Key Insights

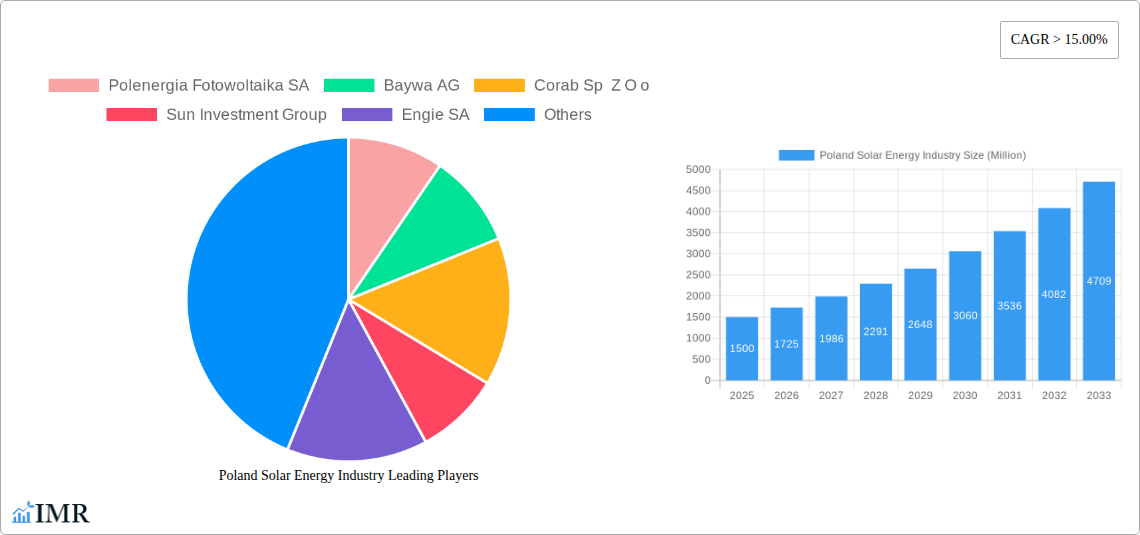

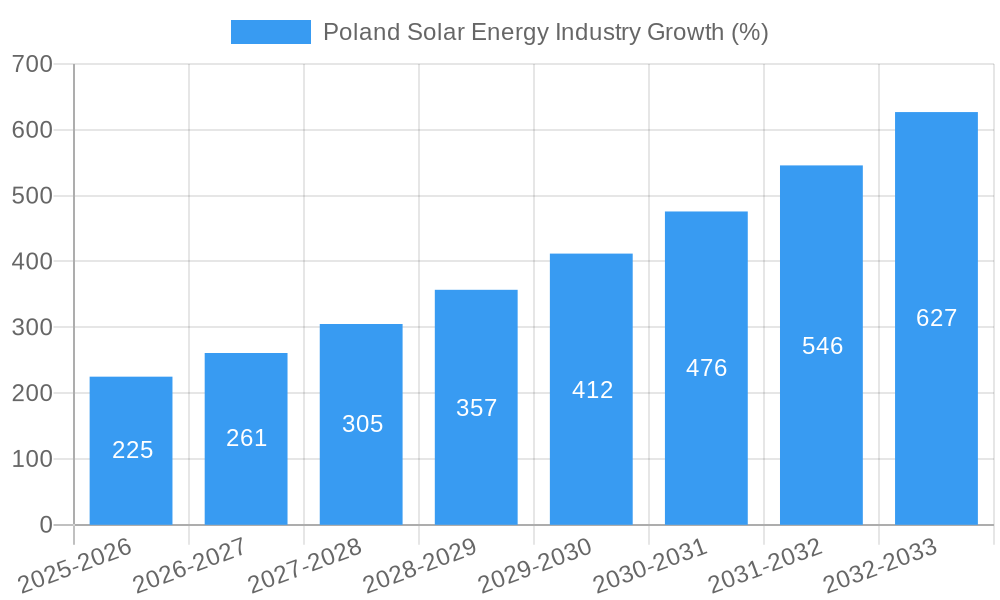

The Polish solar energy industry is experiencing robust growth, driven by supportive government policies promoting renewable energy adoption, decreasing solar panel costs, and increasing energy security concerns. With a Compound Annual Growth Rate (CAGR) exceeding 15% and a market size in the millions, the sector presents significant investment opportunities. The market is segmented by deployment location (ground-mounted and rooftop) and end-user (residential, commercial & industrial, and utility). Ground-mounted solar farms are likely dominating the market share currently, given the higher power generation potential, but rooftop installations are experiencing strong growth fueled by government incentives and decreasing installation costs for residential and commercial applications. The utility sector is also a major player, with large-scale solar farms contributing significantly to Poland's renewable energy goals. Key players like Polenergia Fotowoltaika SA, Baywa AG, and others are driving innovation and competition, leading to improved efficiency and cost reductions.

However, challenges remain. While Poland boasts abundant solar resources, factors like land availability for large-scale projects and grid infrastructure limitations can impede growth. Furthermore, seasonal variations in solar irradiance and potential regulatory hurdles might present short-term obstacles. Despite these, the long-term outlook remains positive, with the industry projected to continue its upward trajectory. The increasing affordability of solar energy coupled with growing environmental awareness amongst consumers and businesses will fuel continued expansion throughout the forecast period (2025-2033). The market’s diverse segments offer various entry points for investors and companies aiming to capitalize on Poland's transition to cleaner energy sources. Further analysis focusing on individual segment growth rates and profitability will provide even more valuable insights for market participants.

This comprehensive report provides a detailed analysis of the Poland solar energy industry, offering invaluable insights for industry professionals, investors, and policymakers. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report leverages extensive data analysis to provide a granular understanding of market dynamics, growth trends, and future prospects. Key segments analyzed include residential, commercial & industrial, and utility solar deployments, across ground-mounted and rooftop installations.

Poland Solar Energy Industry Market Dynamics & Structure

This section analyzes the structure and dynamics of the Polish solar energy market, encompassing market concentration, technological advancements, regulatory landscape, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activity.

Market Concentration: The Polish solar market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Polenergia Fotowoltaika SA and Green Genius Sp Z O o are amongst the key players; however, the presence of numerous smaller companies also contributes to a dynamic market environment. We estimate that the top 5 players hold approximately xx% of the market share in 2025.

Technological Innovation: Technological advancements, such as improved solar panel efficiency and energy storage solutions, are key drivers of market expansion. Innovation is fostered by government incentives and R&D investments. However, barriers exist in terms of initial capital costs and technological complexities for smaller companies.

Regulatory Framework: Government policies and regulations play a crucial role in shaping market growth. The Polish government's supportive policies, including feed-in tariffs and renewable energy targets, have stimulated investments in solar energy. However, regulatory uncertainty occasionally acts as a constraint to the industry's development.

Competitive Substitutes: Other renewable energy sources, particularly wind power, compete with solar energy for investment. However, the relative cost-effectiveness and ease of deployment of solar PV systems gives it a competitive edge in certain segments.

End-User Demographics: Residential consumers, commercial businesses, and large industrial facilities represent the key end-users, with demand driven by factors such as cost reductions, environmental concerns, and energy independence.

M&A Trends: The Polish solar energy market has witnessed a moderate level of M&A activity in recent years, with larger companies strategically acquiring smaller players to expand their market share and gain access to new technologies. We estimate xx M&A deals in the solar sector were concluded during 2019-2024.

Poland Solar Energy Industry Growth Trends & Insights

The Poland solar energy market experienced significant growth during the historical period (2019-2024). Driven by supportive government policies, decreasing solar PV costs, and increasing environmental awareness, the market is expected to maintain a strong growth trajectory during the forecast period (2025-2033). XXX analysis projects a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Market penetration is expected to reach xx% by 2033, compared to xx% in 2025. Key factors influencing this growth include evolving consumer preferences for renewable energy, improving grid infrastructure, and the increasing affordability of solar PV systems. Technological disruptions, like advancements in energy storage and smart grid technologies, further enhance the market’s growth potential. The increasing adoption of rooftop solar in the residential sector presents a particularly significant growth opportunity.

Dominant Regions, Countries, or Segments in Poland Solar Energy Industry

The growth of the Polish solar energy industry is not uniform across all regions or segments. While data on regional specifics is limited, the most significant growth is observed in areas with favorable solar irradiance and access to grid infrastructure. Within the deployment segments, rooftop installations are experiencing faster growth than ground-mounted systems due to the ease of implementation and suitability for residential and commercial applications. The residential sector shows rapid growth in solar energy adoption, surpassing the commercial & industrial sectors in market share due to increasing affordability and governmental incentives. The utility-scale segment presents significant future potential due to large-scale projects and long-term contracts.

Key Drivers for Rooftop Solar Growth:

- Lower upfront investment compared to ground-mounted systems.

- Government incentives specifically targeted at residential installations.

- Relatively straightforward permitting processes.

- Increased consumer awareness of environmental benefits.

Key Drivers for Residential Segment Growth:

- Decreasing PV system costs and readily available financing options.

- Growing awareness of environmental responsibility.

- Incentives from government-backed programs.

- Potential for energy independence and cost savings.

Poland Solar Energy Industry Product Landscape

The Polish solar energy market offers a diverse range of products, encompassing various solar panel technologies (monocrystalline, polycrystalline, thin-film), inverters, mounting systems, and energy storage solutions. Recent innovations focus on higher efficiency panels, improved energy storage technologies, and smart grid integration capabilities. Unique selling propositions include enhanced durability, improved aesthetics, and tailored solutions for specific customer needs.

Key Drivers, Barriers & Challenges in Poland Solar Energy Industry

Key Drivers:

- Government support: Subsidies, tax incentives, and renewable energy targets stimulate market expansion.

- Falling solar PV costs: Increased affordability makes solar energy more accessible to a wider range of consumers.

- Technological advancements: Improved efficiency and performance enhance the attractiveness of solar solutions.

Key Barriers & Challenges:

- Grid infrastructure limitations: Insufficient grid capacity in certain regions hinders large-scale solar deployment.

- Regulatory uncertainty: Changes in government policies and permitting processes can create uncertainty for investors.

- Competition from other renewable energy sources: Wind power and biomass compete for investment capital.

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of solar components. We estimate a xx% increase in solar component costs in 2023 compared to 2022 due to these disruptions.

Emerging Opportunities in Poland Solar Energy Industry

Emerging opportunities include the integration of solar energy with energy storage solutions, expansion into untapped rural markets, and the development of innovative solar applications for agriculture and industry. The increasing demand for corporate sustainability initiatives will also create growth opportunities. The development of community solar projects offers a pathway to increase market participation and widespread adoption.

Growth Accelerators in the Poland Solar Energy Industry Industry

Long-term growth will be propelled by technological breakthroughs in solar panel efficiency and energy storage, strategic partnerships between energy companies and technology providers, and the continued expansion of government support programs. Further market penetration will rely on addressing the challenges related to grid integration and streamlining the permitting process.

Key Players Shaping the Poland Solar Energy Industry Market

- Polenergia Fotowoltaika SA

- Baywa AG (Baywa r.e.)

- Corab Sp Z O o

- Sun Investment Group

- Engie SA (Engie)

- RWE AG (RWE)

- Better Energy Holding A/S (Better Energy)

- Green Genius Sp Z O o

- R Power Sp Z O o

- Pcwo Energy SA

- Alseva Innowacje SA

Notable Milestones in Poland Solar Energy Industry Sector

- 2020: Introduction of revised renewable energy targets by the Polish government.

- 2021: Launch of several large-scale solar PV projects.

- 2022: Significant increase in residential solar installations due to governmental incentives.

- 2023: Several mergers and acquisitions among solar energy companies.

In-Depth Poland Solar Energy Industry Market Outlook

The future of the Polish solar energy market is bright, with continued growth expected across all segments. Strategic opportunities exist for companies that can innovate, adapt to regulatory changes, and address the challenges related to grid infrastructure. The market's long-term success hinges on sustained government support, technological advancements, and a continuing increase in consumer awareness of the environmental and economic benefits of solar energy.

Poland Solar Energy Industry Segmentation

-

1. Location of Deployment

- 1.1. Ground Mounted

- 1.2. Rooftop

-

2. End User

- 2.1. Residential

- 2.2. Commerical and Industrial

- 2.3. Utility

Poland Solar Energy Industry Segmentation By Geography

- 1. Poland

Poland Solar Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Residential End-User Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Solar Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Ground Mounted

- 5.1.2. Rooftop

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commerical and Industrial

- 5.2.3. Utility

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Polenergia Fotowoltaika SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Baywa AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corab Sp Z O o

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sun Investment Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Engie SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rwe AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Better Energy Holding A/S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Green Genius Sp Z O o

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 R Power Sp Z O o

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pcwo Energy SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alseva Innowacje SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Polenergia Fotowoltaika SA

List of Figures

- Figure 1: Poland Solar Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Solar Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: Poland Solar Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Solar Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Poland Solar Energy Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 4: Poland Solar Energy Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 5: Poland Solar Energy Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Poland Solar Energy Industry Volume Gigawatt Forecast, by End User 2019 & 2032

- Table 7: Poland Solar Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Poland Solar Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: Poland Solar Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Poland Solar Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: Poland Solar Energy Industry Revenue Million Forecast, by Location of Deployment 2019 & 2032

- Table 12: Poland Solar Energy Industry Volume Gigawatt Forecast, by Location of Deployment 2019 & 2032

- Table 13: Poland Solar Energy Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Poland Solar Energy Industry Volume Gigawatt Forecast, by End User 2019 & 2032

- Table 15: Poland Solar Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Poland Solar Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Solar Energy Industry?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the Poland Solar Energy Industry?

Key companies in the market include Polenergia Fotowoltaika SA, Baywa AG, Corab Sp Z O o, Sun Investment Group, Engie SA, Rwe AG, Better Energy Holding A/S, Green Genius Sp Z O o, R Power Sp Z O o, Pcwo Energy SA, Alseva Innowacje SA.

3. What are the main segments of the Poland Solar Energy Industry?

The market segments include Location of Deployment , End User .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Residential End-User Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Solar Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Solar Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Solar Energy Industry?

To stay informed about further developments, trends, and reports in the Poland Solar Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence