Key Insights

The North American motorcycle loan market, valued at $20 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key factors. Increasing motorcycle ownership, particularly among younger demographics drawn to the freedom and lifestyle associated with motorcycling, is a significant driver. Furthermore, attractive financing options offered by banks, non-banking financial companies (NBFCs), original equipment manufacturers (OEMs), and fintech companies are making motorcycle purchases more accessible. The rise of innovative financing models, including online lending platforms and flexible repayment plans, further contributes to market growth. While economic downturns could potentially act as a restraint, the overall positive trend in personal spending and the enduring appeal of motorcycles suggest sustained market expansion throughout the forecast period. Segmentation analysis reveals a diverse market, with loan terms ranging from less than three years to more than five years, and varying loan amounts reflecting differing motorcycle models and buyer needs. The market is dominated by established financial institutions such as Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, and Ally Financial, but is also witnessing increased participation from fintech companies offering streamlined and digitally driven lending solutions. The geographic distribution is primarily focused on the USA and Canada, representing the bulk of the North American market.

The market's segment breakdown reveals significant opportunities. The "More than 75%" percentage of amount sanctioned segment likely represents higher-value motorcycles and could show higher growth rates than other segments. Similarly, the longer-term loan options (3-5 years and more than 5 years) may prove attractive to buyers seeking manageable monthly payments. Analyzing the contribution of different lender types will also be crucial, as the fintech sector's growing influence could disrupt traditional lending models. Future growth will depend on factors such as interest rates, consumer confidence, and the introduction of new motorcycle models that may influence purchasing patterns. Continued innovation in financial technology and strategic partnerships between lenders and motorcycle manufacturers will be vital for maintaining the projected growth trajectory of the North American motorcycle loan market.

North America Motorcycle Loan Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America motorcycle loan market, encompassing historical data (2019-2024), current estimates (2025), and future projections (2025-2033). It delves into market dynamics, growth trends, key players, and emerging opportunities within the parent market of financial services and the child market of automotive financing. The report is crucial for financial institutions, OEMs, fintech companies, and investors seeking to understand and capitalize on this evolving market. The total market size in 2025 is estimated at XXX Million.

North America Motorcycle Loan Market Dynamics & Structure

The North American motorcycle loan market is characterized by a moderately consolidated structure, with key players like Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc., and JPMorgan Chase holding significant market share. Market concentration is influenced by the presence of established financial institutions alongside OEM-affiliated financing arms.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Fintech advancements, including digital lending platforms and AI-driven credit scoring, are driving efficiency and accessibility. However, integration of new technologies faces challenges related to data security and regulatory compliance.

- Regulatory Framework: Stringent regulations concerning consumer protection and lending practices influence market operations and competitiveness. Compliance costs impact profitability for smaller players.

- Competitive Product Substitutes: Personal loans and lease financing represent alternatives to motorcycle-specific loans. The attractiveness of these substitutes depends on interest rates and consumer preferences.

- End-User Demographics: The market caters to a diverse range of consumers, including experienced riders, first-time buyers, and enthusiasts. Demographic shifts, particularly among younger generations, will influence future demand.

- M&A Trends: Consolidation within the financial services sector has driven some mergers and acquisitions, impacting market structure and competition. The number of M&A deals in the motorcycle loan sector between 2019-2024 totaled xx.

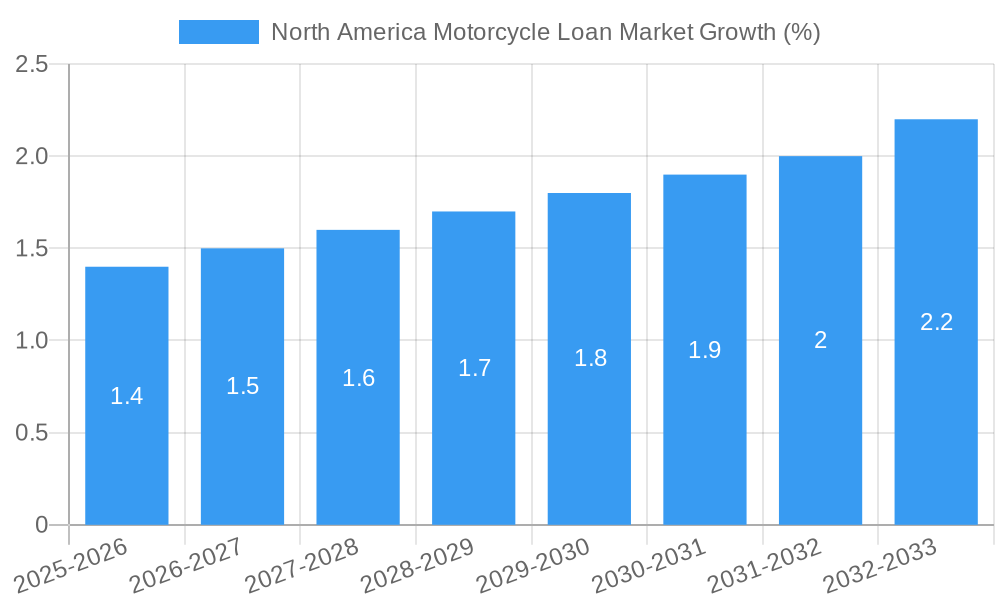

North America Motorcycle Loan Market Growth Trends & Insights

The North American motorcycle loan market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), driven by factors such as rising disposable incomes, increasing motorcycle ownership rates, and favorable financing options. The market size is expected to reach XXX Million by 2033. Technological advancements, particularly in online lending platforms, are streamlining the loan application process and enhancing customer experience, boosting adoption rates. Consumer behavior shifts towards personalized financial products and digital solutions further contribute to this growth. The market penetration rate is expected to increase from xx% in 2025 to xx% by 2033.

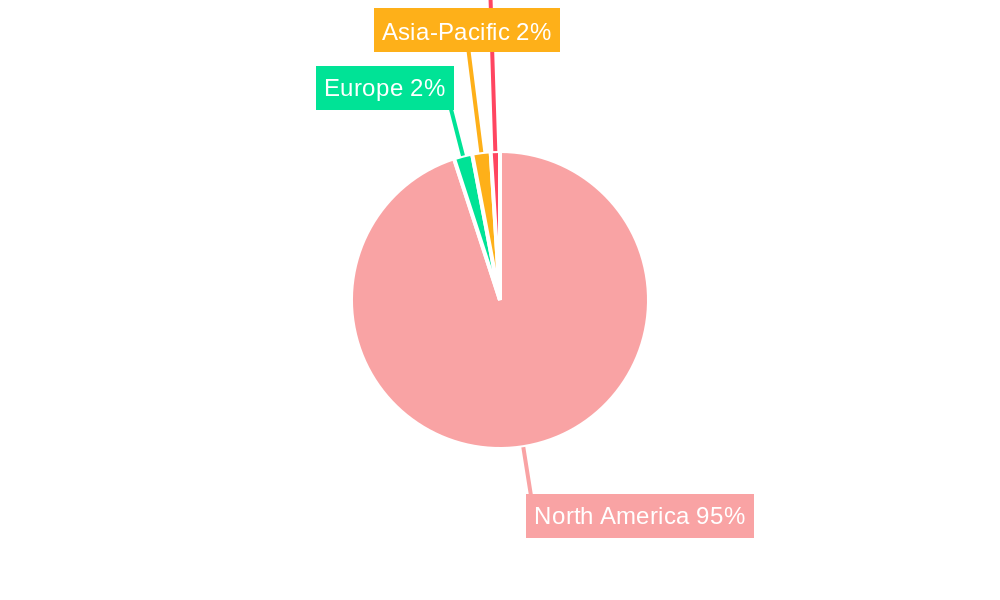

Dominant Regions, Countries, or Segments in North America Motorcycle Loan Market

The USA remains the dominant market for motorcycle loans in North America, accounting for approximately xx% of the total market in 2025. This dominance is attributed to higher motorcycle ownership rates and a larger consumer base compared to Canada and the rest of North America.

- By Provider Type: OEM financing arms hold the largest market share (xx%) due to their established relationships with motorcycle dealerships and buyers. Banks are second (xx%), followed by NBFCs (xx%) and others (xx%).

- By Percentage of Amount Sanctioned: The 25-50% segment represents the largest portion of the market (xx%), reflecting average loan-to-value ratios in the industry.

- By Tenure: Loans with tenure of 3-5 years constitute the dominant segment (xx%), balancing affordability and repayment flexibility.

- By Country: USA (xx%), Canada (xx%), Rest of North America (xx%).

Key drivers for growth include favorable economic conditions, supportive government policies promoting personal mobility, and the increasing popularity of recreational riding.

North America Motorcycle Loan Market Product Landscape

The motorcycle loan product landscape is evolving with the introduction of customizable financing options, including flexible repayment schedules, and competitive interest rates. Some lenders offer bundled products incorporating insurance and maintenance packages. Technological innovations like digital loan origination platforms are improving the customer experience, reducing processing times, and boosting operational efficiency. Unique selling propositions (USPs) frequently include loyalty programs and partnerships with motorcycle dealerships.

Key Drivers, Barriers & Challenges in North America Motorcycle Loan Market

Key Drivers:

- Increased consumer spending on leisure activities and recreational vehicles.

- Growing popularity of motorcycles among diverse demographics.

- Innovative financing solutions offered by both traditional lenders and FinTech companies.

Challenges:

- Economic downturns can significantly impact consumer demand and loan defaults. (estimated impact on market growth: xx%)

- Stringent regulatory compliance requirements increase operational costs for lenders. (estimated impact on profitability: xx%)

- Intense competition among financial institutions for market share.

Emerging Opportunities in North America Motorcycle Loan Market

Untapped markets include attracting younger demographics through tailored financing options and digital marketing campaigns. Innovative applications include integrating loan products with motorcycle insurance and maintenance services. The increasing popularity of electric motorcycles presents a unique opportunity for specialized financing solutions.

Growth Accelerators in the North America Motorcycle Loan Market Industry

Technological advancements in areas such as AI-driven credit scoring, blockchain technology for secure transactions, and digital lending platforms are poised to significantly accelerate market growth. Strategic partnerships between financial institutions and motorcycle manufacturers can enhance market penetration and customer reach. Expansion into underserved markets and the development of niche financing products for specific motorcycle segments will also contribute to growth.

Key Players Shaping the North America Motorcycle Loan Market Market

- Harley-Davidson Financial Services

- Kawasaki Motors Finance Corporation

- Ally Financial Inc.

- JPMorgan Chase

- Honda Financial Services

- Bank of America Corporation

- Wells Fargo

- TD Bank

- Yamaha motor finance corporation

- Mountain America Credit Union

Notable Milestones in North America Motorcycle Loan Market Sector

- June 2023: Stark Future secures €20M loan from Banco Santander to boost motocross bike production, indicating growing investment in the motorcycle industry and potential for associated financing needs.

- April 2022: Harley-Davidson raises USD 550 million in asset-backed securities (ABS) for motorcycle financing, highlighting the substantial capital flow within this sector.

In-Depth North America Motorcycle Loan Market Market Outlook

The North America motorcycle loan market presents significant opportunities for growth, driven by technological innovation, evolving consumer preferences, and the increasing popularity of motorcycles. Strategic partnerships, targeted marketing, and the development of innovative financing products will be crucial to capitalize on this potential. The market's future success hinges on the adaptability of lenders to changing consumer demands and the effective integration of technology to improve efficiency and customer experience.

North America Motorcycle Loan Market Segmentation

-

1. Provider Type

- 1.1. Banks

- 1.2. NBFCs (Non-Banking Financial Services)

- 1.3. OEM (Original Equipment Manufacturer)

- 1.4. Others (Fintech Companies)

-

2. Percentage of Amount Sanctioned

- 2.1. Less than 25%

- 2.2. 25-50%

- 2.3. 51-75%

- 2.4. More than 75%

-

3. Tenure

- 3.1. Less than 3 Years

- 3.2. 3-5 Years

- 3.3. More than 5 Years

North America Motorcycle Loan Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Motorcycle Loan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Motorcycle Ownership; Customized Loan Options

- 3.3. Market Restrains

- 3.3.1. Market Saturation and Competition; Changing Mobility Preferences

- 3.4. Market Trends

- 3.4.1. Banks are the Major Source for Financing in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Motorcycle Loan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Banks

- 5.1.2. NBFCs (Non-Banking Financial Services)

- 5.1.3. OEM (Original Equipment Manufacturer)

- 5.1.4. Others (Fintech Companies)

- 5.2. Market Analysis, Insights and Forecast - by Percentage of Amount Sanctioned

- 5.2.1. Less than 25%

- 5.2.2. 25-50%

- 5.2.3. 51-75%

- 5.2.4. More than 75%

- 5.3. Market Analysis, Insights and Forecast - by Tenure

- 5.3.1. Less than 3 Years

- 5.3.2. 3-5 Years

- 5.3.3. More than 5 Years

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. United States North America Motorcycle Loan Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Motorcycle Loan Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Motorcycle Loan Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Motorcycle Loan Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Harley-Davidson Financial Services

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kawasaki Motors Finance Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ally Financial Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 JPMorgan Chase

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Honda Financial Services

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bank of American Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Wells Fargo

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TD Bank

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yamaha motor finance corporation **List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mountain America Credit Union

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Harley-Davidson Financial Services

List of Figures

- Figure 1: North America Motorcycle Loan Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Motorcycle Loan Market Share (%) by Company 2024

List of Tables

- Table 1: North America Motorcycle Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 3: North America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2019 & 2032

- Table 4: North America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 5: North America Motorcycle Loan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Motorcycle Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Motorcycle Loan Market Revenue Million Forecast, by Provider Type 2019 & 2032

- Table 12: North America Motorcycle Loan Market Revenue Million Forecast, by Percentage of Amount Sanctioned 2019 & 2032

- Table 13: North America Motorcycle Loan Market Revenue Million Forecast, by Tenure 2019 & 2032

- Table 14: North America Motorcycle Loan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Motorcycle Loan Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Motorcycle Loan Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the North America Motorcycle Loan Market?

Key companies in the market include Harley-Davidson Financial Services, Kawasaki Motors Finance Corporation, Ally Financial Inc, JPMorgan Chase, Honda Financial Services, Bank of American Corporation, Wells Fargo, TD Bank, Yamaha motor finance corporation **List Not Exhaustive, Mountain America Credit Union.

3. What are the main segments of the North America Motorcycle Loan Market?

The market segments include Provider Type, Percentage of Amount Sanctioned, Tenure.

4. Can you provide details about the market size?

The market size is estimated to be USD 20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Motorcycle Ownership; Customized Loan Options.

6. What are the notable trends driving market growth?

Banks are the Major Source for Financing in United States.

7. Are there any restraints impacting market growth?

Market Saturation and Competition; Changing Mobility Preferences.

8. Can you provide examples of recent developments in the market?

June 2023: Barcelona-based Stark Future bags €20M loan to scale up production of powerful motocross bike.it has signed a €20M loan agreement with Banco Santander.The funding will enable Stark Future to scale up its production capabilities, streamline manufacturing processes, and bolster research and development efforts related to the Stark VARG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Motorcycle Loan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Motorcycle Loan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Motorcycle Loan Market?

To stay informed about further developments, trends, and reports in the North America Motorcycle Loan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence