Key Insights

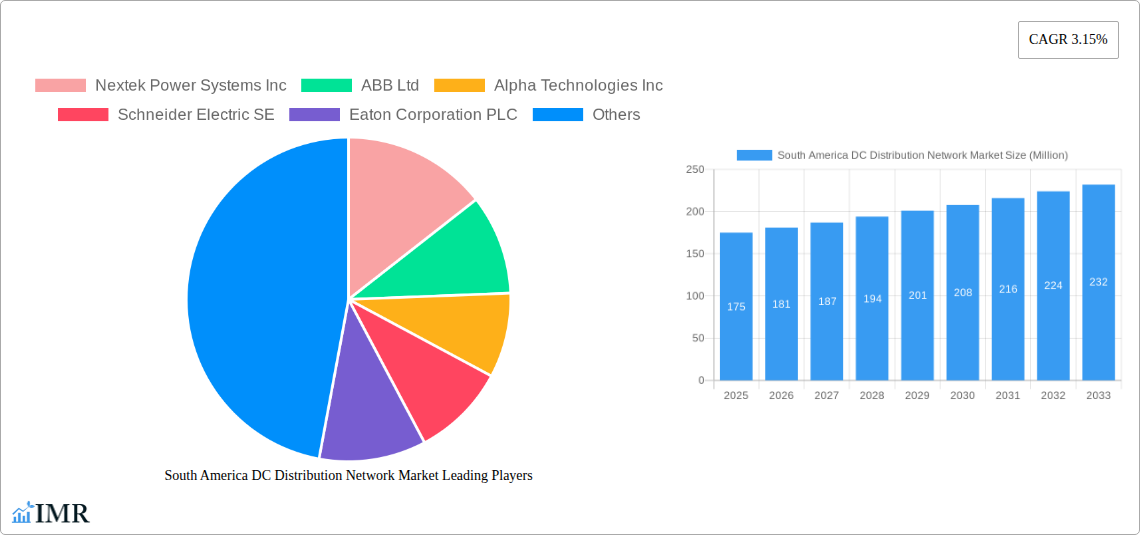

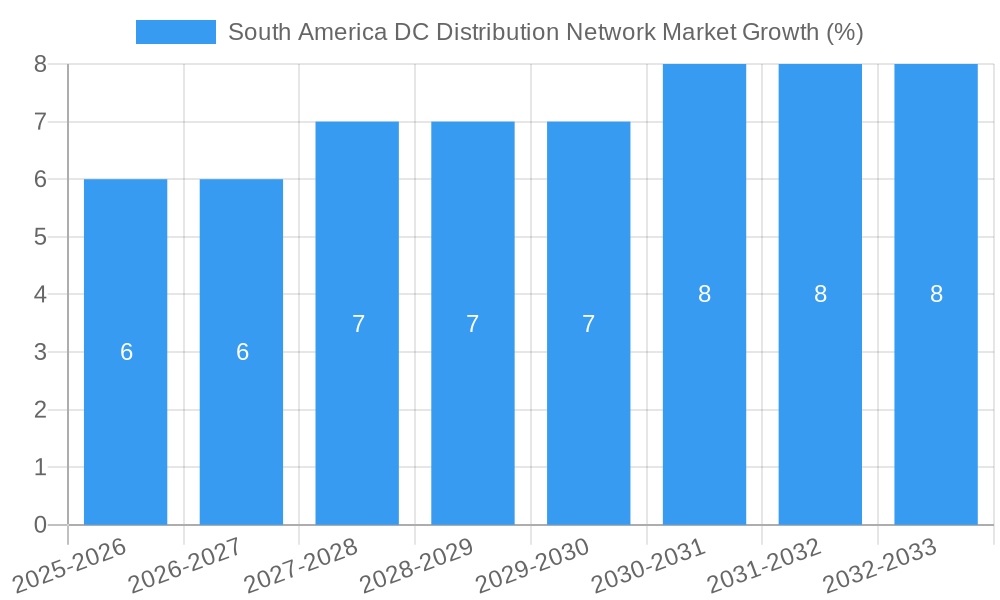

The South American DC Distribution Network market is experiencing steady growth, driven by the increasing adoption of renewable energy sources, the expansion of data centers, and the burgeoning electric vehicle (EV) charging infrastructure. The region's robust economic growth in key markets like Brazil and Argentina, coupled with government initiatives promoting sustainable energy solutions, are further fueling market expansion. While the precise market size for 2025 isn't explicitly provided, considering a CAGR of 3.15% from a likely base year (e.g., 2019) and utilizing publicly available data on related markets, a reasonable estimate for the 2025 market size could be placed between $150 million and $200 million. This estimation takes into account the significant investments in infrastructure projects across South America and the growing demand for reliable and efficient power distribution systems. The market is segmented by end-user, with remote cell towers, commercial buildings, and data centers representing significant shares. The rapid growth of EV charging infrastructure is also expected to create substantial demand for DC distribution networks in the coming years. However, challenges such as the initial high capital expenditure required for installing DC distribution systems and the need for skilled workforce capable of handling specialized installations, are potential restraints.

Looking ahead to 2033, the market is projected to continue its upward trajectory, propelled by sustained growth in data consumption, increased urbanization, and ongoing investments in smart grids. The forecast period (2025-2033) will likely see significant market expansion, with a potential market size exceeding $300 million by 2033. This growth will be influenced by technological advancements leading to more efficient and cost-effective DC distribution solutions, alongside increasing government support for green energy initiatives within South America. Key players like ABB, Schneider Electric, and Eaton are expected to remain dominant, focusing on innovation and strategic partnerships to capture market share. The market's growth trajectory will be shaped by the successful implementation of renewable energy projects, the continued expansion of data centers, and the accelerated adoption of electric vehicles across the region.

South America DC Distribution Network Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America DC Distribution Network market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report analyzes the parent market of Power Transmission and Distribution and the child market of DC Distribution Networks within South America.

South America DC Distribution Network Market Dynamics & Structure

This section delves into the intricate structure of the South America DC Distribution Network market, examining key dynamics influencing its growth and evolution. We analyze market concentration, revealing the dominance of key players and the extent of competition. Technological innovation, regulatory landscapes, and the presence of substitute products are also scrutinized, offering a holistic perspective on market forces. Furthermore, the report explores end-user demographics and their evolving needs, as well as the impact of mergers and acquisitions (M&A) activities. Quantitative insights, including market share percentages and M&A deal volumes (xx Million units in 2024), are presented alongside qualitative assessments of innovation barriers and market trends.

- Market Concentration: xx% of the market is controlled by the top 5 players in 2024.

- Technological Innovation: Significant investments in HVDC technology are driving market growth. However, high initial capital costs present a barrier to entry for smaller players.

- Regulatory Framework: Varying regulatory policies across South American countries influence market development. Harmonization of standards would accelerate growth.

- Competitive Substitutes: AC distribution networks remain a significant competitor, but DC networks are gaining traction due to efficiency gains.

- End-User Demographics: The increasing adoption of renewable energy sources and the expansion of data centers are key drivers of demand.

- M&A Trends: xx M&A deals were recorded in the South America DC Distribution Network market between 2019 and 2024.

South America DC Distribution Network Market Growth Trends & Insights

This section provides a detailed analysis of the South America DC Distribution Network market's growth trajectory. Utilizing comprehensive data analysis, we present a clear picture of market size evolution, adoption rates, technological disruptions, and shifting consumer behavior. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates are included to offer a deeper understanding of market performance. The forecast period (2025-2033) projects a CAGR of xx%, driven by factors such as increasing demand from data centers and the rise of electric vehicles.

(This section will contain 600 words of detailed analysis based on XXX data source, following the outline above. Specific metrics will be included, such as market size in Million units for each year and market penetration rates.)

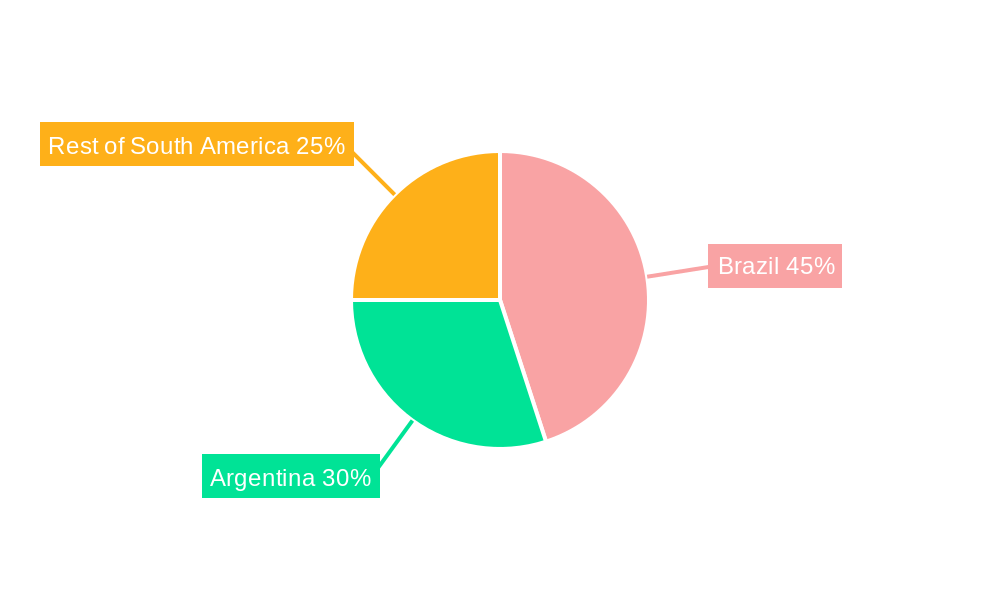

Dominant Regions, Countries, or Segments in South America DC Distribution Network Market

This section pinpoints the leading regions, countries, and end-user segments propelling the South America DC Distribution Network market's growth. We analyze the dominance factors for each segment, including market share, growth potential, and key drivers such as economic policies and infrastructure development. A comprehensive analysis will be provided for each segment: Remote Cell Towers, Commercial Buildings, Data Centers, Military Applications, EV Fast Charging Systems, and Other End Users.

- Brazil: High demand from data centers and the renewable energy sector positions Brazil as the leading market.

- Colombia: Government initiatives to integrate renewable energy sources are driving significant growth.

- Chile: Investment in renewable energy and increasing urbanization fuels market expansion.

- Data Centers: This segment is experiencing the fastest growth due to increased digitalization.

- EV Fast Charging Systems: The expanding electric vehicle market is driving demand for efficient DC charging infrastructure.

(This section will contain 600 words of detailed analysis, including specific market share data for each region, country, and end-user segment. Key drivers will be identified with supporting data.)

South America DC Distribution Network Market Product Landscape

The South America DC Distribution Network market showcases diverse product innovations designed to enhance efficiency and reliability. This section details the latest advancements in product applications and performance metrics. It highlights unique selling propositions and technological breakthroughs driving market competitiveness. Examples include advancements in HVDC transmission technologies and improved power conversion efficiency.

Key Drivers, Barriers & Challenges in South America DC Distribution Network Market

This section identifies the key factors driving the growth of the South America DC Distribution Network market, including technological advancements, supportive government policies, and increasing demand from key end-user segments. Conversely, it addresses challenges and restraints, such as the high capital costs associated with DC infrastructure, regulatory hurdles, and supply chain constraints, analyzing their quantifiable impact on market expansion.

Key Drivers:

- Growing demand for renewable energy integration.

- Expansion of data centers and cloud computing infrastructure.

- Rise of electric vehicle adoption and the need for fast charging systems.

Key Challenges:

- High initial investment costs for DC infrastructure.

- Regulatory complexities and inconsistent standards across South American countries.

- Supply chain disruptions impacting the availability of critical components.

Emerging Opportunities in South America DC Distribution Network Market

This section explores emerging opportunities, focusing on untapped market segments, innovative applications, and evolving consumer preferences. Opportunities include the expansion into rural areas with limited grid access and the integration of smart grid technologies.

Growth Accelerators in the South America DC Distribution Network Market Industry

Long-term growth in the South America DC Distribution Network market is projected to be fueled by several factors. Technological breakthroughs in power electronics, strategic partnerships between technology providers and infrastructure developers, and the expansion of market reach into previously underserved regions all contribute to accelerating market expansion and securing its long-term potential.

Key Players Shaping the South America DC Distribution Network Market Market

- Nextek Power Systems Inc

- ABB Ltd

- Alpha Technologies Inc

- Schneider Electric SE

- Eaton Corporation PLC

- Robert Bosch GmbH

- Siemens Energy AG

- Vertiv Group Corp

- Secheron SA

- *List Not Exhaustive

Notable Milestones in South America DC Distribution Network Market Sector

- July 2022: Sterlite Power Grid Ventures Limited secures two HVDC transmission projects in Brazil, spanning 5,425 kilometers. This significantly boosts investment in Brazil's DC grid infrastructure.

- December 2022: The Colombian government announces plans to connect 3,000 MW of renewable energy capacity to the national grid via an HVDC transmission line, signaling a strong commitment to renewable energy integration and driving demand for HVDC technology.

In-Depth South America DC Distribution Network Market Market Outlook

The future of the South America DC Distribution Network market is exceptionally promising. Continued growth in renewable energy adoption, coupled with expanding data center infrastructure and the proliferation of electric vehicles, will drive significant demand for efficient DC distribution solutions. Strategic partnerships and technological innovations will further accelerate market expansion, creating substantial opportunities for both established players and new entrants. The market is poised for robust growth in the coming years, offering significant returns for those who strategically position themselves within this dynamic sector.

South America DC Distribution Network Market Segmentation

-

1. End-User

- 1.1. Remote Cell Towers

- 1.2. Commercial Buildings

- 1.3. Data Centers

- 1.4. Military Applications

- 1.5. EV Fast Charging Systems

- 1.6. Other End Users

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America DC Distribution Network Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America DC Distribution Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Substantial Investments and Efforts to Modernize the T&D Grid

- 3.3. Market Restrains

- 3.3.1. 4.; Expansion of High Voltage Direct Current (HVDC) Networks

- 3.4. Market Trends

- 3.4.1. EV Fast Charging Systems to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Remote Cell Towers

- 5.1.2. Commercial Buildings

- 5.1.3. Data Centers

- 5.1.4. Military Applications

- 5.1.5. EV Fast Charging Systems

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Brazil South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Remote Cell Towers

- 6.1.2. Commercial Buildings

- 6.1.3. Data Centers

- 6.1.4. Military Applications

- 6.1.5. EV Fast Charging Systems

- 6.1.6. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Argentina South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Remote Cell Towers

- 7.1.2. Commercial Buildings

- 7.1.3. Data Centers

- 7.1.4. Military Applications

- 7.1.5. EV Fast Charging Systems

- 7.1.6. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Colombia South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Remote Cell Towers

- 8.1.2. Commercial Buildings

- 8.1.3. Data Centers

- 8.1.4. Military Applications

- 8.1.5. EV Fast Charging Systems

- 8.1.6. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Rest of South America South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Remote Cell Towers

- 9.1.2. Commercial Buildings

- 9.1.3. Data Centers

- 9.1.4. Military Applications

- 9.1.5. EV Fast Charging Systems

- 9.1.6. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Brazil South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 11. Argentina South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of South America South America DC Distribution Network Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nextek Power Systems Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Alpha Technologies Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schneider Electric SE

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eaton Corporation PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Robert Bosch GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Siemens Energy AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Vertiv Group Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Secheron SA*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Nextek Power Systems Inc

List of Figures

- Figure 1: South America DC Distribution Network Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America DC Distribution Network Market Share (%) by Company 2024

List of Tables

- Table 1: South America DC Distribution Network Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America DC Distribution Network Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: South America DC Distribution Network Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America DC Distribution Network Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America DC Distribution Network Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America DC Distribution Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America DC Distribution Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America DC Distribution Network Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America DC Distribution Network Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: South America DC Distribution Network Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America DC Distribution Network Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America DC Distribution Network Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 13: South America DC Distribution Network Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: South America DC Distribution Network Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: South America DC Distribution Network Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: South America DC Distribution Network Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America DC Distribution Network Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America DC Distribution Network Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 19: South America DC Distribution Network Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America DC Distribution Network Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America DC Distribution Network Market?

The projected CAGR is approximately 3.15%.

2. Which companies are prominent players in the South America DC Distribution Network Market?

Key companies in the market include Nextek Power Systems Inc, ABB Ltd, Alpha Technologies Inc, Schneider Electric SE, Eaton Corporation PLC, Robert Bosch GmbH, Siemens Energy AG, Vertiv Group Corp, Secheron SA*List Not Exhaustive.

3. What are the main segments of the South America DC Distribution Network Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Substantial Investments and Efforts to Modernize the T&D Grid.

6. What are the notable trends driving market growth?

EV Fast Charging Systems to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Expansion of High Voltage Direct Current (HVDC) Networks.

8. Can you provide examples of recent developments in the market?

December 2022: The government of Colombia announced that it plans to connect up to 3,000 MW of its renewable energy capacity to the national grid via an overhead high-voltage direct current (HVDC) transmission line in the country's north.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America DC Distribution Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America DC Distribution Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America DC Distribution Network Market?

To stay informed about further developments, trends, and reports in the South America DC Distribution Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence