Key Insights

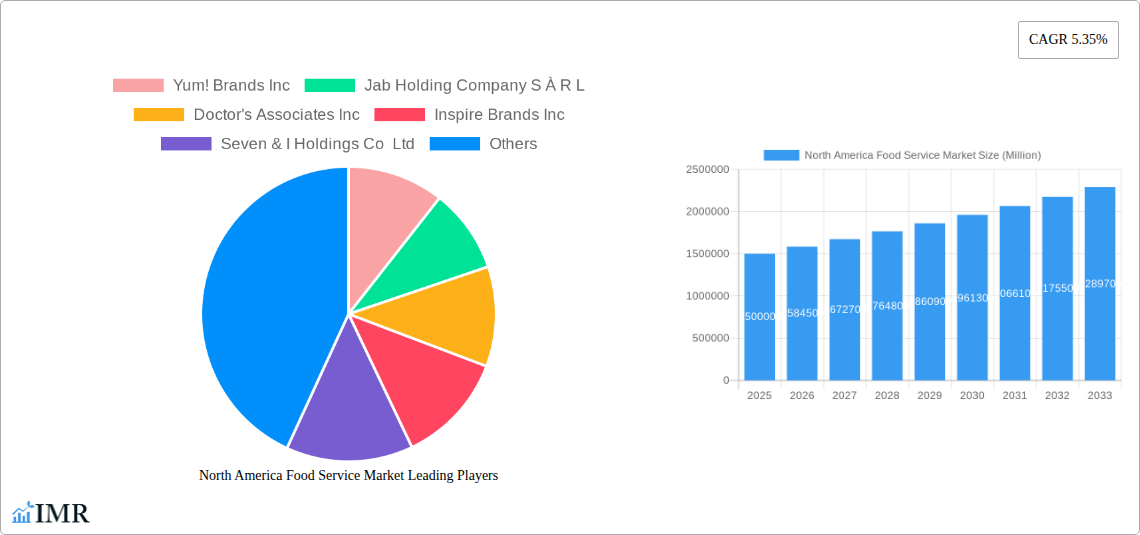

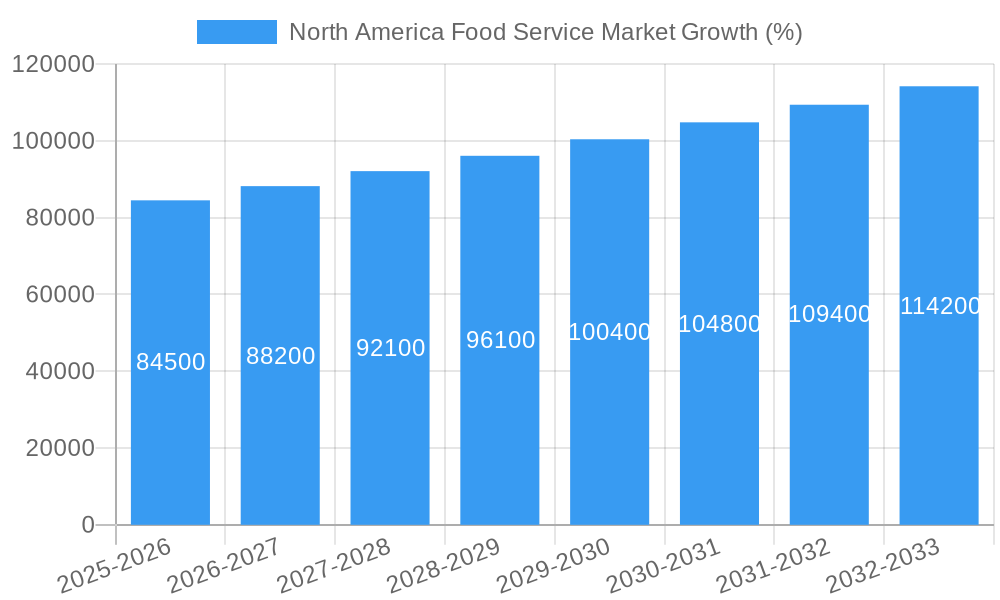

The North American food service market, encompassing diverse segments like quick-service restaurants (QSRs), cafes, bars, and full-service restaurants, presents a dynamic landscape characterized by robust growth and evolving consumer preferences. With a market size estimated at $XXXX million in 2025 (a reasonable estimate considering typical market sizes for this sector and the given CAGR), and a projected Compound Annual Growth Rate (CAGR) of 5.35%, the market is poised for significant expansion through 2033. Key drivers include rising disposable incomes, increasing urbanization leading to higher demand for convenient dining options, and a growing preference for diverse culinary experiences. The increasing popularity of online ordering and delivery services, coupled with the rise of ghost kitchens and cloud kitchens, further fuels this expansion. While the market faces challenges such as fluctuating food prices and labor shortages, these are being mitigated by technological advancements in operations and supply chain management. The segmentation reveals strong performance across various outlets, including chained and independent restaurants, with significant contributions from locations spanning leisure, lodging, retail, standalone establishments, and travel hubs. Geographically, the United States holds the largest market share within North America, followed by Canada and Mexico. The continued expansion of major players like McDonald's, Starbucks, and Yum! Brands, alongside the emergence of innovative smaller chains and independent restaurants, ensures a competitive yet thriving market.

The market's growth trajectory is significantly influenced by consumer behavior, with a notable shift towards healthier options, personalized experiences, and sustainable practices. This translates to increased demand for plant-based alternatives, locally sourced ingredients, and eco-friendly packaging. The increasing focus on digitalization, including loyalty programs, personalized recommendations, and data-driven marketing strategies, plays a critical role in driving customer engagement and market growth. Future market projections suggest a continued expansion, driven by these trends and the ability of food service operators to adapt and innovate in response to changing consumer demands. The robust growth, however, necessitates ongoing strategies to address challenges like maintaining food quality, ensuring food safety, and effectively managing operational costs within a competitive environment. Understanding these dynamic forces is crucial for stakeholders looking to navigate this profitable yet complex sector.

North America Food Service Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America food service market, encompassing its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by outlet (chained and independent), location (leisure, lodging, retail, standalone, travel), country (United States, Canada, Mexico, Rest of North America), and foodservice type (Cafes & Bars, Other QSR Cuisines). The total market size is projected to reach xx Million by 2033.

North America Food Service Market Dynamics & Structure

The North American food service market is a dynamic landscape characterized by high competition, rapid technological advancements, and evolving consumer preferences. Market concentration is moderate, with a few large players dominating specific segments while numerous smaller, independent operators cater to niche markets. Technological innovations, such as online ordering platforms, delivery services, and kitchen automation, are reshaping operational efficiency and customer experiences. Regulatory frameworks, including food safety regulations and labor laws, significantly impact operational costs and practices. The market also witnesses substantial mergers and acquisitions (M&A) activity, reflecting consolidation trends and expansion strategies. Competitive product substitutes, such as meal kits and home-delivered groceries, exert pressure on traditional food service businesses. The end-user demographics show a diverse consumer base with varying preferences across age, income, and lifestyle.

- Market Concentration: The top 5 players hold approximately xx% market share (2024).

- M&A Activity: xx deals recorded in the last 5 years, with an average deal value of xx Million.

- Technological Innovation Drivers: Online ordering, delivery apps, kitchen automation, loyalty programs.

- Regulatory Framework: Health and safety codes, labor regulations, licensing requirements.

- Competitive Substitutes: Meal kits, grocery delivery services, home-cooked meals.

- Innovation Barriers: High initial investment costs for technology adoption, regulatory compliance complexity.

North America Food Service Market Growth Trends & Insights

The North American food service market exhibited robust growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, changing lifestyles, and increasing demand for convenient and diverse dining options. The market experienced a CAGR of xx% during this period. The COVID-19 pandemic caused significant disruptions, impacting dine-in services, yet accelerating the adoption of online ordering and delivery. Post-pandemic, recovery has been uneven, with certain segments experiencing faster growth than others. Technological advancements, such as AI-powered recommendation systems and personalized menu options, are enhancing customer experience and driving market expansion. Shifting consumer preferences towards healthier options and personalized experiences also influence market dynamics. The forecast period (2025-2033) anticipates continued growth, driven by factors such as increasing urbanization, changing demographics, and the ongoing expansion of QSR (Quick Service Restaurants) and FSR (Full Service Restaurants) chains. Market penetration of new technologies is expected to reach xx% by 2033. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

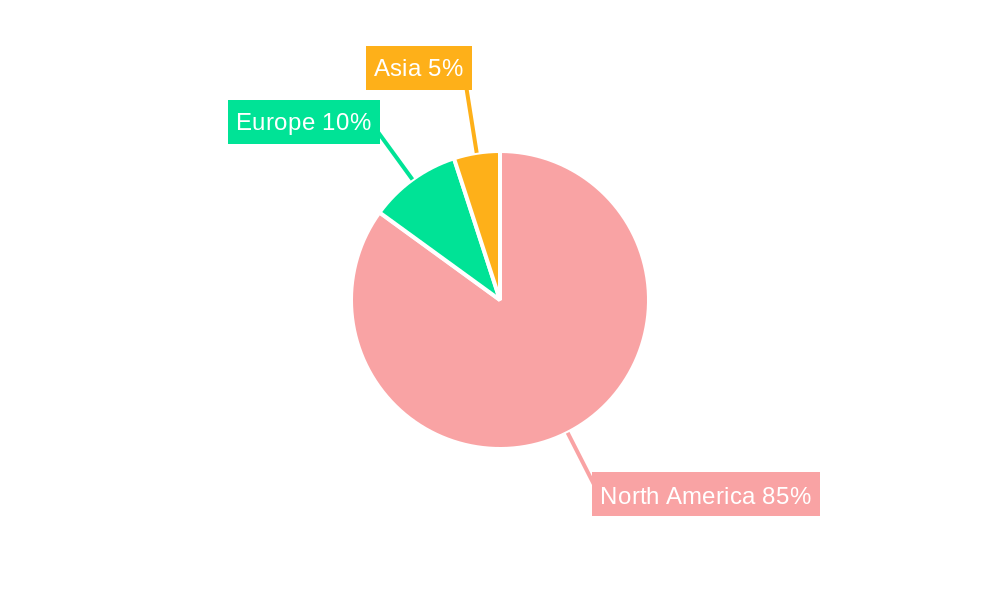

Dominant Regions, Countries, or Segments in North America Food Service Market

The United States remains the dominant market within North America, accounting for approximately xx% of the total market value in 2024. This dominance stems from its large population, high disposable incomes, and robust infrastructure supporting the food service industry. The QSR segment, characterized by its affordability and convenience, accounts for a significant portion of the market share. Among outlets, chained outlets dominate, reflecting the strength of established brands and their ability to leverage economies of scale. Within locations, the standalone segment exhibits substantial growth due to the flexibility it provides to operators in terms of location and menu offerings. The Leisure segment is also experiencing significant growth due to the increase in tourism and leisure activities.

- Key Drivers (US): High disposable incomes, developed infrastructure, large population density, strong consumer spending on food services.

- Key Drivers (Canada): Growing tourism industry, increasing urbanization, expanding middle class.

- Key Drivers (Mexico): Growing middle class, increasing tourism, rising disposable income.

- Dominant Segment (Outlet): Chained Outlets (xx% market share in 2024)

- Dominant Segment (Location): Standalone (xx% market share in 2024)

- Dominant Segment (Foodservice Type): QSR Cuisines (xx% market share in 2024)

North America Food Service Market Product Landscape

The North American food service market exhibits a wide array of product offerings, ranging from traditional fast food to upscale dining experiences. Recent innovations focus on customization, health-conscious options, and technological integration. Many establishments offer personalized menus, mobile ordering capabilities, and loyalty programs. The increasing emphasis on sustainability and ethical sourcing is influencing product choices. Technological advancements include self-ordering kiosks, robotic food preparation systems, and data analytics for optimized operations and menu planning. Key value propositions include convenience, speed of service, affordability, and diverse culinary options.

Key Drivers, Barriers & Challenges in North America Food Service Market

Key Drivers:

- Rising Disposable Incomes: Increased spending power fuels demand for dining out.

- Changing Lifestyles: Busy schedules drive demand for convenient meal options.

- Technological Advancements: Enhanced operational efficiency and customer experience.

Key Challenges:

- Supply Chain Disruptions: Fluctuations in ingredient costs and availability. (estimated impact: xx% increase in operational costs in 2024)

- Labor Shortages: Difficulty in attracting and retaining skilled employees. (estimated impact: xx% increase in labor costs in 2024)

- Intense Competition: Pressure on profit margins from established and emerging players.

- Regulatory Compliance: Strict health and safety regulations increasing compliance costs.

Emerging Opportunities in North America Food Service Market

- Growth in healthy and sustainable food options: Demand for plant-based alternatives, organic ingredients, and sustainable practices.

- Expansion into underserved markets: Reaching rural communities or ethnic niches with targeted offerings.

- Personalized dining experiences: Utilizing data analytics to tailor menus and services to individual preferences.

- Integration of technology: Expanding the use of AI, automation, and mobile ordering platforms.

Growth Accelerators in the North America Food Service Market Industry

Long-term growth in the North American food service market will be driven by several key factors. Technological innovation will continue to optimize operations, personalize experiences, and increase efficiency. Strategic partnerships between food service operators and technology providers will foster the adoption of cutting-edge solutions. The expansion into new markets, both geographically and through diversification of service offerings, will also contribute significantly to long-term growth. A focus on sustainable and ethical practices will attract environmentally conscious consumers, further driving market expansion.

Key Players Shaping the North America Food Service Market Market

- Yum! Brands Inc

- Jab Holding Company S À R L

- Doctor's Associates Inc

- Inspire Brands Inc

- Seven & I Holdings Co Ltd

- Brinker International Inc

- Darden Restaurants Inc

- The Wendy's Company

- Domino's Pizza Inc

- Starbucks Corporation

- Papa John's International Inc

- Restaurant Brands International Inc

- McDonald's Corporation

- Bloomin' Brands Inc

- Boston Pizza International Inc

Notable Milestones in North America Food Service Market Sector

- November 2022: Starbucks unveiled the new Starbucks Reserve Empire State Building store, showcasing innovative experiences and an extended artisan menu.

- December 2022: 7-Eleven expanded its Canadian footprint by converting restaurants into authorized outlets with fine dining seating.

- January 2023: Bloomin' Brands opened redesigned Outback Steakhouse stores in Spring's Grand Parkway Marketplace.

In-Depth North America Food Service Market Market Outlook

The future of the North American food service market is bright, driven by continued technological innovation, evolving consumer preferences, and strategic market expansions. Opportunities abound for companies that embrace personalization, sustainability, and technological advancements. The market is poised for sustained growth, with significant potential for new entrants and established players alike to capitalize on emerging trends and untapped market segments. Strategic partnerships, focused innovation, and adaptable business models will be crucial for success in this competitive and ever-evolving landscape.

North America Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

North America Food Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. United States North America Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Yum! Brands Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Jab Holding Company S À R L

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Doctor's Associates Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Inspire Brands Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Seven & I Holdings Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Brinker International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Darden Restaurants Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Wendy's Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Domino's Pizza Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Starbucks Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Papa John's International Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Restaurant Brands International Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 McDonald's Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Bloomin' Brands Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Boston Pizza International Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Yum! Brands Inc

List of Figures

- Figure 1: North America Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: North America Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: North America Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: North America Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: North America Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 12: North America Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: North America Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: North America Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Food Service Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the North America Food Service Market?

Key companies in the market include Yum! Brands Inc, Jab Holding Company S À R L, Doctor's Associates Inc, Inspire Brands Inc, Seven & I Holdings Co Ltd, Brinker International Inc, Darden Restaurants Inc, The Wendy's Company, Domino's Pizza Inc, Starbucks Corporation, Papa John's International Inc, Restaurant Brands International Inc, McDonald's Corporation, Bloomin' Brands Inc, Boston Pizza International Inc.

3. What are the main segments of the North America Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

January 2023: Bloomin' Brands declared that its brand Outback Steakhouse opened its redesigned stores in Spring's Grand Parkway Marketplace.December 2022: 7-Eleven announced that it started increasing its footprint in Canada by converting a number of its restaurants into authorized outlets with fine dining seating.November 2022: Starbucks unveiled the new Starbucks Reserve Empire State Building store. This unique store celebrates connecting over coffee through innovative experiences such as immersive, hands-on workshops, guided tasting flights, and new coffee beverages and craft cocktails. An extended artisan menu of Princi food is only available at this location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Food Service Market?

To stay informed about further developments, trends, and reports in the North America Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence