Key Insights

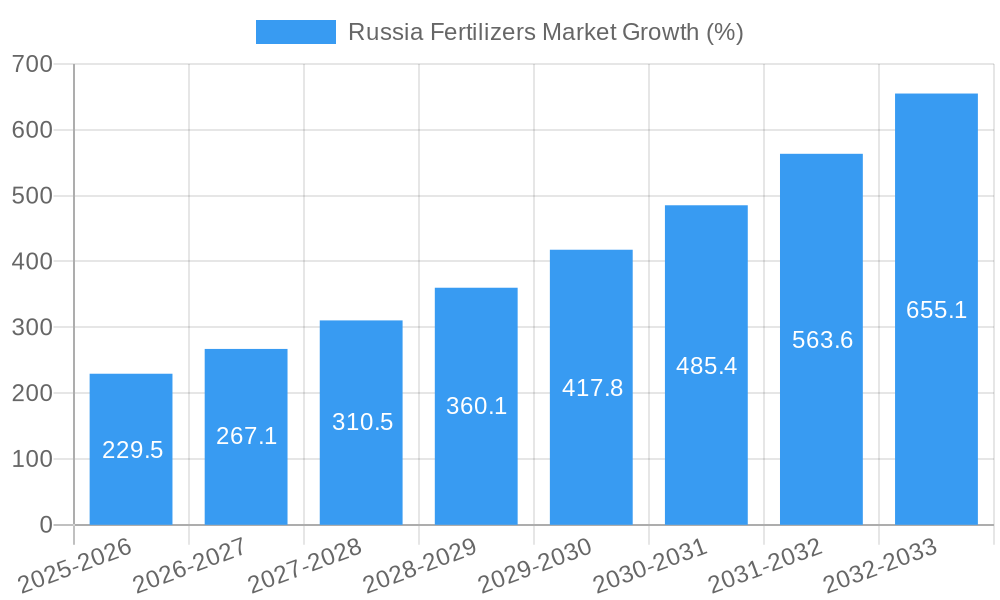

The Russia fertilizers market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 15.30% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for food security in Russia, coupled with the nation's vast agricultural lands, necessitates higher fertilizer consumption to boost crop yields. Secondly, government initiatives promoting agricultural modernization and intensification are fostering the adoption of advanced fertilization techniques, including fertigation and foliar application, across various crop types—field crops, horticultural crops, and turf & ornamental. Finally, the ongoing development of specialized fertilizers tailored to specific crop needs and soil conditions further fuels market growth. However, market expansion is not without its challenges. Fluctuations in global commodity prices, particularly for key fertilizer components, pose a significant constraint, impacting production costs and market accessibility. Furthermore, environmental concerns surrounding fertilizer overuse and the potential for soil and water contamination necessitate sustainable agricultural practices, impacting fertilizer choice and application methods. The market is segmented by fertilizer type (complex, straight), form (conventional, specialty), application mode (fertigation, foliar, soil), and crop type. Key players like Haifa Group, MINUDOBRENIYA JSC, Biolchim SPA, and others compete in this dynamic market, adapting to the evolving demands and regulatory landscape.

The regional distribution of the Russia fertilizers market reveals varied growth potentials across Western, Eastern, Southern, and Northern Russia. Specific regional growth rates may differ based on factors such as agricultural intensity, soil conditions, and government support programs. The historical period (2019-2024) likely showcased fluctuations influenced by external factors like sanctions and global commodity price swings. Considering the 2025 market size and the projected CAGR, the market is poised for substantial growth throughout the forecast period (2025-2033). Understanding these dynamics is critical for companies operating within or looking to enter the Russian fertilizers market. Strategic adjustments, focusing on sustainable practices and adapting to regional nuances, will be crucial for success in this competitive landscape.

Russia Fertilizers Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia fertilizers market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The study delves into the parent market (Agricultural Inputs Market in Russia) and child markets (e.g., Complex Fertilizers, Straight Fertilizers, various application modes, and crop types), offering granular insights for industry professionals. The market size is presented in million units.

Russia Fertilizers Market Dynamics & Structure

The Russia fertilizers market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration is relatively high, with a few major players dominating the landscape. Technological innovation, primarily focused on enhancing fertilizer efficiency and sustainability, is a key driver, although adoption rates vary across segments. Stringent regulatory frameworks governing fertilizer production, distribution, and usage significantly shape market dynamics. The market also faces competition from alternative soil enrichment methods and organic farming practices. End-user demographics, including the size and structure of agricultural businesses (large-scale farms vs. smaller holdings), significantly impact demand patterns. M&A activity within the sector has been moderate, with xx deals recorded between 2019 and 2024, indicating a trend toward consolidation.

- Market Concentration: High, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on precision fertilization, slow-release formulations, and biofertilizers.

- Regulatory Framework: Strict environmental regulations impacting production and usage.

- Competitive Substitutes: Organic farming practices, alternative soil amendments.

- M&A Activity: xx deals between 2019 and 2024, indicating a trend towards consolidation.

Russia Fertilizers Market Growth Trends & Insights

The Russia fertilizers market experienced fluctuating growth during the historical period (2019-2024), influenced by factors such as geopolitical events, economic conditions, and agricultural policies. The market size reached xx million units in 2024, demonstrating a CAGR of xx% between 2019 and 2024. Adoption of advanced fertilizer technologies has been gradual, with xx% market penetration of precision fertilization techniques in 2024. Technological disruptions, such as the emergence of biofertilizers, are slowly altering consumer preferences towards more sustainable and environmentally friendly options. Consumer behavior shifts are evident in a growing demand for specialized fertilizers tailored to specific crop needs. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by increasing agricultural production and government support for the sector.

Dominant Regions, Countries, or Segments in Russia Fertilizers Market

The dominant segment in the Russia fertilizers market is Field Crops (accounting for xx% of the total market in 2024), driven by the vast agricultural land dedicated to grain production. The South Federal District and Central Federal District emerge as leading regions due to their significant arable land and favorable climatic conditions. Key drivers include:

- Government Support: Subsidies and incentives for fertilizer usage in key agricultural regions.

- Infrastructure: Well-developed transportation networks facilitating fertilizer distribution.

- Economic Policies: Government initiatives promoting agricultural growth.

- Technological Adoption: Higher adoption rates of modern fertilizer application techniques in some regions.

The Complex Fertilizers segment is witnessing significant growth, exceeding xx% market share in 2024. This is attributed to their balanced nutrient profile and cost-effectiveness compared to straight fertilizers. Within application modes, soil application maintains its dominance (xx% market share in 2024), while fertigation is exhibiting faster growth, driven by technological improvements and efficiency gains.

Russia Fertilizers Market Product Landscape

The Russia fertilizers market offers a diverse range of products, including conventional and specialty fertilizers. Innovation is focused on enhancing nutrient efficiency, improving crop yields, and reducing environmental impact. Specialty fertilizers, tailored to specific crop needs and soil conditions, are gaining traction, especially within the horticultural and turf & ornamental segments. The emphasis is on slow-release formulations, improved nutrient uptake, and the incorporation of bio-stimulants for enhanced crop health. Companies are differentiating their products through superior quality, targeted nutrient profiles, and sustainable production processes.

Key Drivers, Barriers & Challenges in Russia Fertilizers Market

Key Drivers: Growing demand for agricultural products, government support for the agricultural sector, advancements in fertilizer technology leading to higher crop yields, and increasing awareness among farmers about the importance of balanced fertilization.

Key Challenges: Fluctuations in global commodity prices impacting fertilizer costs, supply chain disruptions (particularly after 2022), and environmental concerns associated with fertilizer use. The impact of sanctions on import/export operations also presents significant challenges. These sanctions impacted market growth by approximately xx% in 2022 compared to 2021.

Emerging Opportunities in Russia Fertilizers Market

Emerging opportunities lie in the growing demand for sustainable and organic fertilizers, precision farming technologies, and tailored solutions for specific crop types and soil conditions. Untapped markets exist in less developed agricultural regions. Opportunities also exist in providing technical assistance and education to farmers to optimize fertilizer use and improve sustainability practices.

Growth Accelerators in the Russia Fertilizers Market Industry

Technological advancements in fertilizer production and application, strategic partnerships between fertilizer companies and agricultural businesses, and expansion into new geographical markets are key growth accelerators. Government initiatives promoting sustainable agricultural practices also play a crucial role in driving long-term market expansion.

Key Players Shaping the Russia Fertilizers Market Market

- Haifa Group

- MINUDOBRENIYA JSC

- Biolchim SPA

- PhosAgro Group of Companies

- EuroChem Group

- Trade Corporation International

- Yara International AS

- KuibyshevAzot PJSC

- Mivena BV

- ICL Group Ltd

Notable Milestones in Russia Fertilizers Market Sector

- May 2022: ICL launched three new NPK formulations of Solinure, enhancing product offerings.

- May 2022: ICL signed agreements with Indian and Chinese customers for potash supply, boosting international sales.

- January 2023: ICL partnered with General Mills for specialty phosphate solutions, signifying a strategic expansion.

In-Depth Russia Fertilizers Market Market Outlook

The Russia fertilizers market is poised for continued growth, driven by technological advancements, supportive government policies, and increasing demand for agricultural products. Strategic partnerships, market expansion, and a focus on sustainable solutions will play a key role in shaping future market dynamics. The market presents significant opportunities for companies that can offer innovative products and services, adapting to changing consumer preferences and addressing the challenges of a dynamic and evolving agricultural landscape.

Russia Fertilizers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Russia Fertilizers Market Segmentation By Geography

- 1. Russia

Russia Fertilizers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Fertilizers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Western Russia Russia Fertilizers Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Fertilizers Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Fertilizers Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Fertilizers Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Haifa Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 MINUDOBRENIYA JSC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Biolchim SPA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PhosAgro Group of Companies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 EuroChem Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Trade Corporation International

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Yara International AS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KuibyshevAzot PJSC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mivena BV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ICL Group Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Haifa Group

List of Figures

- Figure 1: Russia Fertilizers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Fertilizers Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Fertilizers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Fertilizers Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Russia Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Russia Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Russia Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Russia Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Russia Fertilizers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Russia Fertilizers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Western Russia Russia Fertilizers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Eastern Russia Russia Fertilizers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southern Russia Russia Fertilizers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northern Russia Russia Fertilizers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Fertilizers Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: Russia Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: Russia Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Russia Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: Russia Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: Russia Fertilizers Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Fertilizers Market?

The projected CAGR is approximately 15.30%.

2. Which companies are prominent players in the Russia Fertilizers Market?

Key companies in the market include Haifa Group, MINUDOBRENIYA JSC, Biolchim SPA, PhosAgro Group of Companies, EuroChem Group, Trade Corporation International, Yara International AS, KuibyshevAzot PJSC, Mivena BV, ICL Group Ltd.

3. What are the main segments of the Russia Fertilizers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL has launched three new NPK formulations of Solinure, a product with increased trace elements to optimise yieldsMay 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric tons of potash, respectively, in 2022 at USD 590 per ton.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Fertilizers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Fertilizers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Fertilizers Market?

To stay informed about further developments, trends, and reports in the Russia Fertilizers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence