Key Insights

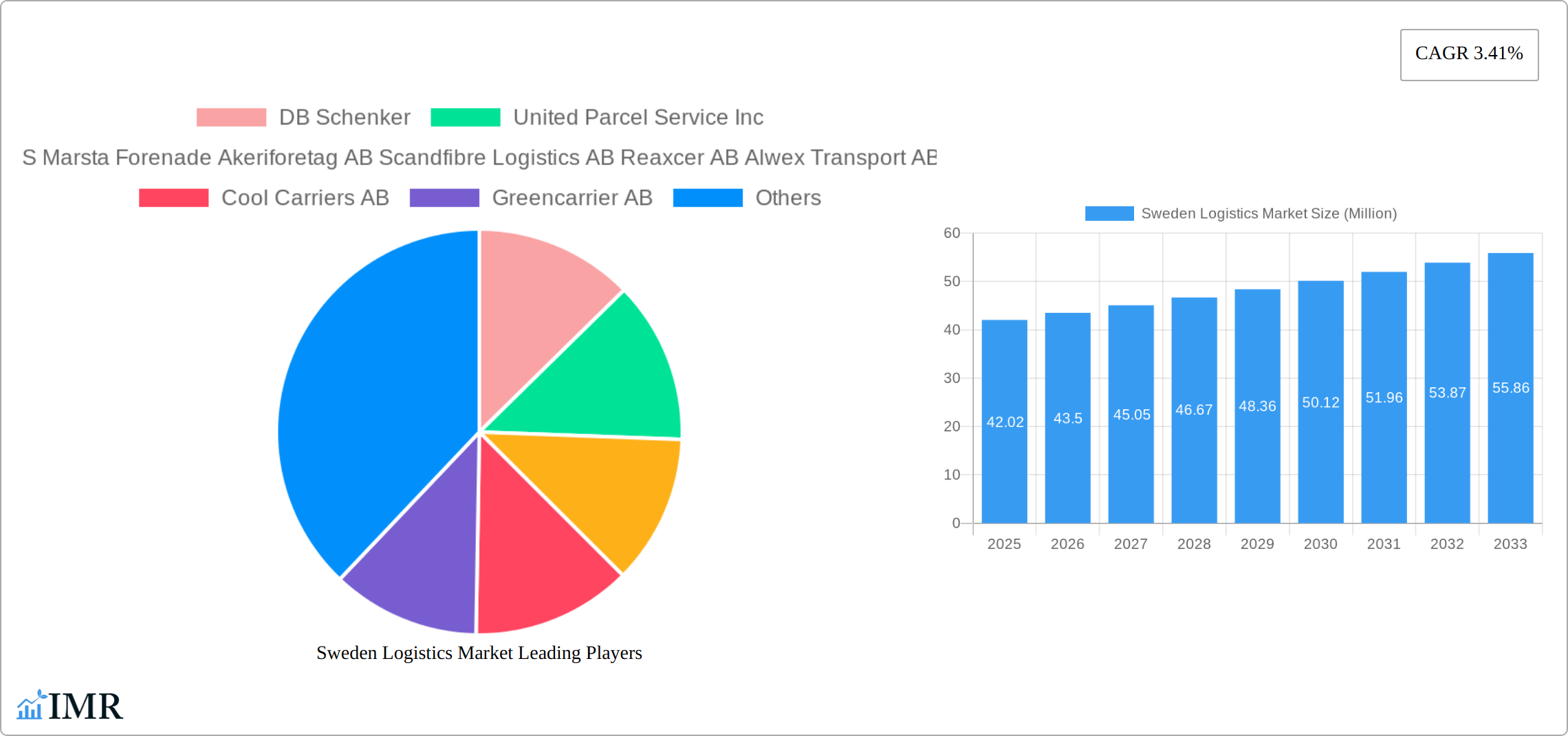

The Sweden logistics market, valued at €42.02 million in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 3.41% from 2025 to 2033. This growth is fueled by several key factors. The expanding e-commerce sector within Sweden necessitates efficient and reliable logistics solutions, boosting demand for warehousing, freight forwarding, and value-added services. Furthermore, the country's robust manufacturing and automotive sectors contribute significantly to the market's expansion, requiring seamless supply chain management. The increasing focus on sustainability within the logistics industry, with companies adopting eco-friendly practices and technologies, also presents a significant growth opportunity. While challenges like fluctuating fuel prices and labor shortages exist, the overall market outlook remains positive due to continuous investment in infrastructure and technological advancements like automation and digitalization within the supply chain. The diverse end-user segments, including manufacturing, automotive, oil and gas, and retail, ensure a broad base for market growth. Key players like DB Schenker, UPS, and Kuehne + Nagel are well-positioned to capitalize on these opportunities, while smaller, specialized logistics providers cater to niche market demands.

The segmentation of the Swedish logistics market reveals a strong emphasis on freight transport, warehousing, and value-added services within the rail and road transportation modes. The manufacturing and automotive sectors represent major end-users, highlighting the importance of efficient supply chains in these industries. The competitive landscape is characterized by a mix of large multinational corporations and smaller domestic players, suggesting a healthy level of competition and innovation. Future growth will likely see increased adoption of technology, including advanced analytics and real-time tracking, to improve efficiency and transparency throughout the supply chain. Further investment in sustainable solutions and infrastructure development will be crucial to supporting continued market expansion and addressing potential environmental concerns. Analysis suggests a potential market value exceeding €55 million by 2033, based on the projected CAGR.

Sweden Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sweden logistics market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report analyzes the market across various segments, including rail freight forwarding, warehousing, value-added services, and different end-user industries. Market size is presented in million units.

Sweden Logistics Market Dynamics & Structure

The Swedish logistics market, valued at xx million in 2024, exhibits a moderately concentrated structure, with both large multinational corporations and smaller domestic players competing. Technological advancements, particularly in automation and digitalization, are major drivers of market transformation. Stringent regulatory frameworks related to sustainability and data privacy impact operational strategies. Competitive pressures arise from substitute transportation modes and evolving end-user demands. Mergers and acquisitions (M&A) activity remains relatively modest, with xx deals recorded in the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Focus on automation (e.g., robotics in warehousing), digitalization (e.g., blockchain for supply chain transparency), and sustainable solutions (e.g., electric vehicles).

- Regulatory Landscape: Emphasis on environmental regulations, data protection (GDPR compliance), and efficient transport infrastructure.

- Competitive Substitutes: Road, rail, air, and maritime transport compete for market share.

- End-User Demographics: Significant presence of manufacturing, automotive, and e-commerce sectors.

- M&A Activity: Relatively low volume, xx deals recorded between 2019-2024, primarily focused on consolidation within specific segments.

Sweden Logistics Market Growth Trends & Insights

The Swedish logistics market demonstrates consistent growth driven by factors such as increasing e-commerce penetration, expanding manufacturing activity, and government investments in infrastructure. Technological advancements fuel efficiency gains and improved supply chain visibility. Consumer behavior shifts towards faster delivery times and greater transparency influence the market.

- Market Size Evolution: From xx million in 2019 to xx million in 2024, experiencing a CAGR of xx%.

- Adoption Rates: Rapid adoption of digital technologies and sustainable practices observed across the sector.

- Technological Disruptions: Automation and AI are reshaping warehousing and transportation processes.

- Consumer Behavior Shifts: Demand for faster delivery, real-time tracking, and increased sustainability are prominent.

Dominant Regions, Countries, or Segments in Sweden Logistics Market

The Southern region of Sweden dominates the logistics market due to its proximity to major ports and industrial hubs. The manufacturing and automotive sectors are the largest end-users, contributing significantly to market growth. Freight forwarding and warehousing are the leading functional segments.

- Key Drivers: Government infrastructure investments, strategic location of ports, and high concentration of manufacturing and automotive industries.

- Dominance Factors: High volume of goods movement, efficient infrastructure, and presence of major logistics hubs.

- Growth Potential: Continued expansion of e-commerce and the automotive sector promises sustained growth. Growth is expected in the Northern and Western parts of Sweden, driven by rising tourism and investments in renewable energy infrastructure.

Sweden Logistics Market Product Landscape

The product landscape includes a diverse range of services, from traditional freight forwarding and warehousing to specialized value-added services like packaging, labeling, and inventory management. Technological advancements drive improvements in tracking, efficiency, and security. Unique selling propositions frequently involve specialized expertise in specific sectors or superior technological platforms.

Key Drivers, Barriers & Challenges in Sweden Logistics Market

Key Drivers:

- Increasing e-commerce activity significantly boosts demand for last-mile delivery services.

- Government initiatives promoting sustainable logistics solutions create growth opportunities.

- Technological advancements like automation and AI enhance efficiency and productivity.

Key Challenges and Restraints:

- Labor shortages and rising labor costs constrain operational efficiency.

- Infrastructure limitations in certain regions restrict expansion and efficient transportation.

- Intense competition from established and emerging logistics providers creates pricing pressures.

Emerging Opportunities in Sweden Logistics Market

The growth of e-commerce necessitates last-mile delivery solutions tailored to urban areas. The rising importance of sustainability creates opportunities for eco-friendly logistics solutions (e.g., electric vehicles, optimized routing). Specialized logistics for specific industries like pharmaceuticals or temperature-sensitive goods offers high-margin potential.

Growth Accelerators in the Sweden Logistics Market Industry

Strategic partnerships and alliances between logistics providers and technology companies accelerate the adoption of innovative solutions. Investments in infrastructure modernization, particularly in rail and port facilities, support efficient transportation networks. Focus on sustainable practices and the circular economy attracts environmentally conscious customers.

Key Players Shaping the Sweden Logistics Market Market

- DB Schenker

- United Parcel Service Inc

- Posten Norge

- CEVA Logistics

- Agility Logistics Pvt Ltd

- Hellmann Worldwide Logistics

- Foria AB

- Hector Rail AB

- DFDS Marsta

- Forenade Akeriforetag AB

- Scandfibre Logistics AB

- Reaxcer AB

- Alwex Transport AB

- Aditro Logistics AB

- Scan Global Logistics A/S

- Spedman Global Logistics

- Godecke Logistics

- Exacta and Avatar Logistics A

- Cool Carriers AB

- Greencarrier AB

- Kuehne + Nagel International AG

- PostNord AB

- DSV AS

- Deutsche Post DHL Group

- MaserFrakt AB

- Geodis

- Fraktkedjan

- GDL Transport AB

Notable Milestones in Sweden Logistics Market Sector

- August 2023: DHL and Volvo partner to deploy electric heavy-duty trucks for long-distance regional transport in Sweden, marking a significant step towards sustainable logistics.

- June 2022: CEVA Logistics opens a new facility in the Philippines, expanding its Southeast Asian capabilities. While not directly in Sweden, it reflects the global expansion strategies of key players.

- April 2022: Alstom secures a contract to deliver high-speed trains to SJ, impacting rail freight capacity and efficiency in Sweden.

In-Depth Sweden Logistics Market Market Outlook

The Swedish logistics market is poised for continued growth, fueled by advancements in technology, sustainability initiatives, and evolving consumer expectations. Strategic investments in infrastructure, coupled with increasing e-commerce penetration and robust manufacturing activity, promise lucrative opportunities for logistics providers. Companies that embrace innovation, prioritize sustainability, and effectively address labor challenges will be best positioned for success.

Sweden Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Sweden Logistics Market Segmentation By Geography

- 1. Sweden

Sweden Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Skilled labor

- 3.4. Market Trends

- 3.4.1. Growth in the rail freight segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Posten Norge Ceva Logistics Agility Logistics Pvt Ltd Hellmann Worldwide Logistics Foria AB Hector Rail AB DFDS Marsta Forenade Akeriforetag AB Scandfibre Logistics AB Reaxcer AB Alwex Transport AB Aditro Logistics AB Scan Global Logistics A/S Spedman Global Logistics Godecke Logistics Exacta and Avatar Logistics A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cool Carriers AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Greencarrier AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PostNord AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEVA Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Deutsche Post DHL Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MaserFrakt AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Geodis

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fraktkedjan**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 GDL Transport AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Sweden Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Sweden Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Sweden Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sweden Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sweden Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: Sweden Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Sweden Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Logistics Market?

The projected CAGR is approximately 3.41%.

2. Which companies are prominent players in the Sweden Logistics Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Posten Norge Ceva Logistics Agility Logistics Pvt Ltd Hellmann Worldwide Logistics Foria AB Hector Rail AB DFDS Marsta Forenade Akeriforetag AB Scandfibre Logistics AB Reaxcer AB Alwex Transport AB Aditro Logistics AB Scan Global Logistics A/S Spedman Global Logistics Godecke Logistics Exacta and Avatar Logistics A, Cool Carriers AB, Greencarrier AB, Kuehne + Nagel International AG, PostNord AB, CEVA Logistics, DSV AS, Deutsche Post DHL Group, MaserFrakt AB, Geodis, Fraktkedjan**List Not Exhaustive 6 3 Other Companies (Key Information/Overview), GDL Transport AB.

3. What are the main segments of the Sweden Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.02 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market.

6. What are the notable trends driving market growth?

Growth in the rail freight segment.

7. Are there any restraints impacting market growth?

4.; Shortage of Skilled labor.

8. Can you provide examples of recent developments in the market?

August 2023: DHL and Volvo have joined forces to accelerate the deployment of electric heavy-duty trucks for regional transport across Europe. The partnership marks another significant step towards climate-friendly transport solutions. Until now, electric trucks have only been used for short distances within urban areas. DHL and Volvo have launched a project focused on long-distance heavy transport. This project includes exclusive, world-first pilot tests of Volvo FH trucks with gross combined weights of 60 tonnes. From March, the Volvo FH trucks will be deployed between DHL’s logistics terminals located in Sweden, covering an approximate 150 km one-way distance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Logistics Market?

To stay informed about further developments, trends, and reports in the Sweden Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence