Key Insights

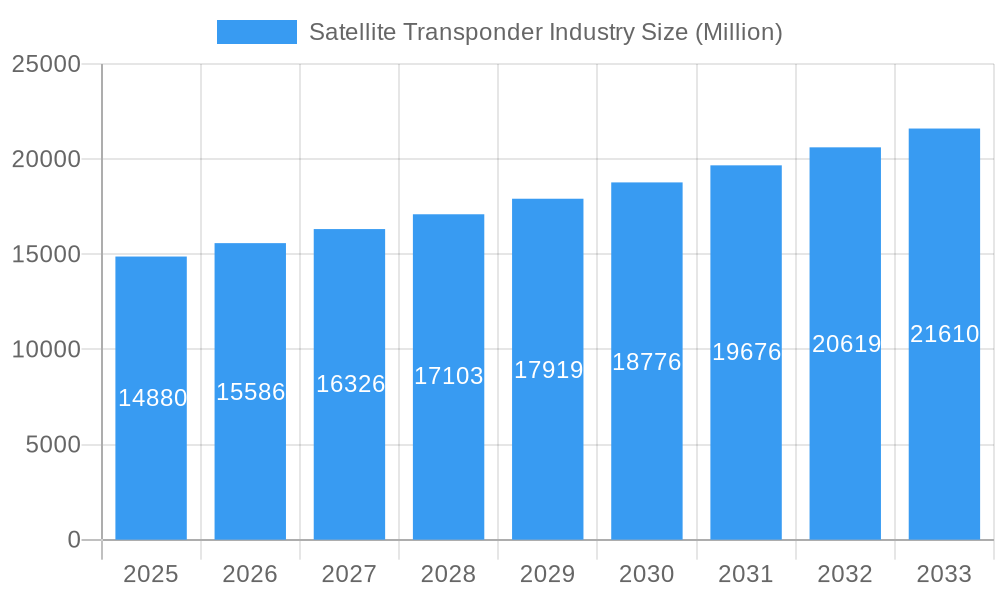

The global satellite transponder market, valued at $14.88 billion in 2025, is projected to experience robust growth, driven by increasing demand for high-bandwidth communication solutions across various sectors. The Compound Annual Growth Rate (CAGR) of 4.78% from 2025 to 2033 indicates a significant expansion, fueled by the rising adoption of satellite technology in commercial communications, government operations, navigation systems, and remote sensing applications. Growth is further stimulated by the expanding need for reliable connectivity in underserved regions and the increasing integration of satellite transponders into Internet of Things (IoT) applications. Leasing remains a dominant service segment, although maintenance and support services are experiencing significant growth reflecting the need for ongoing operational efficiency and longevity of satellite assets. Key players like Russian Satellite Communications Company, China Satellite Communications Co Ltd, Eutelsat Communications SA, and others are strategically investing in network expansion and technological advancements to cater to this growing market. Competition is intensifying with a focus on offering innovative solutions and enhancing service quality.

Satellite Transponder Industry Market Size (In Billion)

However, market expansion may be somewhat tempered by factors like the high initial investment costs associated with satellite infrastructure and ongoing operational expenses. Further regulatory hurdles and the potential for interference from terrestrial technologies could also create minor limitations. Nevertheless, the long-term outlook for the satellite transponder market remains positive, driven by ongoing technological innovations and an increasing reliance on reliable satellite communication across multiple sectors globally. The Asia-Pacific region is anticipated to show particularly strong growth, driven by increasing infrastructure development and a rising demand for broadband access in emerging economies. North America and Europe will continue to be significant markets, with a focus on advanced applications and sophisticated services.

Satellite Transponder Industry Company Market Share

Satellite Transponder Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Satellite Transponder industry, encompassing market dynamics, growth trends, regional insights, and key player strategies. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. It serves as an essential resource for industry professionals, investors, and anyone seeking to understand the complexities and future potential of this vital sector. The report breaks down the market by application (Commercial Communications, Government Communications, Navigation, Remote Sensing, Other Applications) and by service (Leasing, Maintenance and Support, Other Services).

Satellite Transponder Industry Market Dynamics & Structure

The satellite transponder market exhibits a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, particularly in high-throughput satellites (HTS) and Low Earth Orbit (LEO) constellations, is a key driver, alongside increasing demand for bandwidth-intensive applications. Regulatory frameworks, including spectrum allocation and orbital slot assignments, significantly influence market dynamics. Competitive pressures arise from terrestrial alternatives like fiber optics, and M&A activity has been moderate, with xx deals valued at approximately $xx million in the historical period.

- Market Concentration: Highly concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: HTS, LEO constellations, and advancements in signal processing are key drivers.

- Regulatory Framework: Spectrum allocation and orbital slot management impact market access and competition.

- Competitive Substitutes: Fiber optics and terrestrial networks pose a significant competitive threat.

- M&A Activity: Moderate activity in recent years, with xx deals completed between 2019-2024.

- End-User Demographics: Dominated by telecommunications companies, government agencies, and broadcast organizations.

Satellite Transponder Industry Growth Trends & Insights

The global satellite transponder market is experiencing robust growth, driven by increasing demand for broadband internet access, particularly in underserved regions. The market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. This growth is projected to continue throughout the forecast period, reaching xx million units by 2033, with a projected CAGR of xx%. Technological advancements, such as the emergence of LEO constellations offering higher capacity and lower latency, are accelerating adoption rates across various sectors. Consumer behavior shifts towards greater reliance on data-intensive applications further contribute to market expansion. The increasing adoption of IoT devices and the expansion of 5G networks will fuel the demand for satellite transponders in the coming years.

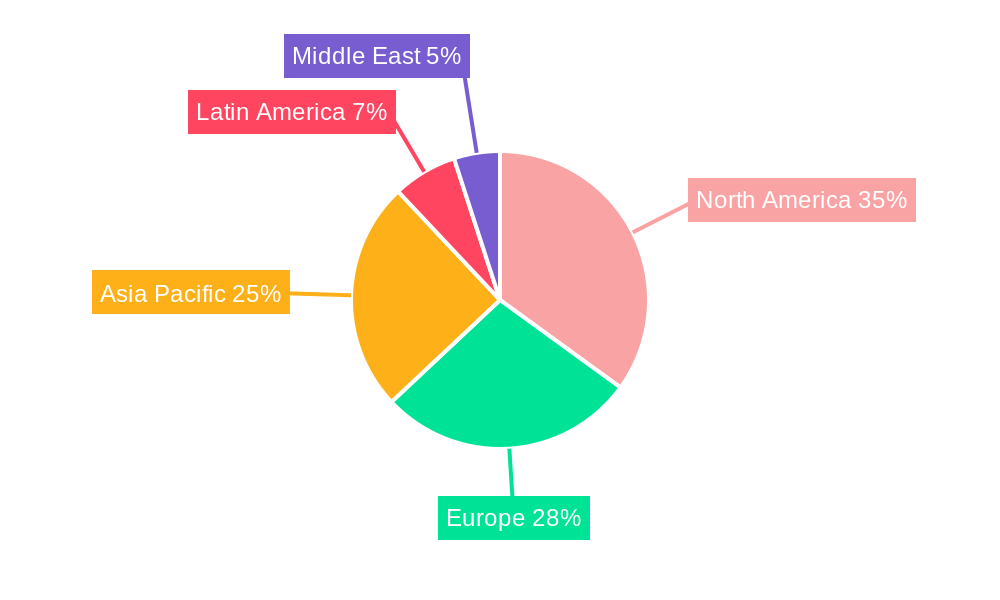

Dominant Regions, Countries, or Segments in Satellite Transponder Industry

The North American region currently dominates the global satellite transponder market, driven by strong demand from commercial communications and government sectors. This dominance is attributed to well-established satellite infrastructure, advanced technological capabilities, and significant investments in space technology. The Asia-Pacific region is experiencing rapid growth, driven by increasing investments in satellite communication infrastructure and the expansion of telecommunications networks. Within application segments, commercial communications account for the largest market share, followed by government communications. The leasing service segment dominates the service category, reflecting the prevalent business model within the industry.

- North America: Strong demand, well-established infrastructure, high technological capabilities.

- Asia-Pacific: Rapid growth, increased investment in satellite communication infrastructure.

- Commercial Communications: Largest application segment, driven by increasing data demands.

- Leasing Services: Largest service segment, reflecting prevalent business model.

Satellite Transponder Industry Product Landscape

The satellite transponder market offers a range of products with varying capacities, bandwidths, and frequency bands. Recent innovations focus on enhancing efficiency, increasing throughput, and improving signal quality. Key features include advanced modulation techniques, adaptive coding and modulation (ACM), and integrated network management systems. These technological advancements enable greater flexibility, scalability, and cost-effectiveness, supporting the growing demand for high-bandwidth applications.

Key Drivers, Barriers & Challenges in Satellite Transponder Industry

Key Drivers: The increasing demand for high-bandwidth applications, expansion of broadband internet access in remote areas, and technological advancements in satellite technology are key drivers. Government investments in space exploration and national security also fuel market growth.

Challenges: High upfront investment costs for satellite infrastructure, regulatory hurdles related to spectrum allocation and orbital slot assignments, and competition from terrestrial alternatives (fiber optic cables) represent major challenges. Supply chain disruptions can also impact production and delivery timelines. Furthermore, the highly specialized nature of the industry creates a skilled labor shortage.

Emerging Opportunities in Satellite Transponder Industry

The growing adoption of IoT devices and the increasing demand for reliable connectivity in remote locations present significant opportunities. Advancements in satellite technology, such as the development of more efficient and cost-effective transponders, further create avenues for market expansion. The integration of satellite communication systems with other technologies, such as 5G networks, will also unlock new possibilities.

Growth Accelerators in the Satellite Transponder Industry

Technological breakthroughs in satellite constellation design, efficient power systems, and advanced signal processing technologies are key growth catalysts. Strategic partnerships between satellite operators and telecommunication providers can unlock new markets and expand service offerings. Market expansion strategies, such as targeting underserved regions and developing innovative applications, will also drive future growth.

Key Players Shaping the Satellite Transponder Industry Market

- Russian Satellite Communications Company List Not Exhaustive

- China Satellite Communications Co Ltd

- Eutelsat Communications SA

- Hispasat SA (Red Electrica)

- SKY Perfect JSAT Corporation

- Singapore Telecommunication Ltd (Singtel)

- SES SA

- Telesat

- Intesat SA

- EchoStar Corporation

Notable Milestones in Satellite Transponder Industry Sector

- August 2023: EM Solutions completes system-level tests for a transponder developed for Telesat’s LEO 3 demonstration satellite.

- August 2023: Thaicom and Eutelsat Asia sign a partnership agreement for a new satellite at the 119.5 degrees East orbital slot.

In-Depth Satellite Transponder Industry Market Outlook

The future of the satellite transponder industry is bright, driven by continued technological advancements, expanding demand for high-bandwidth applications, and the proliferation of satellite constellations. Strategic partnerships and investments in next-generation technologies will shape market dynamics. The integration of satellite communication with terrestrial networks and the emergence of new applications in sectors like IoT and autonomous vehicles will create significant opportunities for growth and innovation in the coming decade.

Satellite Transponder Industry Segmentation

-

1. Application

- 1.1. Commercial Communications

- 1.2. Government Communications

- 1.3. Navigation

- 1.4. Remote Sensing

- 1.5. Other Applications

-

2. Service

- 2.1. Leasing

- 2.2. Maintenance and Support

- 2.3. Other Services

Satellite Transponder Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Satellite Transponder Industry Regional Market Share

Geographic Coverage of Satellite Transponder Industry

Satellite Transponder Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for New TV Platforms and Technologies; Growth in KU-Band and KA-Band Services

- 3.3. Market Restrains

- 3.3.1. Competition From Fiber-Optic Transmission Cable Networks; Requirement of High Capital Investment

- 3.4. Market Trends

- 3.4.1. Transponders Leasing as Service is Expected to Gain Significant Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Communications

- 5.1.2. Government Communications

- 5.1.3. Navigation

- 5.1.4. Remote Sensing

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Leasing

- 5.2.2. Maintenance and Support

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Communications

- 6.1.2. Government Communications

- 6.1.3. Navigation

- 6.1.4. Remote Sensing

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Leasing

- 6.2.2. Maintenance and Support

- 6.2.3. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Communications

- 7.1.2. Government Communications

- 7.1.3. Navigation

- 7.1.4. Remote Sensing

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Leasing

- 7.2.2. Maintenance and Support

- 7.2.3. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Communications

- 8.1.2. Government Communications

- 8.1.3. Navigation

- 8.1.4. Remote Sensing

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Leasing

- 8.2.2. Maintenance and Support

- 8.2.3. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Communications

- 9.1.2. Government Communications

- 9.1.3. Navigation

- 9.1.4. Remote Sensing

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Leasing

- 9.2.2. Maintenance and Support

- 9.2.3. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Satellite Transponder Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Communications

- 10.1.2. Government Communications

- 10.1.3. Navigation

- 10.1.4. Remote Sensing

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Leasing

- 10.2.2. Maintenance and Support

- 10.2.3. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Russian Satellite Communications Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Satellite Communications Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eutelsat Communications SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hispasat SA (Red Electrica)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SKY Perfect JSAT Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Singapore Telecommunication Ltd (Singtel)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SES SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Telesat

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intesat SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EchoStar Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Russian Satellite Communications Company*List Not Exhaustive

List of Figures

- Figure 1: Global Satellite Transponder Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 5: North America Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 11: Europe Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 17: Asia Pacific Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 18: Asia Pacific Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 23: Latin America Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Latin America Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Satellite Transponder Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East Satellite Transponder Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East Satellite Transponder Industry Revenue (Million), by Service 2025 & 2033

- Figure 29: Middle East Satellite Transponder Industry Revenue Share (%), by Service 2025 & 2033

- Figure 30: Middle East Satellite Transponder Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Satellite Transponder Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 3: Global Satellite Transponder Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 9: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Satellite Transponder Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Satellite Transponder Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Satellite Transponder Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Transponder Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the Satellite Transponder Industry?

Key companies in the market include Russian Satellite Communications Company*List Not Exhaustive, China Satellite Communications Co Ltd, Eutelsat Communications SA, Hispasat SA (Red Electrica), SKY Perfect JSAT Corporation, Singapore Telecommunication Ltd (Singtel), SES SA, Telesat, Intesat SA, EchoStar Corporation.

3. What are the main segments of the Satellite Transponder Industry?

The market segments include Application, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for New TV Platforms and Technologies; Growth in KU-Band and KA-Band Services.

6. What are the notable trends driving market growth?

Transponders Leasing as Service is Expected to Gain Significant Traction.

7. Are there any restraints impacting market growth?

Competition From Fiber-Optic Transmission Cable Networks; Requirement of High Capital Investment.

8. Can you provide examples of recent developments in the market?

August 2023 - Communications manufacturer EM Solutions has completed the first system-level tests for a transponder developed for Telesat’s LEO 3 demonstration satellite. According to an announcement launched on 18 July, the satellite payload features both Ka and V-band uplinks and downlinking on either Ka or Q-band.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Transponder Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Transponder Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Transponder Industry?

To stay informed about further developments, trends, and reports in the Satellite Transponder Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence