Key Insights

The Asia-Pacific (APAC) fashion accessories market is projected to reach $741.24 billion by 2025, with a compound annual growth rate (CAGR) of 6.31% from 2025 to 2033. This expansion is driven by increasing disposable incomes, particularly in China and India, coupled with the growing influence of social media and e-commerce. The demand for personalized accessories and the increasing presence of global and local brands catering to fashion-forward millennials and Gen Z consumers are also significant growth factors.

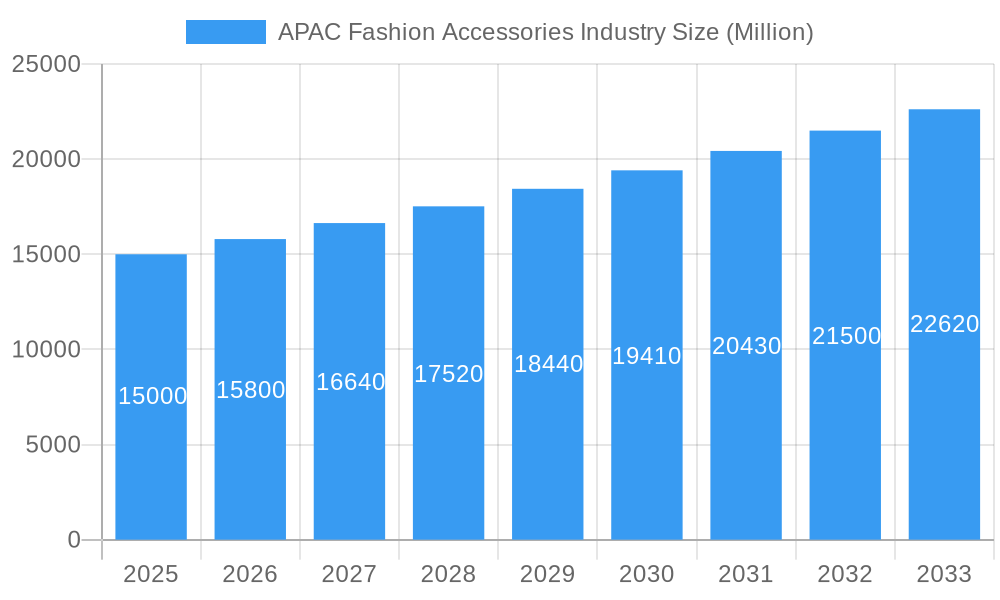

APAC Fashion Accessories Industry Market Size (In Billion)

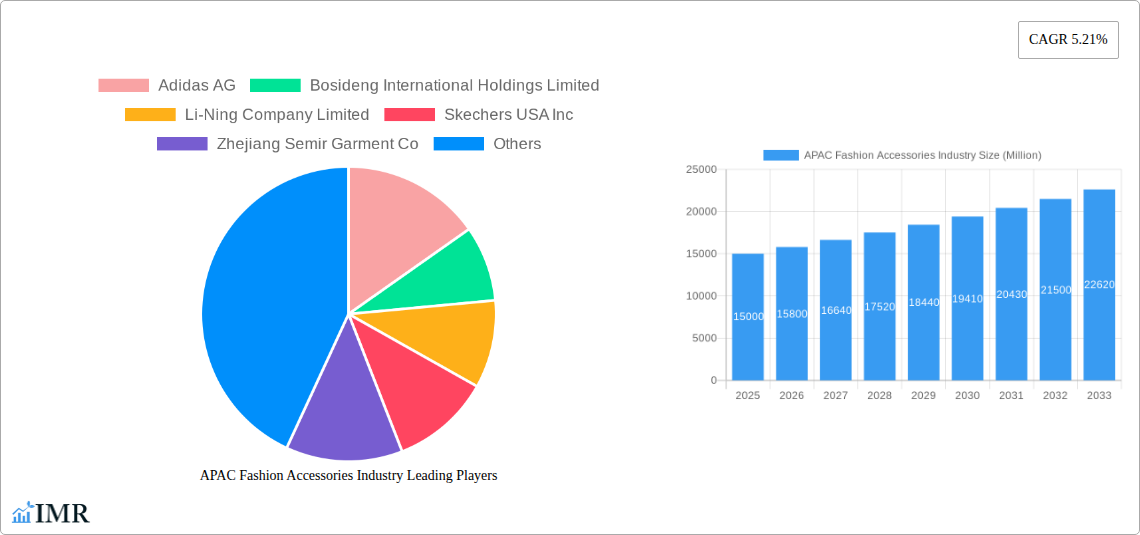

Despite economic fluctuations and challenges from counterfeit products, the APAC fashion accessories market offers significant opportunities. Segmentation across men's, women's, kids', and unisex categories, with distribution via online and offline channels for products like footwear, apparel, wallets, and handbags, allows for niche market penetration. Major brands such as Adidas, Nike, Puma, Bosideng, and Li-Ning are actively shaping the competitive landscape. Emerging markets in India and Southeast Asia present particularly strong future prospects for the industry.

APAC Fashion Accessories Industry Company Market Share

APAC Fashion Accessories Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) fashion accessories market, encompassing historical data (2019-2024), the base year (2025), and a forecast to 2033. It delves into market dynamics, growth trends, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and strategists. The report covers various segments including footwear, apparel, handbags, and watches, across different distribution channels and end-users. Market values are presented in million units.

APAC Fashion Accessories Industry Market Dynamics & Structure

The APAC fashion accessories market exhibits a complex structure characterized by both established global giants and rapidly growing regional players. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller businesses cater to niche segments. Technological innovation, particularly in e-commerce and personalized experiences, is a key driver. Regulatory frameworks concerning product safety and labeling vary across countries, impacting market dynamics. The industry faces competition from substitute products, including counterfeit goods, and witnesses considerable M&A activity. End-user demographics are evolving, with increasing demand from young adults and a growing middle class.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong emphasis on e-commerce integration, personalized designs, and sustainable materials.

- Regulatory Frameworks: Diverse across APAC countries, impacting product compliance and labeling.

- Competitive Substitutes: Counterfeit goods and other affordable alternatives pose a significant challenge.

- End-User Demographics: Shift towards younger consumers and growing middle class fuels demand.

- M&A Trends: Consolidation and expansion through acquisitions are expected to increase over the forecast period, with an estimated xx deals per year in 2025.

APAC Fashion Accessories Industry Growth Trends & Insights

The APAC fashion accessories market experienced robust growth during the historical period (2019-2024), driven by factors including rising disposable incomes, increasing urbanization, and a burgeoning e-commerce sector. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This positive trend is projected to continue into the forecast period (2025-2033), with a projected CAGR of xx%. Technological disruptions such as the metaverse and personalized online shopping experiences are reshaping consumer behavior, leading to a rise in online sales and customized product offerings. Market penetration of e-commerce is expected to reach xx% by 2033. Consumer preferences are shifting towards sustainable and ethically sourced products.

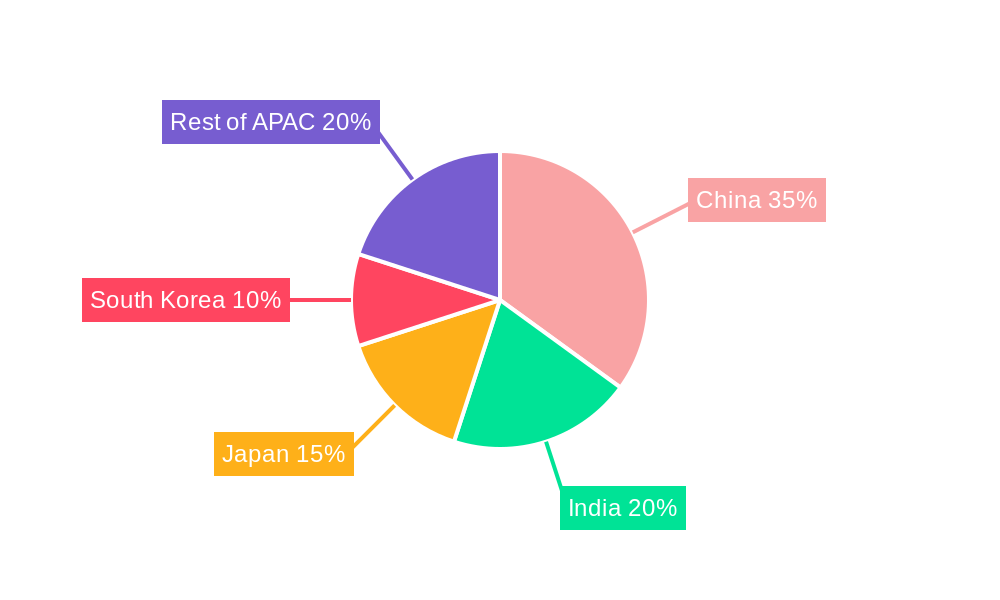

Dominant Regions, Countries, or Segments in APAC Fashion Accessories Industry

China and India lead the APAC fashion accessories market, followed by Japan, South Korea, and Australia. The women's segment dominates in terms of both value and volume, followed by the men's segment. The online retail channel exhibits rapid growth, outpacing the offline channel, while footwear and handbags remain the dominant product types.

- Leading Region: China and India

- Dominant End-User Segment: Women

- Fastest-Growing Distribution Channel: Online Retail

- Largest Product Categories: Footwear and Handbags

- Key Drivers: Rising disposable income, increasing urbanization, e-commerce adoption, and growing awareness of fashion trends.

APAC Fashion Accessories Industry Product Landscape

The APAC fashion accessories market showcases a diverse product landscape with continuous innovations. Smartwatches, personalized accessories, and sustainable materials are gaining traction. Brands focus on unique selling propositions such as collaborations with designers, limited-edition collections, and superior craftsmanship. Technological advancements, such as 3D printing and AI-powered design tools, are transforming product development and customization.

Key Drivers, Barriers & Challenges in APAP Fashion Accessories Industry

Key Drivers: Rising disposable incomes across APAC, particularly in emerging economies; increasing urbanization leading to higher fashion consciousness; the rapid growth of e-commerce; and the influence of social media and fashion influencers.

Challenges: Intense competition, particularly from counterfeit products; supply chain disruptions; fluctuations in raw material prices; and evolving consumer preferences that require companies to adapt swiftly. The impact of counterfeit goods is estimated to reduce market revenue by approximately xx million units annually.

Emerging Opportunities in APAP Fashion Accessories Industry

Untapped markets in Southeast Asia present significant growth opportunities. The increasing demand for sustainable and ethically sourced products represents a major trend. Personalization and customization of accessories through online platforms offer significant opportunities for revenue generation and customer engagement.

Growth Accelerators in the APAC Fashion Accessories Industry

Technological advancements in manufacturing and supply chain management offer substantial cost savings and efficiency improvements. Strategic partnerships between brands and technology companies are creating innovative solutions to enhance the customer experience. Expanding into new markets and penetrating under-served regions with tailored products will fuel further expansion.

Key Players Shaping the APAC Fashion Accessories Industry Market

- Adidas AG

- Bosideng International Holdings Limited

- Li-Ning Company Limited

- Skechers USA Inc

- Zhejiang Semir Garment Co

- Aditya Birla Group

- Puma SE

- Fossil Group Inc

- Nike Inc

- Uniqlo Co Ltd

- List Not Exhaustive

Notable Milestones in APAC Fashion Accessories Industry Sector

- May 2021: Senreve launched its first pop-up store in Singapore.

- December 2021: Roger Dubuis opened its first Australian store in Sydney.

- September 2022: Forever 21 and American Eagle Outfitters announced their return to the Japanese market.

In-Depth APAC Fashion Accessories Industry Market Outlook

The APAC fashion accessories market is poised for sustained growth over the forecast period, driven by favorable demographics, technological innovation, and rising consumer spending. Strategic partnerships, investment in sustainable practices, and expansion into new markets will further fuel this growth. Brands that effectively leverage digital channels and personalize the shopping experience will capture the greatest market share. The market's future is bright, with immense potential for both established players and new entrants.

APAC Fashion Accessories Industry Segmentation

-

1. Product Type

- 1.1. Footwear

- 1.2. Apparel

- 1.3. Wallets

- 1.4. Handbags

- 1.5. Watches

- 1.6. Other Products

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

- 2.4. Unisex

-

3. Distibution Channel

- 3.1. Offline Retail Channel

- 3.2. Online Retail Channel

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

APAC Fashion Accessories Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

APAC Fashion Accessories Industry Regional Market Share

Geographic Coverage of APAC Fashion Accessories Industry

APAC Fashion Accessories Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Growing Preference for Luxury Fashion Accessories is Pushing the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Footwear

- 5.1.2. Apparel

- 5.1.3. Wallets

- 5.1.4. Handbags

- 5.1.5. Watches

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.2.4. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Offline Retail Channel

- 5.3.2. Online Retail Channel

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Footwear

- 6.1.2. Apparel

- 6.1.3. Wallets

- 6.1.4. Handbags

- 6.1.5. Watches

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.2.4. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Offline Retail Channel

- 6.3.2. Online Retail Channel

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Footwear

- 7.1.2. Apparel

- 7.1.3. Wallets

- 7.1.4. Handbags

- 7.1.5. Watches

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.2.4. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Offline Retail Channel

- 7.3.2. Online Retail Channel

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Footwear

- 8.1.2. Apparel

- 8.1.3. Wallets

- 8.1.4. Handbags

- 8.1.5. Watches

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.2.4. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Offline Retail Channel

- 8.3.2. Online Retail Channel

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Footwear

- 9.1.2. Apparel

- 9.1.3. Wallets

- 9.1.4. Handbags

- 9.1.5. Watches

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.2.4. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. Offline Retail Channel

- 9.3.2. Online Retail Channel

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific APAC Fashion Accessories Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Footwear

- 10.1.2. Apparel

- 10.1.3. Wallets

- 10.1.4. Handbags

- 10.1.5. Watches

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Kids/Children

- 10.2.4. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. Offline Retail Channel

- 10.3.2. Online Retail Channel

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Adidas AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosideng International Holdings Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Li-Ning Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Skechers USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhejiang Semir Garment Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aditya Birla Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puma SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fossil Group Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nike Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Uniqlo Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Adidas AG

List of Figures

- Figure 1: Global APAC Fashion Accessories Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: China APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: China APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: China APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: China APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 7: China APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 8: China APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 9: China APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: China APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Japan APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Japan APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Japan APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Japan APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Japan APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 17: Japan APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 18: Japan APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 19: Japan APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Japan APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Japan APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: India APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 23: India APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: India APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 25: India APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 26: India APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 27: India APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 28: India APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 29: India APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 30: India APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: India APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Australia APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Australia APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 35: Australia APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: Australia APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 37: Australia APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 38: Australia APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Australia APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Australia APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Australia APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by End User 2025 & 2033

- Figure 45: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 47: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 48: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Geography 2025 & 2033

- Figure 49: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Fashion Accessories Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 9: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 14: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 19: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 24: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 27: Global APAC Fashion Accessories Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 29: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Fashion Accessories Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Fashion Accessories Industry?

The projected CAGR is approximately 6.31%.

2. Which companies are prominent players in the APAC Fashion Accessories Industry?

Key companies in the market include Adidas AG, Bosideng International Holdings Limited, Li-Ning Company Limited, Skechers USA Inc, Zhejiang Semir Garment Co, Aditya Birla Group, Puma SE, Fossil Group Inc, Nike Inc, Uniqlo Co Ltd*List Not Exhaustive.

3. What are the main segments of the APAC Fashion Accessories Industry?

The market segments include Product Type, End User, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 741.24 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Growing Preference for Luxury Fashion Accessories is Pushing the Market.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

September 2022: Forever 21 and American Eagle Outfitters Inc. announced their comeback to the Japanese market after leaving in 2019. Forever has stated that it will begin e-commerce sales and launch a physical store in February 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Fashion Accessories Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Fashion Accessories Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Fashion Accessories Industry?

To stay informed about further developments, trends, and reports in the APAC Fashion Accessories Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence