Key Insights

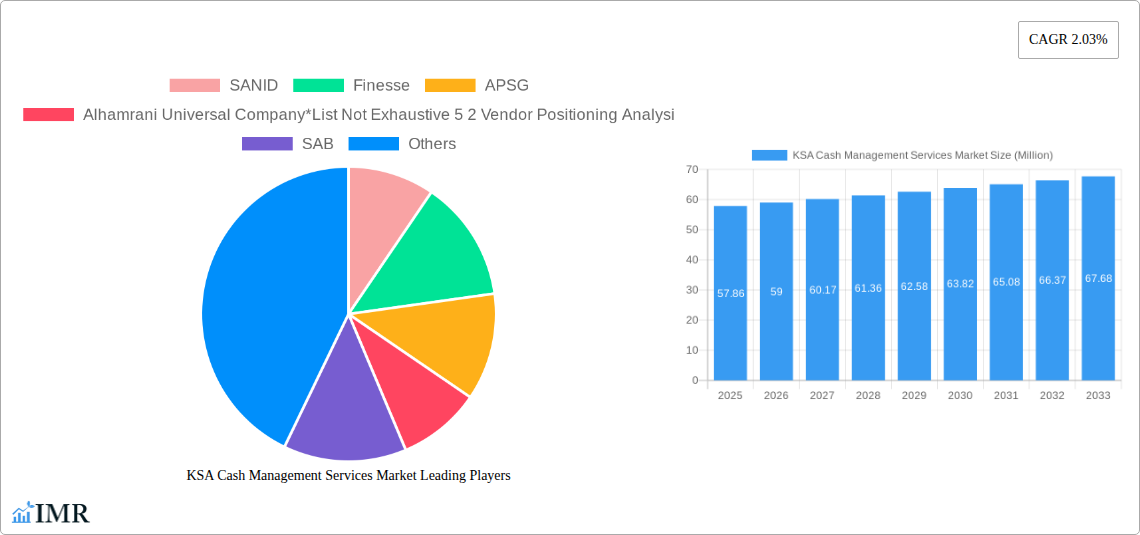

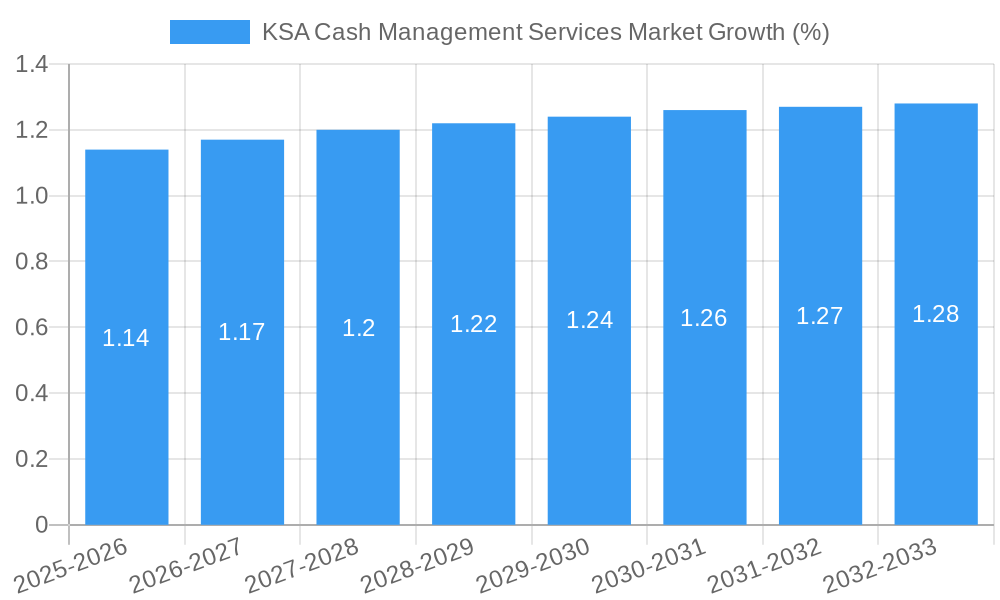

The Kingdom of Saudi Arabia (KSA) cash management services market, valued at $57.86 million in 2025, is projected to experience steady growth, driven by the nation's ongoing economic diversification and digital transformation initiatives. A Compound Annual Growth Rate (CAGR) of 2.03% is anticipated from 2025 to 2033, indicating a consistent, albeit moderate, expansion. This growth is fueled by increasing adoption of digital banking solutions, particularly among businesses seeking streamlined treasury management and improved operational efficiency. The rising penetration of mobile banking and fintech solutions further contributes to market expansion, as these platforms offer enhanced security, convenience, and cost-effectiveness compared to traditional methods. The market segmentation reveals significant demand across various sectors. Urban development and cultural heritage projects, along with the burgeoning agricultural and energy sectors, are key drivers for cash management service utilization. While challenges like stringent regulatory compliance and potential cybersecurity risks could pose restraints, the overall market outlook remains positive, driven by the government's Vision 2030 initiatives which aim to modernize the financial sector and boost economic activity.

The KSA cash management services market is segmented by type (earth observation data and value-added services), satellite orbit (low earth orbit, medium earth orbit, and geostationary orbit), and end-use (urban development and cultural heritage, agriculture, climate services, energy and raw materials, infrastructure, and others). While precise market share data for each segment isn't available, it can be reasonably inferred that the value-added services segment (e.g., reconciliation, forecasting, and reporting tools) will likely witness faster growth than the raw earth observation data segment due to increasing demand for sophisticated cash flow analysis and optimization capabilities. Similarly, the urban development and energy sectors are expected to be major contributors to the overall market size due to their higher capital expenditure requirements. Competition in the market is relatively intense, with a mix of both domestic and international players vying for market share. However, the market's expansion is likely to support the entry of new players, particularly those offering innovative technology solutions.

KSA Cash Management Services Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kingdom of Saudi Arabia (KSA) Cash Management Services Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is segmented by Type (Earth Observation Data, Value Added Services) and End-Use (Urban Development and Cultural Heritage, Agriculture, Climate Services, Energy and Raw Materials, Infrastructure, Other End-Use). The report also analyzes the competitive landscape, featuring key players such as SANID, Finesse, APSG, Alhamrani Universal Company, SAB, NCR Corporation, Northern Trust Corporation, ABANA Enterprises Group Co, Finastra, and Al Fareeq Security Services.

KSA Cash Management Services Market Market Dynamics & Structure

The KSA cash management services market is experiencing significant transformation driven by technological advancements, evolving regulatory frameworks, and shifting consumer preferences. Market concentration is moderate, with a few dominant players and numerous smaller firms competing. Technological innovation, particularly in digital payment solutions and mobile banking, is a key growth driver. The regulatory environment plays a crucial role, impacting market access and operational procedures. While the market is relatively mature, the ongoing digitalization efforts in the Kingdom create opportunities for new entrants and innovative solutions. The increasing adoption of fintech solutions is also creating a competitive landscape, where traditional banks face pressure from newer technology-driven firms. The market is witnessing a moderate level of mergers and acquisitions (M&A) activity, with larger players consolidating their market share and expanding their service offerings.

- Market Concentration: Moderate, with a xx% market share held by the top 5 players in 2024.

- Technological Innovation: Rapid adoption of digital payment systems, mobile banking, and AI-driven solutions are transforming the sector.

- Regulatory Framework: The Saudi Arabian Monetary Authority (SAMA) plays a significant role, influencing regulations related to financial transactions, data security, and compliance.

- Competitive Product Substitutes: The rise of fintech companies offering alternative payment solutions and cash management services poses a competitive threat to traditional players.

- End-User Demographics: The market caters to a diverse range of users, from individuals to large corporations, with varying needs and technological adoption levels.

- M&A Trends: A total of xx M&A deals were recorded in the KSA cash management services sector between 2019 and 2024, indicating consolidation and expansion efforts.

KSA Cash Management Services Market Growth Trends & Insights

The KSA cash management services market demonstrates consistent growth driven by increasing financial inclusion, government initiatives promoting digital transformation, and a rising adoption of cashless transactions. The market size reached xx million in 2024 and is projected to reach xx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The adoption rate of digital cash management solutions is steadily increasing, fueled by the convenience and efficiency offered by these platforms. Technological disruptions, such as the integration of blockchain technology and artificial intelligence, are creating opportunities for enhanced security and personalized services. Consumer behavior is shifting towards digital channels, leading to a decline in the reliance on traditional banking methods.

Dominant Regions, Countries, or Segments in KSA Cash Management Services Market

The KSA cash management services market is geographically concentrated, with major urban centers such as Riyadh, Jeddah, and Dammam exhibiting the highest growth rates. The Value Added Services segment holds the largest market share, driven by the increasing demand for specialized financial solutions. Key drivers include:

- Economic growth: Strong economic growth in KSA fosters increased demand for advanced cash management services.

- Government initiatives: Government support for digitalization and financial inclusion fuels market expansion.

- Infrastructure development: Improvements in internet penetration and mobile network coverage facilitate the adoption of digital platforms.

- Rising disposable income: Increased disposable income among the population drives the demand for advanced financial services.

The Value Added Services segment is projected to dominate the market throughout the forecast period, fuelled by the rising demand for customized solutions and specialized financial services.

KSA Cash Management Services Market Product Landscape

The KSA cash management services market offers a diverse range of products, encompassing traditional banking services and innovative digital solutions. These products include online banking platforms, mobile payment apps, treasury management systems, and specialized services for corporate clients. Key product innovations include enhanced security features, personalized financial management tools, and seamless integration with other financial applications. These advancements provide unique selling propositions focusing on increased efficiency, security, and customer experience. Technological advancements such as AI and machine learning are also transforming cash management services, offering improved fraud detection and risk management capabilities.

Key Drivers, Barriers & Challenges in KSA Cash Management Services Market

Key Drivers:

- Growing adoption of digital banking and mobile payment solutions.

- Government initiatives promoting financial inclusion and digital transformation.

- Increasing demand for specialized cash management solutions from corporate clients.

Challenges & Restraints:

- Cybersecurity threats and data breaches remain a major concern.

- Regulatory complexities and compliance requirements can hinder market entry.

- Competition from both traditional and fintech players poses a challenge. This competition has resulted in a xx% reduction in average profit margins for established players in the last 2 years.

Emerging Opportunities in KSA Cash Management Services Market

- Untapped markets in rural areas present significant opportunities for expansion.

- Innovative applications of blockchain technology can enhance security and transparency.

- Growing demand for personalized financial management tools offers scope for tailored services.

Growth Accelerators in the KSA Cash Management Services Market Industry

The KSA cash management services market is poised for sustained growth fueled by ongoing technological advancements, strategic partnerships between financial institutions and fintech companies, and government support for digital transformation. The expansion into underserved markets, coupled with tailored product development to meet specific customer needs, will act as a catalyst for long-term market expansion.

Key Players Shaping the KSA Cash Management Services Market Market

- SANID

- Finesse

- APSG

- Alhamrani Universal Company

- SAB

- NCR Corporation

- Northern Trust Corporation

- ABANA Enterprises Group Co

- Finastra

- Al Fareeq Security Services

Notable Milestones in KSA Cash Management Services Market Sector

- November 2022: American Express Saudi Arabia and Marriott Bonvoy launched the Marriott Bonvoy American Express Credit Card, boosting the adoption of rewards-based cash management solutions.

- December 2022: Saudi British Bank launched the SABB VISA Cashback Platinum Credit Card, further enhancing the attractiveness of credit-based cash management options.

- February 2023: Bank AlJazira and American Express Saudi Arabia partnered to expand ATM access for American Express cardholders, demonstrating increased collaborative efforts within the market.

In-Depth KSA Cash Management Services Market Market Outlook

The KSA cash management services market presents significant future potential, driven by the Kingdom's ongoing Vision 2030 initiatives and a growing emphasis on digitalization. The market is expected to experience sustained growth, driven by technological innovations, strategic partnerships, and a constantly evolving regulatory landscape. Strategic opportunities lie in developing customized solutions tailored to the specific needs of different customer segments, leveraging emerging technologies like AI and blockchain, and expanding into untapped markets within the country. The market's trajectory suggests a promising future for both established players and innovative newcomers.

KSA Cash Management Services Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

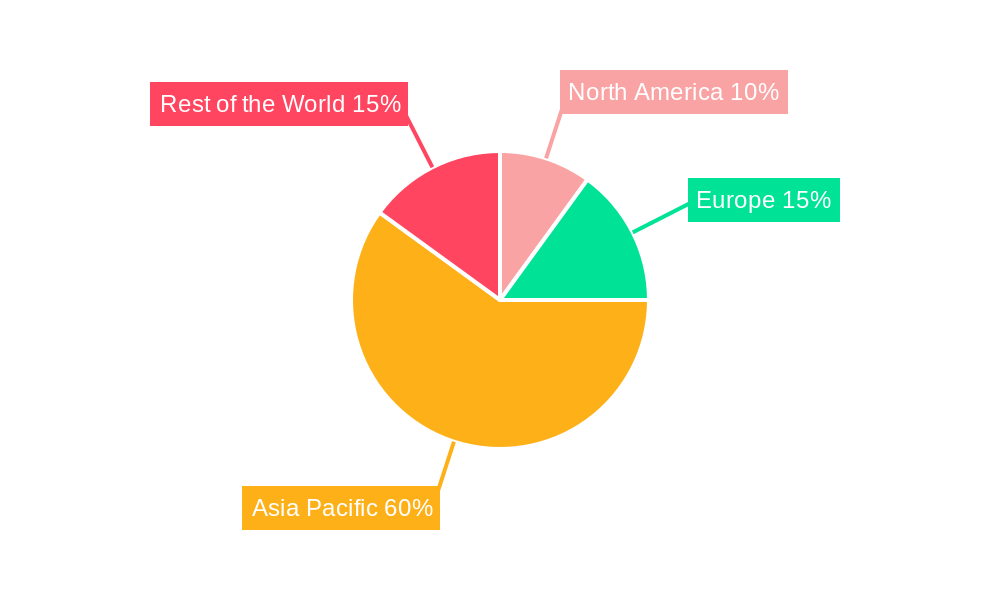

KSA Cash Management Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

KSA Cash Management Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand For Automation and Optimization of Working Capital Among Various Retailers4.; Increasing Adoption of Debit and Credit Cards4.; Adoption of AI and Advanced Analytics to Predict Patterns In Cash Forecasting

- 3.3. Market Restrains

- 3.3.1 4.; Shift Toward Non-cash Transaction4.; Software Incompatibility During Expansions

- 3.3.2 Lack of Expertise

- 3.3.3 and Insufficient Cash Management Skills

- 3.4. Market Trends

- 3.4.1. Growing Demand For Automation and Optimization of Working Capital Among Various Retailers is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. North America KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of the World KSA Cash Management Services Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 SANID

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Finesse

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 APSG

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Alhamrani Universal Company*List Not Exhaustive 5 2 Vendor Positioning Analysi

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 SAB

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 NCR Corporation

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Northern Trust Corporation

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 ABANA Enterprises Group Co

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Finastra

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Al Fareeq Security Services

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 SANID

List of Figures

- Figure 1: Global KSA Cash Management Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America KSA Cash Management Services Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 11: North America KSA Cash Management Services Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 12: North America KSA Cash Management Services Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 13: North America KSA Cash Management Services Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 14: North America KSA Cash Management Services Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 15: North America KSA Cash Management Services Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 16: North America KSA Cash Management Services Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America KSA Cash Management Services Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America KSA Cash Management Services Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 19: North America KSA Cash Management Services Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 20: North America KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America KSA Cash Management Services Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 23: South America KSA Cash Management Services Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 24: South America KSA Cash Management Services Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 25: South America KSA Cash Management Services Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 26: South America KSA Cash Management Services Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 27: South America KSA Cash Management Services Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 28: South America KSA Cash Management Services Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: South America KSA Cash Management Services Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: South America KSA Cash Management Services Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 31: South America KSA Cash Management Services Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 32: South America KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 33: South America KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe KSA Cash Management Services Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 35: Europe KSA Cash Management Services Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 36: Europe KSA Cash Management Services Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 37: Europe KSA Cash Management Services Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 38: Europe KSA Cash Management Services Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 39: Europe KSA Cash Management Services Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 40: Europe KSA Cash Management Services Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Europe KSA Cash Management Services Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Europe KSA Cash Management Services Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 43: Europe KSA Cash Management Services Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 44: Europe KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Europe KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East & Africa KSA Cash Management Services Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 47: Middle East & Africa KSA Cash Management Services Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 48: Middle East & Africa KSA Cash Management Services Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 49: Middle East & Africa KSA Cash Management Services Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 50: Middle East & Africa KSA Cash Management Services Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 51: Middle East & Africa KSA Cash Management Services Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 52: Middle East & Africa KSA Cash Management Services Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: Middle East & Africa KSA Cash Management Services Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: Middle East & Africa KSA Cash Management Services Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 55: Middle East & Africa KSA Cash Management Services Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 56: Middle East & Africa KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 57: Middle East & Africa KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 59: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 60: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 61: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 62: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 63: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 64: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 67: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 68: Asia Pacific KSA Cash Management Services Market Revenue (Million), by Country 2024 & 2032

- Figure 69: Asia Pacific KSA Cash Management Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global KSA Cash Management Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global KSA Cash Management Services Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global KSA Cash Management Services Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global KSA Cash Management Services Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global KSA Cash Management Services Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global KSA Cash Management Services Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global KSA Cash Management Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global KSA Cash Management Services Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Global KSA Cash Management Services Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Global KSA Cash Management Services Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Global KSA Cash Management Services Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Global KSA Cash Management Services Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global KSA Cash Management Services Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Global KSA Cash Management Services Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 27: Global KSA Cash Management Services Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 28: Global KSA Cash Management Services Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 29: Global KSA Cash Management Services Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 30: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Brazil KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Argentina KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of South America KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global KSA Cash Management Services Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 35: Global KSA Cash Management Services Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 36: Global KSA Cash Management Services Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 37: Global KSA Cash Management Services Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 38: Global KSA Cash Management Services Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 39: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United Kingdom KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Germany KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Benelux KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Nordics KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global KSA Cash Management Services Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: Global KSA Cash Management Services Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 51: Global KSA Cash Management Services Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 52: Global KSA Cash Management Services Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 53: Global KSA Cash Management Services Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 54: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Turkey KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Israel KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: GCC KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: North Africa KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East & Africa KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global KSA Cash Management Services Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 62: Global KSA Cash Management Services Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 63: Global KSA Cash Management Services Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 64: Global KSA Cash Management Services Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 65: Global KSA Cash Management Services Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 66: Global KSA Cash Management Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: China KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Japan KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: South Korea KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: ASEAN KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Oceania KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Rest of Asia Pacific KSA Cash Management Services Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the KSA Cash Management Services Market?

The projected CAGR is approximately 2.03%.

2. Which companies are prominent players in the KSA Cash Management Services Market?

Key companies in the market include SANID, Finesse, APSG, Alhamrani Universal Company*List Not Exhaustive 5 2 Vendor Positioning Analysi, SAB, NCR Corporation, Northern Trust Corporation, ABANA Enterprises Group Co, Finastra, Al Fareeq Security Services.

3. What are the main segments of the KSA Cash Management Services Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.86 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand For Automation and Optimization of Working Capital Among Various Retailers4.; Increasing Adoption of Debit and Credit Cards4.; Adoption of AI and Advanced Analytics to Predict Patterns In Cash Forecasting.

6. What are the notable trends driving market growth?

Growing Demand For Automation and Optimization of Working Capital Among Various Retailers is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Shift Toward Non-cash Transaction4.; Software Incompatibility During Expansions. Lack of Expertise. and Insufficient Cash Management Skills.

8. Can you provide examples of recent developments in the market?

February 2023 - Bank AlJazira and American Express Saudi Arabia signed a new partnership contract to provide American Express Cardmembers access to more than 600 ATMs nationwide. The agreement assists American Express Saudi Arabia's guarantee towards increasing the number of sites in which its Cardmembers can contact its services. By permitting ATM withdrawal transactions access to be processed more suitability, American Express Saudi Arabia pursues to strengthen its presence within the country and expand value assistance to its Cardmembers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "KSA Cash Management Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the KSA Cash Management Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the KSA Cash Management Services Market?

To stay informed about further developments, trends, and reports in the KSA Cash Management Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence