Key Insights

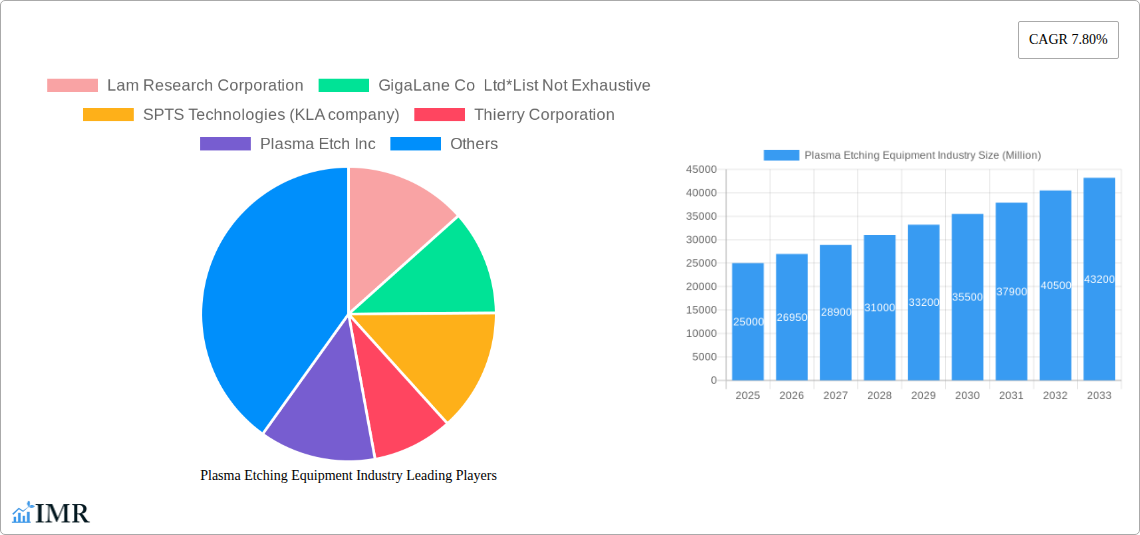

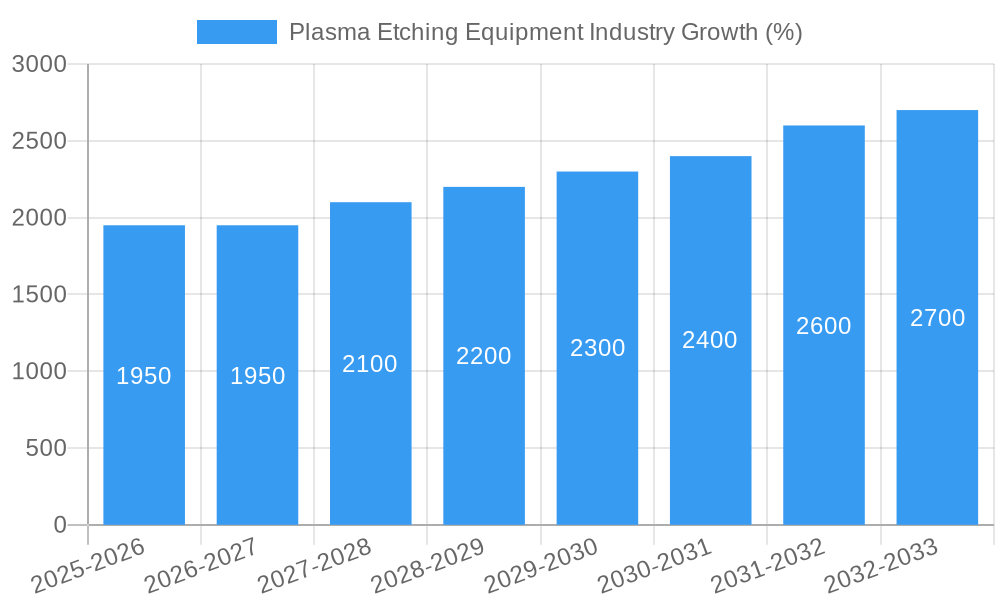

The Plasma Etching Equipment market, valued at approximately $X billion in 2025 (assuming a reasonable market size based on the provided CAGR and a starting point, which needs to be provided for accurate calculation), is projected to experience robust growth at a compound annual growth rate (CAGR) of 7.80% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for advanced semiconductor devices in consumer electronics, particularly smartphones and other mobile devices, is a significant catalyst. Furthermore, the burgeoning medical device industry's need for precision microfabrication techniques relies heavily on plasma etching equipment. Growth in industrial applications, including manufacturing processes requiring high-precision surface modifications, also contributes to market expansion. Technological advancements, such as the development of more efficient and precise etching techniques like Deep Reactive Ion Etching (DRIE) and Inductively Coupled Plasma Etching (ICP), are further propelling market growth. While competitive pressures and the high cost of equipment represent potential restraints, the overall market outlook remains positive due to the consistent demand for miniaturization and improved performance across diverse sectors.

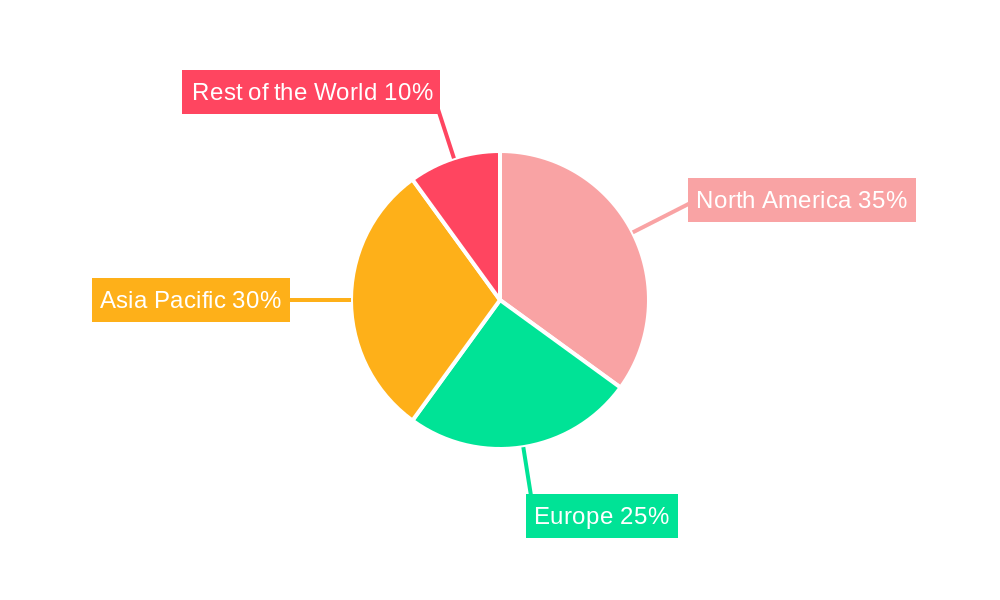

The market segmentation reveals a dynamic landscape. Inductively Coupled Plasma Etching (ICP) systems likely hold the largest market share among equipment types, given their superior performance and versatility. Deep Reactive Ion Etching (DRIE) is also a significant segment, catering to high-aspect-ratio etching requirements. Consumer electronics represent a major application segment, followed by the rapidly growing medical and industrial sectors. Geographically, the Asia-Pacific region is anticipated to dominate the market due to the high concentration of semiconductor manufacturing facilities and increasing investments in advanced technology. North America and Europe also maintain substantial market shares, driven by strong research and development activities and established industries. Key players like Lam Research Corporation, Applied Materials Inc., and Tokyo Electron Limited are actively shaping market dynamics through technological innovations and strategic partnerships. The forecast period (2025-2033) suggests continued expansion, driven by the sustained demand for advanced technologies and the ongoing miniaturization trends across various sectors.

Plasma Etching Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Plasma Etching Equipment industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and navigate this dynamic market. The market is segmented by type (Reactive Ion Etching (RIE), Inductively Coupled Plasma Etching (ICP), Deep Reactive Ion Etching (DRIE), and Other Types) and application (Industrial Applications, Medical Applications, Consumer Electronics, and Other Applications).

Plasma Etching Equipment Industry Market Dynamics & Structure

The Plasma Etching Equipment market is characterized by moderate concentration, with key players such as Lam Research, Applied Materials, and Tokyo Electron holding significant market share. Technological innovation, particularly in areas like DRIE and advanced plasma control, is a major driver. Regulatory frameworks concerning environmental compliance and safety standards influence manufacturing processes. Competitive product substitutes are limited, given the specialized nature of plasma etching technology. End-user demographics are primarily driven by the semiconductor, medical device, and consumer electronics industries. M&A activity has been relatively moderate in recent years, with a projected xx number of deals completed between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share.

- Technological Innovation: Focus on enhancing precision, throughput, and process control, leading to the development of advanced systems like ICP and DRIE.

- Regulatory Landscape: Stringent environmental and safety regulations impacting manufacturing and waste disposal.

- Competitive Substitutes: Limited viable alternatives due to the specialized nature of plasma etching.

- End-User Demographics: Primarily semiconductor manufacturers, medical device companies, and consumer electronics producers.

- M&A Activity: xx M&A deals projected between 2019 and 2024, driven by expansion and technological integration strategies.

Plasma Etching Equipment Industry Growth Trends & Insights

The global plasma etching equipment market is experiencing significant growth, driven by increasing demand from the semiconductor industry and advancements in microfabrication technologies. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the rising adoption of advanced semiconductor devices in various applications, including 5G technology, artificial intelligence, and the Internet of Things. Technological disruptions, such as the development of more precise and efficient etching techniques, contribute to market expansion. Consumer behavior, particularly the increasing demand for smaller and more powerful electronic devices, further stimulates market growth. Market penetration in emerging economies is also a key growth factor.

Dominant Regions, Countries, or Segments in Plasma Etching Equipment Industry

The Asia-Pacific region, particularly countries like South Korea, Taiwan, and China, dominates the plasma etching equipment market due to the strong presence of semiconductor manufacturing facilities and robust government support for technological advancements. Within the market segmentation, Deep Reactive Ion Etching (DRIE) systems are experiencing particularly rapid growth owing to their ability to create high-aspect-ratio features crucial in advanced semiconductor manufacturing. The semiconductor industry remains the largest application segment, and growth in this area significantly impacts the overall market.

- Key Drivers: Strong presence of semiconductor manufacturing hubs in Asia-Pacific; high demand for advanced semiconductor devices; supportive government policies; significant investments in R&D.

- Dominance Factors: High market share for Asia-Pacific; increasing adoption of DRIE systems; robust growth in the semiconductor application segment.

- Growth Potential: Emerging economies present significant growth potential; expanding applications in medical devices and consumer electronics.

Plasma Etching Equipment Industry Product Landscape

The plasma etching equipment market showcases a diverse range of products, each with unique selling propositions based on their technological advancements. Reactive ion etching (RIE) systems are widely used for general-purpose etching, while inductively coupled plasma etching (ICP) systems are favored for their higher precision and control. Deep reactive ion etching (DRIE) systems are critical for creating high-aspect-ratio features in microelectronics. Recent innovations focus on enhancing etch rates, improving uniformity, and minimizing damage to substrates. Performance metrics such as etch rate, selectivity, and uniformity are crucial for determining the efficacy of these systems.

Key Drivers, Barriers & Challenges in Plasma Etching Equipment Industry

Key Drivers: The increasing demand for advanced semiconductor devices is the primary driver. Advancements in microfabrication technologies, particularly for smaller and more complex circuitry, necessitate highly precise etching techniques. Government support and investments in R&D further accelerate innovation.

Key Challenges: High capital costs associated with purchasing and maintaining advanced plasma etching systems pose a significant barrier. Intense competition among established players and emerging companies creates pricing pressures. Maintaining compliance with environmental regulations can also be challenging and costly. Supply chain disruptions can lead to delays and increased costs.

Emerging Opportunities in Plasma Etching Equipment Industry

Untapped markets in emerging economies present substantial opportunities. Growing applications in medical device manufacturing, particularly in areas such as drug delivery systems and microfluidic devices, represent a significant emerging market. Innovations in materials science and the development of new etching processes for advanced materials will open new avenues for growth. Customization and process optimization services for specific application needs are other lucrative areas.

Growth Accelerators in the Plasma Etching Equipment Industry

Technological breakthroughs in plasma generation and control are major growth accelerators. Strategic partnerships between equipment manufacturers and semiconductor companies streamline integration and customization. Market expansion strategies, targeting new application segments and emerging economies, further accelerate market growth. Investment in R&D related to new materials and etching techniques plays a crucial role in industry expansion.

Key Players Shaping the Plasma Etching Equipment Industry Market

- Lam Research Corporation

- GigaLane Co Ltd

- SPTS Technologies (KLA company)

- Thierry Corporation

- Plasma Etch Inc

- Applied Materials Inc

- Plasma-Therm LLC

- Tokyo Electron Limited

- Oxford Instruments PLC

- Samco Inc

- Sentech Instruments GmbH

- Advanced Micro-Fabrication Equipment Inc

Notable Milestones in Plasma Etching Equipment Industry Sector

- February 2022: Lam Research Corporation announced the Syndion GP, a new DRIE system for next-generation power management integrated circuits.

- December 2021: Tokyo Electron launched Impressio 2400 PICP Pro, a plasma etch system for 8th-generation glass substrates.

In-Depth Plasma Etching Equipment Industry Market Outlook

The future of the plasma etching equipment market is bright, driven by continued advancements in semiconductor technology and the expansion of applications across various industries. Strategic partnerships, investments in R&D, and the exploration of new markets will further propel growth. The focus on improving precision, efficiency, and sustainability will be crucial for success in this dynamic market. The market shows a robust potential for sustained expansion, presenting attractive strategic opportunities for industry players.

Plasma Etching Equipment Industry Segmentation

-

1. Type

- 1.1. Reactive Ion Etching (RIE)

- 1.2. Inductively Coupled Plasma Etching (ICP)

- 1.3. Deep Reactive Ion Etching (DRIE)

- 1.4. Other Types

-

2. Application

- 2.1. Industrial Applications

- 2.2. Medical Applications

- 2.3. Consumer Electronics

- 2.4. Other Applications

Plasma Etching Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Plasma Etching Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Semiconductor Industry; Rising Demand for Compact and Energy Efficient Electronic Devices

- 3.3. Market Restrains

- 3.3.1. Growing Complexities Related to Miniaturized Structures of Circuits

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Reactive Ion Etching (RIE)

- 5.1.2. Inductively Coupled Plasma Etching (ICP)

- 5.1.3. Deep Reactive Ion Etching (DRIE)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial Applications

- 5.2.2. Medical Applications

- 5.2.3. Consumer Electronics

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Reactive Ion Etching (RIE)

- 6.1.2. Inductively Coupled Plasma Etching (ICP)

- 6.1.3. Deep Reactive Ion Etching (DRIE)

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial Applications

- 6.2.2. Medical Applications

- 6.2.3. Consumer Electronics

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Reactive Ion Etching (RIE)

- 7.1.2. Inductively Coupled Plasma Etching (ICP)

- 7.1.3. Deep Reactive Ion Etching (DRIE)

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial Applications

- 7.2.2. Medical Applications

- 7.2.3. Consumer Electronics

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Reactive Ion Etching (RIE)

- 8.1.2. Inductively Coupled Plasma Etching (ICP)

- 8.1.3. Deep Reactive Ion Etching (DRIE)

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial Applications

- 8.2.2. Medical Applications

- 8.2.3. Consumer Electronics

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Reactive Ion Etching (RIE)

- 9.1.2. Inductively Coupled Plasma Etching (ICP)

- 9.1.3. Deep Reactive Ion Etching (DRIE)

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial Applications

- 9.2.2. Medical Applications

- 9.2.3. Consumer Electronics

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Plasma Etching Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Lam Research Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 GigaLane Co Ltd*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 SPTS Technologies (KLA company)

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Thierry Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Plasma Etch Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Applied Materials Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Plasma-Therm LLC

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Tokyo Electron Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Oxford Instruments PLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Samco Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Sentech Instruments GmbH

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Advanced Micro-Fabrication Equipment Inc

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Lam Research Corporation

List of Figures

- Figure 1: Global Plasma Etching Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Plasma Etching Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Plasma Etching Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Plasma Etching Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Plasma Etching Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Plasma Etching Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe Plasma Etching Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Plasma Etching Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Plasma Etching Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Plasma Etching Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Plasma Etching Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Plasma Etching Equipment Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Rest of the World Plasma Etching Equipment Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Rest of the World Plasma Etching Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Plasma Etching Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Plasma Etching Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Plasma Etching Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Plasma Etching Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Plasma Etching Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Plasma Etching Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plasma Etching Equipment Industry?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Plasma Etching Equipment Industry?

Key companies in the market include Lam Research Corporation, GigaLane Co Ltd*List Not Exhaustive, SPTS Technologies (KLA company), Thierry Corporation, Plasma Etch Inc, Applied Materials Inc, Plasma-Therm LLC, Tokyo Electron Limited, Oxford Instruments PLC, Samco Inc, Sentech Instruments GmbH, Advanced Micro-Fabrication Equipment Inc.

3. What are the main segments of the Plasma Etching Equipment Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Semiconductor Industry; Rising Demand for Compact and Energy Efficient Electronic Devices.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Drive the Demand.

7. Are there any restraints impacting market growth?

Growing Complexities Related to Miniaturized Structures of Circuits.

8. Can you provide examples of recent developments in the market?

February 2022 - Lam Research Corporation, a plasma etch and deposition tool manufacturer, announced the Syndion GP, a new product designed to enable chipmakers to develop next-generation power management integrated circuits and power devices using deep silicon etch technology. According to the company, Syndion GP can provide good control of the plasma across the wafer by controlling the distribution of ions and radicals for the deep silicon etch (DRIE) process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plasma Etching Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plasma Etching Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plasma Etching Equipment Industry?

To stay informed about further developments, trends, and reports in the Plasma Etching Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence