Key Insights

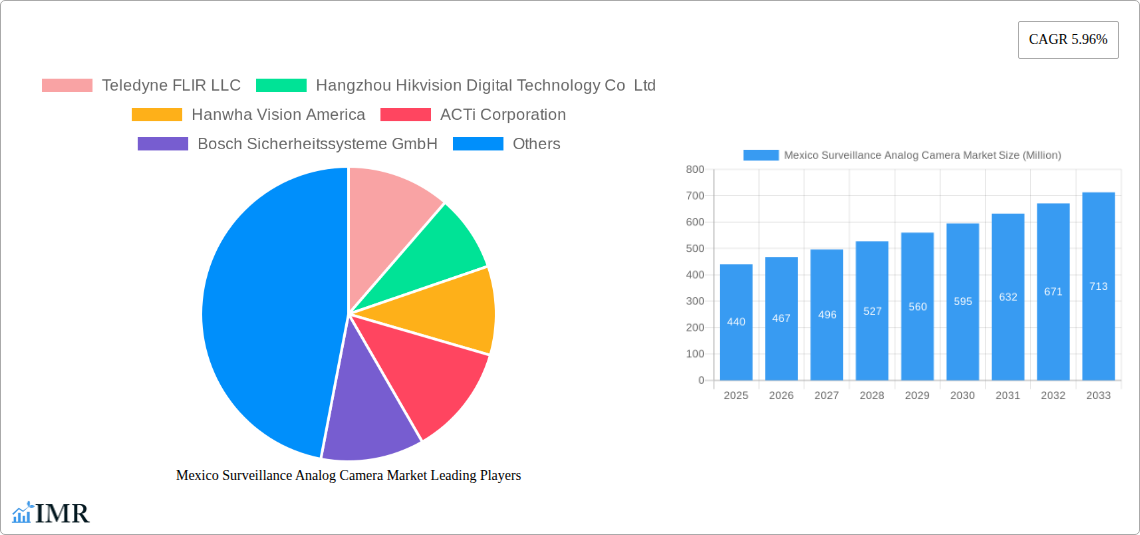

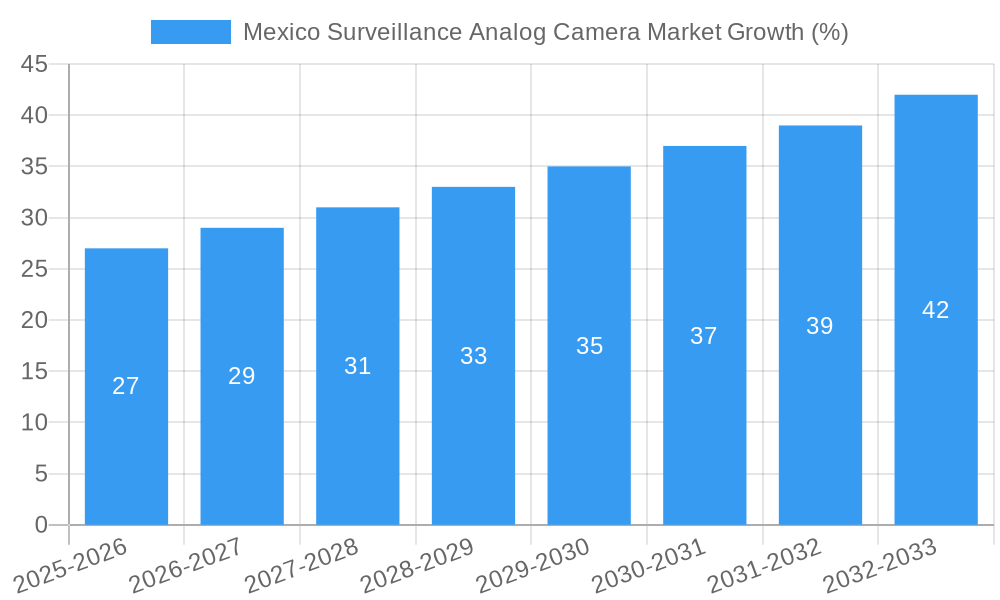

The Mexico surveillance analog camera market, valued at $440 million in 2025, is projected to experience steady growth, driven by increasing demand for security solutions across various sectors. The Compound Annual Growth Rate (CAGR) of 5.96% from 2025 to 2033 indicates a promising outlook for market expansion. Key drivers include rising concerns about crime and safety, particularly in urban areas and commercial establishments. The adoption of analog technology, despite the emergence of IP-based systems, continues to be prevalent due to its cost-effectiveness and ease of installation, particularly in smaller businesses and residential settings. However, the market faces restraints such as the limitations of analog technology in terms of image quality, scalability, and integration with advanced features like analytics. Furthermore, the ongoing transition to IP-based security systems presents a significant challenge to analog camera market growth. Market segmentation likely includes cameras based on resolution (e.g., low, medium, high), application (e.g., residential, commercial, government), and technology (e.g., CCTV, DVR). Major players like Teledyne FLIR, Hikvision, Hanwha Vision, and Bosch are actively competing in the market, offering a diverse range of products. The regional distribution within Mexico likely shows higher concentration in urban centers like Mexico City, Guadalajara, and Monterrey.

The market's trajectory indicates a gradual increase in value over the forecast period. While the transition to IP-based systems is inevitable, the analog camera market will likely maintain a presence due to its cost advantage and established infrastructure in many sectors. To sustain growth, manufacturers may focus on incorporating advanced features such as improved low-light performance and better image quality into their analog offerings, thereby extending the lifespan of the technology while serving niche market needs. Competitive pressures will likely drive price reductions and innovation in features, shaping the future landscape of the market. This will be further influenced by government initiatives promoting public safety and security infrastructure development.

Mexico Surveillance Analog Camera Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico surveillance analog camera market, covering market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The parent market is the broader Mexico security equipment market, while the child market is specifically analog surveillance cameras. This report is crucial for industry professionals, investors, and stakeholders seeking to understand the opportunities and challenges within this dynamic sector. The market size is projected to reach xx Million units by 2033.

Mexico Surveillance Analog Camera Market Dynamics & Structure

The Mexican surveillance analog camera market is characterized by a moderately concentrated landscape with several key players holding significant market share. Technological innovation, particularly in low-light imaging and HD over coax solutions, is a major driver. The regulatory framework, while evolving, generally supports the adoption of security solutions. Competition from IP cameras represents a significant challenge, though analog cameras retain a strong position, especially in price-sensitive segments. The market is driven by increasing concerns about crime and security, coupled with rising investments in infrastructure development and government initiatives. M&A activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, resulting in a market share shift of approximately xx%.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Technological Drivers: Advancements in low-light imaging, HD over coax technology, and compact designs.

- Regulatory Landscape: Supportive of security solutions, with ongoing updates and regulations.

- Competitive Substitutes: IP cameras pose the primary competitive threat.

- End-User Demographics: Significant demand from small and medium businesses (SMBs), retail, and government sectors.

- M&A Trends: Moderate activity in recent years, with xx deals recorded between 2019 and 2024.

Mexico Surveillance Analog Camera Market Growth Trends & Insights

The Mexican surveillance analog camera market experienced a CAGR of xx% during the historical period (2019-2024). This growth is attributed to factors such as increasing urbanization, rising crime rates, and the growing adoption of security systems across various sectors. While the market is witnessing a gradual shift towards IP-based solutions, the demand for analog cameras remains robust, particularly in cost-sensitive segments. The adoption rate for analog cameras is expected to decline gradually, with a projected penetration rate of xx% by 2033. However, technological advancements in analog technology continue to provide a competitive edge, with enhanced features like improved night vision and higher resolution. Consumer behavior trends indicate a preference for user-friendly, cost-effective solutions that integrate seamlessly into existing infrastructure. The market exhibits a strong correlation with economic growth and infrastructure development, with higher adoption rates in regions with robust economic activity.

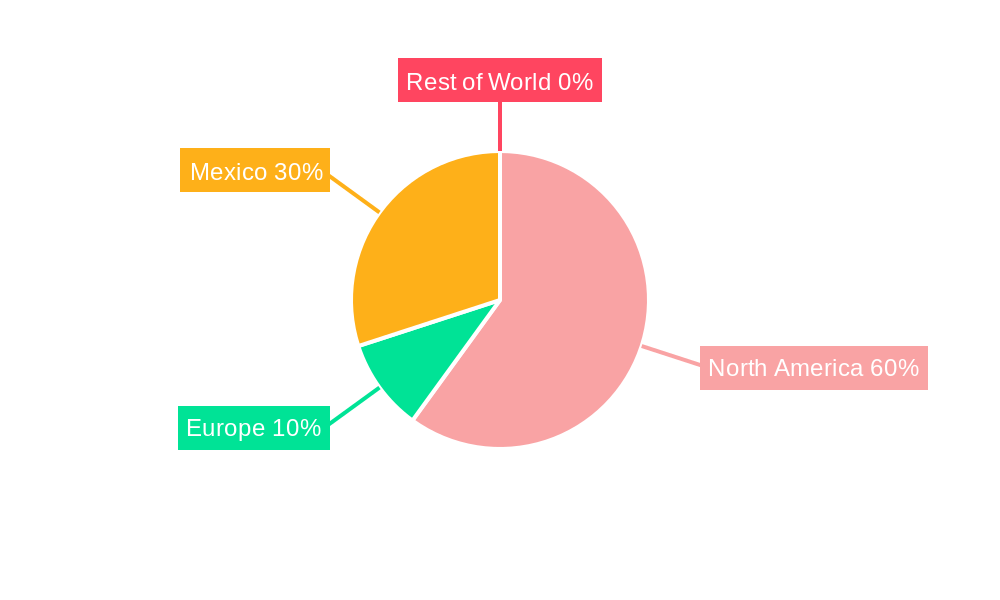

Dominant Regions, Countries, or Segments in Mexico Surveillance Analog Camera Market

The Mexico City metropolitan area and other major urban centers dominate the surveillance analog camera market, driven by high population density, increased security concerns, and significant investments in infrastructure projects. These areas show higher adoption rates across various sectors such as retail, commercial, and industrial establishments. Furthermore, the government sector, particularly related to public safety and border security, acts as a significant driver for market growth in these regions.

- Key Drivers: High population density, increased security concerns, government investments in infrastructure, and robust economic activity.

- Dominance Factors: Higher demand, increased spending on security solutions, and favorable regulatory environment.

- Growth Potential: Continued growth is expected, although at a moderate pace due to the transition to IP-based solutions.

Mexico Surveillance Analog Camera Market Product Landscape

Analog surveillance cameras in the Mexican market are characterized by a diverse range of products catering to varied needs and budgets. These include fixed dome, bullet, and turret cameras, offering varying resolutions, features (such as night vision and weatherproofing), and price points. Key advancements include improved low-light performance through larger apertures and enhanced sensor technology, enabling clearer images even in challenging conditions. The market also sees a continued emphasis on HD over coaxial cable technology, offering a cost-effective upgrade path for existing analog systems.

Key Drivers, Barriers & Challenges in Mexico Surveillance Analog Camera Market

Key Drivers:

- Rising crime rates and security concerns.

- Increased investments in infrastructure development across various sectors.

- Government initiatives promoting public safety and security measures.

- Cost-effectiveness of analog cameras compared to IP-based systems.

Key Barriers & Challenges:

- Competition from IP cameras, offering superior features and scalability.

- Potential supply chain disruptions impacting component availability and costs.

- Regulatory hurdles and compliance requirements potentially affecting market entry and growth.

- Price sensitivity among certain end-users, limiting the adoption of higher-end models. This impact is estimated to constrain growth by approximately xx% annually.

Emerging Opportunities in Mexico Surveillance Analog Camera Market

- Expansion into rural areas: Growing demand for security solutions in less-developed regions.

- Integration with smart city initiatives: Opportunities to integrate analog cameras into broader security networks.

- Development of niche applications: Targeted solutions for specific sectors such as agriculture, transportation, and energy.

- Focus on enhanced features: Demand for improved low-light performance and analytics capabilities.

Growth Accelerators in the Mexico Surveillance Analog Camera Market Industry

Technological advancements, strategic partnerships between manufacturers and distributors, and government support for security infrastructure projects are driving long-term growth. The continued improvement in analog camera technology, along with efforts to improve supply chain resilience and address regulatory challenges, will further fuel market expansion.

Key Players Shaping the Mexico Surveillance Analog Camera Market Market

- Teledyne FLIR LLC

- Hangzhou Hikvision Digital Technology Co Ltd

- Hanwha Vision America

- ACTi Corporation

- Bosch Sicherheitssysteme GmbH

- Pelco

- Zhejiang Uniview Technologies Co Ltd

- IDIS Ltd

- Honeywell International Inc

- Panasonic Corporation

- CP Plus

Notable Milestones in Mexico Surveillance Analog Camera Market Sector

- October 2023: Hikvision launched the ColorVu Fixed Turret (DS-2CE70DF0T-MF) and Bullet (DS-2CE10DF0T-F) cameras, featuring an F1.0 aperture, enhancing low-light performance.

- April 2024: Hikvision unveiled its Turbo HD 8.0 series, featuring real-time communication, 180-degree video coverage, enhanced night vision, and a compact design.

In-Depth Mexico Surveillance Analog Camera Market Market Outlook

The Mexican surveillance analog camera market is poised for continued growth, driven by advancements in technology, increased security concerns, and the expanding adoption of security systems across various sectors. While the transition towards IP-based solutions is expected to continue, the affordability and ease of integration of analog systems will ensure its sustained presence in the market. Strategic partnerships and investments in enhancing product capabilities will further unlock growth opportunities for key players in the coming years. The continued focus on cost-effective and reliable solutions will be paramount for maintaining market relevance.

Mexico Surveillance Analog Camera Market Segmentation

-

1. End-user Industry

- 1.1. Government

- 1.2. Banking

- 1.3. Healthcare

- 1.4. Transportation and Logistics

- 1.5. Industrial

- 1.6. Other End-user Industries

Mexico Surveillance Analog Camera Market Segmentation By Geography

- 1. Mexico

Mexico Surveillance Analog Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime

- 3.4. Market Trends

- 3.4.1. Cost Effectiveness and Affordability of Analog Cameras are Driving their Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Surveillance Analog Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Government

- 5.1.2. Banking

- 5.1.3. Healthcare

- 5.1.4. Transportation and Logistics

- 5.1.5. Industrial

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Teledyne FLIR LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hanwha Vision America

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ACTi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosch Sicherheitssysteme GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pelco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zhejiang Uniview Technologies Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDIS Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CP Plu

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Teledyne FLIR LLC

List of Figures

- Figure 1: Mexico Surveillance Analog Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Surveillance Analog Camera Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Surveillance Analog Camera Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Mexico Surveillance Analog Camera Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Surveillance Analog Camera Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Mexico Surveillance Analog Camera Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Mexico Surveillance Analog Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Mexico Surveillance Analog Camera Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Surveillance Analog Camera Market?

The projected CAGR is approximately 5.96%.

2. Which companies are prominent players in the Mexico Surveillance Analog Camera Market?

Key companies in the market include Teledyne FLIR LLC, Hangzhou Hikvision Digital Technology Co Ltd, Hanwha Vision America, ACTi Corporation, Bosch Sicherheitssysteme GmbH, Pelco, Zhejiang Uniview Technologies Co Ltd, IDIS Ltd, Honeywell International Inc, Panasonic Corporation, CP Plu.

3. What are the main segments of the Mexico Surveillance Analog Camera Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 440 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime.

6. What are the notable trends driving market growth?

Cost Effectiveness and Affordability of Analog Cameras are Driving their Demand.

7. Are there any restraints impacting market growth?

Cost Effectiveness and Affordability; Efforts Being Made by Government and Law Authorities to Leverage Technology to Reduce Crime.

8. Can you provide examples of recent developments in the market?

April 2024: Hikvision unveiled its latest Turbo HD 8.0, the newest iteration of its analog security product line. This upgraded version boasts four key features, namely real-time communication, 180-degree video coverage, enhanced night vision capabilities, and a more compact design. The dual-lens camera, a highlight of this release, leverages proprietary image-stitching technology to seamlessly deliver vivid, colorful 180-degree images, day or night. Due to its large F1.0 aperture and high-sensitivity sensors, these images maintain their vibrancy even in low-light conditions. Moreover, the camera's new compact design enhances its discretion, making it an ideal fit for small and medium businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Surveillance Analog Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Surveillance Analog Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Surveillance Analog Camera Market?

To stay informed about further developments, trends, and reports in the Mexico Surveillance Analog Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence