Key Insights

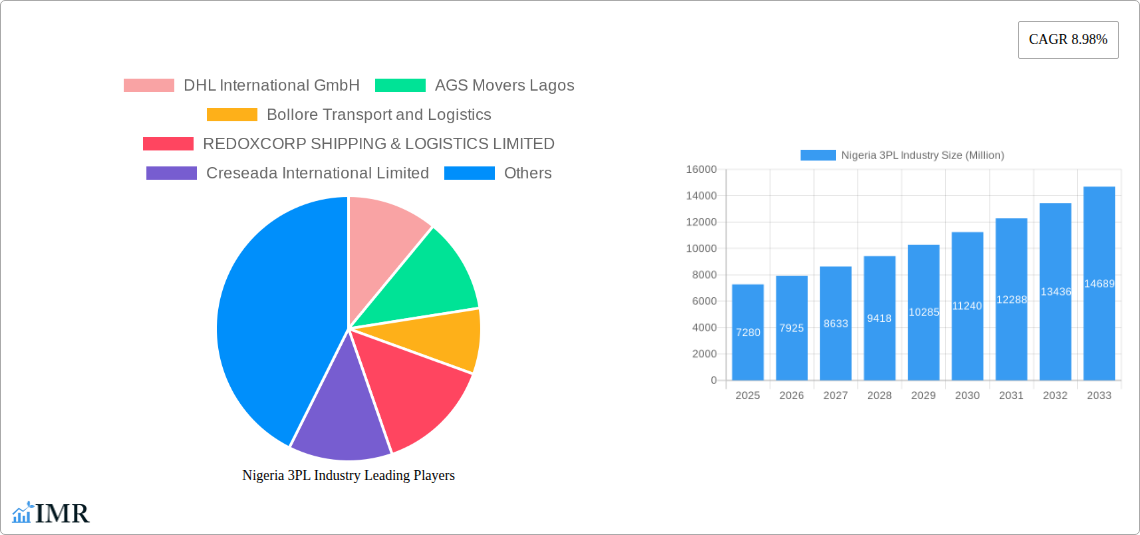

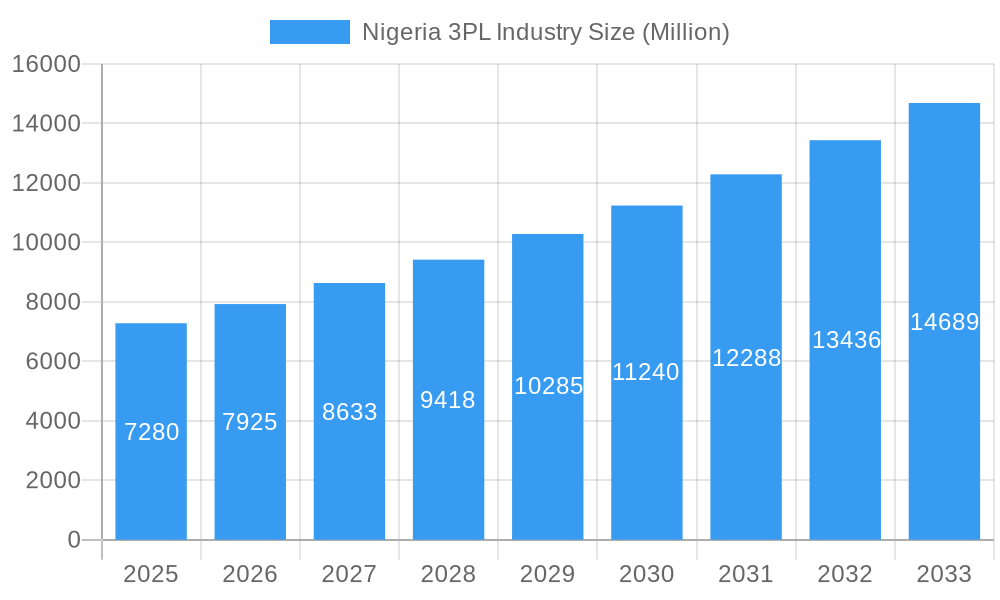

The Nigerian 3PL (Third-Party Logistics) industry is experiencing robust growth, projected to reach a market size of $7.28 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.98% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector in Nigeria fuels demand for efficient warehousing, distribution, and last-mile delivery solutions. Simultaneously, the growth of manufacturing and automotive industries, as well as the oil & gas and chemicals sectors, necessitates reliable and specialized transportation and logistics services. Increased consumer spending and a growing middle class further contribute to this positive market trajectory. The industry is segmented by service type (domestic and international transportation management, value-added warehousing and distribution) and end-user (manufacturing & automotive, oil & gas and chemicals, distributive trade, pharma & healthcare, construction, and others). Key players like DHL, UPS, MSC, and numerous local companies compete within this dynamic landscape, constantly adapting to evolving technological advancements and regulatory changes. Despite challenges such as infrastructure limitations and bureaucratic hurdles, the long-term outlook remains optimistic, indicating significant opportunities for growth and investment in the Nigerian 3PL market.

Nigeria 3PL Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of multinational giants and local logistics providers. Multinationals bring established expertise and global networks, while local companies leverage their intimate understanding of the Nigerian market and its unique challenges. This dynamic interplay fosters innovation and ensures a diverse range of service offerings to meet the evolving needs of various industries. Expansion of the 3PL industry is further facilitated by government initiatives aimed at improving infrastructure and streamlining logistics processes. However, ongoing efforts are required to address infrastructural limitations, security concerns, and regulatory complexities to fully unlock the market's substantial growth potential. The increasing adoption of technology, including digital platforms and advanced tracking systems, is streamlining operations and enhancing transparency across the supply chain, contributing significantly to the sector's overall efficiency and competitiveness.

Nigeria 3PL Industry Company Market Share

Nigeria 3PL Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Nigerian 3PL (Third-Party Logistics) industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033, this report is an essential resource for industry professionals, investors, and strategic planners seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report utilizes data from 2019-2024 (Historical Period), with the base year set at 2025 and a forecast period spanning 2025-2033. Market values are presented in millions of units.

Nigeria 3PL Industry Market Dynamics & Structure

The Nigerian 3PL market is characterized by a moderately concentrated landscape, with both international giants and local players competing. Market share is estimated at xx% for the top 5 players in 2025, indicating room for further consolidation. Technological innovation, while growing, faces barriers including infrastructure limitations and digital literacy gaps. The regulatory framework, though improving, requires further streamlining to foster efficiency and transparency. Competitive substitutes primarily include in-house logistics operations for larger companies. The end-user demographic is diverse, with significant growth potential across various sectors. M&A activity remains moderate, with xx deals recorded in the historical period (2019-2024), primarily focused on expansion and integration.

- Market Concentration: Top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Adoption of advanced technologies like AI and IoT is gradual, hampered by infrastructure challenges.

- Regulatory Framework: Requires further streamlining to improve efficiency and transparency.

- Competitive Substitutes: In-house logistics operations pose a challenge to 3PL providers.

- M&A Activity: xx deals recorded between 2019-2024, driven by expansion and integration strategies.

Nigeria 3PL Industry Growth Trends & Insights

The Nigerian 3PL market exhibits robust growth, driven by the expansion of e-commerce, increasing manufacturing activity, and the growing need for efficient supply chain management. The market size is projected to reach xx million units by 2025, registering a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising adoption rates of 3PL services across various end-user segments, particularly in the distributive trade (wholesale & retail, including e-commerce) and manufacturing sectors. Technological disruptions, including automation and digitization, are accelerating efficiency and transparency, further boosting market expansion. Consumer behavior shifts towards online shopping and the demand for faster delivery are significant contributing factors.

Dominant Regions, Countries, or Segments in Nigeria 3PL Industry

Lagos and other major urban centers dominate the Nigerian 3PL market, driven by higher concentration of businesses and better infrastructure compared to rural areas. Within the service segments, International Transportation Management is experiencing significant growth due to increasing global trade. In terms of end-users, the Distributive Trade (Wholesale and Retail including e-commerce) sector leads, fueled by rapid e-commerce expansion. The Manufacturing & Automotive sector shows considerable potential for future growth.

- Key Drivers: Government initiatives supporting infrastructure development, growth of e-commerce, rising disposable incomes.

- Dominance Factors: High business concentration in urban areas, favorable economic policies, and rising demand from key end-user segments.

Nigeria 3PL Industry Product Landscape

The Nigerian 3PL market offers a diverse range of services, including domestic and international transportation management, warehousing and distribution, and value-added services like inventory management and order fulfillment. Innovations focus on enhancing efficiency and transparency through technology integration, including real-time tracking systems, warehouse management systems (WMS), and transportation management systems (TMS). Unique selling propositions revolve around speed, reliability, cost-effectiveness, and customized solutions tailored to specific client needs.

Key Drivers, Barriers & Challenges in Nigeria 3PL Industry

Key Drivers: Rapid growth of e-commerce, increasing foreign direct investment, government initiatives to improve infrastructure.

Challenges: Poor infrastructure (roads, ports), security concerns, regulatory complexities, and lack of skilled labor impact market growth and profitability, with estimates suggesting a xx% reduction in efficiency due to these factors.

Emerging Opportunities in Nigeria 3PL Industry

Untapped markets in rural areas, expansion of cold chain logistics for the pharma and healthcare sectors, and increasing adoption of technology present significant growth opportunities. The integration of technology across the value chain will bring higher efficiency and drive market expansion.

Growth Accelerators in the Nigeria 3PL Industry

Technological advancements, strategic partnerships between 3PL providers and e-commerce platforms, and government initiatives to enhance infrastructure will further fuel the market's growth trajectory. Expansion into underserved regions also holds immense potential.

Key Players Shaping the Nigeria 3PL Industry Market

- DHL International GmbH

- AGS Movers Lagos

- Bollore Transport and Logistics

- REDOXCORP SHIPPING & LOGISTICS LIMITED

- Creseada International Limited

- Redline Logistics

- ABC Transport

- MSC (Mediterranean Shipping Company)

- UPS (United Postal Services)

- GWX

- Maersk Line

- LOGISTIQ XPEDITORS LIMITED

Notable Milestones in Nigeria 3PL Industry Sector

- June 2022: Bolloré Group's sale of Bolloré Africa Logistics to MSC Group for 6.07 USD billion, significantly impacting market dynamics.

- January 2022: Kuehne+Nagel expands its African network, enhancing regional coverage and service standards.

In-Depth Nigeria 3PL Industry Market Outlook

The Nigerian 3PL market is poised for significant growth over the forecast period, driven by the factors discussed above. Strategic partnerships, technological investments, and improved infrastructure will be key to unlocking the market's full potential. Opportunities exist for both established players and new entrants to capitalize on the expanding demand for efficient and reliable logistics solutions.

Nigeria 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Nigeria 3PL Industry Segmentation By Geography

- 1. Niger

Nigeria 3PL Industry Regional Market Share

Geographic Coverage of Nigeria 3PL Industry

Nigeria 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems

- 3.2.2 fleet management solutions

- 3.2.3 and warehouse automation

- 3.3. Market Restrains

- 3.3.1 4.; Limited cold storage facilities

- 3.3.2 inadequate transportation networks

- 3.3.3 and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector.

- 3.4. Market Trends

- 3.4.1. AfCFTA to Increase Intra Regional Trade

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL International GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AGS Movers Lagos

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bollore Transport and Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 REDOXCORP SHIPPING & LOGISTICS LIMITED

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Creseada International Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Redline Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABC Transport

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MSC (Mediterranean Shipping Company)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UPS (United Postal Services)**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GWX

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Maersk Line

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 LOGISTIQ XPEDITORS LIMITED

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DHL International GmbH

List of Figures

- Figure 1: Nigeria 3PL Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Nigeria 3PL Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Nigeria 3PL Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Nigeria 3PL Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Nigeria 3PL Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Nigeria 3PL Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Nigeria 3PL Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria 3PL Industry?

The projected CAGR is approximately 8.98%.

2. Which companies are prominent players in the Nigeria 3PL Industry?

Key companies in the market include DHL International GmbH, AGS Movers Lagos, Bollore Transport and Logistics, REDOXCORP SHIPPING & LOGISTICS LIMITED, Creseada International Limited, Redline Logistics, ABC Transport, MSC (Mediterranean Shipping Company), UPS (United Postal Services)**List Not Exhaustive, GWX, Maersk Line, LOGISTIQ XPEDITORS LIMITED.

3. What are the main segments of the Nigeria 3PL Industry?

The market segments include Service, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.28 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems. fleet management solutions. and warehouse automation.

6. What are the notable trends driving market growth?

AfCFTA to Increase Intra Regional Trade.

7. Are there any restraints impacting market growth?

4.; Limited cold storage facilities. inadequate transportation networks. and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector..

8. Can you provide examples of recent developments in the market?

June 2022: Following the exclusive negotiations announced on 20 December 2021 and the favorable opinions issued by each of the consulted employee representative bodies, the Bollore Group signed an agreement with the MSC Group for the sale of 100% Bolloré Africa Logistics, comprising Bollore Group's transport and logistics activities in Africa, on the basis of an enterprise value, net of minority interests, of 5.7 billion euros (6.07 USD billion).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria 3PL Industry?

To stay informed about further developments, trends, and reports in the Nigeria 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence