Key Insights

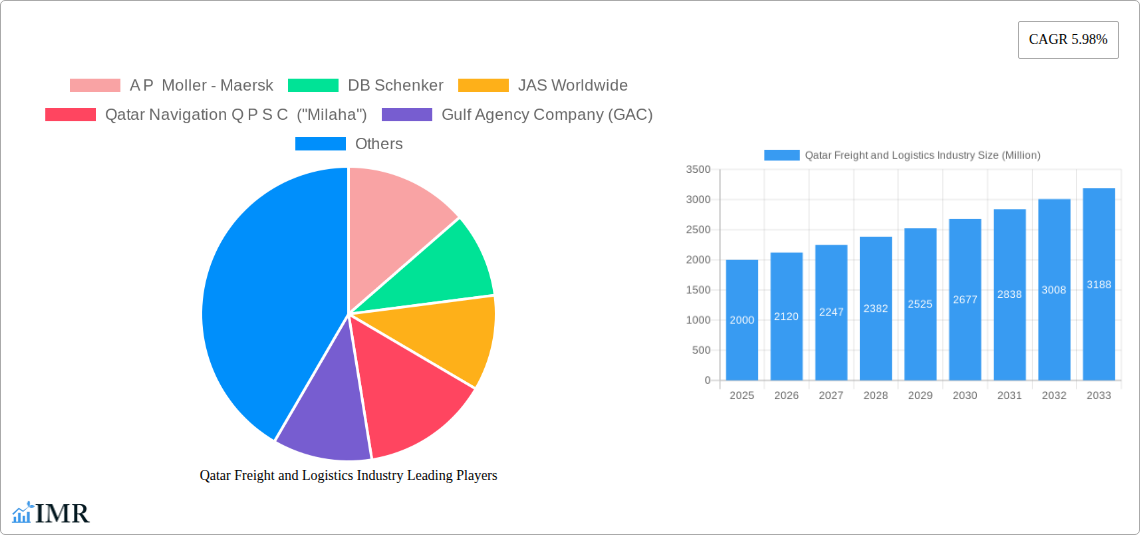

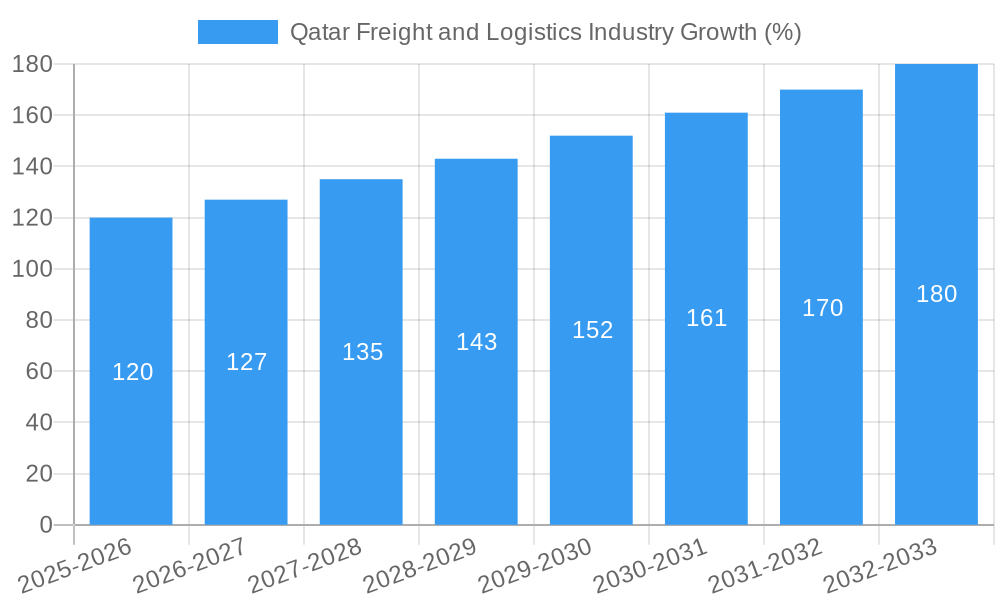

The Qatar freight and logistics industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Qatar's strategic geographic location as a major transit hub in the Middle East, coupled with significant investments in port infrastructure and air cargo facilities, significantly enhances its logistics capabilities and attractiveness to international trade. Secondly, the ongoing development and diversification of Qatar's economy, particularly in sectors like construction (related to ongoing mega-projects) and energy, drives demand for efficient and reliable freight and logistics services. The growth is further bolstered by the increasing adoption of advanced technologies like digital logistics platforms and improved supply chain management practices, aiming to enhance efficiency and transparency. Finally, the burgeoning e-commerce sector within Qatar is creating a significant demand for last-mile delivery solutions, boosting the overall market volume.

However, the industry also faces certain challenges. Fluctuations in global oil prices can impact the overall economic climate and, consequently, freight volumes. Competition from established international players necessitates a focus on innovation and specialized service offerings to maintain a competitive edge. Furthermore, regulatory complexities and potential workforce limitations could hinder the sector's growth trajectory. Nevertheless, the long-term outlook remains positive, with the industry well-positioned to benefit from Qatar's continued economic development and strategic importance in global trade. The market segmentation, encompassing various end-user industries and logistics functions, indicates opportunities for specialized service providers catering to specific niche needs within the rapidly evolving market landscape. The presence of major global players alongside regional companies points to a competitive yet dynamic market structure.

Qatar Freight and Logistics Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Qatar freight and logistics industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and policymakers seeking insights into this rapidly evolving sector. The report leverages extensive primary and secondary research to deliver actionable intelligence.

Qatar Freight and Logistics Industry Market Dynamics & Structure

The Qatari freight and logistics market is characterized by a moderately concentrated structure with several major players alongside numerous smaller operators. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033. Technological innovation, driven by the adoption of AI, automation, and digitalization, is a key driver of growth. However, regulatory frameworks and the need for skilled labor pose significant challenges. The industry witnesses considerable M&A activity, with xx deals recorded in the last five years, primarily focused on consolidating market share and expanding service offerings. Substitute products, such as improved internal transport systems for some sectors, pose a limited competitive threat.

- Market Concentration: Moderately concentrated, with a few dominant players controlling a significant market share.

- Technological Innovation: Strong emphasis on AI, blockchain, IoT, and automation to enhance efficiency and transparency.

- Regulatory Framework: Relatively stable but evolving to address challenges related to sustainability and safety.

- Competitive Substitutes: Limited impact from substitute products, however, internal logistics optimization is an emerging factor.

- End-User Demographics: Significant demand from the Oil & Gas, Construction, and Manufacturing sectors.

- M&A Trends: Active M&A activity, driving consolidation and expansion of services. xx Million in M&A deals from 2020-2024.

Qatar Freight and Logistics Industry Growth Trends & Insights

The Qatari freight and logistics market exhibits robust growth, fueled by sustained economic expansion, infrastructure development, and increasing trade volumes. The market size experienced a CAGR of xx% during the historical period (2019-2024), reaching xx Million in 2024. The adoption of advanced technologies like AI-powered route optimization and predictive analytics is accelerating, improving efficiency and reducing costs. Consumer behavior shifts towards e-commerce and faster delivery times further contribute to growth. The forecast period (2025-2033) anticipates a continued upward trajectory, with a projected market size of xx Million by 2033, driven by investments in logistics infrastructure and the expanding industrial base.

Dominant Regions, Countries, or Segments in Qatar Freight and Logistics Industry

The Oil and Gas sector remains the dominant end-user industry, contributing xx% to the overall market in 2025, followed by Construction (xx%) and Manufacturing (xx%). Within logistics functions, “Other Services” (including warehousing, freight forwarding etc.) command the largest share (xx%), while the CEP segment experiences significant growth driven by the rise of e-commerce, contributing xx%.

- Key Drivers:

- Robust economic growth and diversification strategies of the Qatari government.

- Major infrastructural projects supporting logistics operations (e.g., Hamad Port).

- Growing e-commerce sector impacting the courier, express, and parcel segment.

- Dominance Factors:

- High demand from the Oil & Gas sector and large-scale infrastructural projects.

- Strategic location of Qatar facilitating regional trade.

- Well-developed port facilities and efficient transportation networks.

Qatar Freight and Logistics Industry Product Landscape

The product landscape is characterized by a wide range of services, including freight forwarding, warehousing, customs brokerage, and specialized transportation (e.g., temperature-controlled). Technological advancements are driving innovation, with the emergence of digital platforms for real-time tracking, automated warehousing systems, and AI-powered route optimization. Key differentiators include speed, reliability, traceability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Qatar Freight and Logistics Industry

Key Drivers:

- Government investments in infrastructure, creating better connectivity and efficiency.

- Rising e-commerce driving demand for faster and more reliable delivery services.

- Increasing focus on supply chain resilience and diversification in response to global disruptions.

Challenges:

- Labor shortages and skill gaps hamper industry growth. The lack of qualified workers costs the industry an estimated xx Million annually.

- Stringent regulatory requirements and compliance costs represent a significant burden for operators.

- Intense competition from regional and international players puts pressure on profit margins.

Emerging Opportunities in Qatar Freight and Logistics Industry

- Sustainable Logistics: Growing demand for environmentally friendly solutions, creating opportunities in green logistics and carbon-neutral transportation.

- Last-Mile Delivery: The expansion of e-commerce fuels demand for efficient and cost-effective last-mile delivery solutions.

- Technology Integration: Opportunities in adopting and integrating advanced technologies like blockchain, AI, and IoT to improve efficiency and transparency.

Growth Accelerators in the Qatar Freight and Logistics Industry

Strategic partnerships between logistics providers and technology companies are accelerating growth. Investments in automated warehousing systems and digital platforms are streamlining operations and enhancing efficiency. The expansion of Hamad Port and other key infrastructure projects are further boosting the industry's capacity and connectivity, creating a positive feedback loop.

Key Players Shaping the Qatar Freight and Logistics Industry Market

- A P Moller - Maersk

- DB Schenker

- JAS Worldwide

- Qatar Navigation Q P S C ("Milaha")

- Gulf Agency Company (GAC)

- Bin Yousef Group of Companies W L L

- DHL Group

- Tokyo Freight Service

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- E2E Global Lines

- Gulf Warehousing Company (GWC)

- Qatar Post

- FedEx

- Target Logistics Qatar

- Al Faisal Holding

- Kuehne + Nagel

- BCC Logistics

- Aerofrt (Aero Freight Company Ltd)

- Mannai Corporation QPSC

- Nakilat

- Qatar Airways Group

- Aramex

- Ali Bin Ali Holding

- Rumaillah Group

Notable Milestones in Qatar Freight and Logistics Industry Sector

- September 2023: Kuehne+Nagel and Capgemini partnered to create a supply chain orchestration service, enhancing end-to-end supply chain management.

- January 2024: Kuehne + Nagel launched its Book & Claim insetting solution for electric vehicles, advancing decarbonization efforts.

- March 2023: Maersk divested Maersk Supply Service, focusing its strategy on integrated logistics.

In-Depth Qatar Freight and Logistics Industry Market Outlook

The Qatar freight and logistics market presents significant long-term growth potential, driven by sustained economic development, strategic investments in infrastructure, and the increasing adoption of advanced technologies. Opportunities exist in specialized logistics segments, particularly in the green logistics space and last-mile delivery solutions. Companies adopting innovative technologies and strategic partnerships will be best positioned to capitalize on the market's expansion and evolving consumer needs.

Qatar Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Qatar Freight and Logistics Industry Segmentation By Geography

- 1. Qatar

Qatar Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 A P Moller - Maersk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JAS Worldwide

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Qatar Navigation Q P S C ("Milaha")

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Agency Company (GAC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bin Yousef Group of Companies W L L

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHL Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokyo Freight Service

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 E2E Global Lines

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Gulf Warehousing Company (GWC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Qatar Post

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FedEx

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Target Logistics Qatar

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Al Faisal Holding

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Kuehne + Nagel

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 BCC Logistics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Aerofrt (Aero Freight Company Ltd)

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Mannai Corporation QPSC

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Nakilat

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Qatar Airways Group

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Aramex

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Ali Bin Ali Holding

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Rumaillah Group

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Qatar Freight and Logistics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Freight and Logistics Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Qatar Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Qatar Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Qatar Freight and Logistics Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Qatar Freight and Logistics Industry Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Qatar Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Freight and Logistics Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Qatar Freight and Logistics Industry?

Key companies in the market include A P Moller - Maersk, DB Schenker, JAS Worldwide, Qatar Navigation Q P S C ("Milaha"), Gulf Agency Company (GAC), Bin Yousef Group of Companies W L L, DHL Group, Tokyo Freight Service, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), E2E Global Lines, Gulf Warehousing Company (GWC), Qatar Post, FedEx, Target Logistics Qatar, Al Faisal Holding, Kuehne + Nagel, BCC Logistics, Aerofrt (Aero Freight Company Ltd), Mannai Corporation QPSC, Nakilat, Qatar Airways Group, Aramex, Ali Bin Ali Holding, Rumaillah Group.

3. What are the main segments of the Qatar Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.September 2023: Kuehne+Nagel and Capgemini have entered into a strategic agreement to create a supply chain orchestration service offering to provide end-to-end services across the supply chain network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the Qatar Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence