Key Insights

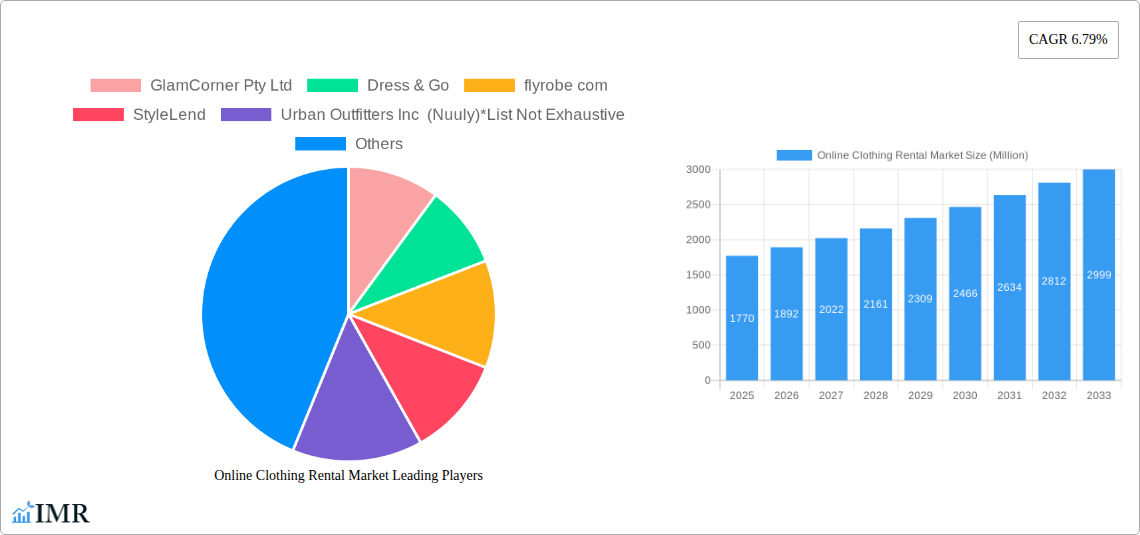

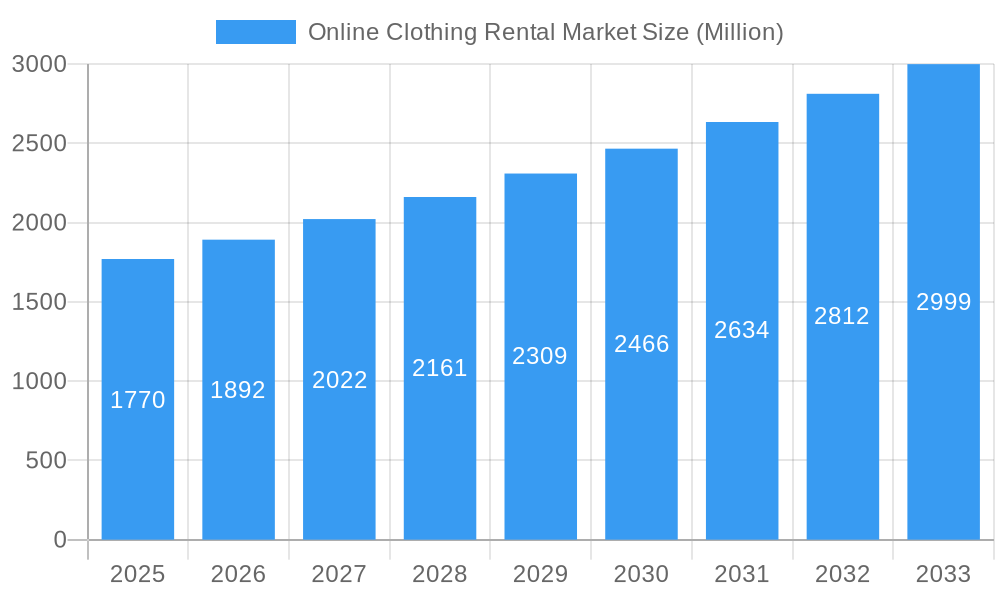

The online clothing rental market, valued at $1.77 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.79% from 2025 to 2033. This growth is fueled by several key drivers. Increasing consumer awareness of sustainability and the circular economy is prompting a shift away from fast fashion towards rental options. The convenience and affordability of renting, particularly for special occasions or trying new styles without commitment, are significant factors. Furthermore, the rise of subscription models and user-friendly mobile applications have streamlined the rental process, enhancing accessibility for a wider consumer base. The market is segmented by end-user demographics (men, women, children) and dress codes (formal, casual, party wear, traditional), providing diverse opportunities for businesses to cater to specific needs. Competition among established players like Rent the Runway and emerging startups is fostering innovation in technology and service offerings, further contributing to market expansion. Geographic expansion into untapped markets in Asia-Pacific and South America, where growing middle classes are increasingly embracing online retail, presents significant future growth potential.

Online Clothing Rental Market Market Size (In Billion)

The market's success hinges on overcoming certain challenges. Maintaining the quality and hygiene of rented garments remains paramount, requiring robust cleaning and quality control processes. Logistics and delivery costs, particularly for international shipments, represent a significant operational expense that can impact profitability. Effective marketing and consumer education are crucial to combat potential misconceptions surrounding hygiene and garment condition. Addressing these challenges will be vital for sustained market growth and wider adoption of online clothing rental services. The evolving fashion landscape, with its trends and styles, requires continuous adaptation and inventory management, necessitating robust data analytics and inventory management systems. Companies must balance cost effectiveness with a diverse catalog to remain competitive.

Online Clothing Rental Market Company Market Share

Online Clothing Rental Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Online Clothing Rental Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this rapidly evolving market. The report analyzes both the parent market (online retail) and the child market (online clothing rental) for a holistic perspective. Market values are presented in million units.

Online Clothing Rental Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory factors influencing the online clothing rental market. The market is characterized by a mix of established players and emerging startups, resulting in a moderately fragmented structure. Market share currently sits at xx% for the top 5 players, with further consolidation expected through M&A activity. Technological advancements, particularly in AI-powered recommendation engines and improved logistics, are key drivers of growth. However, challenges remain in areas such as sustainable practices and regulatory compliance.

- Market Concentration: Moderately fragmented, with top 5 players holding xx% market share.

- Technological Innovation: AI-powered recommendations, improved logistics, sustainable material innovations.

- Regulatory Framework: Varying regulations across regions impacting operations and sustainability initiatives.

- Competitive Substitutes: Traditional retail, secondhand clothing markets, subscription boxes.

- End-User Demographics: High growth potential in women's and children's segments, with increasing adoption by men.

- M&A Trends: xx M&A deals recorded in the historical period (2019-2024), with a projected xx increase in the forecast period.

Online Clothing Rental Market Growth Trends & Insights

The online clothing rental market experienced significant growth during the historical period (2019-2024), driven by changing consumer preferences towards sustainable and accessible fashion. The market size expanded from xx million in 2019 to xx million in 2024, exhibiting a CAGR of xx%. This upward trend is expected to continue, with a projected market size of xx million in 2025 and xx million by 2033, reflecting a CAGR of xx% during the forecast period. Technological disruptions, particularly the rise of mobile apps and personalized recommendations, have further boosted adoption rates. Consumer behavior shifts towards experiences over ownership also play a crucial role.

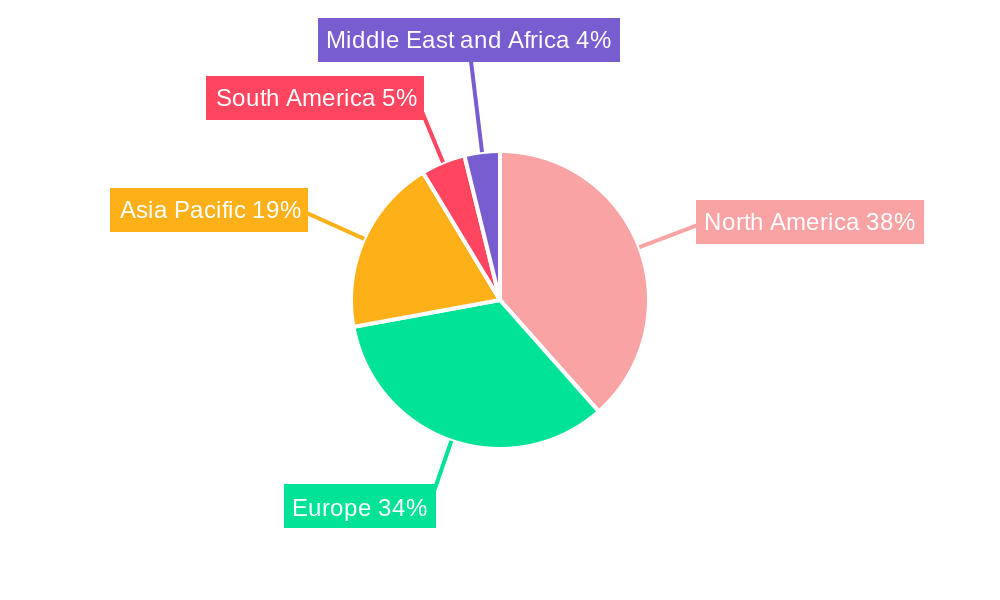

Dominant Regions, Countries, or Segments in Online Clothing Rental Market

The online clothing rental market displays strong regional variations in growth patterns and penetration rates. Currently, North America dominates the market, holding approximately xx% of the global market share, followed by Europe at approximately xx%. The Women's segment holds the largest market share, with significant growth potential in the Men's and Children's segments. Casual wear currently leads the dress code segment, but partywear and formal wear are showing notable growth potential.

- Key Drivers (North America): Strong e-commerce infrastructure, high disposable incomes, fashion-conscious consumer base, early adoption of subscription models.

- Key Drivers (Europe): Increasing environmental awareness, focus on sustainable fashion practices, growing adoption of online shopping.

- Segment Dominance: Women's segment dominates, driven by broad range of choices and higher engagement with online fashion platforms.

Online Clothing Rental Market Product Landscape

The online clothing rental market features a diverse range of offerings, from designer dresses to everyday casual wear. Platforms are constantly innovating with new product features, including advanced search filters, virtual try-on technologies, and personalized style recommendations. This creates unique selling propositions that cater to diverse consumer needs and preferences. Emphasis is placed on seamless user experience, flexible rental plans, and wide selection of styles.

Key Drivers, Barriers & Challenges in Online Clothing Rental Market

Key Drivers: Growing environmental consciousness, increasing demand for affordable fashion, technological advancements enabling efficient operations, changing consumer preferences favoring experiences over ownership.

Key Challenges: Maintaining inventory management efficiency, addressing concerns about hygiene and sanitation, managing logistics and returns, ensuring responsible disposal and recycling of clothing, competitive pricing strategies, and managing unpredictable demand patterns. These challenges impact profitability and sustainability across the value chain.

Emerging Opportunities in Online Clothing Rental Market

Significant opportunities exist in untapped markets, particularly in developing economies, expansion into new niche segments (e.g., plus-size clothing, maternity wear), increased integration of sustainability practices throughout the value chain, and innovative business models like combining rental with resale.

Growth Accelerators in the Online Clothing Rental Market Industry

Strategic partnerships between rental platforms and established brands, coupled with further development of virtual try-on technologies, and a broader range of rental options to cater to diverse consumer needs, will accelerate long-term growth within the online clothing rental market. Expansion into international markets with adaptable strategies for diverse consumer preferences and local regulations will also be key.

Key Players Shaping the Online Clothing Rental Market Market

- GlamCorner Pty Ltd

- Dress & Go

- flyrobe.com

- StyleLend

- Urban Outfitters Inc (Nuuly)

- The Clothing Rental

- Gwynnie Bee

- Rent the Runway

- Powerlook

- Rent It Bae

Notable Milestones in Online Clothing Rental Market Sector

- July 2022: Rent the Runway partnered with Saks Off 5th, launching a pre-owned section, expanding its offerings and tapping into the secondhand market.

- April 2022: David Jones extended its collaboration with GlamCorner via "Reloop," promoting circular economy practices and sustainable consumption.

- May 2022: Nuuly released a new ready-to-rent collection and continued expanding its resale platform, strengthening its position in the sustainable fashion segment.

In-Depth Online Clothing Rental Market Market Outlook

The online clothing rental market exhibits immense growth potential, driven by escalating consumer demand for sustainable and accessible fashion. Strategic partnerships, technological advancements, and expansion into new markets will continue to shape the industry. The market is poised for significant expansion over the next decade, presenting substantial opportunities for both established players and new entrants.

Online Clothing Rental Market Segmentation

-

1. End -User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Dress Code

- 2.1. Formal

- 2.2. Casual

- 2.3. Partywear

- 2.4. Traditional

Online Clothing Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Online Clothing Rental Market Regional Market Share

Geographic Coverage of Online Clothing Rental Market

Online Clothing Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1. Adoption of Subscription-based Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End -User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Dress Code

- 5.2.1. Formal

- 5.2.2. Casual

- 5.2.3. Partywear

- 5.2.4. Traditional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End -User

- 6. North America Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End -User

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Dress Code

- 6.2.1. Formal

- 6.2.2. Casual

- 6.2.3. Partywear

- 6.2.4. Traditional

- 6.1. Market Analysis, Insights and Forecast - by End -User

- 7. Europe Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End -User

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Dress Code

- 7.2.1. Formal

- 7.2.2. Casual

- 7.2.3. Partywear

- 7.2.4. Traditional

- 7.1. Market Analysis, Insights and Forecast - by End -User

- 8. Asia Pacific Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End -User

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Dress Code

- 8.2.1. Formal

- 8.2.2. Casual

- 8.2.3. Partywear

- 8.2.4. Traditional

- 8.1. Market Analysis, Insights and Forecast - by End -User

- 9. South America Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End -User

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Dress Code

- 9.2.1. Formal

- 9.2.2. Casual

- 9.2.3. Partywear

- 9.2.4. Traditional

- 9.1. Market Analysis, Insights and Forecast - by End -User

- 10. Middle East and Africa Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End -User

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Dress Code

- 10.2.1. Formal

- 10.2.2. Casual

- 10.2.3. Partywear

- 10.2.4. Traditional

- 10.1. Market Analysis, Insights and Forecast - by End -User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GlamCorner Pty Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dress & Go

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 flyrobe com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 StyleLend

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Urban Outfitters Inc (Nuuly)*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Clothing Rental

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gwynnie Bee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rent the Runway

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Powerlook

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rent It Bae

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 GlamCorner Pty Ltd

List of Figures

- Figure 1: Global Online Clothing Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 3: North America Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 4: North America Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 5: North America Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 6: North America Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 9: Europe Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 10: Europe Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 11: Europe Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 12: Europe Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 15: Asia Pacific Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 16: Asia Pacific Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 17: Asia Pacific Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 18: Asia Pacific Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 21: South America Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 22: South America Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 23: South America Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 24: South America Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 27: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 28: Middle East and Africa Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 29: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 30: Middle East and Africa Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 2: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 3: Global Online Clothing Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 5: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 6: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 12: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 13: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 22: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 23: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 30: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 31: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 36: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 37: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Clothing Rental Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the Online Clothing Rental Market?

Key companies in the market include GlamCorner Pty Ltd, Dress & Go, flyrobe com, StyleLend, Urban Outfitters Inc (Nuuly)*List Not Exhaustive, The Clothing Rental, Gwynnie Bee, Rent the Runway, Powerlook, Rent It Bae.

3. What are the main segments of the Online Clothing Rental Market?

The market segments include End -User, Dress Code.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Adoption of Subscription-based Services.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

July 2022: Rent the Runway joined forces with Saks Off 5th, integrating a dedicated "pre-owned" section on its website, enabling customers to access pre-owned designer items.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Clothing Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Clothing Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Clothing Rental Market?

To stay informed about further developments, trends, and reports in the Online Clothing Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence