Key Insights

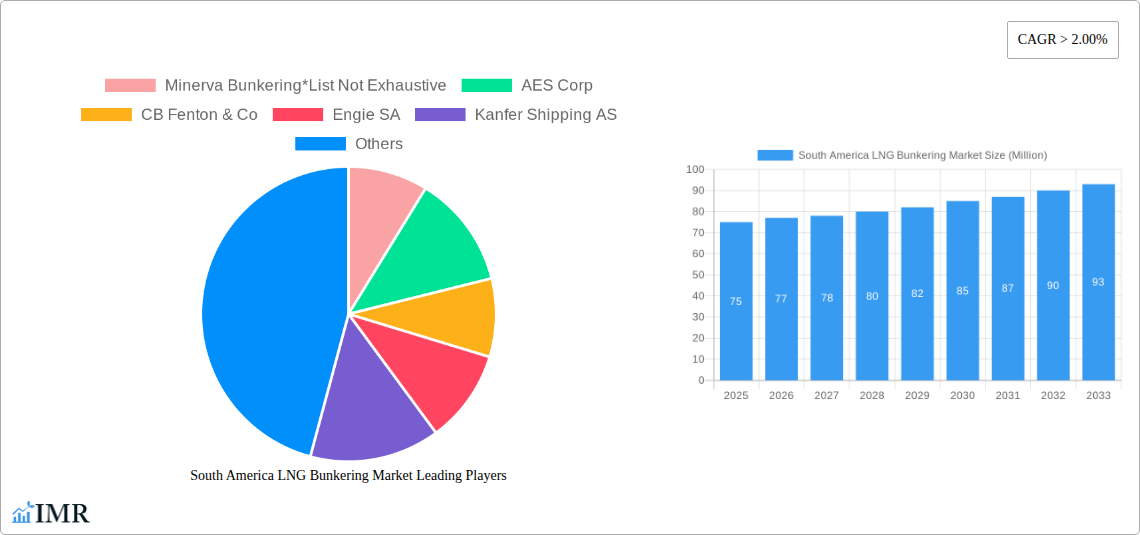

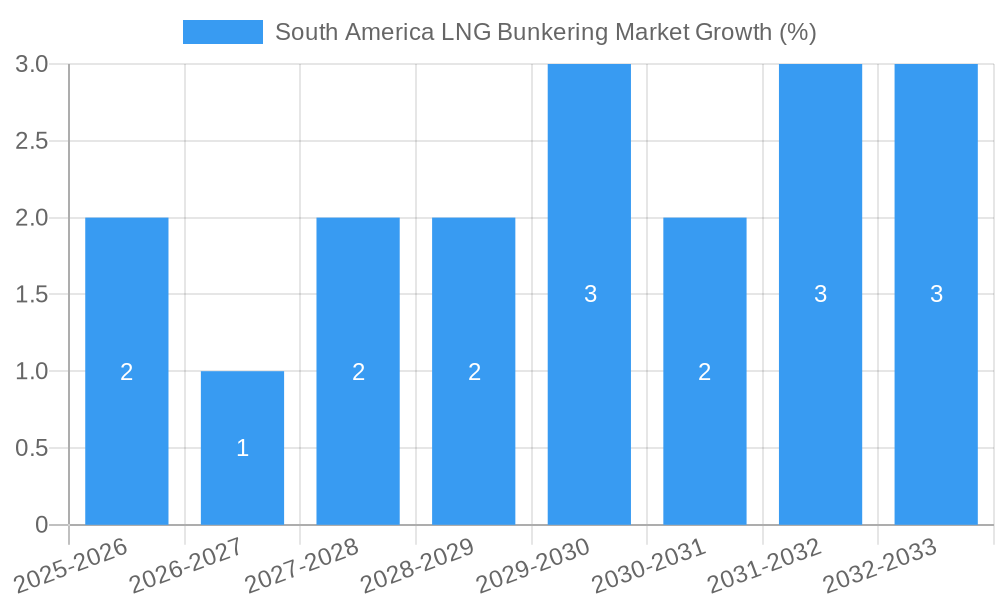

The South American LNG bunkering market is poised for significant growth, driven by increasing environmental regulations aimed at reducing greenhouse gas emissions from shipping and a growing demand for cleaner marine fuels. The region's robust maritime industry, particularly its significant tanker and container fleet operations in Brazil and Argentina, creates a substantial market opportunity. While precise market sizing data is not provided, considering a CAGR of >2.0% and a value unit of millions, we can reasonably estimate the 2025 market size to be in the range of $50-100 million USD, based on the global LNG bunkering market’s growth trajectories and South America's developing infrastructure. This estimate takes into consideration the early adoption of LNG bunkering in some key ports and the potential for future expansion. The market's growth will be fueled by strategic investments in LNG bunkering infrastructure, supported by governmental incentives and collaborations between energy companies and shipping firms. This includes players like Minerva Bunkering, AES Corp, and Engie SA already actively involved. Further growth hinges on the successful implementation of policies promoting the adoption of LNG as a marine fuel.

However, the market faces challenges. High initial investment costs associated with LNG bunkering infrastructure and the relatively higher price of LNG compared to traditional fuels could act as restraints. Furthermore, the uneven distribution of LNG bunkering infrastructure across the region, particularly in the "Rest of South America" segment, represents a barrier to wider adoption. The market segmentation highlights the importance of focusing on the needs of various fleet types, from tankers and containerships to ferries and OSVs, with tailored solutions that address the unique operational requirements of each sector. Growth is expected to be strongest in the Tanker Fleet and Container Fleet segments due to their high fuel consumption. By 2033, the market is projected to show substantial expansion driven by successful regulatory implementation and consistent infrastructure development, potentially reaching values exceeding $150 million USD, assuming a conservative projection based on the provided CAGR.

South America LNG Bunkering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America LNG bunkering market, covering market dynamics, growth trends, regional segmentation, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The report leverages extensive primary and secondary research to deliver actionable insights for strategic decision-making.

South America LNG Bunkering Market Dynamics & Structure

This section analyzes the South American LNG bunkering market's structure, highlighting key dynamics influencing its growth trajectory. We examine market concentration, technological advancements, regulatory frameworks, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The analysis integrates both quantitative (market share, M&A deal volume) and qualitative (innovation barriers) data.

- Market Concentration: The market exhibits a moderately concentrated structure with a few dominant players and numerous smaller participants. The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Technological advancements in LNG bunkering technologies, such as improved storage and handling systems, are crucial drivers. However, high initial investment costs present a significant barrier to entry for smaller players.

- Regulatory Landscape: Varying regulatory frameworks across South American nations influence market development. Harmonization of regulations and standards would encourage greater investment.

- Competitive Substitutes: Competition arises from traditional marine fuels; however, increasing environmental concerns favor the adoption of LNG as a cleaner alternative.

- End-User Demographics: The growth is significantly driven by increasing demand from the tanker fleet, followed by the container and bulk cargo fleets.

- M&A Activity: The past five years have witnessed xx M&A deals, primarily focused on expanding infrastructure and geographic reach.

South America LNG Bunkering Market Growth Trends & Insights

This section provides a detailed analysis of the South America LNG bunkering market's growth trends, utilizing a robust analytical framework. We explore market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior, providing quantitative metrics like Compound Annual Growth Rate (CAGR) and market penetration rates. The market is projected to experience a CAGR of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. Key factors influencing this growth include stringent environmental regulations, the rising preference for cleaner fuels, and expanding LNG infrastructure. The analysis considers various macroeconomic factors and their impact on the market's trajectory.

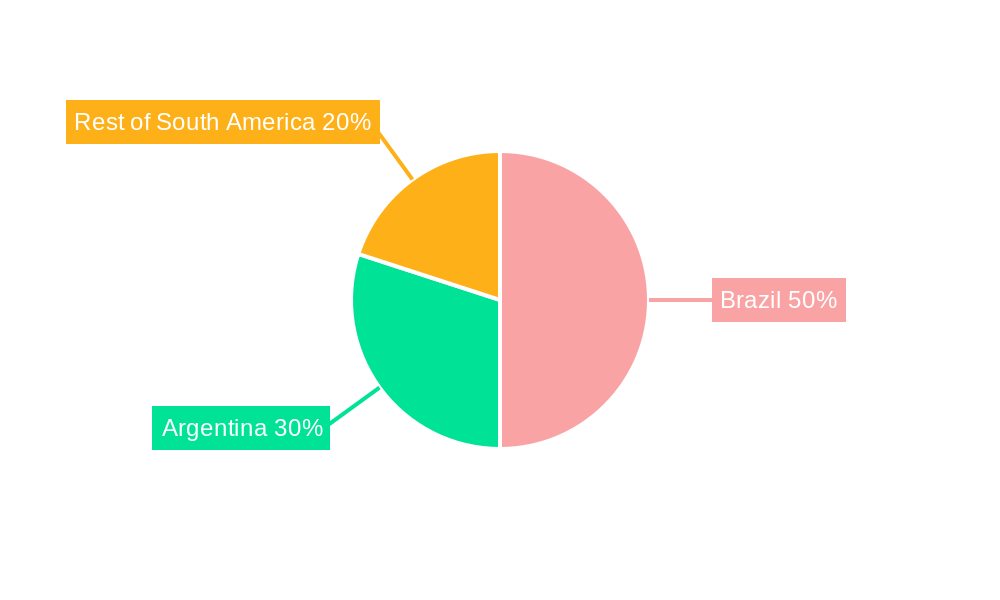

Dominant Regions, Countries, or Segments in South America LNG Bunkering Market

This section identifies the leading regions, countries, and end-user segments driving market growth in South America. We analyze dominance factors, including market share and growth potential, utilizing a combination of paragraph analysis and bullet points to highlight key drivers.

Brazil: Brazil is expected to be the dominant market due to its large and expanding port infrastructure, favorable government policies promoting LNG adoption, and a significant demand from its tanker fleet.

Argentina: While possessing significant LNG resources, Argentina's market growth is somewhat hampered by infrastructural limitations.

Chile: Chile is emerging as a key player, driven by rising maritime activities and government support.

End-User Segments: The Tanker Fleet segment is the largest end-user, driven by higher LNG consumption and a growing number of LNG-fueled vessels. This is followed by the Container Fleet and Bulk and General Cargo Fleet segments.

Key Drivers:

- Stringent environmental regulations incentivizing LNG adoption.

- Government initiatives and subsidies promoting LNG infrastructure development.

- Growing demand from the shipping industry.

South America LNG Bunkering Market Product Landscape

The South American LNG bunkering market features a range of products, including various LNG bunkering vessels and specialized storage and handling equipment. Recent innovations focus on enhancing efficiency, safety, and environmental performance, with a particular emphasis on reducing emissions and optimizing fuel consumption. The unique selling propositions of these products often center on their ability to minimize downtime and improve operational reliability for shipping companies, while adhering to evolving environmental standards.

Key Drivers, Barriers & Challenges in South America LNG Bunkering Market

Key Drivers:

The market is propelled by increasing environmental regulations, growing demand for cleaner fuels within the shipping industry, and government initiatives supporting LNG infrastructure development. The substantial reserves of natural gas in several South American countries also contribute significantly.

Key Challenges & Restraints:

High capital investment costs associated with LNG infrastructure development are a primary challenge. Regulatory inconsistencies across different countries can impede market expansion. Furthermore, competition from traditional marine fuels and potential supply chain disruptions can pose significant risks to the market's growth.

Emerging Opportunities in South America LNG Bunkering Market

Untapped markets in smaller ports and coastal regions present significant opportunities. The development of smaller-scale LNG bunkering solutions and the expansion of LNG infrastructure into these areas can open new avenues for market growth. Further innovation in LNG bunkering technologies, along with strategic partnerships between LNG producers, shipping companies, and bunkering service providers, will play a crucial role in unlocking market potential.

Growth Accelerators in the South America LNG Bunkering Market Industry

Technological advancements in LNG bunkering equipment and processes will be a primary driver of long-term growth. Strategic partnerships between energy companies, shipping lines, and infrastructure developers will facilitate the expansion of LNG bunkering networks. Government policies supporting the adoption of cleaner fuels, coupled with increased investment in LNG infrastructure, will further accelerate market expansion.

Key Players Shaping the South America LNG Bunkering Market Market

- Minerva Bunkering

- AES Corp

- CB Fenton & Co

- Engie SA

- Kanfer Shipping AS

- Avenir LNG Ltd

Notable Milestones in South America LNG Bunkering Market Sector

- December 2022: CB Fenton and Kanfer Shipping signed an MoU to establish an LNG bunkering hub in Panama. This significantly expands bunkering capacity and distribution capabilities in a strategic location.

- September 2022: YPF and Petronas signed a JSDA for an integrated LNG project in Argentina. This highlights the potential for domestic LNG production to support the growth of the bunkering market.

In-Depth South America LNG Bunkering Market Market Outlook

The South America LNG bunkering market is poised for substantial growth, driven by a confluence of factors including increasing environmental regulations, the rising demand for cleaner marine fuels, and strategic investments in LNG infrastructure. The expansion of LNG bunkering capabilities into smaller ports and the development of innovative bunkering solutions will unlock significant opportunities for market players. Strategic partnerships and technological breakthroughs will further accelerate this growth, presenting lucrative prospects for investment and expansion in the coming years.

South America LNG Bunkering Market Segmentation

-

1. End-User

- 1.1. Tanker Fleet

- 1.2. Container Fleet

- 1.3. Bulk and General Cargo Fleet

- 1.4. Ferries and OSV

- 1.5. Others

-

2. Geography

-

2.1. South America

- 2.1.1. Brazil

- 2.1.2. Argentina

- 2.1.3. Rest of South America

-

2.1. South America

South America LNG Bunkering Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries

- 3.3. Market Restrains

- 3.3.1. 4.; The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned

- 3.4. Market Trends

- 3.4.1. Increase in Maritime Activities is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Tanker Fleet

- 5.1.2. Container Fleet

- 5.1.3. Bulk and General Cargo Fleet

- 5.1.4. Ferries and OSV

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. South America

- 5.2.1.1. Brazil

- 5.2.1.2. Argentina

- 5.2.1.3. Rest of South America

- 5.2.1. South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Brazil South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Minerva Bunkering*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 AES Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CB Fenton & Co

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Engie SA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kanfer Shipping AS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Avenir LNG Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Minerva Bunkering*List Not Exhaustive

List of Figures

- Figure 1: South America LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: South America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: South America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South America LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America LNG Bunkering Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: South America LNG Bunkering Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South America LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America South America LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America LNG Bunkering Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the South America LNG Bunkering Market?

Key companies in the market include Minerva Bunkering*List Not Exhaustive, AES Corp, CB Fenton & Co, Engie SA, Kanfer Shipping AS, Avenir LNG Ltd.

3. What are the main segments of the South America LNG Bunkering Market?

The market segments include End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Supportive Government Policies for Waste-to-Energy Plants4.; Increasing Investments in Waste-to-Energy Industries.

6. What are the notable trends driving market growth?

Increase in Maritime Activities is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; The Strict Regulation Imposed Against the Release of Harmful Gases When Trash is Burned.

8. Can you provide examples of recent developments in the market?

In December 2022, CB Fenton, part of Ultramar (Chile), and Norwegian small-scale LNG sea transport and bunkering vessels developer Kanfer Shipping signed a Memorandum of Understanding to establish a hub for LNG bunkering and small-scale LNG distribution in/out of Panama.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the South America LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence