Key Insights

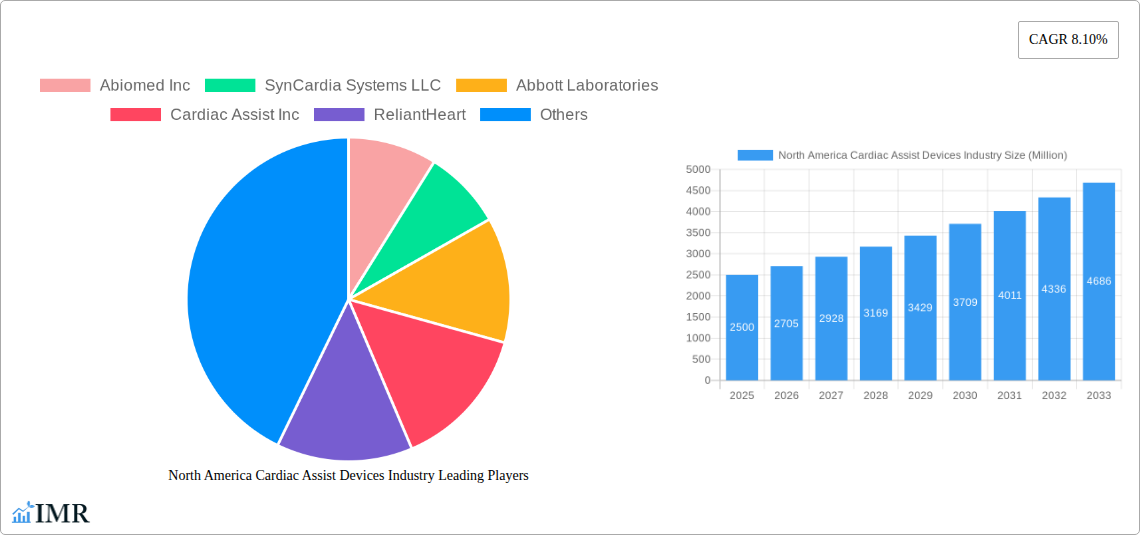

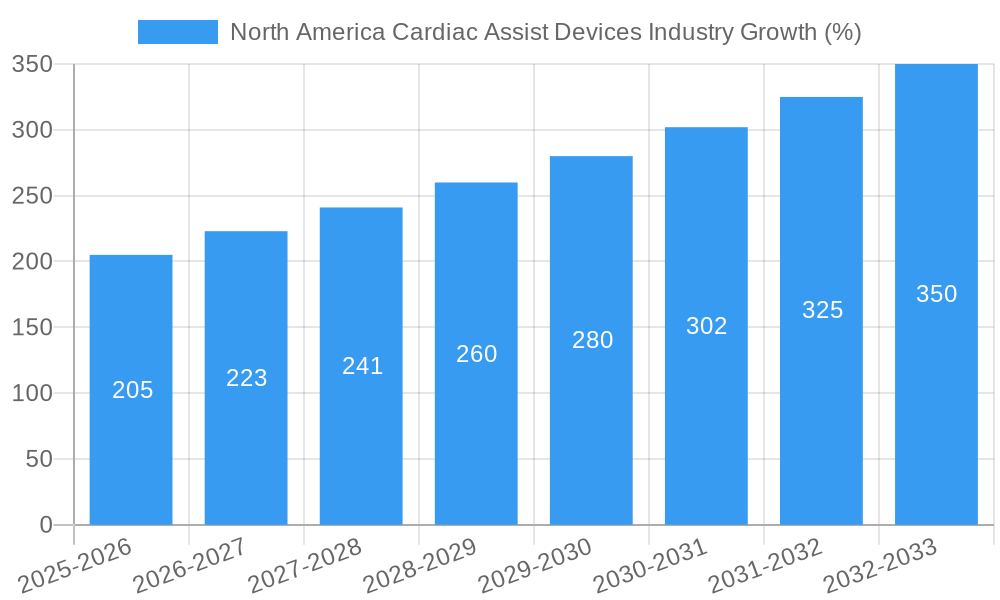

The North American cardiac assist devices market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a rising prevalence of heart failure, an aging population, and advancements in device technology. The 8.10% CAGR from 2019-2033 indicates a significant expansion in market size over the forecast period (2025-2033). Key segments driving this growth include ventricular assist devices (VADs), which currently hold a dominant market share due to their increasing adoption in bridge-to-transplant and destination therapy. Intra-aortic balloon pumps (IABPs), while a more established technology, continue to contribute significantly, particularly in short-term support scenarios. The market also shows promise in the emerging total artificial heart segment, although this area is currently smaller and faces challenges related to cost and long-term durability. Leading companies like Abiomed, SynCardia, and Medtronic are actively involved in research and development, further propelling market innovation and competition. Regulatory approvals and reimbursement policies influence market access, while technological advancements, such as miniaturized devices and improved biocompatibility, are key drivers of market expansion. The United States represents the largest portion of the North American market, fueled by higher healthcare spending and a larger patient pool compared to Canada and Mexico. However, increasing competition and pricing pressures could present some challenges for market players.

Growth in the North American cardiac assist devices market is expected to remain strong throughout the forecast period, spurred by several factors. Continued innovation in VAD technology, including improved durability and reduced complications, will likely contribute significantly to this growth. Furthermore, expansion of indications for VAD therapy and the increasing awareness among healthcare providers regarding the benefits of these devices will positively influence market dynamics. Despite the potential for restraints such as high device costs and the need for specialized surgical procedures, the substantial unmet medical needs in heart failure management, coupled with favorable regulatory environment in North America, will continue to drive market growth over the long-term. The market will witness increased investments in research and development from both large corporations and smaller, innovative companies, leading to better outcomes for patients and overall market expansion.

This comprehensive report provides a detailed analysis of the North America cardiac assist devices market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024. The market is segmented by product type: Intra-aortic Balloon Pumps, Total Artificial Heart, and Ventricular Assist Devices. The parent market is the North American medical device industry, while the child market is cardiac care devices. This report is designed for industry professionals, investors, and strategic decision-makers seeking in-depth insights into this vital sector. Market values are presented in Million units.

North America Cardiac Assist Devices Industry Market Dynamics & Structure

The North American cardiac assist devices market is characterized by moderate concentration, with key players such as Abiomed Inc, Medtronic Plc, and Abbott Laboratories holding significant market share (xx%). Technological innovation, particularly in miniaturization and improved biocompatibility, is a major driver. Stringent regulatory frameworks (e.g., FDA approvals) shape product development and market entry. Competitive pressures arise from substitute therapies and emerging technologies. The end-user demographic is primarily comprised of patients with advanced heart failure. Mergers and acquisitions (M&A) activity has been moderate, with xx deals recorded during the historical period, indicating ongoing consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Focus on miniaturization, improved biocompatibility, and enhanced durability.

- Regulatory Framework: Stringent FDA regulations impact product development timelines and market access.

- Competitive Substitutes: Surgical interventions and pharmacological treatments pose competitive pressure.

- End-User Demographics: Primarily patients with advanced heart failure and other cardiac conditions.

- M&A Activity: xx M&A deals during 2019-2024, indicating a trend toward consolidation.

North America Cardiac Assist Devices Industry Growth Trends & Insights

The North America cardiac assist devices market exhibited a CAGR of xx% during 2019-2024, reaching a market size of xx million units in 2024. This growth is driven by increasing prevalence of heart failure, aging population, technological advancements, and rising healthcare expenditure. Market penetration is expected to increase steadily, driven by improved device efficacy and reduced procedural risks. Technological disruptions, such as the development of less invasive implantation techniques and improved power sources, are contributing to market expansion. Changing consumer preferences towards minimally invasive procedures are also impacting market dynamics. The forecast period (2025-2033) projects a CAGR of xx%, reaching xx million units by 2033.

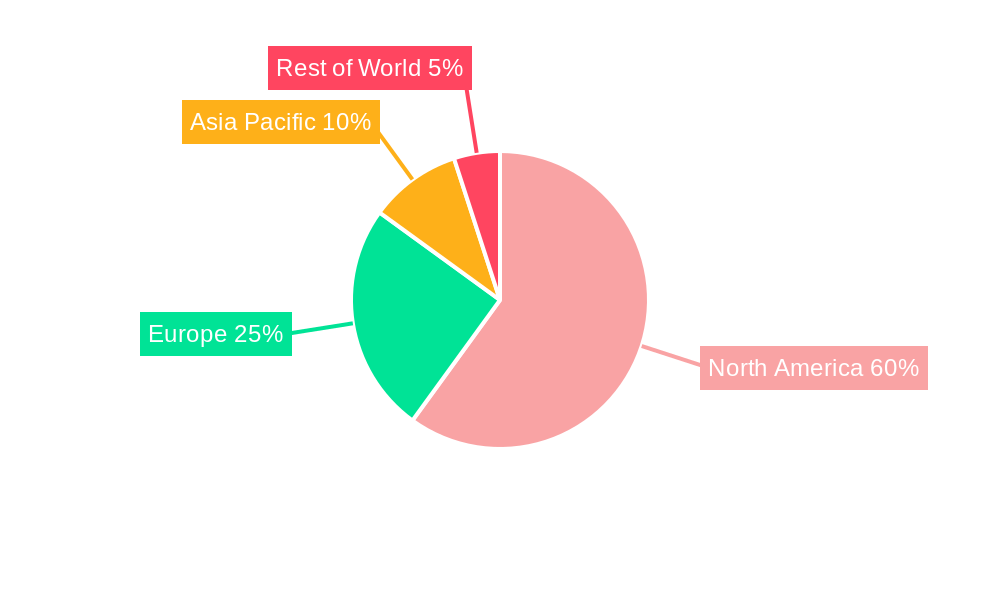

Dominant Regions, Countries, or Segments in North America Cardiac Assist Devices Industry

The United States dominates the North American cardiac assist devices market, accounting for xx% of the total market value. This dominance is attributed to factors such as high prevalence of heart failure, advanced healthcare infrastructure, and substantial healthcare spending. Canada constitutes a smaller but significant market. Within product segments, Ventricular Assist Devices (VADs) represent the largest share (xx%), driven by their versatility and effectiveness in treating various heart conditions. Intra-aortic Balloon Pumps (IABPs) maintain a steady market share (xx%), primarily owing to their established role in short-term circulatory support. The Total Artificial Heart market segment is smaller but demonstrates growth potential (xx%).

- Key Drivers for US Dominance: High prevalence of heart failure, advanced healthcare infrastructure, high healthcare expenditure.

- VAD Market Leadership: Superior efficacy and versatility in treating diverse heart conditions.

- IABP Market Stability: Established role in short-term circulatory support; cost-effectiveness compared to VADs.

- Total Artificial Heart Market Potential: Growth driven by technological advancements and improved patient outcomes.

North America Cardiac Assist Devices Industry Product Landscape

The North American cardiac assist devices market offers a diverse range of products, each characterized by unique selling propositions (USPs) and technological advancements. VADs have evolved to become smaller, more durable, and less invasive. IABPs continue to be refined for improved efficiency and safety. Total artificial hearts benefit from advancements in biomaterials and power sources, enhancing longevity and patient outcomes. These advancements focus on minimizing complications and improving patient quality of life.

Key Drivers, Barriers & Challenges in North America Cardiac Assist Devices Industry

Key Drivers:

- Increasing prevalence of heart failure.

- Technological advancements leading to improved device efficacy and safety.

- Rising healthcare expenditure and insurance coverage.

- Growing geriatric population.

Key Barriers & Challenges:

- High cost of devices and procedures.

- Stringent regulatory approvals and compliance requirements.

- Potential for complications and adverse events.

- Competition from alternative therapies.

- Supply chain disruptions (impact of xx% on market growth during the historical period).

Emerging Opportunities in North America Cardiac Assist Devices Industry

Emerging opportunities include the expansion of minimally invasive surgical techniques, personalized medicine approaches in device design, and development of next-generation devices with improved biocompatibility and integration. Untapped markets include specific patient sub-groups and underserved regions. The adoption of telemedicine and remote monitoring technologies offers significant opportunities for improving patient outcomes and reducing healthcare costs.

Growth Accelerators in the North America Cardiac Assist Devices Industry Industry

Long-term growth will be accelerated by technological breakthroughs in miniaturization, biointegration, and power sources. Strategic partnerships between device manufacturers and healthcare providers will optimize market access and facilitate patient care. Expansion into new geographical markets and sub-populations will further drive growth.

Key Players Shaping the North America Cardiac Assist Devices Industry Market

- Abiomed Inc

- SynCardia Systems LLC

- Abbott Laboratories

- Cardiac Assist Inc

- ReliantHeart

- Calon Cardio-Technology Ltd

- Bioheart Inc

- Medtronic Plc

- Cardiokinetix Inc

- LivaNova PLC (Cardiac Assist Inc)

Notable Milestones in North America Cardiac Assist Devices Industry Sector

- 2020: FDA approval of a new generation VAD by Abiomed.

- 2022: Merger between two smaller cardiac assist device companies.

- 2023: Launch of a novel minimally invasive IABP implantation technique.

- 2024: Publication of landmark clinical trial data demonstrating improved survival rates with a new VAD.

In-Depth North America Cardiac Assist Devices Industry Market Outlook

The North America cardiac assist devices market is poised for continued growth, driven by technological advancements, increasing prevalence of heart failure, and expanding healthcare expenditure. Strategic opportunities exist in developing innovative devices, expanding into new markets, and forging strategic alliances. The future will be defined by devices that are smaller, more durable, and seamlessly integrated with the patient's body.

North America Cardiac Assist Devices Industry Segmentation

-

1. Product

- 1.1. Intra-aortic Balloon Pumps

- 1.2. Total Artificial Heart

-

1.3. Ventricular Assist Devices

- 1.3.1. Left Ventricular Assist Device

- 1.3.2. Right Ventricular Assist Device

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.1. North America

North America Cardiac Assist Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cardiac Assist Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Heart Diseases; Advancements in Technology; Shortage of Heart Donors in Transplantation

- 3.3. Market Restrains

- 3.3.1. Risk Associated with Device Implantation

- 3.4. Market Trends

- 3.4.1. Total Artificial Hearts Segment Dominates the North American Cardiac Assist Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Intra-aortic Balloon Pumps

- 5.1.2. Total Artificial Heart

- 5.1.3. Ventricular Assist Devices

- 5.1.3.1. Left Ventricular Assist Device

- 5.1.3.2. Right Ventricular Assist Device

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Cardiac Assist Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Abiomed Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SynCardia Systems LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Abbott Laboratories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cardiac Assist Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ReliantHeart

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Calon Cardio-Technology Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bioheart Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medtronic Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cardiokinetix Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 LivaNova PLC (Cardiac Assist Inc )

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Abiomed Inc

List of Figures

- Figure 1: North America Cardiac Assist Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cardiac Assist Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Cardiac Assist Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Cardiac Assist Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cardiac Assist Devices Industry?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the North America Cardiac Assist Devices Industry?

Key companies in the market include Abiomed Inc, SynCardia Systems LLC, Abbott Laboratories, Cardiac Assist Inc, ReliantHeart, Calon Cardio-Technology Ltd, Bioheart Inc, Medtronic Plc, Cardiokinetix Inc, LivaNova PLC (Cardiac Assist Inc ).

3. What are the main segments of the North America Cardiac Assist Devices Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Heart Diseases; Advancements in Technology; Shortage of Heart Donors in Transplantation.

6. What are the notable trends driving market growth?

Total Artificial Hearts Segment Dominates the North American Cardiac Assist Devices Market.

7. Are there any restraints impacting market growth?

Risk Associated with Device Implantation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cardiac Assist Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cardiac Assist Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cardiac Assist Devices Industry?

To stay informed about further developments, trends, and reports in the North America Cardiac Assist Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence