Key Insights

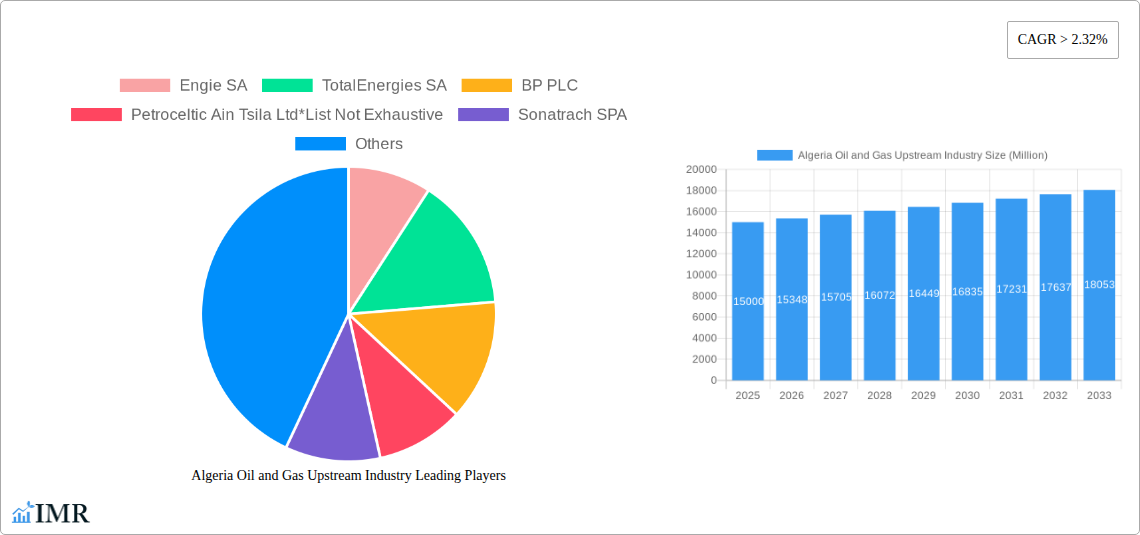

The Algerian oil and gas upstream industry, while facing headwinds, presents a moderately growing market opportunity. The sector's market size in 2025 is estimated at $XX million (replace XX with a plausible estimate based on available data and industry benchmarks for similar countries/regions). A compound annual growth rate (CAGR) exceeding 2.32% through 2033 suggests steady expansion, driven primarily by sustained domestic demand and ongoing exploration activities. While aging infrastructure and fluctuating global energy prices pose challenges, strategic investments in modernization and exploration could unlock further potential. The onshore segment, owing to its established infrastructure and easier accessibility, likely commands a larger share compared to the offshore sector, although offshore exploration holds promise for future growth. Analyzing the project pipeline reveals a mixture of existing, planned, and upcoming projects, indicating continued investment and a relatively stable outlook for the industry in the medium term. Key players like Sonatrach SPA, Engie SA, TotalEnergies SA, and BP PLC are instrumental in shaping the industry's landscape, indicating a concentration of market power. However, potential entry of smaller, specialized players could increase competition and innovation in specific niche areas like enhanced oil recovery or unconventional gas exploration.

The Algerian oil and gas upstream sector is poised for moderate growth, underpinned by consistent domestic demand. The country’s reliance on hydrocarbon revenue necessitates continuous investment in upstream activities, balancing the need for energy security with the global shift towards renewable energy sources. While fluctuating global oil prices remain a significant external factor, strategic partnerships between international oil companies and Sonatrach are expected to play a crucial role in driving exploration, production optimization, and technological advancements. The ongoing transition towards cleaner energy sources might influence the long-term outlook, potentially leading to a diversification of investment towards natural gas and cleaner energy projects, including carbon capture and storage initiatives. The success of the Algerian upstream sector will ultimately depend on its ability to adapt to evolving global energy dynamics and effectively manage its hydrocarbon resources sustainably.

Algeria Oil and Gas Upstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of Algeria's oil and gas upstream industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages rigorous data analysis and expert insights to offer invaluable intelligence for industry professionals, investors, and policymakers. Key segments analyzed include onshore and offshore operations, encompassing existing, pipeline, and upcoming projects.

Keywords: Algeria oil and gas, upstream industry, Sonatrach, Engie, TotalEnergies, BP, Petroceltic, onshore, offshore, market analysis, growth forecast, M&A, industry trends, investment opportunities, energy sector, hydrocarbon exploration, production, Algeria energy market.

Algeria Oil and Gas Upstream Industry Market Dynamics & Structure

This section analyzes the Algerian oil and gas upstream market's competitive landscape, technological advancements, regulatory environment, and market concentration. The analysis includes quantitative data on market share and M&A activity, coupled with qualitative insights into factors influencing industry dynamics. The historical period (2019-2024) provides context, while the forecast period (2025-2033) offers projections.

- Market Concentration: Sonatrach holds a dominant position, with xx% market share in 2025. Other key players, including Engie SA, TotalEnergies SA, and BP PLC, account for a combined xx% market share. The market is characterized by a high degree of vertical integration within Sonatrach.

- Technological Innovation: Technological advancements in exploration techniques (e.g., advanced seismic imaging) and enhanced oil recovery (EOR) methods are driving productivity gains, while digitalization is improving operational efficiency. However, access to advanced technologies and skilled labor remains a challenge.

- Regulatory Framework: The Algerian government plays a significant role in regulating the upstream sector, with a focus on maximizing domestic benefits and attracting foreign investment. Regulatory changes can impact project timelines and investment decisions.

- Competitive Product Substitutes: Limited substitutes exist for conventional oil and gas in Algeria. However, growing interest in renewable energy sources presents a long-term challenge to oil and gas demand.

- End-User Demographics: The primary end-users of Algerian oil and gas are domestic industries and international export markets, with a varying reliance on energy sources across different sectors.

- M&A Trends: The sector has witnessed significant M&A activity in recent years, primarily driven by the government's efforts to attract foreign investment and optimize existing assets. The number of M&A deals in the period 2019-2024 was xx, with a total value of xx Million USD. This trend is anticipated to continue in the forecast period.

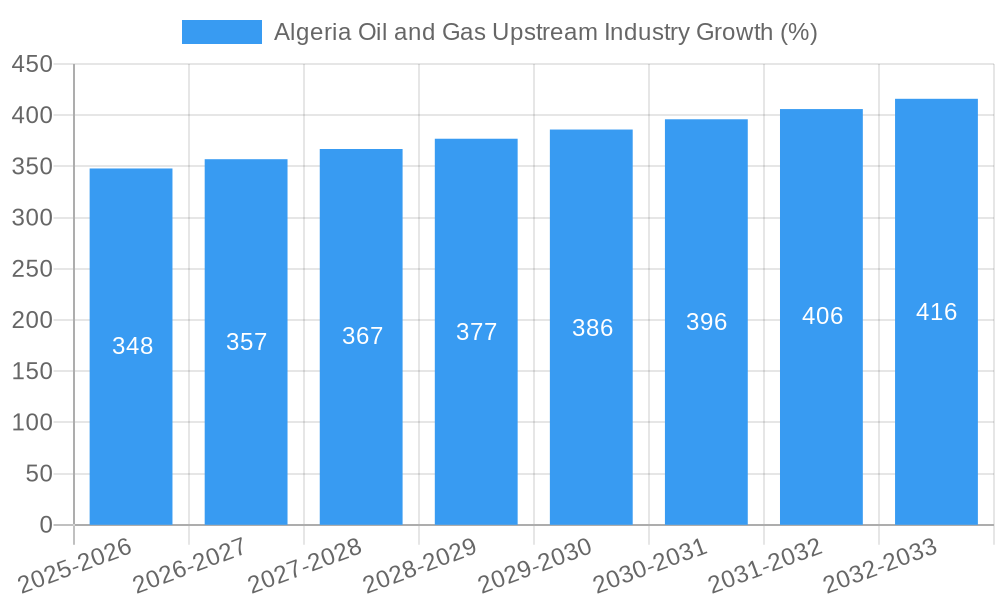

Algeria Oil and Gas Upstream Industry Growth Trends & Insights

This section details the evolution of Algeria's oil and gas upstream market size, technological disruptions, and shifts in consumer behavior. We will analyze market size, growth rate, and adoption rates of new technologies. The analysis uses detailed data and insights to deliver a comprehensive understanding of historical and projected trends. Based on various market indicators, the Algeria Oil and Gas Upstream Industry is projected to achieve a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million USD by 2033. This growth will be driven by increasing domestic demand and strategic partnerships with international players. However, global energy transitions and fluctuating oil prices pose considerable challenges. The market penetration of new technologies in exploration and production is expected to increase steadily during the forecast period.

Dominant Regions, Countries, or Segments in Algeria Oil and Gas Upstream Industry

This section identifies the leading regions and segments driving market growth. The analysis will encompass both onshore and offshore segments, including existing projects, those in the pipeline, and upcoming ventures. The Berkine Basin stands out as a key region with significant exploration potential, while the existing projects in the Amenas and Salah concessions remain central to production.

- Onshore: Existing projects dominate the onshore segment, accounting for xx% of total production in 2025. However, upcoming projects in the Berkine North Basin will play a crucial role in growth. Investments in infrastructure upgrades, and improved technological capabilities will further augment growth.

- Offshore: The offshore segment currently has a smaller market share (xx% in 2025) compared to onshore, although upcoming projects hold great promise.

- Projects in Pipeline: Several projects are planned for the coming years, many focusing on exploring new reserves and expanding existing infrastructure, with potential to contribute xx Million USD to the market by 2033.

- Upcoming Projects: These projects are key drivers of long-term growth and will help in expanding the production capacity, further boosting Algeria's oil and gas industry.

Algeria Oil and Gas Upstream Industry Product Landscape

Algeria's upstream industry predominantly focuses on the exploration and production of crude oil and natural gas, with condensate and LPG as by-products. Technological advancements in EOR techniques and digitalization are enhancing operational efficiency and maximizing resource recovery. The industry shows a progressive approach towards sustainable practices to mitigate environmental impact and adheres to international safety standards in operations.

Key Drivers, Barriers & Challenges in Algeria Oil and Gas Upstream Industry

Key Drivers:

- Increased domestic energy demand.

- Government incentives for foreign investment and infrastructure development.

- Exploration and development of new reserves in areas like the Berkine Basin.

Key Barriers and Challenges:

- Aging infrastructure and the need for significant investment in modernization.

- Geopolitical risks and security concerns impacting operations and investment.

- Fluctuations in global oil and gas prices.

- Competition from renewable energy sources impacting long-term demand for fossil fuels.

Emerging Opportunities in Algeria Oil and Gas Upstream Industry

- Development of unconventional resources.

- Increased investment in renewable energy sources alongside traditional oil and gas production.

- Exploring regional cooperation and collaborations for infrastructure projects.

Growth Accelerators in the Algeria Oil and Gas Upstream Industry Industry

Long-term growth will be fueled by strategic partnerships with international energy companies, technological innovations in exploration and production, and the government's continued support for infrastructure development and exploration activities. A focus on sustainable practices and environmental responsibility will also influence investment decisions and overall growth. Furthermore, exploration of unconventional resources presents a substantial opportunity for expanding reserves and extending production lifecycles.

Key Players Shaping the Algeria Oil and Gas Upstream Industry Market

- Engie SA

- TotalEnergies SA

- BP PLC

- Petroceltic Ain Tsila Ltd

- Sonatrach SPA

Notable Milestones in Algeria Oil and Gas Upstream Industry Sector

- March 2022: Eni and Sonatrach announced a significant oil and gas discovery in the Zemlet el Arbi concession, with an estimated 140 million barrels of oil in place. This discovery significantly boosted exploration prospects in the Berkine Basin.

- September 2022: Eni SpA acquired gas-producing concessions in Amenas and Salah from BP's upstream business, consolidating its position in the Algerian market. This acquisition increased Eni's production capacity significantly.

In-Depth Algeria Oil and Gas Upstream Industry Market Outlook

The Algerian oil and gas upstream sector presents a promising outlook, driven by significant reserves, ongoing exploration activities, and the government's commitment to attracting investment. Strategic partnerships with international companies and investments in modernizing infrastructure are expected to drive production growth. However, the industry needs to adapt to the evolving global energy landscape and prioritize sustainability to ensure long-term competitiveness. The exploration and development of unconventional resources will be a critical component of maintaining long-term production capacity and market share.

Algeria Oil and Gas Upstream Industry Segmentation

-

1. Location

-

1.1. Onshore

-

1.1.1. Overview

- 1.1.1.1. Existing Projects

- 1.1.1.2. Projects in Pipeline

- 1.1.1.3. Upcoming Projects

-

1.1.1. Overview

- 1.2. Offshore

-

1.1. Onshore

Algeria Oil and Gas Upstream Industry Segmentation By Geography

- 1. Algeria

Algeria Oil and Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Clean Energy Sources4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Other Alternative Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Gas Field Production to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Oil and Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Onshore

- 5.1.1.1. Overview

- 5.1.1.1.1. Existing Projects

- 5.1.1.1.2. Projects in Pipeline

- 5.1.1.1.3. Upcoming Projects

- 5.1.1.1. Overview

- 5.1.2. Offshore

- 5.1.1. Onshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Engie SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TotalEnergies SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BP PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Petroceltic Ain Tsila Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonatrach SPA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Engie SA

List of Figures

- Figure 1: Algeria Oil and Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Oil and Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 6: Algeria Oil and Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Oil and Gas Upstream Industry?

The projected CAGR is approximately > 2.32%.

2. Which companies are prominent players in the Algeria Oil and Gas Upstream Industry?

Key companies in the market include Engie SA, TotalEnergies SA, BP PLC, Petroceltic Ain Tsila Ltd*List Not Exhaustive, Sonatrach SPA.

3. What are the main segments of the Algeria Oil and Gas Upstream Industry?

The market segments include Location .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Clean Energy Sources4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Gas Field Production to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Other Alternative Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

In March 2022, Eni and Sonatrach announced a substantial oil and accompanying gas discovery in the Zemlet el Arbi concession in the Algerian desert's Berkine North Basin. This concession is being operated in a joint venture with Sonatrach (51%), Eni (49%), and other parties. According to preliminary assessments of the extent of the discovery, there may be 140 million barrels of oil in place.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Oil and Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Oil and Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Oil and Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Algeria Oil and Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence