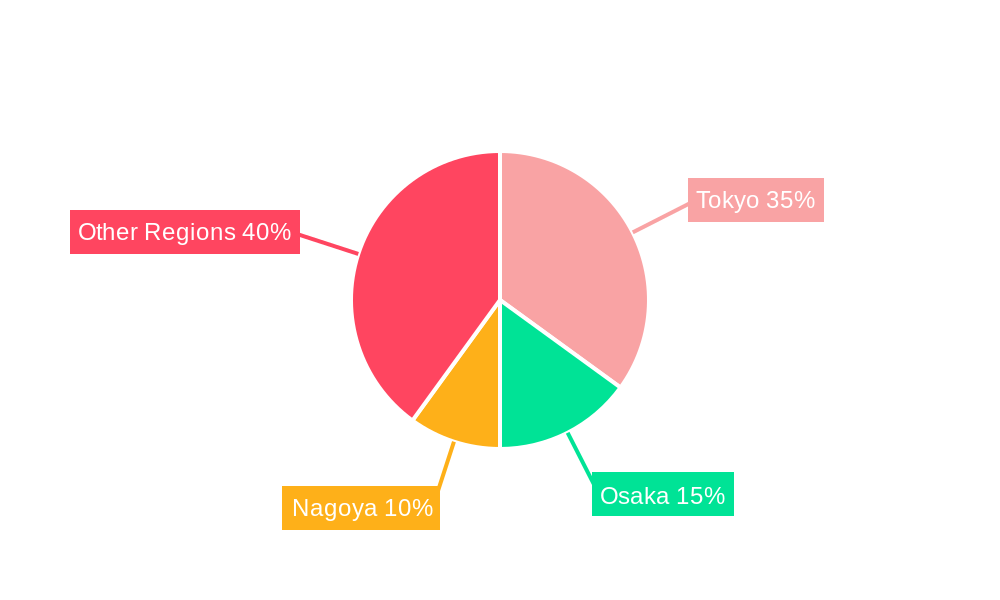

Dominant Regions, Countries, or Segments in Japan Private Banking Market

The Kanto region (Tokyo and surrounding areas) remains the dominant market segment, owing to its concentration of HNWIs and financial institutions. The concentration of wealth and sophisticated financial infrastructure in this region contributes significantly to its market share. While other regions exhibit growth potential, the Kanto region's established dominance is expected to continue throughout the forecast period. Key drivers include robust economic activity, developed infrastructure, and the presence of major financial institutions. Other regions show promising growth, but lack the same density of HNWIs and financial expertise.

- Kanto Region: Dominant market share (xx% in 2024), driven by high HNWIs concentration and established financial infrastructure.

- Kansai Region: Significant but smaller market share (xx% in 2024), growing steadily due to increasing regional wealth.

- Other Regions: Collectively contribute to market growth but remain relatively less dominant due to various factors, including lower HNWIs concentration and infrastructure development.

Japan Private Banking Market Product Landscape

The product landscape is characterized by a range of services tailored to the specific needs of HNWIs. These include portfolio management, wealth planning, trust services, and family office services. Technological advancements are enhancing client experience through digital platforms, providing real-time portfolio tracking and enhanced communication channels. Unique selling propositions include personalized wealth management strategies, leveraging strong relationships with clients, and access to exclusive investment opportunities.

Key Drivers, Barriers & Challenges in Japan Private Banking Market

Key Drivers: A growing number of HNWIs, increasing awareness of wealth management solutions, technological advancements enabling improved service delivery, and government initiatives supporting financial literacy.

Key Challenges: Regulatory hurdles, increasing competitive pressure from fintech firms, and demographic shifts that could affect long-term market growth. The aging population of Japan presents both opportunity and challenge regarding succession planning for wealth transfer. Maintaining client relationships in a shifting technological landscape presents an operational challenge.

Emerging Opportunities in Japan Private Banking Market

Untapped markets in regional areas present substantial growth potential as wealth distribution expands beyond major metropolitan centers. The increasing adoption of sustainable and impact investing creates an opportunity for private banks to offer innovative solutions catering to environmentally and socially conscious clients. The use of AI and machine learning offers opportunities to optimize portfolio management and enhance client services.

Growth Accelerators in the Japan Private Banking Market Industry

Strategic partnerships between banks and fintech companies are expected to accelerate growth by combining traditional banking expertise with cutting-edge technologies. Government support and initiatives to promote financial inclusion are likely to broaden the private banking market’s reach. Expansion into new product offerings and services catering to specific client segments will drive further growth.

Key Players Shaping the Japan Private Banking Market Market

- Mitsubishi UFJ Financial Group

- Japan Post Bank Co Ltd

- Mizuho Financial Group

- Sumitomo Mitsui Financial Group

- Norinchukin Bank

- Resona Holdings

- Fukuoka Financial Group

- Chiba Bank

- Bank of Yokohama

- Hokuhoku Financial Group Inc

Notable Milestones in Japan Private Banking Market Sector

- January 2023: Mitsubishi UFJ Financial Group (MUFG) announced plans to close deals worth at least 108 billion in Asia-Pacific, expanding its international presence.

- January 2023: Sumitomo Mitsui Financial Group (SMFG) plans to significantly increase its net profit from its ventures in Asia, demonstrating its focus on regional expansion.

In-Depth Japan Private Banking Market Market Outlook

The future of the Japan Private Banking market looks promising, driven by the continued growth of HNWIs, technological advancements, and strategic initiatives by major players. The market is poised for expansion driven by increased internationalization, evolving client needs, and innovations in wealth management solutions. The strategic partnerships and market expansion into new service areas will create a competitive landscape with attractive growth opportunities.

Japan Private Banking Market Segmentation

-

1. Type

- 1.1. Asset Management Service

- 1.2. Insurance Service

- 1.3. Trust Service

- 1.4. Tax Consulting

- 1.5. Real Estate Consulting

-

2. Application

- 2.1. Personal

- 2.2. Enterprise

Japan Private Banking Market Segmentation By Geography

- 1. Japan

Japan Private Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Number of High Net Worth Adult Individuals (HNWI) in Japan in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Private Banking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Asset Management Service

- 5.1.2. Insurance Service

- 5.1.3. Trust Service

- 5.1.4. Tax Consulting

- 5.1.5. Real Estate Consulting

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal

- 5.2.2. Enterprise

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mitsubishi UFJ Financial Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Japan Post Bank Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mizuho Financial Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sumitomo Mitsui Financial Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Norinchukin Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Resona Holdings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fukuoka Financial Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chiba Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bank of Yokohama

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hokuhoku Financial Group Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi UFJ Financial Group

List of Figures

- Figure 1: Japan Private Banking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Private Banking Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Private Banking Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Private Banking Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan Private Banking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Private Banking Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Japan Private Banking Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Japan Private Banking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Private Banking Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Japan Private Banking Market?

Key companies in the market include Mitsubishi UFJ Financial Group, Japan Post Bank Co Ltd, Mizuho Financial Group, Sumitomo Mitsui Financial Group, Norinchukin Bank, Resona Holdings, Fukuoka Financial Group, Chiba Bank, Bank of Yokohama, Hokuhoku Financial Group Inc *List Not Exhaustive.

3. What are the main segments of the Japan Private Banking Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Number of High Net Worth Adult Individuals (HNWI) in Japan in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Mitsubishi UFJ Financial Group Inc., or MUFG, which earns about half of its net operating profit from overseas operations, expects to close deals worth at least a combined 108 billion in Asia-Pacific in 2023. The bank and its subsidiaries announced plans in 2022 to acquire various consumer finance and securities businesses in the Philippines, Indonesia, and Thailand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Private Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Private Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Private Banking Market?

To stay informed about further developments, trends, and reports in the Japan Private Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence