Key Insights

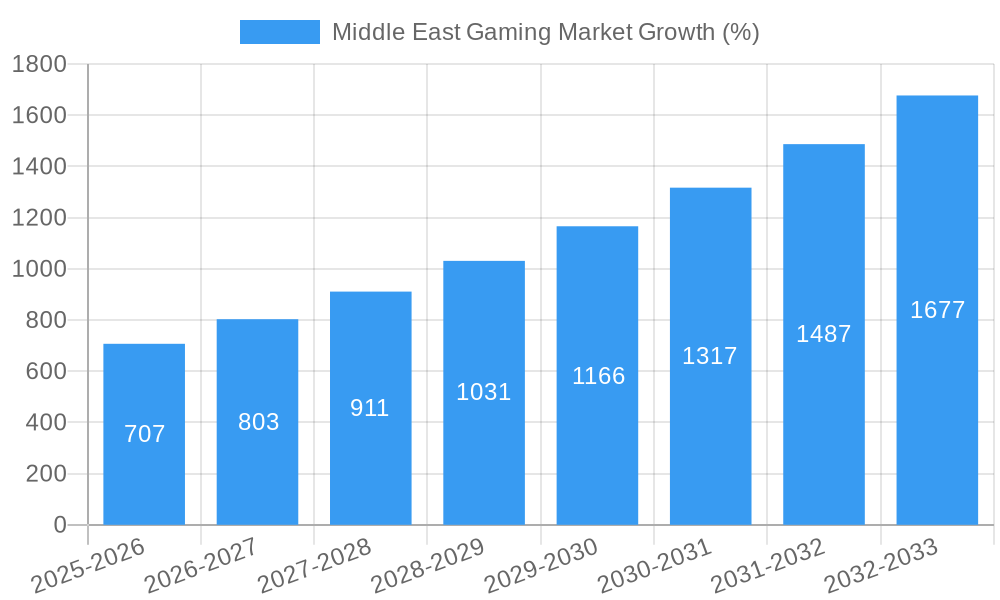

The Middle East gaming market, valued at $6.34 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 11.02% from 2025 to 2033. This expansion is driven by several key factors. The region's burgeoning young population, with a significant portion of digitally native individuals, is a primary driver. Increasing smartphone penetration and affordable internet access are further fueling market growth, allowing wider access to gaming platforms and online multiplayer experiences. Government initiatives promoting digital economies and investments in esports infrastructure also contribute to this upward trajectory. The preference for mobile gaming, coupled with the popularity of established titles and emerging regional esports scenes, creates a dynamic and rapidly evolving market landscape.

Significant growth is anticipated across various segments. Mobile gaming (Smartphone, Tablets) will likely dominate, reflecting global trends. The downloaded/box PC segment, although potentially smaller compared to mobile, will continue to have a presence, particularly among enthusiasts. Country-specific analysis reveals strong performance in the UAE and Saudi Arabia, reflecting higher disposable incomes and a more developed gaming ecosystem compared to other Middle Eastern nations. However, growth opportunities also exist in countries like Turkey and Iran, where the gaming market is still developing but possesses immense untapped potential. Key players, including Electronic Arts, NetEase, Google, Microsoft, Apple, and Sony, are actively competing for market share through strategic partnerships, content creation, and platform development. While challenges exist, such as regional regulatory hurdles and concerns regarding internet accessibility in certain areas, the overall outlook for the Middle East gaming market remains incredibly promising.

Middle East Gaming Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East gaming market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by platform (Browser PC, Smartphone, Tablets, Gaming Console, Downloaded/Box PC) and country (United Arab Emirates, Saudi Arabia, Turkey, Iran, Kuwait, Rest of Middle East), offering granular insights into this rapidly expanding sector. Key players such as Electronic Arts Inc, NetEase Inc, Google LLC (Alphabet Inc), Microsoft Corporation, Apple Inc, and Sony Corporation are analyzed, though the list is not exhaustive. The report's findings are invaluable for investors, industry professionals, and anyone seeking a strategic understanding of the Middle East gaming landscape.

Middle East Gaming Market Dynamics & Structure

The Middle East gaming market exhibits a dynamic interplay of factors shaping its structure and growth trajectory. Market concentration is moderate, with a few major players holding significant shares, alongside a vibrant ecosystem of smaller developers and publishers. Technological innovation, particularly in areas like cloud gaming and esports, is a primary driver, while regulatory frameworks and their evolution significantly impact market access and operations. The presence of strong competitive product substitutes, such as streaming services and other forms of entertainment, presents challenges. End-user demographics, predominantly skewed towards younger age groups, influence game preferences and spending habits. M&A activity is steadily increasing, reflecting both consolidation within the industry and strategic investments in promising areas.

- Market Concentration: Moderate, with top 5 players holding xx% of market share in 2024.

- Technological Innovation: Cloud gaming, VR/AR integration, and esports are key drivers.

- Regulatory Frameworks: Vary across countries, impacting game content and monetization strategies.

- Competitive Substitutes: Streaming services and other entertainment options create competitive pressure.

- End-User Demographics: Predominantly young adults (18-35), influencing game preferences and spending.

- M&A Trends: Increasing deal volume, reflecting industry consolidation and strategic investments (xx deals in 2024).

Middle East Gaming Market Growth Trends & Insights

The Middle East gaming market is experiencing robust growth, fueled by increasing smartphone penetration, rising disposable incomes, and a burgeoning esports culture. The market size, valued at xx million units in 2024, is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is driven by the significant adoption of mobile gaming, which accounts for the largest segment. Technological disruptions, such as the rise of cloud gaming and the metaverse, are poised to further accelerate market expansion. Consumer behavior is shifting towards more immersive and interactive experiences, favoring games that offer social interaction and competitive gameplay. The market is also witnessing a growing interest in esports, with an increasing number of tournaments and sponsorships.

Dominant Regions, Countries, or Segments in Middle East Gaming Market

Saudi Arabia and the United Arab Emirates are the leading countries in the Middle East gaming market, driven by strong economic growth, high internet penetration, and supportive government policies. The smartphone segment dominates the platform landscape, reflecting the widespread availability and affordability of smartphones. However, gaming consoles and PC gaming are also witnessing significant growth, particularly in urban areas.

- Leading Countries: Saudi Arabia and UAE (holding xx% and xx% market share respectively in 2024).

- Dominant Platform: Smartphones (accounting for xx% of the market in 2024).

- Key Growth Drivers: High internet penetration, rising disposable incomes, supportive government initiatives (e.g., Vision 2030 in Saudi Arabia).

Middle East Gaming Market Product Landscape

The Middle East gaming market boasts a diverse product landscape encompassing mobile, PC, and console games across various genres. Innovative game mechanics, engaging storylines, and immersive graphics are key differentiators. Hyper-casual games, multiplayer online battle arenas (MOBAs), and battle royale titles are popular among consumers. Technological advancements in graphics rendering, AI, and virtual reality (VR) are further enhancing gaming experiences, leading to a more dynamic and immersive gaming environment.

Key Drivers, Barriers & Challenges in Middle East Gaming Market

Key Drivers:

- Increasing smartphone and internet penetration.

- Rising disposable incomes among younger demographics.

- Government support for the gaming and esports industries.

- Growth of esports and associated events.

Key Barriers & Challenges:

- Regulatory hurdles related to game content and licensing.

- Limited access to high-speed internet in certain regions.

- Competition from other forms of entertainment.

- Dependence on international game developers, limiting local content creation. The impact of these challenges could reduce market growth by an estimated xx% by 2033 if not addressed.

Emerging Opportunities in Middle East Gaming Market

The Middle East gaming market presents significant opportunities for growth, particularly in untapped markets beyond the major urban centers. The expansion of cloud gaming services offers potential to reach broader audiences, particularly in areas with limited internet bandwidth. The growing popularity of esports presents opportunities for tournament organizers, sponsors, and streaming platforms. Furthermore, the development of localized game content and the incorporation of regional cultural elements offer a unique opportunity to cater to diverse preferences.

Growth Accelerators in the Middle East Gaming Market Industry

Technological advancements, especially in cloud gaming and virtual reality (VR), are primary growth catalysts. Strategic partnerships between international gaming companies and local distributors are enabling market expansion. Government initiatives aimed at fostering a vibrant gaming ecosystem, along with the rising popularity of esports, are further propelling the market's growth. These combined factors point to a highly promising future for the Middle East gaming industry.

Key Players Shaping the Middle East Gaming Market Market

- Electronic Arts Inc

- NetEase Inc

- Google LLC (Alphabet Inc)

- Microsoft Corporation

- Apple Inc

- Sony Corporation

Notable Milestones in Middle East Gaming Market Sector

- April 2023: Wemade signs MoU with Saudi Ministry of Investment (MISA) to develop Saudi Arabia's gaming and blockchain sectors. This signifies increased government support for technological advancements within the gaming market.

- May 2022: Gamerji, an Indian esports platform, expands into the UAE and Saudi Arabia, indicating growing interest from international companies in the region's market.

In-Depth Middle East Gaming Market Market Outlook

The Middle East gaming market is poised for sustained growth, driven by technological innovation, favorable government policies, and a rapidly evolving consumer landscape. The expansion of cloud gaming and the growing popularity of esports will be key drivers. Strategic partnerships and investments from international gaming companies are expected to further accelerate market expansion, creating significant opportunities for both established players and new entrants. The market's long-term potential is substantial, offering ample rewards for businesses that understand and cater to the specific needs and preferences of the region's gaming community.

Middle East Gaming Market Segmentation

-

1. Platform

- 1.1. Browser PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

Middle East Gaming Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Presence of Young and Millennial Consumers; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Issues like Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. The Smartphones Segment is Expected to Hold the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Browser PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. United Arab Emirates Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Electronic Arts Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 NetEase Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Google LLC (Alphabet Inc )

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Microsoft Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Apple Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Sony Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Electronic Arts Inc

List of Figures

- Figure 1: Middle East Gaming Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Gaming Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 3: Middle East Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Middle East Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United Arab Emirates Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Saudi Arabia Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Qatar Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Israel Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Egypt Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Oman Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Middle East Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 13: Middle East Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Arabia Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Arab Emirates Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Israel Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Qatar Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kuwait Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Oman Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Bahrain Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Jordan Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Lebanon Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Gaming Market?

The projected CAGR is approximately 11.02%.

2. Which companies are prominent players in the Middle East Gaming Market?

Key companies in the market include Electronic Arts Inc, NetEase Inc *List Not Exhaustive, Google LLC (Alphabet Inc ), Microsoft Corporation, Apple Inc, Sony Corporation.

3. What are the main segments of the Middle East Gaming Market?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Presence of Young and Millennial Consumers; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

The Smartphones Segment is Expected to Hold the Significant Market Share.

7. Are there any restraints impacting market growth?

Issues like Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

Apr 2023: Wemade, the South Korean game company behind the worldwide blockchain gaming platform WEMIX PLAY, signed a Memorandum of Understanding (MoU) with the Saudi Ministry of Investment (MISA). The partnership will focus on developing and expanding Saudi Arabia's gaming and blockchain sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Gaming Market?

To stay informed about further developments, trends, and reports in the Middle East Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence